@guyonabuffalo Not sure if it would fit your trading style but if you like the Waddah Attar Explosion and Ray Bull Power indicators then you might also like the Didi Index indicator... It can help stay in trends longer even when they may not look like trends... I run a modified version of the one posted here in the forums at https://usethinkscript.com/threads/...erts-and-mtf-scanner-for-tos.4793/#post-44440... Not sure if will help you or not but I've used it with several setups...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

blackFLAG FTS - SwingArm Trend Indicator using ATRTrailing Stop and Fibonacci Retracements

- Status

- Not open for further replies.

I need some help in creating a label for the Swingarm zone that displays the distance from the trailing stop line to the Fib3 line and based on that display the position size to take based on the dollar risk set in the label parameters. I have found a similar label on the forum and think it can be used as reference / modification.

Edit: With my limited copy and paste knowledge I combined the two together.

Edit: With my limited copy and paste knowledge I combined the two together.

Code:

input RiskUnit = 100;

input AggregationPeriod = AggregationPeriod.FIFTEEN_MIN;

def highVal = Round(Fib3, 2);

def lowVal = Round(TrailingStop, 2);

AddLabel(

yes,

"High: " + highVal + " Low: " + lowVal,

Color.Gray

);

def diff = highVal-LowVal;

AddLabel(

yes,

AsDollars(RiskUnit) + " risk with " + AsDollars(diff) + " stop = " + Floor(Round(RiskUnit/diff)) + " shares",

Color.Gray

);

Last edited:

Gives 4 errors.I need some help in creating a label for the Swingarm zone that displays the distance from the trailing stop line to the Fib3 line and based on that display the position size to take based on the dollar risk set in the label parameters. I have found a similar label on the forum and think it can be used as reference / modification.

Edit: With my limited copy and paste knowledge I combined the two together.

Code:input RiskUnit = 100; input AggregationPeriod = AggregationPeriod.FIFTEEN_MIN; def highVal = Round(Fib3, 2); def lowVal = Round(TrailingStop, 2); AddLabel( yes, "High: " + highVal + " Low: " + lowVal, Color.Gray ); def diff = highVal-LowVal; AddLabel( yes, AsDollars(RiskUnit) + " risk with " + AsDollars(diff) + " stop = " + Floor(Round(RiskUnit/diff)) + " shares", Color.Gray );

@chewie76 where is Fib .618, a stronger support or resistance level, thanks!@unkownriver

This has shades, no bubbles.

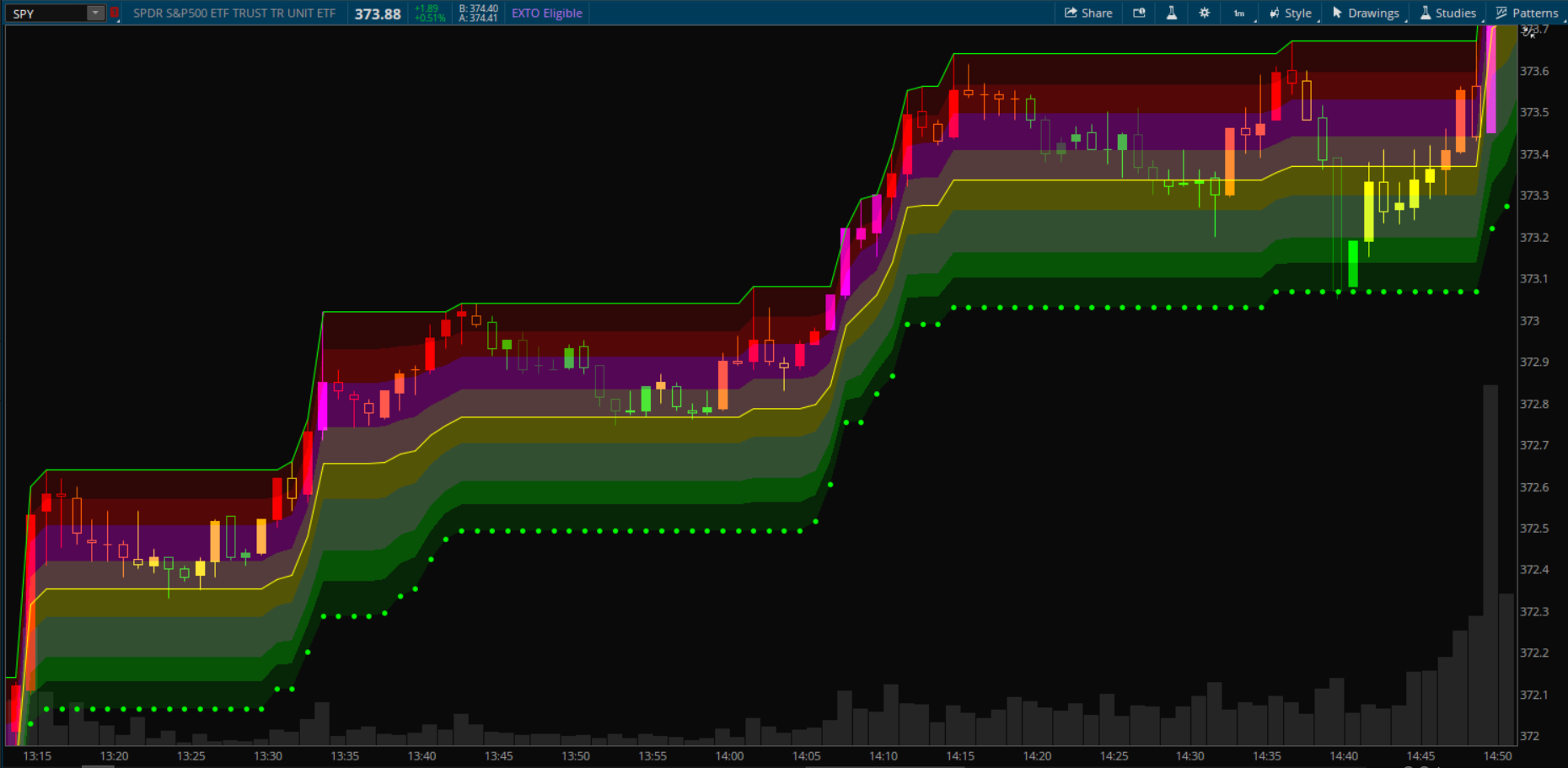

Picture is SPY on 1 min. chart http://tos.mx/p31Urnx

The yellow line is 50% fib.

It's the next line color change from the yellow 50 line. Below it if in uptrend, and above it in downtrend.@chewie76 where is Fib .618, a stronger support or resistance level, thanks!

guyonabuffalo

New member

Hi Ben, can you create a strategy that opens a position when price crosses the fib3(88.6) level? I've done it with the close of the candle but I'd like it to trigger whenever price touches that 88.6 level.@madantv73 I don't recall seeing any backtesting strategy for this indicator. However, it should be fairly simple to set one up. How would you like the buy and sell orders to be triggered? I would keep the conditions within the SwingArm indicator's scope and not get any other scripts involved to simplify the coding process.

Could you share the code for close of the candle? I've been trying to create a strategy but no success.Hi Ben, can you create a strategy that opens a position when price crosses the fib3(88.6) level? I've done it with the close of the candle but I'd like it to trigger whenever price touches that 88.6 level.

I can I remove all of the bubbles and names@fjr1300 - thanks for your research and helping heart.

I am still a beginner trying to get success ..

https://tos.mx/lEkVYbC

Added all the studies those discussed in this group with latest code.

this is with white background. So edited a bit to change colors. Also shortened the comments in the bubbles.

I hope this is useful and let me know if you find anything wrong with this.

https://tos.mx/lEkVYbC

guyonabuffalo

New member

The addorder are at the bottom. As you can see I was playing around with different ways but I couldn't figure it out. Unfortunately I've moved onto a different strategy. Not because this one doesn't work, it really does, but I've found another that fits my style a bit better. If you do figure it out though, please post the results.Could you share the code for close of the candle? I've been trying to create a strategy but no success.

Code:

# Original Code From: TD Ameritrade IP Company, Inc. (c) 2009-2020

# Original StudyName: ATRTrailingStop

# Type: Study

# blackFLAG FTS SwingArms

# StudyName: blackFLAG_Futures_SwingArm_ATRTrail

# My preferred setting is 28 / 5 FOR ALL TIMEFRAMES

# Edited by: Jose Azcarate

# blackFLAG Futures Trading - FOR EDUCATIONAL PURPOSES ONLY

# TWITTER: @blackflagfuture

# UPDATED: 5/16/2020

# NOTE: WHEN IMPORTING STUDY, MAKE SURE YOU UPDATE THE LOOK AND FEEL TO MATCH MY CHARTS WITHIN THE STUDY SETTINGS.

#-----------------------------------

#-----------------------------------

# BUY & SELL ALERTS ARE CREATED BY THE HULL MOVING AVERAGE TURNING POINTS STUDY AND MUST BE IN AGREEMENT WITH SWINGARM SUPPORT OR RESISTANCE ZONES TO BE VALID. (UseThinkScript.com by mashume - Upper Study). MY UPDATED CODE INCLUDES THE BUY / SELL BUBBLES. THE SETTINGS ARE: 1 MIN: 255 PERIOD; 5 MIN: 255 PERIOD; 4 HOUR 255 PERIOD.

