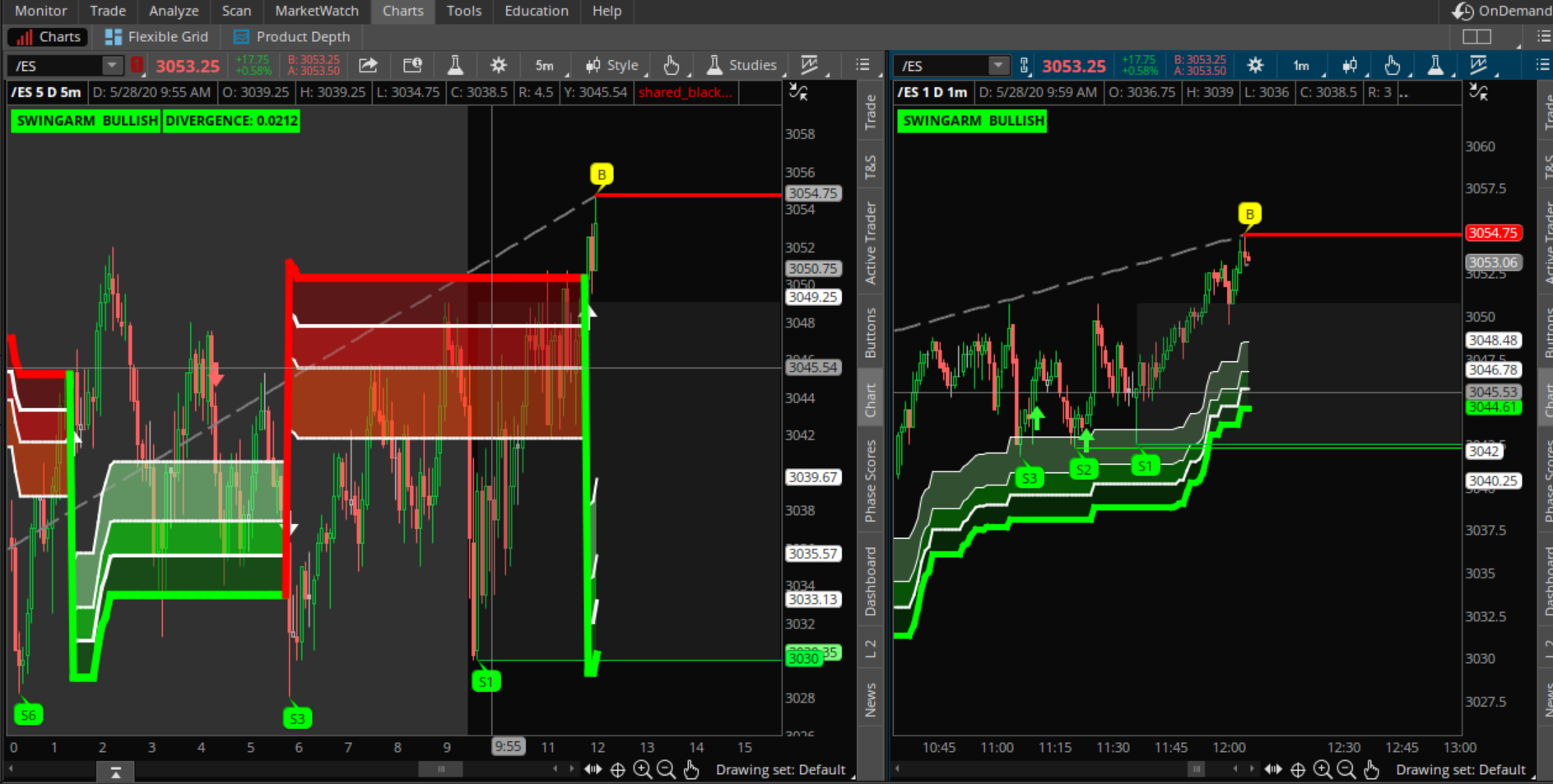

@mckenzieatix , I imported the 5min and 1min grid in post #1, that has worked for me and looks the same as @fjr1300

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

blackFLAG FTS - SwingArm Trend Indicator using ATRTrailing Stop and Fibonacci Retracements

- Status

- Not open for further replies.

