@tjlizwelicha I believe those are just labels added. Not really a functional indicator. But feel free to share an image so I know for sure what you're asking for.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

blackFLAG FTS - SwingArm Trend Indicator using ATRTrailing Stop and Fibonacci Retracements

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

tjlizwelicha

Active member

Thank you. I am not a computer wiz, it is so out of my scope of practice since I am a nurse.

Last edited by a moderator:

@tjlizwelicha Yup, that is the Hull moving average that I mentioned to you in the previous message.

If you want to chart bubbles, you can use this version: https://usethinkscript.com/threads/...op-and-fibonacci-retracements.2486/post-24637

If you want to chart bubbles, you can use this version: https://usethinkscript.com/threads/...op-and-fibonacci-retracements.2486/post-24637

@madantv73 I don't recall seeing any backtesting strategy for this indicator. However, it should be fairly simple to set one up. How would you like the buy and sell orders to be triggered? I would keep the conditions within the SwingArm indicator's scope and not get any other scripts involved to simplify the coding process.

I totally agree it has to be confined to swingarm's indicator to keep it simple. I am thinking #1 use case is to enter a trade when ATR truns Green to red and Vice Versa.@madantv73 I don't recall seeing any backtesting strategy for this indicator. However, it should be fairly simple to set one up. How would you like the buy and sell orders to be triggered? I would keep the conditions within the SwingArm indicator's scope and not get any other scripts involved to simplify the coding process.

guyonabuffalo

New member

TOS already has a strategy called ATRTrailingStopLE and ATRTrailingStopSE that I believe will do what you're looking for.I totally agree it has to be confined to swingarm's indicator to keep it simple. I am thinking #1 use case is to enter a trade when ATR truns Green to red and Vice Versa.

tjlizwelicha

Active member

Thank you.TOS already has a strategy called ATRTrailingStopLE and ATRTrailingStopSE that I believe will do what you're looking for.

tjlizwelicha

Active member

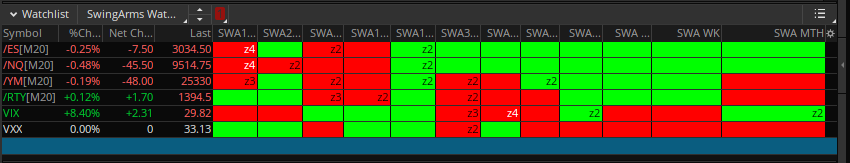

Could you please help me find the thinkscript for the above two? I have used the thinkscript from page one, however it's not appearing as above. Thanks.@Playstation, it does seem to work correctly for me, I even posted a 10min screenshot of the zone, the watchlist on ES was showing short in zone 4 as per above posts. I can also see it now for instance live on a 1min chart ES short and in the zones as well for the alert.

@tjlizwelicha Which component are you looking for exactly?

tjlizwelicha

Active member

From Playstation concerning The Swingarm@tjlizwelicha Which component are you looking for exactly?

@tjlizwelicha I know what you're referring to, but there are two screenshots in that post with lots of different indicators. What are you looking for exactly?