#-----------------------------------

#-----------------------------------

input trailType = {default modified, unmodified};

input ATRPeriod = 28;

input ATRFactor = 5;

input firstTrade = {default long, short};

input averageType = AverageType.WILDERS;

input fib1Level = 61.8;

input fib2Level = 78.6;

input fib3Level = 88.6;

Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor);

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE);

def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE);

def ex = if BuySignal then high else if SellSignal then low else if state == state.long then Max(ex[1], high) else if state == state.short then Min(ex[1], low) else ex[1];

plot TrailingStop = trail;

TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS);

TrailingStop.DefineColor("Long", Color.GREEN);

TrailingStop.DefineColor("Short", Color.RED);

TrailingStop.AssignValueColor(if state == state.long

then TrailingStop.Color("Long")

else TrailingStop.Color("Short"));

plot Extremum = ex;

Extremum.SetPaintingStrategy(PaintingStrategy.POINTS);

Extremum.DefineColor("HH", Color.GREEN);

Extremum.DefineColor("LL", Color.RED);

Extremum.AssignValueColor(if state == state.long

then Extremum.Color("HH")

else Extremum.Color("LL"));

Extremum.Hide();

def f1 = ex + (trail - ex) * fib1Level / 100;

def f2 = ex + (trail - ex) * fib2Level / 100;

def f3 = ex + (trail - ex) * fib3Level / 100;

def l100 = trail + 0;

plot Fib1 = f1;

Fib1.SetPaintingStrategy(PaintingStrategy.POINTS);

Fib1.SetDefaultColor(Color.BLACK);

Fib1.Hide();

plot Fib2 = f2;

Fib2.SetPaintingStrategy(PaintingStrategy.POINTS);

Fib2.SetDefaultColor(Color.BLACK);

Fib2.Hide();

plot Fib3 = f3;

Fib3.SetPaintingStrategy(PaintingStrategy.POINTS);

Fib3.SetDefaultColor(Color.BLACK);

Fib3.Hide();

AddCloud(f1, f2, Color.LIGHT_GREEN, Color.LIGHT_RED, no);

AddCloud(f2, f3, Color.GREEN, Color.RED, no);

AddCloud(f3, l100, Color.DARK_GREEN, Color.DARK_RED, no);

def l1 = state[1] == state.long and close crosses below f1[1];

def l2 = state[1] == state.long and close crosses below f2[1];

def l3 = state[1] == state.long and close crosses below f3[1];

def s1 = state[1] == state.short and close crosses above f1[1];

def s2 = state[1] == state.short and close crosses above f2[1];

def s3 = state[1] == state.short and close crosses above f3[1];

def atr = Average(TrueRange(high, close, low), 14);

plot LS1 = if l1 then low - atr else Double.NaN;

plot LS2 = if l2 then low - 1.5 * atr else Double.NaN;

plot LS3 = if l3 then low - 2 * atr else Double.NaN;

plot SS1 = if s1 then high + atr else Double.NaN;

plot SS2 = if s2 then high + 1.5 * atr else Double.NaN;

plot SS3 = if s3 then high + 2 * atr else Double.NaN;

LS1.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

LS1.SetDefaultColor(Color.GREEN);

LS1.SetLineWeight(1);

LS1.Hide();

LS2.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

LS2.SetDefaultColor(Color.GREEN);

LS2.SetLineWeight(1);

LS2.Hide();

LS3.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

LS3.SetDefaultColor(Color.GREEN);

LS3.SetLineWeight(1);

LS3.Hide();

SS1.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SS1.SetDefaultColor(Color.RED);

SS1.SetLineWeight(1);

SS1.Hide();

SS2.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SS2.SetDefaultColor(Color.RED);

SS2.SetLineWeight(1);

SS2.Hide();

SS3.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SS3.SetDefaultColor(Color.RED);

SS3.SetLineWeight(1);

SS3.Hide();

Alert(l1, "Price crossed below Fib1 level in long trend", Alert.BAR, Sound.Bell);

#Alert(l2, "Price crossed below Fib2 level in long trend", Alert.BAR, Sound.Bell);

#Alert(l3, "Price crossed below Fib3 level in long trend", Alert.BAR, Sound.Bell);

Alert(s1, "Price crossed above Fib1 level in short trend", Alert.BAR, Sound.Bell);

#Alert(s2, "Price crossed above Fib2 level in short trend", Alert.BAR, Sound.Bell);

#Alert(s3, "Price crossed above Fib3 level in short trend", Alert.BAR, Sound.Bell);

#AddOrder(OrderType.BUY_TO_OPEN, condition = l3, price = open, 1, tickColor = GetColor(1), arrowColor = GetColor(1), name #= "BTO");

AddOrder(OrderType.BUY_TO_OPEN, condition = l3, close[0], 1, tickColor = GetColor(1), arrowColor = GetColor(1), name = "BTO");

#AddOrder(OrderType.BUY_TO_OPEN, price crosses below f3, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = "BTO");

#AddOrder(OrderType.SELL_TO_CLOSE, close > EntryPrice() - 40);

#AddOrder(OrderType.SELL_TO_OPEN, condition = s3, price = open, 1, tickColor = GetColor(2), arrowColor = GetColor(2), name #= "STO");

#AddOrder(OrderType.SELL_TO_OPEN, condition = s3, 1, tickColor = GetColor(2), arrowColor = GetColor(2), name = "STO");⚠ This thread has exhausted its substantive discussion of this indicator so it has been locked ⚠

This thread is still available for reading. If looking for specific information in this thread, here is a great hack for searching many-paged threads.Can someone who codes take the script from these indicators and make them for TOS? Here are the two indicators I am looking for this code is for average true range trailing stop colored

average true range trailing stop colored

average true range trailing stop colored

Code:

////////////////////////////////////////////////////////////

// Copyright by HPotter v2.0 13/10/2014

// Average True Range Trailing Stops Strategy, by Sylvain Vervoort

// The related article is copyrighted material from Stocks & Commodities Jun 2009

////////////////////////////////////////////////////////////

study(title="Average True Range Trailing Stops Strategy, by Sylvain Vervoort", overlay = true)

nATRPeriod = input(5)

nATRMultip = input(3.5)

xATR = atr(nATRPeriod)

nLoss = nATRMultip * xATR

xATRTrailingStop = iff(close > nz(xATRTrailingStop[1], 0) and close[1] > nz(xATRTrailingStop[1], 0), max(nz(xATRTrailingStop[1]), close - nLoss),

iff(close < nz(xATRTrailingStop[1], 0) and close[1] < nz(xATRTrailingStop[1], 0), min(nz(xATRTrailingStop[1]), close + nLoss),

iff(close > nz(xATRTrailingStop[1], 0), close - nLoss, close + nLoss)))

pos = iff(close[1] < nz(xATRTrailingStop[1], 0) and close > nz(xATRTrailingStop[1], 0), 1,

iff(close[1] > nz(xATRTrailingStop[1], 0) and close < nz(xATRTrailingStop[1], 0), -1, nz(pos[1], 0)))

color = pos == -1 ? red: pos == 1 ? green : blue

plot(xATRTrailingStop, color=color, title="ATR Trailing Stop")

smart money Concepts [LUX]

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=5

indicator("Smart Money Concepts [LUX]", "Smart Money Concepts [LuxAlgo]"

, overlay = true

, max_labels_count = 500

, max_lines_count = 500

, max_boxes_count = 500

, max_bars_back = 500)

//-----------------------------------------------------------------------------{

//Constants

//-----------------------------------------------------------------------------{

color TRANSP_CSS = #ffffff00

//Tooltips

string MODE_TOOLTIP = 'Allows to display historical Structure or only the recent ones'

string STYLE_TOOLTIP = 'Indicator color theme'

string COLOR_CANDLES_TOOLTIP = 'Display additional candles with a color reflecting the current trend detected by structure'

string SHOW_INTERNAL = 'Display internal market structure'

string CONFLUENCE_FILTER = 'Filter non significant internal structure breakouts'

string SHOW_SWING = 'Display swing market Structure'

string SHOW_SWING_POINTS = 'Display swing point as labels on the chart'

string SHOW_SWHL_POINTS = 'Highlight most recent strong and weak high/low points on the chart'

string INTERNAL_OB = 'Display internal order blocks on the chart\n\nNumber of internal order blocks to display on the chart'

string SWING_OB = 'Display swing order blocks on the chart\n\nNumber of internal swing blocks to display on the chart'

string FILTER_OB = 'Method used to filter out volatile order blocks \n\nIt is recommended to use the cumulative mean range method when a low amount of data is available'

string SHOW_EQHL = 'Display equal highs and equal lows on the chart'

string EQHL_BARS = 'Number of bars used to confirm equal highs and equal lows'

string EQHL_THRESHOLD = 'Sensitivity threshold in a range (0, 1) used for the detection of equal highs & lows\n\nLower values will return fewer but more pertinent results'

string SHOW_FVG = 'Display fair values gaps on the chart'

string AUTO_FVG = 'Filter out non significant fair value gaps'

string FVG_TF = 'Fair value gaps timeframe'

string EXTEND_FVG = 'Determine how many bars to extend the Fair Value Gap boxes on chart'

string PED_ZONES = 'Display premium, discount, and equilibrium zones on chart'

//-----------------------------------------------------------------------------{

//Settings

//-----------------------------------------------------------------------------{

//General

//----------------------------------------{

mode = input.string('Historical'

, options = ['Historical', 'Present']

, group = 'Smart Money Concepts'

, tooltip = MODE_TOOLTIP)

style = input.string('Colored'

, options = ['Colored', 'Monochrome']

, group = 'Smart Money Concepts'

, tooltip = STYLE_TOOLTIP)

show_trend = input(false, 'Color Candles'

, group = 'Smart Money Concepts'

, tooltip = COLOR_CANDLES_TOOLTIP)

//----------------------------------------}

//Internal Structure

//----------------------------------------{

show_internals = input(true, 'Show Internal Structure'

, group = 'Real Time Internal Structure'

, tooltip = SHOW_INTERNAL)

show_ibull = input.string('All', 'Bullish Structure'

, options = ['All', 'BOS', 'CHoCH']

, inline = 'ibull'

, group = 'Real Time Internal Structure')

swing_ibull_css = input(#089981, ''

, inline = 'ibull'

, group = 'Real Time Internal Structure')

//Bear Structure

show_ibear = input.string('All', 'Bearish Structure'

, options = ['All', 'BOS', 'CHoCH']

, inline = 'ibear'

, group = 'Real Time Internal Structure')

swing_ibear_css = input(#f23645, ''

, inline = 'ibear'

, group = 'Real Time Internal Structure')

ifilter_confluence = input(false, 'Confluence Filter'

, group = 'Real Time Internal Structure'

, tooltip = CONFLUENCE_FILTER)

