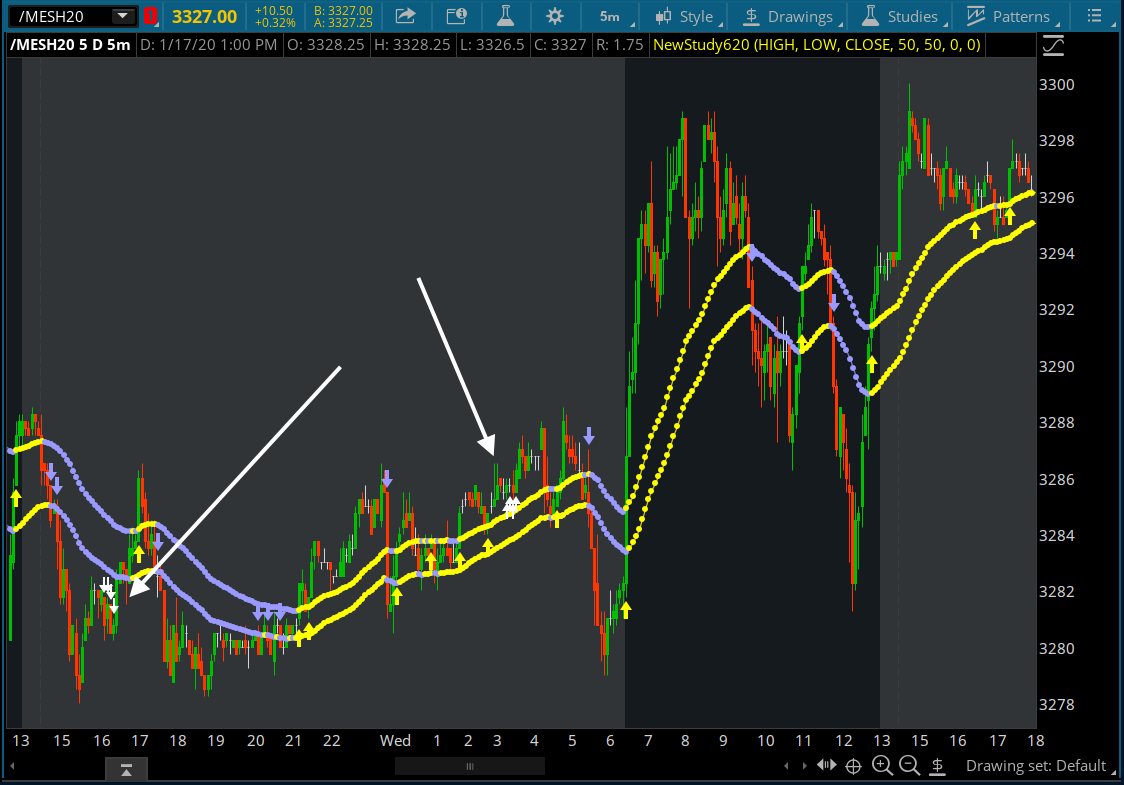

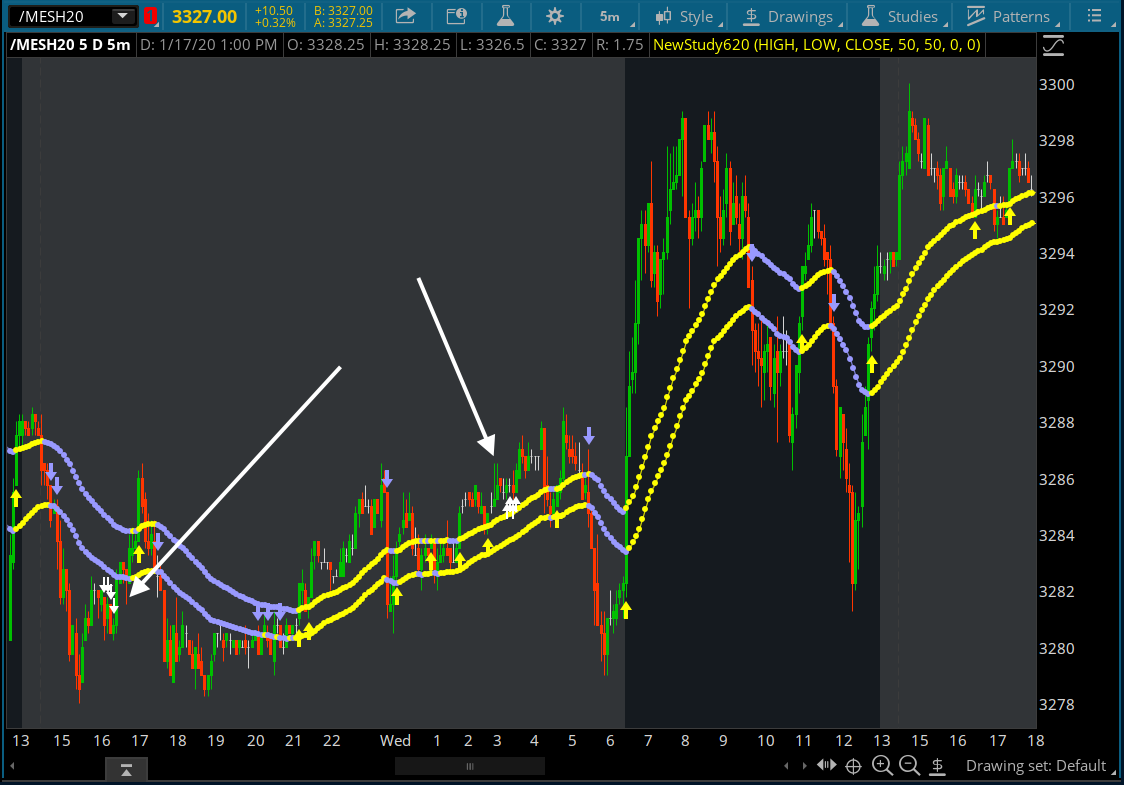

Ben have there been any upgrades to market maker I beleive I'm running uhm do not have a vers number@Billions Didn't see any white arrows for today or yesterday, but it was there from a couple days ago. Very rare to spot.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Black Dog System Indicator for ThinkorSwim - Strategy

- Thread starter BenTen

- Start date

Don't know if anyone cares, but BD has been originally designed to be used on 15 minutes, with 15 EMA as a filter for the channel. If you're using 50 MA on 15 minutes, you're trading a running average of the 12.5 hours time frame. If you're using 15 EMA as a filter, you're using 3.75 hours filter. Personally, I don't agree with the EMA settings, I think SMA should be used, but there isn't that much of a difference.

On 5 minutes, it is a totally different ball game. If you're using 50 MA channel on 5-min, you're trading a running average of 4 hours. So basically, on 5-minutes, you're trading 15 EMA of the 15 minutes. If you want to trade 5-min and want to stick with the original design, the length of the channel should be 150.

On 5 minutes, it is a totally different ball game. If you're using 50 MA channel on 5-min, you're trading a running average of 4 hours. So basically, on 5-minutes, you're trading 15 EMA of the 15 minutes. If you want to trade 5-min and want to stick with the original design, the length of the channel should be 150.

Thanks Ben@Billions Didn't see any white arrows for today or yesterday, but it was there from a couple days ago. Very rare to spot.