thaisangcr7

New member

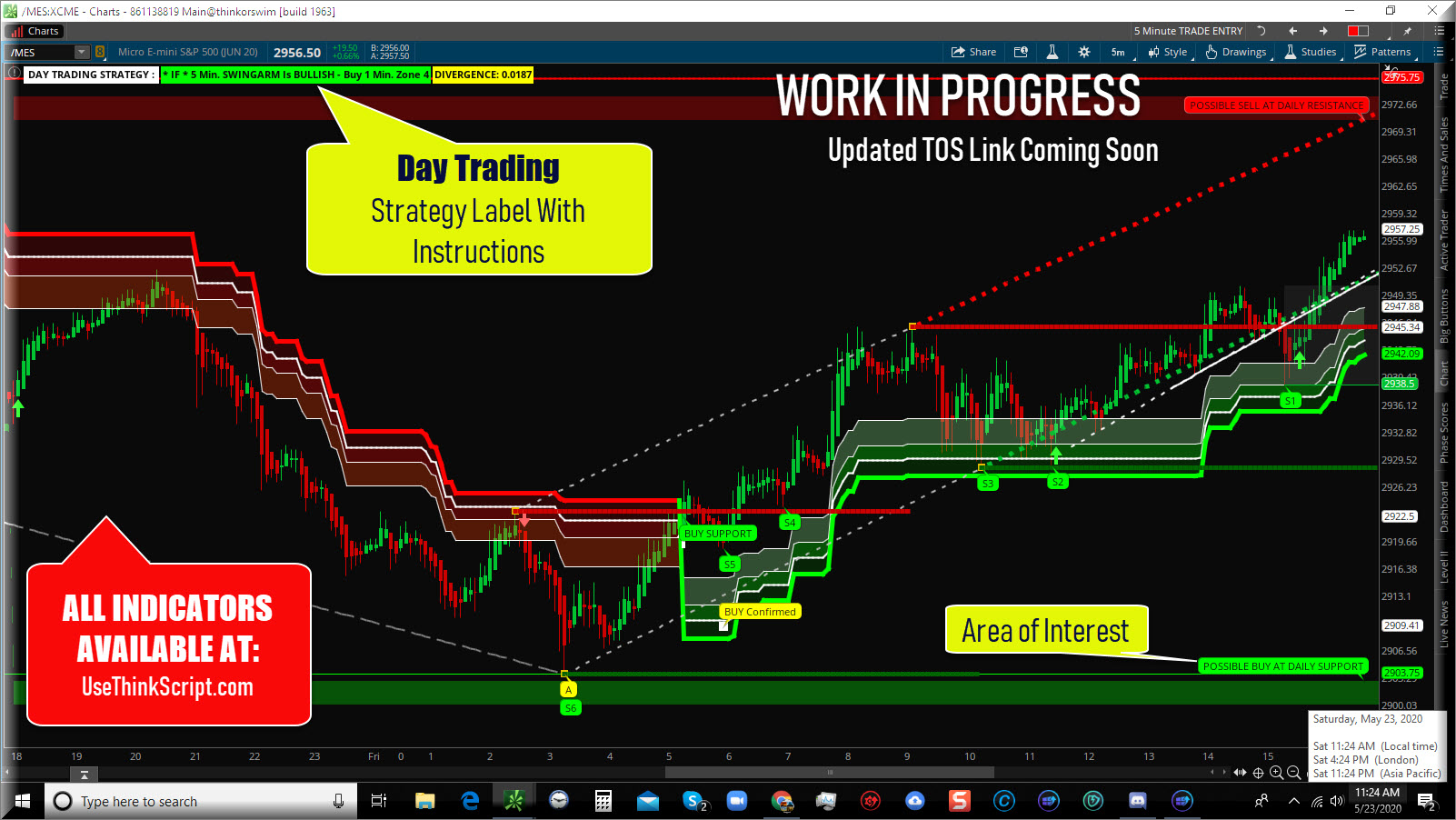

Hi! Are you done with your chart? Can you share the chart and indicators that look like your screenshot please?Thank you @Playstation