//----------------------------------------}

//Swing Structure

//----------------------------------------{

show_Structure = input(true, 'Show Swing Structure'

, group = 'Real Time Swing Structure'

, tooltip = SHOW_SWING)

//Bull Structure

show_bull = input.string('All', 'Bullish Structure'

, options = ['All', 'BOS', 'CHoCH']

, inline = 'bull'

, group = 'Real Time Swing Structure')

swing_bull_css = input(#089981, ''

, inline = 'bull'

, group = 'Real Time Swing Structure')

//Bear Structure

show_bear = input.string('All', 'Bearish Structure'

, options = ['All', 'BOS', 'CHoCH']

, inline = 'bear'

, group = 'Real Time Swing Structure')

swing_bear_css = input(#f23645, ''

, inline = 'bear'

, group = 'Real Time Swing Structure')

//Swings

show_swings = input(false, 'Show Swings Points'

, inline = 'swings'

, group = 'Real Time Swing Structure'

, tooltip = SHOW_SWING_POINTS)

length = input.int(50, ''

, minval = 10

, inline = 'swings'

, group = 'Real Time Swing Structure')

show_hl_swings = input(true, 'Show Strong/Weak High/Low'

, group = 'Real Time Swing Structure'

, tooltip = SHOW_SWHL_POINTS)

//----------------------------------------}

//Order Blocks

//----------------------------------------{

show_iob = input(true, 'Internal Order Blocks'

, inline = 'iob'

, group = 'Order Blocks'

, tooltip = INTERNAL_OB)

iob_showlast = input.int(5, ''

, minval = 1

, inline = 'iob'

, group = 'Order Blocks')

show_ob = input(false, 'Swing Order Blocks'

, inline = 'ob'

, group = 'Order Blocks'

, tooltip = SWING_OB)

ob_showlast = input.int(5, ''

, minval = 1

, inline = 'ob'

, group = 'Order Blocks')

ob_filter = input.string('Atr', 'Order Block Filter'

, options = ['Atr', 'Cumulative Mean Range']

, group = 'Order Blocks'

, tooltip = FILTER_OB)

ibull_ob_css = input.color(color.new(#3179f5, 80), 'Internal Bullish OB'

, group = 'Order Blocks')

ibear_ob_css = input.color(color.new(#f77c80, 80), 'Internal Bearish OB'

, group = 'Order Blocks')

bull_ob_css = input.color(color.new(#1848cc, 80), 'Bullish OB'

, group = 'Order Blocks')

bear_ob_css = input.color(color.new(#b22833, 80), 'Bearish OB'

, group = 'Order Blocks')

//----------------------------------------}

//EQH/EQL

//----------------------------------------{

show_eq = input(true, 'Equal High/Low'

, group = 'EQH/EQL'

, tooltip = SHOW_EQHL)

eq_len = input.int(3, 'Bars Confirmation'

, minval = 1

, group = 'EQH/EQL'

, tooltip = EQHL_BARS)

eq_threshold = input.float(0.1, 'Threshold'

, minval = 0

, maxval = 0.5

, step = 0.1

, group = 'EQH/EQL'

, tooltip = EQHL_THRESHOLD)

//----------------------------------------}

//Fair Value Gaps

//----------------------------------------{

show_fvg = input(false, 'Fair Value Gaps'

, group = 'Fair Value Gaps'

, tooltip = SHOW_FVG)

fvg_auto = input(true, "Auto Threshold"

, group = 'Fair Value Gaps'

, tooltip = AUTO_FVG)

fvg_tf = input.timeframe('', "Timeframe"

, group = 'Fair Value Gaps'

, tooltip = FVG_TF)

bull_fvg_css = input.color(color.new(#00ff68, 70), 'Bullish FVG'

, group = 'Fair Value Gaps')

bear_fvg_css = input.color(color.new(#ff0008, 70), 'Bearish FVG'

, group = 'Fair Value Gaps')

fvg_extend = input.int(1, "Extend FVG"

, minval = 0

, group = 'Fair Value Gaps'

, tooltip = EXTEND_FVG)

//----------------------------------------}

//Previous day/week high/low

//----------------------------------------{

//Daily

show_pdhl = input(false, 'Daily'

, inline = 'daily'

, group = 'Highs & Lows MTF')

pdhl_style = input.string('⎯⎯⎯', ''

, options = ['⎯⎯⎯', '----', '····']

, inline = 'daily'

, group = 'Highs & Lows MTF')

pdhl_css = input(#2157f3, ''

, inline = 'daily'

, group = 'Highs & Lows MTF')

//Weekly

show_pwhl = input(false, 'Weekly'

, inline = 'weekly'

, group = 'Highs & Lows MTF')

pwhl_style = input.string('⎯⎯⎯', ''

, options = ['⎯⎯⎯', '----', '····']

, inline = 'weekly'

, group = 'Highs & Lows MTF')

pwhl_css = input(#2157f3, ''

, inline = 'weekly'

, group = 'Highs & Lows MTF')

//Monthly

show_pmhl = input(false, 'Monthly'

, inline = 'monthly'

, group = 'Highs & Lows MTF')

pmhl_style = input.string('⎯⎯⎯', ''

, options = ['⎯⎯⎯', '----', '····']

, inline = 'monthly'

, group = 'Highs & Lows MTF')

pmhl_css = input(#2157f3, ''

, inline = 'monthly'

, group = 'Highs & Lows MTF')

//----------------------------------------}

//Premium/Discount zones

//----------------------------------------{

show_sd = input(false, 'Premium/Discount Zones'

, group = 'Premium & Discount Zones'

, tooltip = PED_ZONES)

premium_css = input.color(#f23645, 'Premium Zone'

, group = 'Premium & Discount Zones')

eq_css = input.color(#b2b5be, 'Equilibrium Zone'

, group = 'Premium & Discount Zones')

discount_css = input.color(#089981, 'Discount Zone'

, group = 'Premium & Discount Zones')

//-----------------------------------------------------------------------------}

//Functions

//-----------------------------------------------------------------------------{

n = bar_index

atr = ta.atr(200)

cmean_range = ta.cum(high - low) / n

//HL Output function

hl() => [high, low]

//Get ohlc values function

get_ohlc()=> [close[1], open[1], high, low, high[2], low[2]]

//Display Structure function

display_Structure(x, y, txt, css, dashed, down, lbl_size)=>

structure_line = line.new(x, y, n, y

, color = css

, style = dashed ? line.style_dashed : line.style_solid)

structure_lbl = label.new(int(math.avg(x, n)), y, txt

, color = TRANSP_CSS

, textcolor = css

, style = down ? label.style_label_down : label.style_label_up

, size = lbl_size)

if mode == 'Present'

line.delete(structure_line[1])

label.delete(structure_lbl[1])

//Swings detection/measurements

swings(len)=>

var os = 0

upper = ta.highest(len)

lower = ta.lowest(len)

os := high[len] > upper ? 0 : low[len] < lower ? 1 : os[1]

top = os == 0 and os[1] != 0 ? high[len] : 0

btm = os == 1 and os[1] != 1 ? low[len] : 0

[top, btm]

//Order block coordinates function

ob_coord(use_max, loc, target_top, target_btm, target_left, target_type)=>

min = 99999999.

max = 0.

idx = 1

ob_threshold = ob_filter == 'Atr' ? atr : cmean_range

//Search for highest/lowest high within the structure interval and get range

if use_max

for i = 1 to (n - loc)-1

if (high - low) < ob_threshold * 2

max := math.max(high, max)

min := max == high ? low : min

idx := max == high ? i : idx

else

for i = 1 to (n - loc)-1

if (high - low) < ob_threshold * 2

min := math.min(low, min)

max := min == low ? high : max

idx := min == low ? i : idx

array.unshift(target_top, max)

array.unshift(target_btm, min)

array.unshift(target_left, time[idx])

array.unshift(target_type, use_max ? -1 : 1)

//Set order blocks

display_ob(boxes, target_top, target_btm, target_left, target_type, show_last, swing, size)=>

for i = 0 to math.min(show_last-1, size-1)

get_box = array.get(boxes, i)

box.set_lefttop(get_box, array.get(target_left, i), array.get(target_top, i))

box.set_rightbottom(get_box, array.get(target_left, i), array.get(target_btm, i))

box.set_extend(get_box, extend.right)

color css = na

if swing

if style == 'Monochrome'

css := array.get(target_type, i) == 1 ? color.new(#b2b5be, 80) : color.new(#5d606b, 80)

border_css = array.get(target_type, i) == 1 ? #b2b5be : #5d606b

box.set_border_color(get_box, border_css)

else

css := array.get(target_type, i) == 1 ? bull_ob_css : bear_ob_css

box.set_border_color(get_box, css)

box.set_bgcolor(get_box, css)

else

if style == 'Monochrome'

css := array.get(target_type, i) == 1 ? color.new(#b2b5be, 80) : color.new(#5d606b, 80)

else

css := array.get(target_type, i) == 1 ? ibull_ob_css : ibear_ob_css

box.set_border_color(get_box, css)

box.set_bgcolor(get_box, css)

//Line Style function

get_line_style(style) =>

out = switch style

'⎯⎯⎯' => line.style_solid

'----' => line.style_dashed

'····' => line.style_dotted

//Set line/labels function for previous high/lows

phl(h, l, tf, css)=>

var line high_line = line.new(na,na,na,na

, xloc = xloc.bar_time

, color = css

, style = get_line_style(pdhl_style))

var label high_lbl = label.new(na,na

, xloc = xloc.bar_time

, text = str.format('P{0}H', tf)

, color = TRANSP_CSS

, textcolor = css

, size = size.small

, style = label.style_label_left)

var line low_line = line.new(na,na,na,na

, xloc = xloc.bar_time

, color = css

, style = get_line_style(pdhl_style))

var label low_lbl = label.new(na,na

, xloc = xloc.bar_time

, text = str.format('P{0}L', tf)