Jose, first of all, thank you so much for your contributions. I, too, am currently testing your system and have made some modifications to the script to get rid of some clutter and make sure it suits my needs. Two questions.

Can you please explain what the divergence label signify exactly? I'm not sure what it relates to, divergence between what? Thank you!

I also wonder - which indicators on your chart repaint? I know the swingarm itself does not, as BenTen confirmed, but other than the obvious support and resistance rising and falling trendlines, what else? I'm just wondering to know as I'm backtesting and was wondering if what I see on a 5-min chart from a week ago, is similar to what it looked in real time.

Can you please explain what the divergence label signify exactly? I'm not sure what it relates to, divergence between what? Thank you!

I also wonder - which indicators on your chart repaint? I know the swingarm itself does not, as BenTen confirmed, but other than the obvious support and resistance rising and falling trendlines, what else? I'm just wondering to know as I'm backtesting and was wondering if what I see on a 5-min chart from a week ago, is similar to what it looked in real time.

Last edited by a moderator:

D

[deleted]13

Guest

@fjr1300 Am I correct in saying that only the swingarm code was updated on your website and all other indicator code unchanged?

Yes.

@fjr1300 - thanks for your research and helping heart.

I am still a beginner trying to get success ..

https://tos.mx/lEkVYbC

Added all the studies those discussed in this group with latest code.

this is with white background. So edited a bit to change colors. Also shortened the comments in the bubbles.

I hope this is useful and let me know if you find anything wrong with this.

https://tos.mx/lEkVYbC

I am still a beginner trying to get success ..

https://tos.mx/lEkVYbC

Added all the studies those discussed in this group with latest code.

this is with white background. So edited a bit to change colors. Also shortened the comments in the bubbles.

I hope this is useful and let me know if you find anything wrong with this.

https://tos.mx/lEkVYbC

D

[deleted]13

Guest

Jose - do you trade off of the 2 minute or 1 minute? And these buys at the 2 minute or 1 minute are based on whether the 5 min is bullish/bearish?

Hi, I am happy to screen share anytime and answer your questions.

My trading decisions are based on multi-timeframe analysis Then using the lower timeframes to have a razor-sharp entry with minimal risk exposure.

@fjr1300 Jose, I just finished viewing Zoom Session #3: SwingArm Trend Indicator for ThinkorSwim. Your explanation for the need to do multi-timeframe analysis was easily understandable. It is something that was sorely lacking in my own strategies. You and @BenTen taking the time to share your knowledge is amazingly wonderful and appreciated.

Go to setting and then price axis...

Go to setting and then price axis...

You are going to think I am retarded but it doenst work ahaha, also how do I change the settings for 255 days like this:

# 1 MINUTE CHART SETTING 255 period HMA

@michalg95 Something is creating the blue line at the bottom of your chart, I can confirm that it is not the swingarm.

So before I start I wanted to thank the creator Mr. Azcarate for sharing this with all on the public forum. It takes a great effort to share to all what ones built for self.