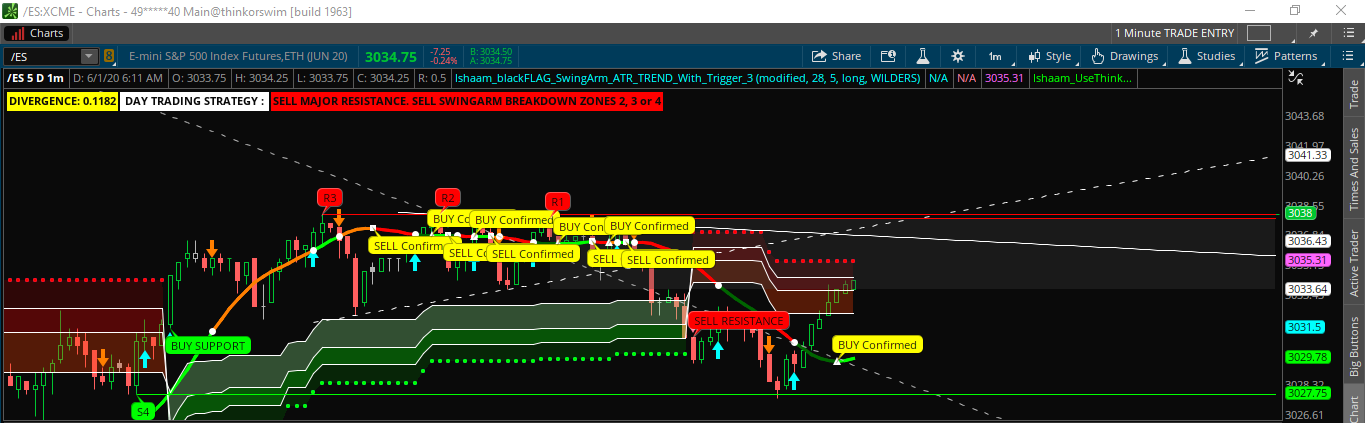

Updated chart. As soon as some of the detailed work is done, I will update the code and settings for all tools being used.

@thaisangcr7 Here are the indicators from that screenshot:

- SwingArm (code can be found on the first page of this thread

- Average Price Movement

- Auto Support / Resistance

thaisangcr7

New member

Thanks Ben.

Hi @BenTen Are you able to create a backtest strategy when price comes to zone 4 and take profit at a specified amount? Takes a bit of time to see which timeframe works best for each ticker. I attempted myself and couldn't get it work.@madantv73 I don't recall seeing any backtesting strategy for this indicator. However, it should be fairly simple to set one up. How would you like the buy and sell orders to be triggered? I would keep the conditions within the SwingArm indicator's scope and not get any other scripts involved to simplify the coding process.

Hello all,

I am new to testing out the SwingArm scripts and so far I have watched the introduction and the watchlist videos. I've added the scripts/styles for charting and I see a round info button in the top left corner. Its content varies between screens, but usually contains similar items like:

"Secondary period cannot be less than primary"

"Classic and Fibonacci pattern search is not available for current chart type or aggregation type. Use a time chart with unmodified price: bar, Candle, Area, Line, Candle Trend."

I usually see many different studies getting the less than primary message.

Is this normal function or do I have something incorrect?

Thanks in advance for your help,

Rich

I am new to testing out the SwingArm scripts and so far I have watched the introduction and the watchlist videos. I've added the scripts/styles for charting and I see a round info button in the top left corner. Its content varies between screens, but usually contains similar items like:

"Secondary period cannot be less than primary"

"Classic and Fibonacci pattern search is not available for current chart type or aggregation type. Use a time chart with unmodified price: bar, Candle, Area, Line, Candle Trend."

I usually see many different studies getting the less than primary message.

Is this normal function or do I have something incorrect?

Thanks in advance for your help,

Rich

Loaded the strategy on my TOS using the link:

SWINGARM MULTI TIMEFRAME LINK UPDATE: http://tos.mx/sr01DrZ

Two notification messages pop-up. One with sound of DING and one with CHIMES.

It happens to be that both the messages are same but alert with different sound. In quick succession or with delay.

": CHART ALERT

1 d 1m chart for /MES:XCME

shared_UseThinkScript_Hull_Moving_Average_Turning_Points_Mahsume ((H+L)/2, 255, 2)

Sell"

": CHART ALERT

1 d 1m chart for /MES:XCME

shared_UseThinkScript_Hull_Moving_Average_Turning_Points_Mahsume ((H+L)/2, 255, 2)

Sell"

Sometimes, I get a BUY alert with DING and SELL alert with CHIMES and so on....

.

What is the purpose of sound variation here?

Is it actionable, if sound is DING or if sound is CHIMES?

If price is only at a certain point on the SwingArm, the alerts are actionable. If so, where?

SWINGARM MULTI TIMEFRAME LINK UPDATE: http://tos.mx/sr01DrZ

Two notification messages pop-up. One with sound of DING and one with CHIMES.

It happens to be that both the messages are same but alert with different sound. In quick succession or with delay.