, color = TRANSP_CSS

, textcolor = css

, size = size.small

, style = label.style_label_left)

hy = ta.valuewhen(h != h[1], h, 1)

hx = ta.valuewhen(h == high, time, 1)

ly = ta.valuewhen(l != l[1], l, 1)

lx = ta.valuewhen(l == low, time, 1)

if barstate.islast

ext = time + (time - time[1])*20

//High

line.set_xy1(high_line, hx, hy)

line.set_xy2(high_line, ext, hy)

label.set_xy(high_lbl, ext, hy)

//Low

line.set_xy1(low_line, lx, ly)

line.set_xy2(low_line, ext, ly)

label.set_xy(low_lbl, ext, ly)

//-----------------------------------------------------------------------------}

//Global variables

//-----------------------------------------------------------------------------{

var trend = 0, var itrend = 0

var top_y = 0., var top_x = 0

var btm_y = 0., var btm_x = 0

var itop_y = 0., var itop_x = 0

var ibtm_y = 0., var ibtm_x = 0

var trail_up = high, var trail_dn = low

var trail_up_x = 0, var trail_dn_x = 0

var top_cross = true, var btm_cross = true

var itop_cross = true, var ibtm_cross = true

var txt_top = '', var txt_btm = ''

//Alerts

bull_choch_alert = false

bull_bos_alert = false

bear_choch_alert = false

bear_bos_alert = false

bull_ichoch_alert = false

bull_ibos_alert = false

bear_ichoch_alert = false

bear_ibos_alert = false

bull_iob_break = false

bear_iob_break = false

bull_ob_break = false

bear_ob_break = false

eqh_alert = false

eql_alert = false

//Structure colors

var bull_css = style == 'Monochrome' ? #b2b5be

: swing_bull_css

var bear_css = style == 'Monochrome' ? #b2b5be

: swing_bear_css

var ibull_css = style == 'Monochrome' ? #b2b5be

: swing_ibull_css

var ibear_css = style == 'Monochrome' ? #b2b5be

: swing_ibear_css

//Swings

[top, btm] = swings(length)

[itop, ibtm] = swings(5)

//-----------------------------------------------------------------------------}

//Pivot High

//-----------------------------------------------------------------------------{

var line extend_top = na

var label extend_top_lbl = label.new(na, na

, color = TRANSP_CSS

, textcolor = bear_css

, style = label.style_label_down

, size = size.tiny)

if top

top_cross := true

txt_top := top > top_y ? 'HH' : 'LH'

if show_swings

top_lbl = label.new(n-length, top, txt_top

, color = TRANSP_CSS

, textcolor = bear_css

, style = label.style_label_down

, size = size.small)

if mode == 'Present'

label.delete(top_lbl[1])

//Extend recent top to last bar

line.delete(extend_top[1])

extend_top := line.new(n-length, top, n, top

, color = bear_css)

top_y := top

top_x := n - length

trail_up := top

trail_up_x := n - length

if itop

itop_cross := true

itop_y := itop

itop_x := n - 5

//Trailing maximum

trail_up := math.max(high, trail_up)

trail_up_x := trail_up == high ? n : trail_up_x

//Set top extension label/line

if barstate.islast and show_hl_swings

line.set_xy1(extend_top, trail_up_x, trail_up)

line.set_xy2(extend_top, n + 20, trail_up)

label.set_x(extend_top_lbl, n + 20)

label.set_y(extend_top_lbl, trail_up)

label.set_text(extend_top_lbl, trend < 0 ? 'Strong High' : 'Weak High')

//-----------------------------------------------------------------------------}

//Pivot Low

//-----------------------------------------------------------------------------{

var line extend_btm = na

var label extend_btm_lbl = label.new(na, na

, color = TRANSP_CSS

, textcolor = bull_css

, style = label.style_label_up

, size = size.tiny)

if btm

btm_cross := true

txt_btm := btm < btm_y ? 'LL' : 'HL'

if show_swings

btm_lbl = label.new(n - length, btm, txt_btm

, color = TRANSP_CSS

, textcolor = bull_css

, style = label.style_label_up

, size = size.small)

if mode == 'Present'

label.delete(btm_lbl[1])

//Extend recent btm to last bar

line.delete(extend_btm[1])

extend_btm := line.new(n - length, btm, n, btm

, color = bull_css)

btm_y := btm

btm_x := n-length

trail_dn := btm

trail_dn_x := n-length

if ibtm

ibtm_cross := true

ibtm_y := ibtm

ibtm_x := n - 5

//Trailing minimum

trail_dn := math.min(low, trail_dn)

trail_dn_x := trail_dn == low ? n : trail_dn_x

//Set btm extension label/line

if barstate.islast and show_hl_swings

line.set_xy1(extend_btm, trail_dn_x, trail_dn)

line.set_xy2(extend_btm, n + 20, trail_dn)

label.set_x(extend_btm_lbl, n + 20)

label.set_y(extend_btm_lbl, trail_dn)

label.set_text(extend_btm_lbl, trend > 0 ? 'Strong Low' : 'Weak Low')

//-----------------------------------------------------------------------------}

//Order Blocks Arrays

//-----------------------------------------------------------------------------{

var iob_top = array.new_float(0)

var iob_btm = array.new_float(0)

var iob_left = array.new_int(0)

var iob_type = array.new_int(0)

var ob_top = array.new_float(0)

var ob_btm = array.new_float(0)

var ob_left = array.new_int(0)

var ob_type = array.new_int(0)

//-----------------------------------------------------------------------------}

//Pivot High BOS/CHoCH

//-----------------------------------------------------------------------------{

//Filtering

var bull_concordant = true

if ifilter_confluence

bull_concordant := high - math.max(close, open) > math.min(close, open - low)

//Detect internal bullish Structure

if ta.crossover(close, itop_y) and itop_cross and top_y != itop_y and bull_concordant

bool choch = na

if itrend < 0

choch := true

bull_ichoch_alert := true

else

bull_ibos_alert := true

txt = choch ? 'CHoCH' : 'BOS'

if show_internals

if show_ibull == 'All' or (show_ibull == 'BOS' and not choch) or (show_ibull == 'CHoCH' and choch)

display_Structure(itop_x, itop_y, txt, ibull_css, true, true, size.tiny)

itop_cross := false

itrend := 1

//Internal Order Block

if show_iob

ob_coord(false, itop_x, iob_top, iob_btm, iob_left, iob_type)

//Detect bullish Structure

if ta.crossover(close, top_y) and top_cross

bool choch = na

if trend < 0

choch := true

bull_choch_alert := true

else

bull_bos_alert := true

txt = choch ? 'CHoCH' : 'BOS'

if show_Structure

if show_bull == 'All' or (show_bull == 'BOS' and not choch) or (show_bull == 'CHoCH' and choch)

display_Structure(top_x, top_y, txt, bull_css, false, true, size.small)

//Order Block

if show_ob

ob_coord(false, top_x, ob_top, ob_btm, ob_left, ob_type)

top_cross := false

trend := 1

//-----------------------------------------------------------------------------}

//Pivot Low BOS/CHoCH

//-----------------------------------------------------------------------------{

var bear_concordant = true

if ifilter_confluence

bear_concordant := high - math.max(close, open) < math.min(close, open - low)

//Detect internal bearish Structure

if ta.crossunder(close, ibtm_y) and ibtm_cross and btm_y != ibtm_y and bear_concordant

bool choch = false

if itrend > 0

choch := true

bear_ichoch_alert := true

else

bear_ibos_alert := true

txt = choch ? 'CHoCH' : 'BOS'

if show_internals

if show_ibear == 'All' or (show_ibear == 'BOS' and not choch) or (show_ibear == 'CHoCH' and choch)

display_Structure(ibtm_x, ibtm_y, txt, ibear_css, true, false, size.tiny)

ibtm_cross := false

itrend := -1

//Internal Order Block

if show_iob

ob_coord(true, ibtm_x, iob_top, iob_btm, iob_left, iob_type)

//Detect bearish Structure

if ta.crossunder(close, btm_y) and btm_cross

bool choch = na

if trend > 0

choch := true

bear_choch_alert := true

else

bear_bos_alert := true

txt = choch ? 'CHoCH' : 'BOS'

if show_Structure

if show_bear == 'All' or (show_bear == 'BOS' and not choch) or (show_bear == 'CHoCH' and choch)

display_Structure(btm_x, btm_y, txt, bear_css, false, false, size.small)

//Order Block

if show_ob

ob_coord(true, btm_x, ob_top, ob_btm, ob_left, ob_type)

btm_cross := false

trend := -1

//-----------------------------------------------------------------------------}

//Order Blocks

//-----------------------------------------------------------------------------{

//Set order blocks

var iob_boxes = array.new_box(0)

var ob_boxes = array.new_box(0)

//Delete internal order blocks box coordinates if top/bottom is broken

for element in iob_type

index = array.indexof(iob_type, element)

if close < array.get(iob_btm, index) and element == 1

array.remove(iob_top, index)

array.remove(iob_btm, index)

array.remove(iob_left, index)

array.remove(iob_type, index)

bull_iob_break := true

else if close > array.get(iob_top, index) and element == -1

array.remove(iob_top, index)

array.remove(iob_btm, index)

array.remove(iob_left, index)

array.remove(iob_type, index)

bear_iob_break := true

//Delete internal order blocks box coordinates if top/bottom is broken

for element in ob_type

index = array.indexof(ob_type, element)

if close < array.get(ob_btm, index) and element == 1

array.remove(ob_top, index)

array.remove(ob_btm, index)

array.remove(ob_left, index)

array.remove(ob_type, index)

bull_ob_break := true

else if close > array.get(ob_top, index) and element == -1

array.remove(ob_top, index)

array.remove(ob_btm, index)

array.remove(ob_left, index)

array.remove(ob_type, index)

bear_ob_break := true

iob_size = array.size(iob_type)

ob_size = array.size(ob_type)

if barstate.isfirst

if show_iob

for i = 0 to iob_showlast-1

array.push(iob_boxes, box.new(na,na,na,na, xloc = xloc.bar_time))

if show_ob

for i = 0 to ob_showlast-1

array.push(ob_boxes, box.new(na,na,na,na, xloc = xloc.bar_time))

if iob_size > 0

if barstate.islast

display_ob(iob_boxes, iob_top, iob_btm, iob_left, iob_type, iob_showlast, false, iob_size)

if ob_size > 0

if barstate.islast

display_ob(ob_boxes, ob_top, ob_btm, ob_left, ob_type, ob_showlast, true, ob_size)

