swing arm tracker is always showing 30min, 1min on thinkorswim even if i change the timeframe , am I doing something wrong?Today, I have been working at it make minor changes to the labels with the help of our members around the world. Thanks @Playstation

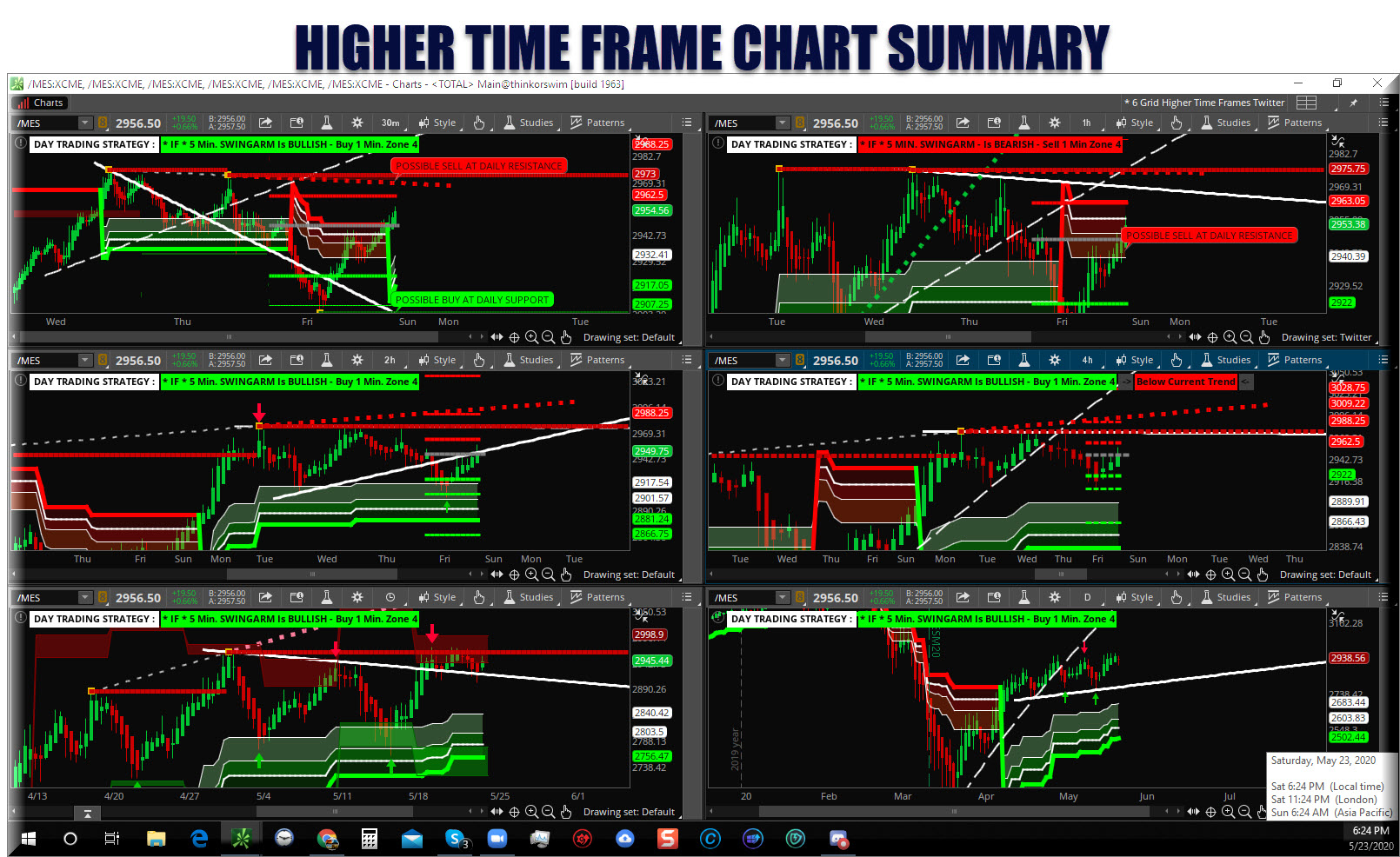

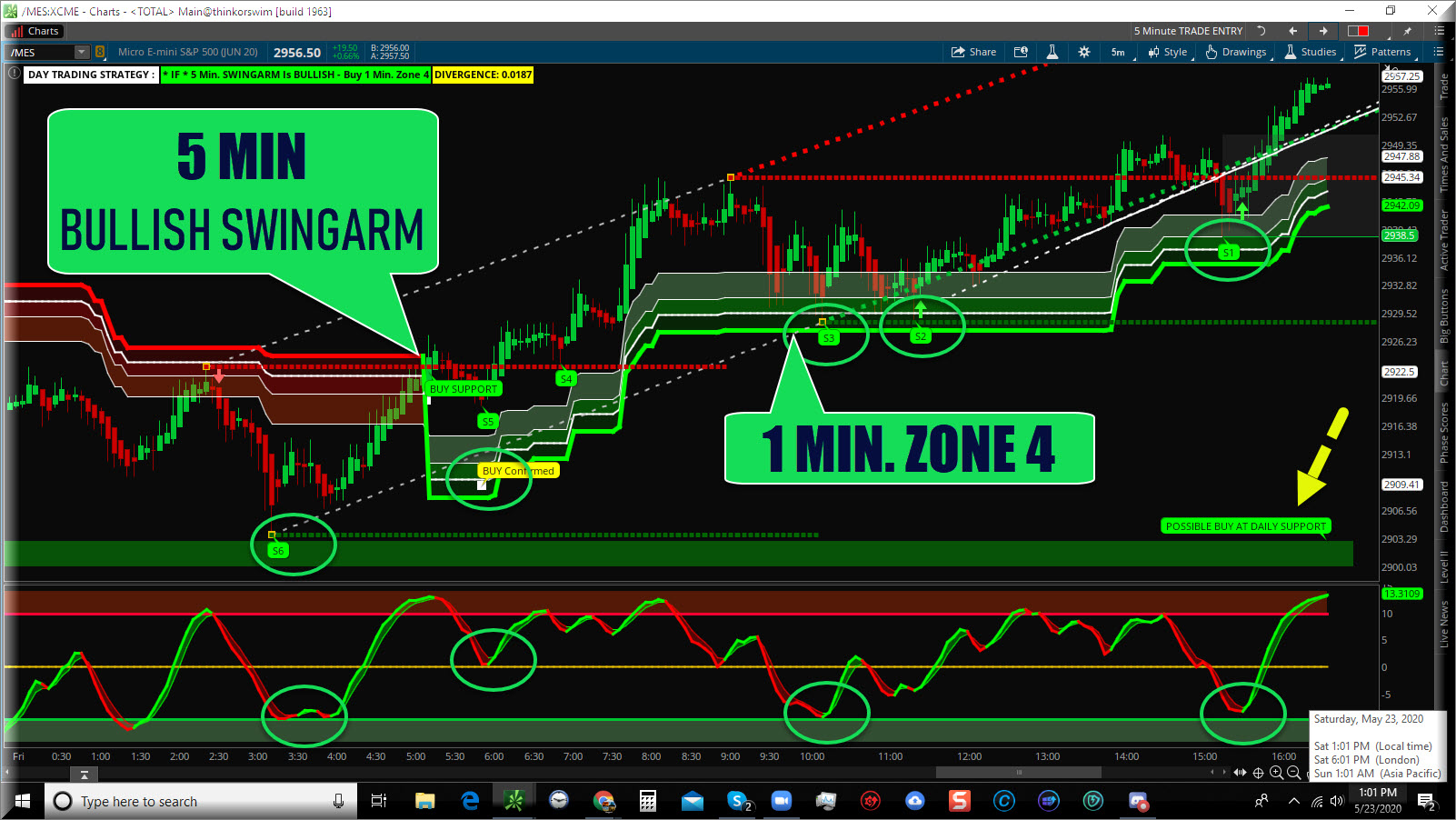

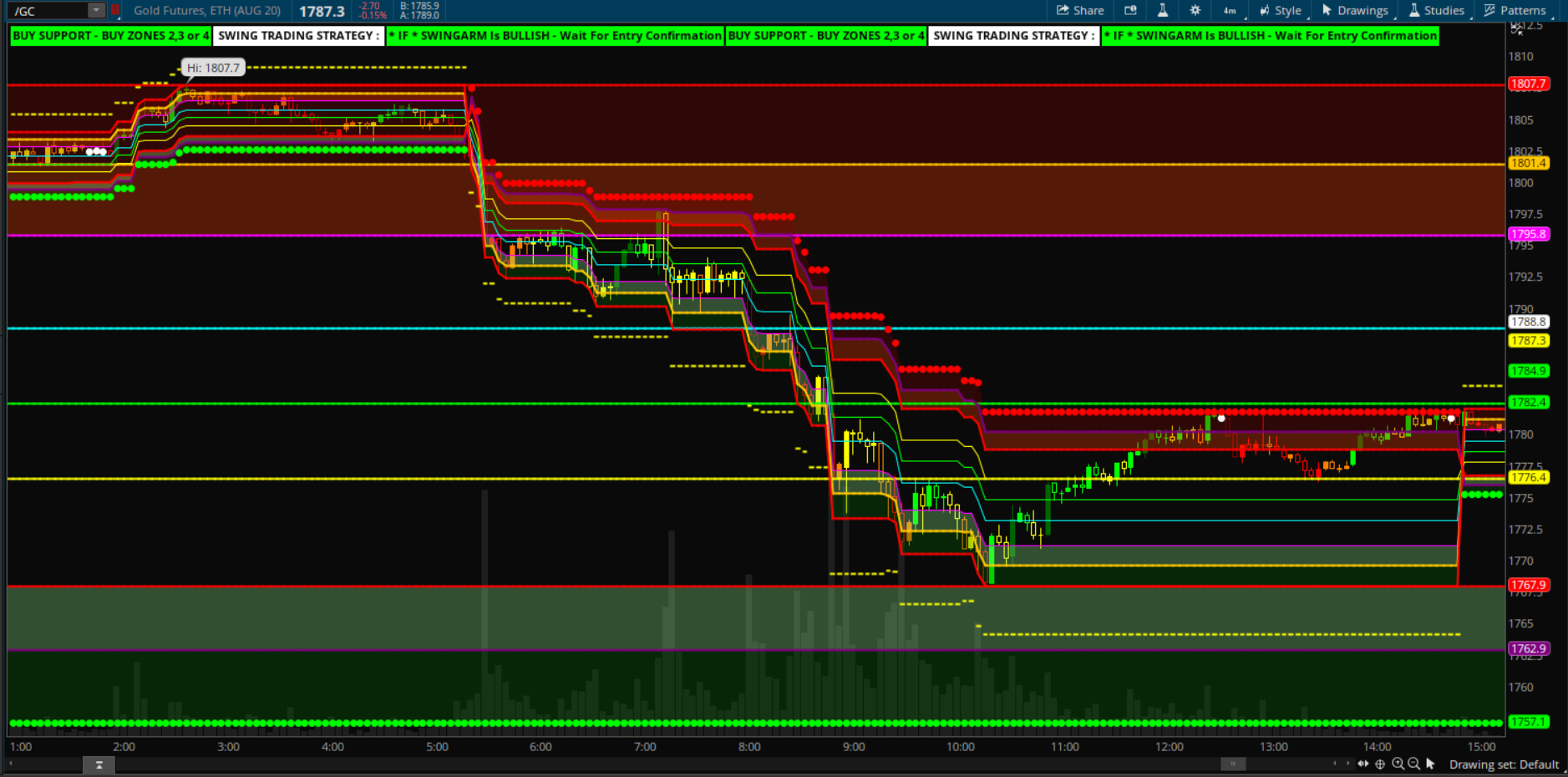

These are some of the updated images of charts:

#1 Understand Your Surroundings (Support and Resistance at higher timeframes) - DO NOT GET RUN OVER BY NOT PAYING ATTENTION AT A MAJOR TRAFFIC INTERSECTION.