": CHART ALERT

1 d 1m chart for /MES:XCME

shared_UseThinkScript_Hull_Moving_Average_Turning_Points_Mahsume ((H+L)/2, 255, 2)

Sell"

": CHART ALERT

1 d 1m chart for /MES:XCME

shared_UseThinkScript_Hull_Moving_Average_Turning_Points_Mahsume ((H+L)/2, 255, 2)

Sell"

Sometimes, I get a BUY alert with DING and SELL alert with CHIMES and so on....

.

What is the purpose of sound variation here?

Is it actionable, if sound is DING or if sound is CHIMES?

If price is only at a certain point on the SwingArm, the alerts are actionable. If so, where?

@tom23824 I know that 38pages of this thread is ALOT to wade through. But this strategy is discussed in-depth especially in the first 20pgs. and it provides in detail what actions to take for which signals.

This strategy utilizes two indicators:

Mashume's Hull Moving Average Turning Points and Concavity

This is another long thread but much of what I have learned about trading, TOS, and math has come from @mashume's threads and is well worth the read. The Hull MA indicator is what is giving your the Bells and Chimes.

Alert(condition = buy, text = "Buy", "alert type" = Alert.BAR, sound = Sound.Bell);

Alert(condition = sell, text = "Sell", "alert type" = Alert.BAR, sound = Sound.Chimes);

The other indicator used in this strategy is TOS's ATR Trailing Stop Loss. An excellent indicator.

You will get 1000's of hits googling this indicator. Once you have read up on this indicator, you will better understand what the "DINGS" alerts are alerting you to.

Alert(BuySignal, "Trail Stop Long Entry", Alert.BAR, Sound.DING);

Alert(SellSignal, "Trail Stop Short Entry", Alert.BAR, Sound.DING);

HTH

This strategy utilizes two indicators:

Mashume's Hull Moving Average Turning Points and Concavity

This is another long thread but much of what I have learned about trading, TOS, and math has come from @mashume's threads and is well worth the read. The Hull MA indicator is what is giving your the Bells and Chimes.

Alert(condition = buy, text = "Buy", "alert type" = Alert.BAR, sound = Sound.Bell);

Alert(condition = sell, text = "Sell", "alert type" = Alert.BAR, sound = Sound.Chimes);

The other indicator used in this strategy is TOS's ATR Trailing Stop Loss. An excellent indicator.

You will get 1000's of hits googling this indicator. Once you have read up on this indicator, you will better understand what the "DINGS" alerts are alerting you to.

Alert(BuySignal, "Trail Stop Long Entry", Alert.BAR, Sound.DING);

Alert(SellSignal, "Trail Stop Short Entry", Alert.BAR, Sound.DING);

HTH

guyonabuffalo

New member

TL;DR using this strategy successfully but looking for tweaks, especially with managing risk

Anyone else still using this? Mind sharing your strategy? Here's what I've been doing:

what's on my chart:

5m swingarm

HA candles

vwap

240hma

TMO

Waddah Attar Explosion

Ray Bull Power

I also look at a 60m chart with a 20 day or 30 day composite volume profile. I use this to mark high volume nodes(hvn) and low volume nodes(lvn)

The above strategy gave me the following stats:

Trades: 274

Winners: 67

Losers: 207

Win%: 24%

Loss%: 76%

W/L Ratio: 0.32

Avg Win: $131.09

Avg Loss: $33.26

Reward/Risk Ratio: 3.94

Risk/Reward Ratio: 0.25

Expectancy: $6.93

Although I feel those stats are decent and profitable, I noticed I was missing trades when the price would come into the bucket and reverse before coming all the way down to zone 4. I've been trying to find a way to capitalize on those secondary entry opportunities and that's where the waddah and ray bull power came into play. I love using the waddah for entry, it's kept me out of some plays that just didn't materialize where I probably would've entered into a trade otherwise. It's also a pretty good indicator for trend strength and possible reversals. I tried using the mahsume turning points for a secondary entry but found that at times I would get whipsawed so badly that it would wipe out a considerable amount of profit for the day or the move was almost over by the time I got a signal and I'd get stopped out much lower.