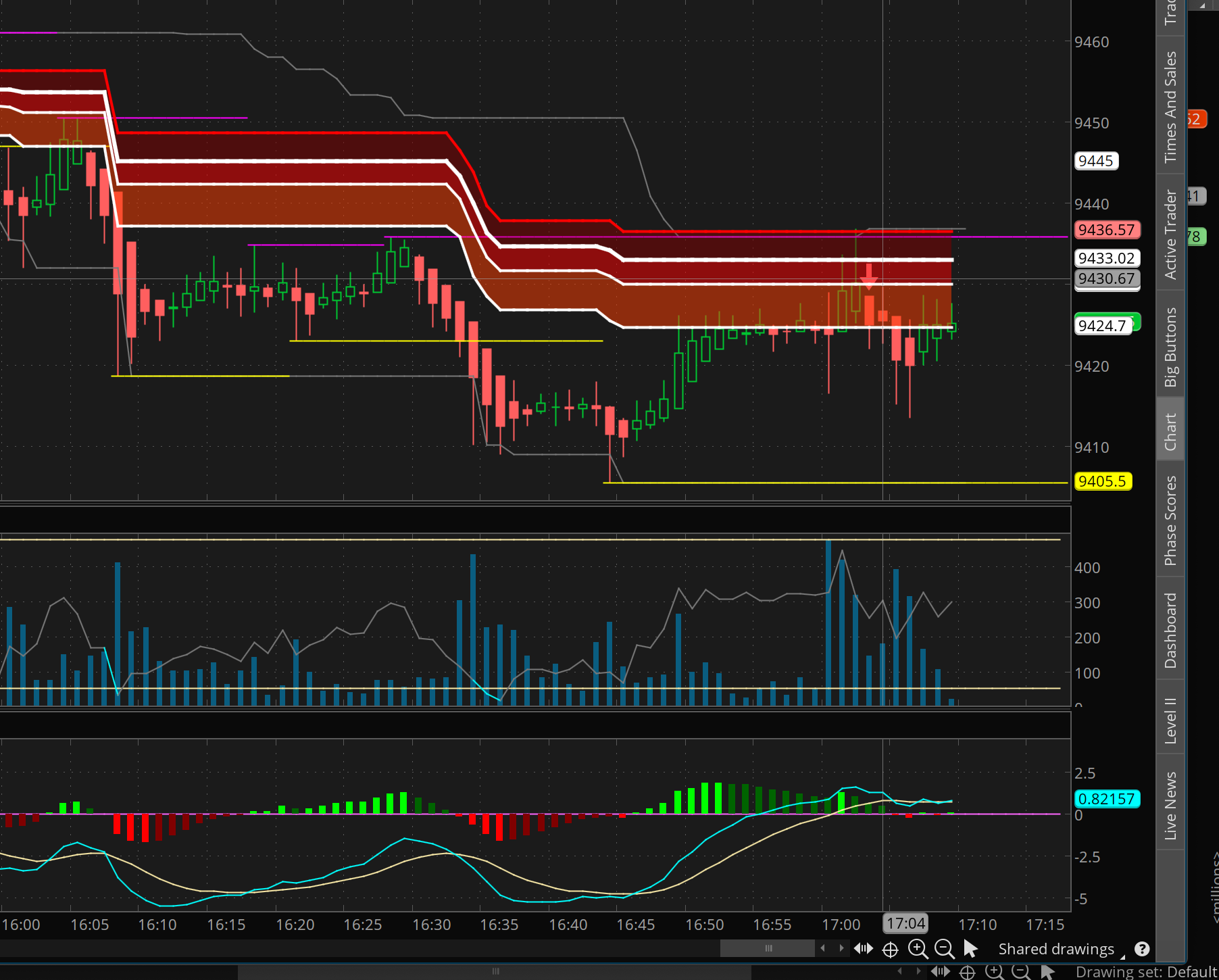

What I've noticed so far (BOD = Benefit of the Doubt)

1. Hull_moving_average_turning_points - BOD are not accurate for me

2. Discord_Watt_Support_Resistance - Works well for me. But I cannot use now as it needs some changes to make it less busy. My humble opinion IMHO:

A: Modify to disregard auto-fit studies tab. Example - Instead of seeing price $80-84 on y-axis you see $60-100. When zooming in to 80-84 and then scrolling it does not auto-fit along x-axis. This makes this tool only for research and not active trading as it reduces response time.

B: Remove all the S1,R1 bubbles. Zooming out those bubbles stay the same size and cover prices. (line 78 "#R1" ?)

C: Grey box removed

3. Average_Price_Movement_Indicator - BOD do not see a use for it.

4. SwingArm_ATR_Trend_With_Trigger - Merely Indicates beginning of swing of arm. Useful perhaps for secondary monitors. Changed to Up-Wedge and Low-Wedge White Indicators.

5. Enhanced_Trend_Reversal_Indicator - Interesting. I'm going to run some tests on prior trades before I give IMHO . Right now it looks if I could guess the volatility regardless of being a bullish or bearish day this could be useful. *Jigsaw puzzle not included.

6. ChrisAutoTrendline - More useful for longer time-frames. I have disabled on my shorter time frames.

7. ProjectionPivots_BenTen - This study interferes with my auto-scale settings as well and needs a disable. BOD Im not sure I know how to use this and feel it takes more time away from studying other indicators.