#2 Day Trading Example. Allow extremes to develop. Then Use SwingArms and other tools provided in this forum to guide you along the way. You have three options. #1 Enter at support and hope that it holds. #2 Allow the 1 min swingarm to develop and provide confirmation to enter. #3 Wait for 5 min swingarm to develop and then enter when the 1 min cycles and provides entry confirmation in the same direction as the 5 minutes. It all depends on each individual account size, risk awareness, patience, etc. Not one size fits all. But the system works for any timeframe and account size. There are just minor adjustments to consider.

ONE MINUTE TRADE ENTRY - Illustration

When do you close the trade? that answer will vary by the trader. Some may choose to close when the 1-minute cycles, or the 2 minutes or the five minutes. It is up to the trader to make that decision. In my case, I would stay with the trade as long as the 5 minute is bullish. Or if reaching a higher timeframe swingarm level, I will decide then. Either scale-out or close all.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

blackFLAG FTS - SwingArm Trend Indicator using ATRTrailing Stop and Fibonacci Retracements

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Hi Ben, thank you i did watch the video and setup the scanners exactly the same way as shown but scanner is not showing any results

Hi Ben - any chance you could post again the code for the color indicators in a watchlist ? I looked at your video on your tube. It goes into copying the code but doesn't show the source. Is it the standard study ? the scans? Thank you!@sshaniga Can you post a screenshot of your scanner?

I like this indicator using a 4 min chart with a 4 hour indicator overlaid. Very cool indicator!

I love our version of swing arms very very useful. Can i get the code for the alt time frame in your version ? greatly appreciated

@mcallen You can find it on the first page of this thread.

Here is the shared link for the MTF version: https://tos.mx/zEqum1p

Here is the shared link for the MTF version: https://tos.mx/zEqum1p

unknownriver

New member

Hi, is there some one who has simple version of this script which gives me bubbles and shades... i am very new to trading trying to keep things simple...so trying to avoid those lines(price levels)

@unkownriver

This has shades, no bubbles.