//-----------------------------------------------------------------------------}

//EQH/EQL

//-----------------------------------------------------------------------------{

var eq_prev_top = 0.

var eq_top_x = 0

var eq_prev_btm = 0.

var eq_btm_x = 0

if show_eq

eq_top = ta.pivothigh(eq_len, eq_len)

eq_btm = ta.pivotlow(eq_len, eq_len)

if eq_top

max = math.max(eq_top, eq_prev_top)

min = math.min(eq_top, eq_prev_top)

if max < min + atr * eq_threshold

eqh_line = line.new(eq_top_x, eq_prev_top, n-eq_len, eq_top

, color = bear_css

, style = line.style_dotted)

eqh_lbl = label.new(int(math.avg(n-eq_len, eq_top_x)), eq_top, 'EQH'

, color = #00000000

, textcolor = bear_css

, style = label.style_label_down

, size = size.tiny)

if mode == 'Present'

line.delete(eqh_line[1])

label.delete(eqh_lbl[1])

eqh_alert := true

eq_prev_top := eq_top

eq_top_x := n-eq_len

if eq_btm

max = math.max(eq_btm, eq_prev_btm)

min = math.min(eq_btm, eq_prev_btm)

if min > max - atr * eq_threshold

eql_line = line.new(eq_btm_x, eq_prev_btm, n-eq_len, eq_btm

, color = bull_css

, style = line.style_dotted)

eql_lbl = label.new(int(math.avg(n-eq_len, eq_btm_x)), eq_btm, 'EQL'

, color = #00000000

, textcolor = bull_css

, style = label.style_label_up

, size = size.tiny)

eql_alert := true

if mode == 'Present'

line.delete(eql_line[1])

label.delete(eql_lbl[1])

eq_prev_btm := eq_btm

eq_btm_x := n-eq_len

//-----------------------------------------------------------------------------}

//Fair Value Gaps

//-----------------------------------------------------------------------------{

var bullish_fvg_max = array.new_box(0)

var bullish_fvg_min = array.new_box(0)

var bearish_fvg_max = array.new_box(0)

var bearish_fvg_min = array.new_box(0)

float bullish_fvg_avg = na

float bearish_fvg_avg = na

bullish_fvg_cnd = false

bearish_fvg_cnd = false

[src_c1, src_o1, src_h, src_l, src_h2, src_l2] =

request.security(syminfo.tickerid, fvg_tf, get_ohlc())

if show_fvg

delta_per = (src_c1 - src_o1) / src_o1 * 100

change_tf = timeframe.change(fvg_tf)

threshold = fvg_auto ? ta.cum(math.abs(change_tf ? delta_per : 0)) / n * 2

: 0

//FVG conditions

bullish_fvg_cnd := src_l > src_h2

and src_c1 > src_h2

and delta_per > threshold

and change_tf

bearish_fvg_cnd := src_h < src_l2

and src_c1 < src_l2

and -delta_per > threshold

and change_tf

//FVG Areas

if bullish_fvg_cnd

array.unshift(bullish_fvg_max, box.new(n-1, src_l, n + fvg_extend, math.avg(src_l, src_h2)

, border_color = bull_fvg_css

, bgcolor = bull_fvg_css))

array.unshift(bullish_fvg_min, box.new(n-1, math.avg(src_l, src_h2), n + fvg_extend, src_h2

, border_color = bull_fvg_css

, bgcolor = bull_fvg_css))

if bearish_fvg_cnd

array.unshift(bearish_fvg_max, box.new(n-1, src_h, n + fvg_extend, math.avg(src_h, src_l2)

, border_color = bear_fvg_css

, bgcolor = bear_fvg_css))

array.unshift(bearish_fvg_min, box.new(n-1, math.avg(src_h, src_l2), n + fvg_extend, src_l2

, border_color = bear_fvg_css

, bgcolor = bear_fvg_css))

for bx in bullish_fvg_min

if low < box.get_bottom(bx)

box.delete(bx)

box.delete(array.get(bullish_fvg_max, array.indexof(bullish_fvg_min, bx)))

for bx in bearish_fvg_max

if high > box.get_top(bx)

box.delete(bx)

box.delete(array.get(bearish_fvg_min, array.indexof(bearish_fvg_max, bx)))

//-----------------------------------------------------------------------------}

//Previous day/week high/lows

//-----------------------------------------------------------------------------{

//Daily high/low

[pdh, pdl] = request.security(syminfo.tickerid, 'D', hl()

, lookahead = barmerge.lookahead_on)

//Weekly high/low

[pwh, pwl] = request.security(syminfo.tickerid, 'W', hl()

, lookahead = barmerge.lookahead_on)

//Monthly high/low

[pmh, pml] = request.security(syminfo.tickerid, 'M', hl()

, lookahead = barmerge.lookahead_on)

//Display Daily

if show_pdhl

phl(pdh, pdl, 'D', pdhl_css)

//Display Weekly

if show_pwhl

phl(pwh, pwl, 'W', pwhl_css)

//Display Monthly

if show_pmhl

phl(pmh, pml, 'M', pmhl_css)

//-----------------------------------------------------------------------------}

//Premium/Discount/Equilibrium zones

//-----------------------------------------------------------------------------{

var premium = box.new(na, na, na, na

, bgcolor = color.new(premium_css, 80)

, border_color = na)

var premium_lbl = label.new(na, na

, text = 'Premium'

, color = TRANSP_CSS

, textcolor = premium_css

, style = label.style_label_down

, size = size.small)

var eq = box.new(na, na, na, na

, bgcolor = color.rgb(120, 123, 134, 80)

, border_color = na)

var eq_lbl = label.new(na, na

, text = 'Equilibrium'

, color = TRANSP_CSS

, textcolor = eq_css

, style = label.style_label_left

, size = size.small)

var discount = box.new(na, na, na, na

, bgcolor = color.new(discount_css, 80)

, border_color = na)

var discount_lbl = label.new(na, na

, text = 'Discount'

, color = TRANSP_CSS

, textcolor = discount_css

, style = label.style_label_up

, size = size.small)

//Show Premium/Discount Areas

if barstate.islast and show_sd

avg = math.avg(trail_up, trail_dn)

box.set_lefttop(premium, math.max(top_x, btm_x), trail_up)

box.set_rightbottom(premium, n, .95 * trail_up + .05 * trail_dn)

label.set_xy(premium_lbl, int(math.avg(math.max(top_x, btm_x), n)), trail_up)

box.set_lefttop(eq, math.max(top_x, btm_x), .525 * trail_up + .475*trail_dn)

box.set_rightbottom(eq, n, .525 * trail_dn + .475 * trail_up)

label.set_xy(eq_lbl, n, avg)

box.set_lefttop(discount, math.max(top_x, btm_x), .95 * trail_dn + .05 * trail_up)

box.set_rightbottom(discount, n, trail_dn)

label.set_xy(discount_lbl, int(math.avg(math.max(top_x, btm_x), n)), trail_dn)

//-----------------------------------------------------------------------------}

//Trend

//-----------------------------------------------------------------------------{

var color trend_css = na

if show_trend

if style == 'Colored'

trend_css := itrend == 1 ? bull_css : bear_css

else if style == 'Monochrome'

trend_css := itrend == 1 ? #b2b5be : #5d606b

plotcandle(open, high, low, close

, color = trend_css

, wickcolor = trend_css

, bordercolor = trend_css

, editable = false)

//-----------------------------------------------------------------------------}

//Alerts

//-----------------------------------------------------------------------------{

//Internal Structure

alertcondition(bull_ibos_alert, 'Internal Bullish BOS', 'Internal Bullish BOS formed')

alertcondition(bull_ichoch_alert, 'Internal Bullish CHoCH', 'Internal Bullish CHoCH formed')

alertcondition(bear_ibos_alert, 'Internal Bearish BOS', 'Internal Bearish BOS formed')

alertcondition(bear_ichoch_alert, 'Internal Bearish CHoCH', 'Internal Bearish CHoCH formed')

//Swing Structure

alertcondition(bull_bos_alert, 'Bullish BOS', 'Internal Bullish BOS formed')

alertcondition(bull_choch_alert, 'Bullish CHoCH', 'Internal Bullish CHoCH formed')

alertcondition(bear_bos_alert, 'Bearish BOS', 'Bearish BOS formed')

alertcondition(bear_choch_alert, 'Bearish CHoCH', 'Bearish CHoCH formed')

//order Blocks

alertcondition(bull_iob_break, 'Bullish Internal OB Breakout', 'Price broke bullish iternal OB')

alertcondition(bear_iob_break, 'Bearish Internal OB Breakout', 'Price broke bearish iternal OB')

alertcondition(bull_ob_break, 'Bullish OB Breakout', 'Price broke bullish iternal OB')

alertcondition(bear_ob_break, 'bearish OB Breakout', 'Price broke bearish iternal OB')

//EQH/EQL

alertcondition(eqh_alert, 'Equal Highs', 'Equal highs detected')

alertcondition(eql_alert, 'Equal Lows', 'Equal lows detected')

//FVG

alertcondition(bullish_fvg_cnd, 'Bullish FVG', 'Bullish FVG formed')

alertcondition(bearish_fvg_cnd, 'Bearish FVG', 'Bearish FVG formed')

//-----------------------------------------------------------------------------}

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=5

indicator("Smart Money Concepts [LUX]", "Smart Money Concepts [LuxAlgo]"

, overlay = true

, max_labels_count = 500

, max_lines_count = 500

, max_boxes_count = 500

, max_bars_back = 500)