I also hated giving up profit or having a trade turn into breakeven so that's when I started using the hvn and lvn as targets and potential reversal areas. Using the first strategy and including the tweaks I made gave me the following stats:

Trades: 48

Winners: 23

Losers: 25

Win%: 48%

Loss%: 52%

W/L Ratio: 0.92

Avg Win: $95.33

Avg Loss: $36.94

Reward/Risk Ratio: 2.58

Risk/Reward Ratio: 0.39

Expectancy: $26.44

Much better but I still think that this strategy can be tweaked as the second set of trades is a smaller sample size. The biggest issue I'm having is with risk management. Placing an order at zone 4, I know my stop is below the trailing stop and my risk is defined pretty much the same every time. Not only that, once the trailing stop is broken the trend usually changes to the other direction and the trade is broken anyhow. However, if I enter with a waddah explosion in the direction of the trend while price is in the swingarm, I struggle to find where to place my stop. Thought about using a dollar amount, but that's just an arbitrary number and I've been stopped out only to see price hold at zone 4 and reverse without me. If I place my stop below the trailing stop, I'm usually not comfortable with the amount of potential loss and it could sway my p&l results to the negative.

Anyways, sorry for the long post but I'm open to any suggestions and looking forward to how anyone else has been using this method.

Anyone else still using this? Mind sharing your strategy? Here's what I've been doing:

what's on my chart:

5m swingarm

HA candles

vwap

240hma

TMO

Waddah Attar Explosion

Ray Bull Power

I also look at a 60m chart with a 20 day or 30 day composite volume profile. I use this to mark high volume nodes(hvn) and low volume nodes(lvn)

- trade /mes and /mnq only.

- try to only trade during RTH (Although I have found that I've been missing opportunities during ETH).

- using the 5m swingarm, I find the trend using the 60m 20hma. I plot that as a 240hma on the 5m chart

- if the swingarm is trending in the same direction as the 240hma, I place an order at zone 4, with a stop just beyond the ATR trailing stop. (For /mes it's usually about 8 handles and 20 handles for /mnq but could be less)

- I exit either at EOD or when I have a "hunch"

The above strategy gave me the following stats:

Trades: 274

Winners: 67

Losers: 207

Win%: 24%

Loss%: 76%

W/L Ratio: 0.32

Avg Win: $131.09

Avg Loss: $33.26

Reward/Risk Ratio: 3.94

Risk/Reward Ratio: 0.25

Expectancy: $6.93

Although I feel those stats are decent and profitable, I noticed I was missing trades when the price would come into the bucket and reverse before coming all the way down to zone 4. I've been trying to find a way to capitalize on those secondary entry opportunities and that's where the waddah and ray bull power came into play. I love using the waddah for entry, it's kept me out of some plays that just didn't materialize where I probably would've entered into a trade otherwise. It's also a pretty good indicator for trend strength and possible reversals. I tried using the mahsume turning points for a secondary entry but found that at times I would get whipsawed so badly that it would wipe out a considerable amount of profit for the day or the move was almost over by the time I got a signal and I'd get stopped out much lower.

I also hated giving up profit or having a trade turn into breakeven so that's when I started using the hvn and lvn as targets and potential reversal areas. Using the first strategy and including the tweaks I made gave me the following stats:

Trades: 48

Winners: 23

Losers: 25

Win%: 48%

Loss%: 52%

W/L Ratio: 0.92

Avg Win: $95.33

Avg Loss: $36.94

Reward/Risk Ratio: 2.58

Risk/Reward Ratio: 0.39

Expectancy: $26.44

Much better but I still think that this strategy can be tweaked as the second set of trades is a smaller sample size. The biggest issue I'm having is with risk management. Placing an order at zone 4, I know my stop is below the trailing stop and my risk is defined pretty much the same every time. Not only that, once the trailing stop is broken the trend usually changes to the other direction and the trade is broken anyhow. However, if I enter with a waddah explosion in the direction of the trend while price is in the swingarm, I struggle to find where to place my stop. Thought about using a dollar amount, but that's just an arbitrary number and I've been stopped out only to see price hold at zone 4 and reverse without me. If I place my stop below the trailing stop, I'm usually not comfortable with the amount of potential loss and it could sway my p&l results to the negative.

Anyways, sorry for the long post but I'm open to any suggestions and looking forward to how anyone else has been using this method.

- Status

- Not open for further replies.

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1069

Online

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.