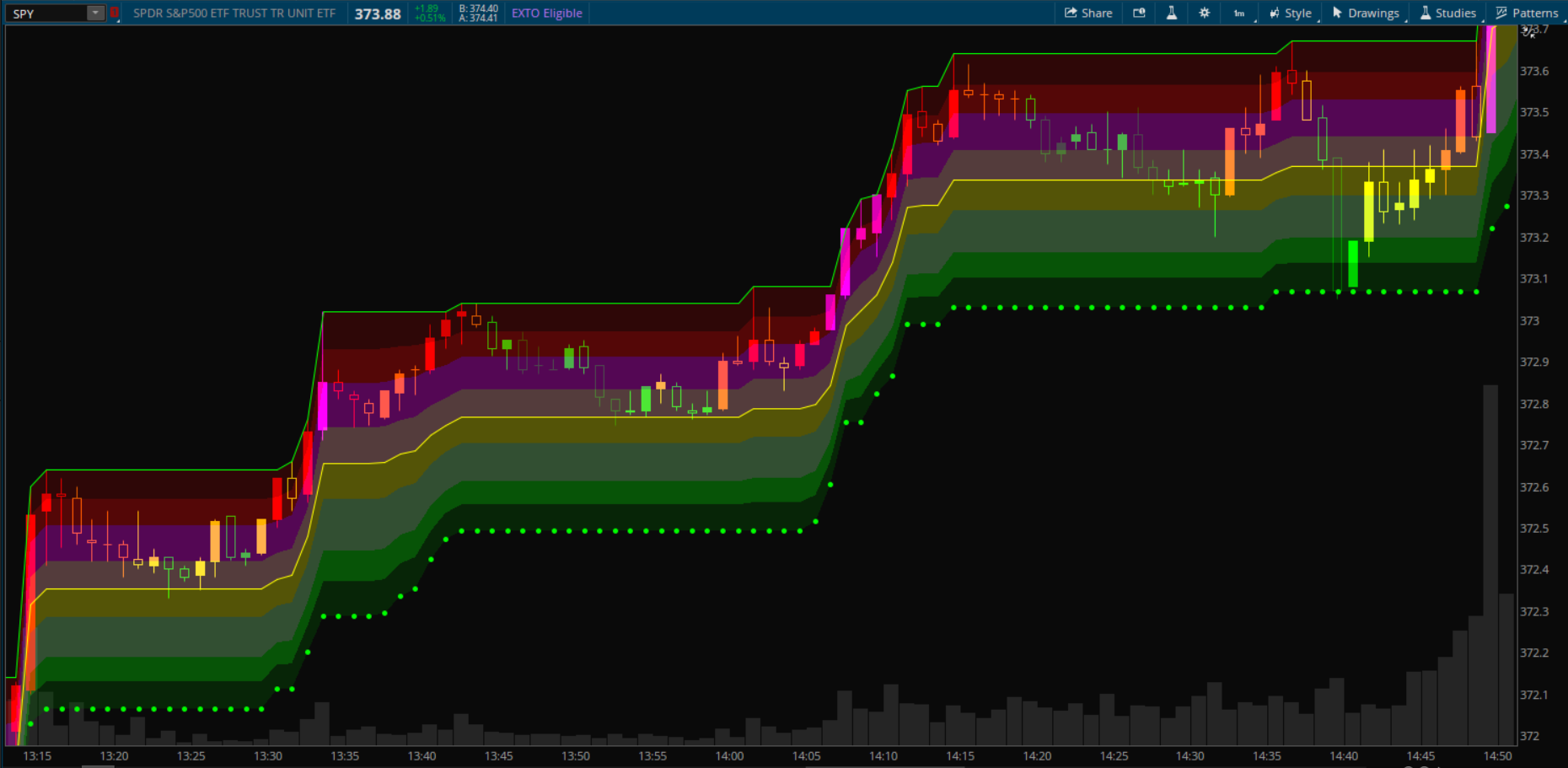

Picture is SPY on 1 min. chart http://tos.mx/p31Urnx

The yellow line is 50% fib.

This has shades, no bubbles.

Picture is SPY on 1 min. chart http://tos.mx/p31Urnx

The yellow line is 50% fib.

Can someone look into this for me. The version from Jan 1 is not the same as the request below.

I would like to see if someone can help me with modifying the swingarm indicator to include a line that runs parallel to the Extremum dots. Distance from Extremum dots can be adjusted, i.e $1, $2,….. off from the Extremum dots. If possible to have the option to have multiple line.

I would like to see if someone can help me with modifying the swingarm indicator to include a line that runs parallel to the Extremum dots. Distance from Extremum dots can be adjusted, i.e $1, $2,….. off from the Extremum dots. If possible to have the option to have multiple line.

You can use this and change the dashed lines into one that is near the Extremum dots. http://tos.mx/ugj73PhCan someone look into this for me. The version from Jan 1 is not the same as the request below.

I would like to see if someone can help me with modifying the swingarm indicator to include a line that runs parallel to the Extremum dots. Distance from Extremum dots can be adjusted, i.e $1, $2,….. off from the Extremum dots. If possible to have the option to have multiple line.

Thank you! This will workYou can use this and change the dashed lines into one that is near the Extremum dots. http://tos.mx/ugj73Ph

@Gellidus It's a custom indicator. It can be found here with paid subscription for colored candles. https://tosindicators.com/indicators/dynamic-rsi

tjlizwelicha

Active member

Hello @deleted13 I just joined today. I have been going through the thread to find the think script for the swingarm with the confirmation and unable to locate. Could you please provide the thinkscript? I use a 1 min and 5 min chart will this be okay to use as well?While the system can be used on Stock, it was designed for futures. So you must understand before going forward with stocks and putting money at risk. Regards, Jose.

@tjlizwelicha You must be looking for this indicator: https://usethinkscript.com/threads/...ng-points-and-concavity-2nd-derivatives.1803/

tjlizwelicha

Active member

Thank you @BenTen for responding so quickly. At the top of the chart it has Day Trading Straegy (white box), If 5 min. Swingarm is Bullish Buy 1 min Zone (green box), and Divergence (red box). It has buy support than buy confirmed. I took a screen shot, but I was unable to upload it in the message box. I hope this helps to know what I am talking about. lol

- Status

- Not open for further replies.

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1590

Online

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.