//-----------------------------------------------------------------------------{

//Constants

//-----------------------------------------------------------------------------{

color TRANSP_CSS = #ffffff00

//Tooltips

string MODE_TOOLTIP = 'Allows to display historical Structure or only the recent ones'

string STYLE_TOOLTIP = 'Indicator color theme'

string COLOR_CANDLES_TOOLTIP = 'Display additional candles with a color reflecting the current trend detected by structure'

string SHOW_INTERNAL = 'Display internal market structure'

string CONFLUENCE_FILTER = 'Filter non significant internal structure breakouts'

string SHOW_SWING = 'Display swing market Structure'

string SHOW_SWING_POINTS = 'Display swing point as labels on the chart'

string SHOW_SWHL_POINTS = 'Highlight most recent strong and weak high/low points on the chart'

string INTERNAL_OB = 'Display internal order blocks on the chart\n\nNumber of internal order blocks to display on the chart'

string SWING_OB = 'Display swing order blocks on the chart\n\nNumber of internal swing blocks to display on the chart'

string FILTER_OB = 'Method used to filter out volatile order blocks \n\nIt is recommended to use the cumulative mean range method when a low amount of data is available'

string SHOW_EQHL = 'Display equal highs and equal lows on the chart'

string EQHL_BARS = 'Number of bars used to confirm equal highs and equal lows'

string EQHL_THRESHOLD = 'Sensitivity threshold in a range (0, 1) used for the detection of equal highs & lows\n\nLower values will return fewer but more pertinent results'

string SHOW_FVG = 'Display fair values gaps on the chart'

string AUTO_FVG = 'Filter out non significant fair value gaps'

string FVG_TF = 'Fair value gaps timeframe'

string EXTEND_FVG = 'Determine how many bars to extend the Fair Value Gap boxes on chart'

string PED_ZONES = 'Display premium, discount, and equilibrium zones on chart'

//-----------------------------------------------------------------------------{

//Settings

//-----------------------------------------------------------------------------{

//General

//----------------------------------------{

mode = input.string('Historical'

, options = ['Historical', 'Present']

, group = 'Smart Money Concepts'

, tooltip = MODE_TOOLTIP)

style = input.string('Colored'

, options = ['Colored', 'Monochrome']

, group = 'Smart Money Concepts'

, tooltip = STYLE_TOOLTIP)

show_trend = input(false, 'Color Candles'

, group = 'Smart Money Concepts'

, tooltip = COLOR_CANDLES_TOOLTIP)

//----------------------------------------}

//Internal Structure

//----------------------------------------{

show_internals = input(true, 'Show Internal Structure'

, group = 'Real Time Internal Structure'

, tooltip = SHOW_INTERNAL)

show_ibull = input.string('All', 'Bullish Structure'

, options = ['All', 'BOS', 'CHoCH']

, inline = 'ibull'

, group = 'Real Time Internal Structure')

swing_ibull_css = input(#089981, ''

, inline = 'ibull'

, group = 'Real Time Internal Structure')

//Bear Structure

show_ibear = input.string('All', 'Bearish Structure'

, options = ['All', 'BOS', 'CHoCH']

, inline = 'ibear'

, group = 'Real Time Internal Structure')

swing_ibear_css = input(#f23645, ''

, inline = 'ibear'

, group = 'Real Time Internal Structure')

ifilter_confluence = input(false, 'Confluence Filter'

, group = 'Real Time Internal Structure'

, tooltip = CONFLUENCE_FILTER)

//----------------------------------------}

//Swing Structure

//----------------------------------------{

show_Structure = input(true, 'Show Swing Structure'

, group = 'Real Time Swing Structure'

, tooltip = SHOW_SWING)

//Bull Structure

show_bull = input.string('All', 'Bullish Structure'

, options = ['All', 'BOS', 'CHoCH']

, inline = 'bull'

, group = 'Real Time Swing Structure')

swing_bull_css = input(#089981, ''

, inline = 'bull'

, group = 'Real Time Swing Structure')

//Bear Structure

show_bear = input.string('All', 'Bearish Structure'

, options = ['All', 'BOS', 'CHoCH']

, inline = 'bear'

, group = 'Real Time Swing Structure')

swing_bear_css = input(#f23645, ''

, inline = 'bear'

, group = 'Real Time Swing Structure')

//Swings

show_swings = input(false, 'Show Swings Points'

, inline = 'swings'

, group = 'Real Time Swing Structure'

, tooltip = SHOW_SWING_POINTS)

length = input.int(50, ''

, minval = 10

, inline = 'swings'

, group = 'Real Time Swing Structure')

show_hl_swings = input(true, 'Show Strong/Weak High/Low'

, group = 'Real Time Swing Structure'

, tooltip = SHOW_SWHL_POINTS)

//----------------------------------------}

//Order Blocks

//----------------------------------------{

show_iob = input(true, 'Internal Order Blocks'

, inline = 'iob'

, group = 'Order Blocks'

, tooltip = INTERNAL_OB)

iob_showlast = input.int(5, ''

, minval = 1

, inline = 'iob'

, group = 'Order Blocks')

show_ob = input(false, 'Swing Order Blocks'

, inline = 'ob'

, group = 'Order Blocks'

, tooltip = SWING_OB)

ob_showlast = input.int(5, ''

, minval = 1

, inline = 'ob'

, group = 'Order Blocks')

ob_filter = input.string('Atr', 'Order Block Filter'

, options = ['Atr', 'Cumulative Mean Range']

, group = 'Order Blocks'

, tooltip = FILTER_OB)

ibull_ob_css = input.color(color.new(#3179f5, 80), 'Internal Bullish OB'

, group = 'Order Blocks')

ibear_ob_css = input.color(color.new(#f77c80, 80), 'Internal Bearish OB'

, group = 'Order Blocks')

bull_ob_css = input.color(color.new(#1848cc, 80), 'Bullish OB'

, group = 'Order Blocks')

bear_ob_css = input.color(color.new(#b22833, 80), 'Bearish OB'

, group = 'Order Blocks')

//----------------------------------------}

//EQH/EQL

//----------------------------------------{

show_eq = input(true, 'Equal High/Low'

, group = 'EQH/EQL'

, tooltip = SHOW_EQHL)

eq_len = input.int(3, 'Bars Confirmation'

, minval = 1

, group = 'EQH/EQL'

, tooltip = EQHL_BARS)

eq_threshold = input.float(0.1, 'Threshold'

, minval = 0

, maxval = 0.5

, step = 0.1

, group = 'EQH/EQL'

, tooltip = EQHL_THRESHOLD)

//----------------------------------------}

//Fair Value Gaps

//----------------------------------------{

show_fvg = input(false, 'Fair Value Gaps'

, group = 'Fair Value Gaps'

, tooltip = SHOW_FVG)

fvg_auto = input(true, "Auto Threshold"

, group = 'Fair Value Gaps'

, tooltip = AUTO_FVG)

fvg_tf = input.timeframe('', "Timeframe"

, group = 'Fair Value Gaps'

, tooltip = FVG_TF)

bull_fvg_css = input.color(color.new(#00ff68, 70), 'Bullish FVG'

, group = 'Fair Value Gaps')

bear_fvg_css = input.color(color.new(#ff0008, 70), 'Bearish FVG'

, group = 'Fair Value Gaps')

fvg_extend = input.int(1, "Extend FVG"

, minval = 0

, group = 'Fair Value Gaps'

, tooltip = EXTEND_FVG)

//----------------------------------------}

//Previous day/week high/low

//----------------------------------------{

//Daily

show_pdhl = input(false, 'Daily'

, inline = 'daily'

, group = 'Highs & Lows MTF')

pdhl_style = input.string('⎯⎯⎯', ''

, options = ['⎯⎯⎯', '----', '····']

, inline = 'daily'

, group = 'Highs & Lows MTF')

pdhl_css = input(#2157f3, ''

, inline = 'daily'

, group = 'Highs & Lows MTF')

//Weekly

show_pwhl = input(false, 'Weekly'

, inline = 'weekly'

, group = 'Highs & Lows MTF')

pwhl_style = input.string('⎯⎯⎯', ''

, options = ['⎯⎯⎯', '----', '····']

, inline = 'weekly'

, group = 'Highs & Lows MTF')

pwhl_css = input(#2157f3, ''

, inline = 'weekly'

, group = 'Highs & Lows MTF')

//Monthly

show_pmhl = input(false, 'Monthly'

, inline = 'monthly'

, group = 'Highs & Lows MTF')

pmhl_style = input.string('⎯⎯⎯', ''

, options = ['⎯⎯⎯', '----', '····']

, inline = 'monthly'

, group = 'Highs & Lows MTF')

pmhl_css = input(#2157f3, ''

, inline = 'monthly'

, group = 'Highs & Lows MTF')

//----------------------------------------}

//Premium/Discount zones

//----------------------------------------{

show_sd = input(false, 'Premium/Discount Zones'

, group = 'Premium & Discount Zones'

, tooltip = PED_ZONES)

premium_css = input.color(#f23645, 'Premium Zone'

, group = 'Premium & Discount Zones')

eq_css = input.color(#b2b5be, 'Equilibrium Zone'

, group = 'Premium & Discount Zones')

discount_css = input.color(#089981, 'Discount Zone'

, group = 'Premium & Discount Zones')

//-----------------------------------------------------------------------------}

//Functions

//-----------------------------------------------------------------------------{

n = bar_index

atr = ta.atr(200)

cmean_range = ta.cum(high - low) / n

//HL Output function

hl() => [high, low]

//Get ohlc values function

get_ohlc()=> [close[1], open[1], high, low, high[2], low[2]]

//Display Structure function

display_Structure(x, y, txt, css, dashed, down, lbl_size)=>

structure_line = line.new(x, y, n, y

, color = css

, style = dashed ? line.style_dashed : line.style_solid)

structure_lbl = label.new(int(math.avg(x, n)), y, txt

, color = TRANSP_CSS

, textcolor = css

, style = down ? label.style_label_down : label.style_label_up

, size = lbl_size)

if mode == 'Present'

line.delete(structure_line[1])

label.delete(structure_lbl[1])