8. Futures_Swingarm_ATRTrail - This is the Main Study and the subject of this thread. Ive merely changed the width to 1 to allow my candles more illumination. I've added this on one monitor and will test for a few weeks. While I will not incorporate it yet into any strategies as I feel its merely at this moment a strong first look indicator. There's something about comparing all the time frames for verification of trends but that will need to be tested.

A: Can anyone share time frames they've found work well together testing against.

B: Was this developed more for futures and forex? Have you tested against securities on NSQ/NYSE? What is an example of a strategy you use with it. (You do not need to share your strategy but I am curious of how it is used. Swing, News, etc)

C: So the level 2,3,4 recommendations you advised for in your video could use more explanation how you intended it.

D: I got very confused from editing and moving around the studies so much that I lost your RSI and MACD studies. Which were they?

Link to Studies I found most helpful 4,5,8

What I've noticed so far (BOD = Benefit of the Doubt)

1. Hull_moving_average_turning_points - BOD are not accurate for me

2. Discord_Watt_Support_Resistance - Works well for me. But I cannot use now as it needs some changes to make it less busy. My humble opinion IMHO:

A: Modify to disregard auto-fit studies tab. Example - Instead of seeing price $80-84 on y-axis you see $60-100. When zooming in to 80-84 and then scrolling it does not auto-fit along x-axis. This makes this tool only for research and not active trading as it reduces response time.

B: Remove all the S1,R1 bubbles. Zooming out those bubbles stay the same size and cover prices. (line 78 "#R1" ?)

C: Grey box removed

3. Average_Price_Movement_Indicator - BOD do not see a use for it.

4. SwingArm_ATR_Trend_With_Trigger - Merely Indicates beginning of swing of arm. Useful perhaps for secondary monitors. Changed to Up-Wedge and Low-Wedge White Indicators.

5. Enhanced_Trend_Reversal_Indicator - Interesting. I'm going to run some tests on prior trades before I give IMHO . Right now it looks if I could guess the volatility regardless of being a bullish or bearish day this could be useful. *Jigsaw puzzle not included.

6. ChrisAutoTrendline - More useful for longer time-frames. I have disabled on my shorter time frames.

7. ProjectionPivots_BenTen - This study interferes with my auto-scale settings as well and needs a disable. BOD Im not sure I know how to use this and feel it takes more time away from studying other indicators.

8. Futures_Swingarm_ATRTrail - This is the Main Study and the subject of this thread. Ive merely changed the width to 1 to allow my candles more illumination. I've added this on one monitor and will test for a few weeks. While I will not incorporate it yet into any strategies as I feel its merely at this moment a strong first look indicator. There's something about comparing all the time frames for verification of trends but that will need to be tested.

A: Can anyone share time frames they've found work well together testing against.

B: Was this developed more for futures and forex? Have you tested against securities on NSQ/NYSE? What is an example of a strategy you use with it. (You do not need to share your strategy but I am curious of how it is used. Swing, News, etc)

C: So the level 2,3,4 recommendations you advised for in your video could use more explanation how you intended it.

D: I got very confused from editing and moving around the studies so much that I lost your RSI and MACD studies. Which were they?

Link to Studies I found most helpful 4,5,8

@mckenzieatix Just want to chime in real quick and point out that the Enhanced_Trend_Reversal_Indicator will repaint, meaning if the signal is wrong, it will disappear. You will only be able to see the right signal after the fact.

@mckenzieatix I just downloaded your Study and added YoungTraders Support and resistance study as well. Just wondering, from your study, how would you interpret this current situation? I am still very confused about all these lines.

D

[deleted]13

Guest

@michalg95 I see a blue line on the upper chart on the bottom. there is an added study there that is causing the main chart to be super compressed. Whatever the study it is that provides the blue line, disable it. and you should be fine.

Take your time and do some studying before drawing conclusions on anything. #1 Seek to Understand. Join us in the VIP room and there are a ton of people willing to extend a hand and offer what they already know.

Looking forward to seeing you.

Take your time and do some studying before drawing conclusions on anything. #1 Seek to Understand. Join us in the VIP room and there are a ton of people willing to extend a hand and offer what they already know.

Looking forward to seeing you.

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

605

Online

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.