//Swings detection/measurements

swings(len)=>

var os = 0

upper = ta.highest(len)

lower = ta.lowest(len)

os := high[len] > upper ? 0 : low[len] < lower ? 1 : os[1]

top = os == 0 and os[1] != 0 ? high[len] : 0

btm = os == 1 and os[1] != 1 ? low[len] : 0

[top, btm]

//Order block coordinates function

ob_coord(use_max, loc, target_top, target_btm, target_left, target_type)=>

min = 99999999.

max = 0.

idx = 1

ob_threshold = ob_filter == 'Atr' ? atr : cmean_range

//Search for highest/lowest high within the structure interval and get range

if use_max

for i = 1 to (n - loc)-1

if (high - low) < ob_threshold * 2

max := math.max(high, max)

min := max == high ? low : min

idx := max == high ? i : idx

else

for i = 1 to (n - loc)-1

if (high - low) < ob_threshold * 2

min := math.min(low, min)

max := min == low ? high : max

idx := min == low ? i : idx

array.unshift(target_top, max)

array.unshift(target_btm, min)

array.unshift(target_left, time[idx])

array.unshift(target_type, use_max ? -1 : 1)

//Set order blocks

display_ob(boxes, target_top, target_btm, target_left, target_type, show_last, swing, size)=>

for i = 0 to math.min(show_last-1, size-1)

get_box = array.get(boxes, i)

box.set_lefttop(get_box, array.get(target_left, i), array.get(target_top, i))

box.set_rightbottom(get_box, array.get(target_left, i), array.get(target_btm, i))

box.set_extend(get_box, extend.right)

color css = na

if swing

if style == 'Monochrome'

css := array.get(target_type, i) == 1 ? color.new(#b2b5be, 80) : color.new(#5d606b, 80)

border_css = array.get(target_type, i) == 1 ? #b2b5be : #5d606b

box.set_border_color(get_box, border_css)

else

css := array.get(target_type, i) == 1 ? bull_ob_css : bear_ob_css

box.set_border_color(get_box, css)

box.set_bgcolor(get_box, css)

else

if style == 'Monochrome'

css := array.get(target_type, i) == 1 ? color.new(#b2b5be, 80) : color.new(#5d606b, 80)

else

css := array.get(target_type, i) == 1 ? ibull_ob_css : ibear_ob_css

box.set_border_color(get_box, css)

box.set_bgcolor(get_box, css)

//Line Style function

get_line_style(style) =>

out = switch style

'⎯⎯⎯' => line.style_solid

'----' => line.style_dashed

'····' => line.style_dotted

//Set line/labels function for previous high/lows

phl(h, l, tf, css)=>

var line high_line = line.new(na,na,na,na

, xloc = xloc.bar_time

, color = css

, style = get_line_style(pdhl_style))

var label high_lbl = label.new(na,na

, xloc = xloc.bar_time

, text = str.format('P{0}H', tf)

, color = TRANSP_CSS

, textcolor = css

, size = size.small

, style = label.style_label_left)

var line low_line = line.new(na,na,na,na

, xloc = xloc.bar_time

, color = css

, style = get_line_style(pdhl_style))

var label low_lbl = label.new(na,na

, xloc = xloc.bar_time

, text = str.format('P{0}L', tf)

, color = TRANSP_CSS

, textcolor = css

, size = size.small

, style = label.style_label_left)

hy = ta.valuewhen(h != h[1], h, 1)

hx = ta.valuewhen(h == high, time, 1)

ly = ta.valuewhen(l != l[1], l, 1)

lx = ta.valuewhen(l == low, time, 1)

if barstate.islast

ext = time + (time - time[1])*20

//High

line.set_xy1(high_line, hx, hy)

line.set_xy2(high_line, ext, hy)

label.set_xy(high_lbl, ext, hy)

//Low

line.set_xy1(low_line, lx, ly)

line.set_xy2(low_line, ext, ly)

label.set_xy(low_lbl, ext, ly)

//-----------------------------------------------------------------------------}

//Global variables

//-----------------------------------------------------------------------------{

var trend = 0, var itrend = 0

var top_y = 0., var top_x = 0

var btm_y = 0., var btm_x = 0

var itop_y = 0., var itop_x = 0

var ibtm_y = 0., var ibtm_x = 0

var trail_up = high, var trail_dn = low

var trail_up_x = 0, var trail_dn_x = 0

var top_cross = true, var btm_cross = true

var itop_cross = true, var ibtm_cross = true

var txt_top = '', var txt_btm = ''

//Alerts

bull_choch_alert = false

bull_bos_alert = false

bear_choch_alert = false

bear_bos_alert = false

bull_ichoch_alert = false

bull_ibos_alert = false

bear_ichoch_alert = false

bear_ibos_alert = false

bull_iob_break = false

bear_iob_break = false

bull_ob_break = false

bear_ob_break = false

eqh_alert = false

eql_alert = false

//Structure colors

var bull_css = style == 'Monochrome' ? #b2b5be

: swing_bull_css

var bear_css = style == 'Monochrome' ? #b2b5be

: swing_bear_css

var ibull_css = style == 'Monochrome' ? #b2b5be

: swing_ibull_css

var ibear_css = style == 'Monochrome' ? #b2b5be

: swing_ibear_css

//Swings

[top, btm] = swings(length)

[itop, ibtm] = swings(5)

//-----------------------------------------------------------------------------}

//Pivot High

//-----------------------------------------------------------------------------{

var line extend_top = na

var label extend_top_lbl = label.new(na, na

, color = TRANSP_CSS

, textcolor = bear_css

, style = label.style_label_down

, size = size.tiny)

if top

top_cross := true

txt_top := top > top_y ? 'HH' : 'LH'

if show_swings

top_lbl = label.new(n-length, top, txt_top

, color = TRANSP_CSS

, textcolor = bear_css

, style = label.style_label_down

, size = size.small)

if mode == 'Present'

label.delete(top_lbl[1])

//Extend recent top to last bar

line.delete(extend_top[1])

extend_top := line.new(n-length, top, n, top

, color = bear_css)

top_y := top

top_x := n - length

trail_up := top

trail_up_x := n - length

if itop

itop_cross := true

itop_y := itop

itop_x := n - 5

//Trailing maximum

trail_up := math.max(high, trail_up)

trail_up_x := trail_up == high ? n : trail_up_x

//Set top extension label/line

if barstate.islast and show_hl_swings

line.set_xy1(extend_top, trail_up_x, trail_up)

line.set_xy2(extend_top, n + 20, trail_up)

label.set_x(extend_top_lbl, n + 20)

label.set_y(extend_top_lbl, trail_up)

label.set_text(extend_top_lbl, trend < 0 ? 'Strong High' : 'Weak High')

//-----------------------------------------------------------------------------}

//Pivot Low

//-----------------------------------------------------------------------------{

var line extend_btm = na

var label extend_btm_lbl = label.new(na, na

, color = TRANSP_CSS

, textcolor = bull_css

, style = label.style_label_up

, size = size.tiny)

if btm

btm_cross := true

txt_btm := btm < btm_y ? 'LL' : 'HL'

if show_swings

btm_lbl = label.new(n - length, btm, txt_btm

, color = TRANSP_CSS

, textcolor = bull_css

, style = label.style_label_up

, size = size.small)

if mode == 'Present'

label.delete(btm_lbl[1])

//Extend recent btm to last bar

line.delete(extend_btm[1])

extend_btm := line.new(n - length, btm, n, btm

, color = bull_css)

btm_y := btm

btm_x := n-length

trail_dn := btm

trail_dn_x := n-length

if ibtm

ibtm_cross := true

ibtm_y := ibtm

ibtm_x := n - 5

//Trailing minimum

trail_dn := math.min(low, trail_dn)

trail_dn_x := trail_dn == low ? n : trail_dn_x

//Set btm extension label/line

if barstate.islast and show_hl_swings

line.set_xy1(extend_btm, trail_dn_x, trail_dn)

line.set_xy2(extend_btm, n + 20, trail_dn)

label.set_x(extend_btm_lbl, n + 20)

label.set_y(extend_btm_lbl, trail_dn)

label.set_text(extend_btm_lbl, trend > 0 ? 'Strong Low' : 'Weak Low')

//-----------------------------------------------------------------------------}

//Order Blocks Arrays

//-----------------------------------------------------------------------------{

var iob_top = array.new_float(0)

var iob_btm = array.new_float(0)

var iob_left = array.new_int(0)

var iob_type = array.new_int(0)

var ob_top = array.new_float(0)

var ob_btm = array.new_float(0)

var ob_left = array.new_int(0)

var ob_type = array.new_int(0)

//-----------------------------------------------------------------------------}

//Pivot High BOS/CHoCH

//-----------------------------------------------------------------------------{

//Filtering

var bull_concordant = true

if ifilter_confluence

bull_concordant := high - math.max(close, open) > math.min(close, open - low)

//Detect internal bullish Structure

if ta.crossover(close, itop_y) and itop_cross and top_y != itop_y and bull_concordant

bool choch = na

if itrend < 0

choch := true

bull_ichoch_alert := true

else

bull_ibos_alert := true

txt = choch ? 'CHoCH' : 'BOS'

if show_internals

if show_ibull == 'All' or (show_ibull == 'BOS' and not choch) or (show_ibull == 'CHoCH' and choch)

display_Structure(itop_x, itop_y, txt, ibull_css, true, true, size.tiny)

itop_cross := false

itrend := 1

//Internal Order Block

if show_iob

ob_coord(false, itop_x, iob_top, iob_btm, iob_left, iob_type)

//Detect bullish Structure

if ta.crossover(close, top_y) and top_cross

bool choch = na

if trend < 0

choch := true

bull_choch_alert := true

else

bull_bos_alert := true

txt = choch ? 'CHoCH' : 'BOS'

if show_Structure

if show_bull == 'All' or (show_bull == 'BOS' and not choch) or (show_bull == 'CHoCH' and choch)

display_Structure(top_x, top_y, txt, bull_css, false, true, size.small)

//Order Block

if show_ob

ob_coord(false, top_x, ob_top, ob_btm, ob_left, ob_type)

top_cross := false

trend := 1

//-----------------------------------------------------------------------------}

//Pivot Low BOS/CHoCH

//-----------------------------------------------------------------------------{

var bear_concordant = true

if ifilter_confluence

bear_concordant := high - math.max(close, open) < math.min(close, open - low)

//Detect internal bearish Structure

if ta.crossunder(close, ibtm_y) and ibtm_cross and btm_y != ibtm_y and bear_concordant

bool choch = false

if itrend > 0

choch := true

bear_ichoch_alert := true

else

bear_ibos_alert := true

txt = choch ? 'CHoCH' : 'BOS'

if show_internals

if show_ibear == 'All' or (show_ibear == 'BOS' and not choch) or (show_ibear == 'CHoCH' and choch)

display_Structure(ibtm_x, ibtm_y, txt, ibear_css, true, false, size.tiny)

ibtm_cross := false

itrend := -1

//Internal Order Block

if show_iob

ob_coord(true, ibtm_x, iob_top, iob_btm, iob_left, iob_type)

//Detect bearish Structure

if ta.crossunder(close, btm_y) and btm_cross

bool choch = na

if trend > 0

choch := true

bear_choch_alert := true

else

bear_bos_alert := true

txt = choch ? 'CHoCH' : 'BOS'

if show_Structure

if show_bear == 'All' or (show_bear == 'BOS' and not choch) or (show_bear == 'CHoCH' and choch)

display_Structure(btm_x, btm_y, txt, bear_css, false, false, size.small)

//Order Block

if show_ob

ob_coord(true, btm_x, ob_top, ob_btm, ob_left, ob_type)

btm_cross := false

trend := -1

//-----------------------------------------------------------------------------}

//Order Blocks

//-----------------------------------------------------------------------------{

//Set order blocks

var iob_boxes = array.new_box(0)

var ob_boxes = array.new_box(0)

//Delete internal order blocks box coordinates if top/bottom is broken

for element in iob_type

index = array.indexof(iob_type, element)

if close < array.get(iob_btm, index) and element == 1

array.remove(iob_top, index)

array.remove(iob_btm, index)

array.remove(iob_left, index)

array.remove(iob_type, index)

bull_iob_break := true

else if close > array.get(iob_top, index) and element == -1

array.remove(iob_top, index)

array.remove(iob_btm, index)

array.remove(iob_left, index)

array.remove(iob_type, index)

bear_iob_break := true

//Delete internal order blocks box coordinates if top/bottom is broken

for element in ob_type

index = array.indexof(ob_type, element)

if close < array.get(ob_btm, index) and element == 1

array.remove(ob_top, index)

array.remove(ob_btm, index)

array.remove(ob_left, index)

array.remove(ob_type, index)

bull_ob_break := true

else if close > array.get(ob_top, index) and element == -1

array.remove(ob_top, index)

array.remove(ob_btm, index)

array.remove(ob_left, index)

array.remove(ob_type, index)

bear_ob_break := true

iob_size = array.size(iob_type)

ob_size = array.size(ob_type)

if barstate.isfirst

if show_iob

for i = 0 to iob_showlast-1

array.push(iob_boxes, box.new(na,na,na,na, xloc = xloc.bar_time))

if show_ob

for i = 0 to ob_showlast-1

array.push(ob_boxes, box.new(na,na,na,na, xloc = xloc.bar_time))

if iob_size > 0

if barstate.islast

display_ob(iob_boxes, iob_top, iob_btm, iob_left, iob_type, iob_showlast, false, iob_size)

if ob_size > 0

if barstate.islast

display_ob(ob_boxes, ob_top, ob_btm, ob_left, ob_type, ob_showlast, true, ob_size)

//-----------------------------------------------------------------------------}

//EQH/EQL

//-----------------------------------------------------------------------------{

var eq_prev_top = 0.

var eq_top_x = 0

var eq_prev_btm = 0.

var eq_btm_x = 0

if show_eq

eq_top = ta.pivothigh(eq_len, eq_len)

eq_btm = ta.pivotlow(eq_len, eq_len)

if eq_top

max = math.max(eq_top, eq_prev_top)

min = math.min(eq_top, eq_prev_top)

if max < min + atr * eq_threshold

eqh_line = line.new(eq_top_x, eq_prev_top, n-eq_len, eq_top

, color = bear_css

, style = line.style_dotted)

eqh_lbl = label.new(int(math.avg(n-eq_len, eq_top_x)), eq_top, 'EQH'

, color = #00000000

, textcolor = bear_css

, style = label.style_label_down

, size = size.tiny)

if mode == 'Present'

line.delete(eqh_line[1])

label.delete(eqh_lbl[1])

eqh_alert := true

eq_prev_top := eq_top

eq_top_x := n-eq_len

if eq_btm

max = math.max(eq_btm, eq_prev_btm)

min = math.min(eq_btm, eq_prev_btm)

if min > max - atr * eq_threshold

eql_line = line.new(eq_btm_x, eq_prev_btm, n-eq_len, eq_btm

, color = bull_css

, style = line.style_dotted)

eql_lbl = label.new(int(math.avg(n-eq_len, eq_btm_x)), eq_btm, 'EQL'

, color = #00000000

, textcolor = bull_css

, style = label.style_label_up

, size = size.tiny)

eql_alert := true

if mode == 'Present'

line.delete(eql_line[1])

label.delete(eql_lbl[1])

eq_prev_btm := eq_btm

eq_btm_x := n-eq_len

//-----------------------------------------------------------------------------}

//Fair Value Gaps

//-----------------------------------------------------------------------------{

var bullish_fvg_max = array.new_box(0)

var bullish_fvg_min = array.new_box(0)

var bearish_fvg_max = array.new_box(0)

var bearish_fvg_min = array.new_box(0)

float bullish_fvg_avg = na

float bearish_fvg_avg = na

bullish_fvg_cnd = false

bearish_fvg_cnd = false

[src_c1, src_o1, src_h, src_l, src_h2, src_l2] =

request.security(syminfo.tickerid, fvg_tf, get_ohlc())

if show_fvg

delta_per = (src_c1 - src_o1) / src_o1 * 100

change_tf = timeframe.change(fvg_tf)

threshold = fvg_auto ? ta.cum(math.abs(change_tf ? delta_per : 0)) / n * 2

: 0

//FVG conditions

bullish_fvg_cnd := src_l > src_h2

and src_c1 > src_h2

and delta_per > threshold

and change_tf

bearish_fvg_cnd := src_h < src_l2

and src_c1 < src_l2

and -delta_per > threshold

and change_tf

//FVG Areas

if bullish_fvg_cnd

array.unshift(bullish_fvg_max, box.new(n-1, src_l, n + fvg_extend, math.avg(src_l, src_h2)

, border_color = bull_fvg_css

, bgcolor = bull_fvg_css))

array.unshift(bullish_fvg_min, box.new(n-1, math.avg(src_l, src_h2), n + fvg_extend, src_h2

, border_color = bull_fvg_css

, bgcolor = bull_fvg_css))

if bearish_fvg_cnd

array.unshift(bearish_fvg_max, box.new(n-1, src_h, n + fvg_extend, math.avg(src_h, src_l2)

, border_color = bear_fvg_css

, bgcolor = bear_fvg_css))

array.unshift(bearish_fvg_min, box.new(n-1, math.avg(src_h, src_l2), n + fvg_extend, src_l2

, border_color = bear_fvg_css

, bgcolor = bear_fvg_css))

for bx in bullish_fvg_min

if low < box.get_bottom(bx)

box.delete(bx)

box.delete(array.get(bullish_fvg_max, array.indexof(bullish_fvg_min, bx)))

for bx in bearish_fvg_max

if high > box.get_top(bx)

box.delete(bx)

box.delete(array.get(bearish_fvg_min, array.indexof(bearish_fvg_max, bx)))

//-----------------------------------------------------------------------------}

//Previous day/week high/lows

//-----------------------------------------------------------------------------{

//Daily high/low

[pdh, pdl] = request.security(syminfo.tickerid, 'D', hl()

, lookahead = barmerge.lookahead_on)

//Weekly high/low

[pwh, pwl] = request.security(syminfo.tickerid, 'W', hl()

, lookahead = barmerge.lookahead_on)

//Monthly high/low

[pmh, pml] = request.security(syminfo.tickerid, 'M', hl()

, lookahead = barmerge.lookahead_on)

//Display Daily

if show_pdhl

phl(pdh, pdl, 'D', pdhl_css)

//Display Weekly

if show_pwhl

phl(pwh, pwl, 'W', pwhl_css)

//Display Monthly

if show_pmhl

phl(pmh, pml, 'M', pmhl_css)

//-----------------------------------------------------------------------------}

//Premium/Discount/Equilibrium zones

//-----------------------------------------------------------------------------{

var premium = box.new(na, na, na, na

, bgcolor = color.new(premium_css, 80)

, border_color = na)

var premium_lbl = label.new(na, na

, text = 'Premium'

, color = TRANSP_CSS

, textcolor = premium_css

, style = label.style_label_down

, size = size.small)

var eq = box.new(na, na, na, na

, bgcolor = color.rgb(120, 123, 134, 80)

, border_color = na)

var eq_lbl = label.new(na, na

, text = 'Equilibrium'

, color = TRANSP_CSS

, textcolor = eq_css

, style = label.style_label_left

, size = size.small)

var discount = box.new(na, na, na, na

, bgcolor = color.new(discount_css, 80)

, border_color = na)

var discount_lbl = label.new(na, na

, text = 'Discount'

, color = TRANSP_CSS

, textcolor = discount_css

, style = label.style_label_up

, size = size.small)

//Show Premium/Discount Areas

if barstate.islast and show_sd

avg = math.avg(trail_up, trail_dn)

box.set_lefttop(premium, math.max(top_x, btm_x), trail_up)

box.set_rightbottom(premium, n, .95 * trail_up + .05 * trail_dn)

label.set_xy(premium_lbl, int(math.avg(math.max(top_x, btm_x), n)), trail_up)

box.set_lefttop(eq, math.max(top_x, btm_x), .525 * trail_up + .475*trail_dn)