So in the settings I would change from 50 to 150 is that correct?Don't know if anyone cares, but BD has been originally designed to be used on 15 minutes, with 15 EMA as a filter for the channel. If you're using 50 MA on 15 minutes, you're trading a running average of the 12.5 hours time frame. If you're using 15 EMA as a filter, you're using 3.75 hours filter. Personally, I don't agree with the EMA settings, I think SMA should be used, but there isn't that much of a difference.

On 5 minutes, it is a totally different ball game. If you're using 50 MA channel on 5-min, you're trading a running average of 4 hours. So basically, on 5-minutes, you're trading 15 EMA of the 15 minutes. If you want to trade 5-min and want to stick with the original design, the length of the channel should be 150.

Have you used this and what is the outcome?@Billions

Have you loaded up a 5m / 100day chart or something? You don't get the black dogs every day. Sometimes not for weeks at a time.

Another way to do it... add 20 and 100 EMAs on a 20 minutes chart. Find where they cross. Go to your 5m chart and that's where you should have a dog.

@Billions I don't use the original system. I use the VWAP, volume profile, RSI and Fibs.

Generally speaking, for intraday trading, if the price is above the 50 channel and 50 MA > 200 MA, the price is an uptrend and vice versa. But here is the thing, it isn't that simple. The price is often in a counter-trend, either going towards the 50 channel from above it or below it. It is going to encounter resistance and reverse when it runs into the prior range, the first touch is usually a high probability trade. When 50 and 200 are near each other, we get a lot of chop.

Generally speaking, for intraday trading, if the price is above the 50 channel and 50 MA > 200 MA, the price is an uptrend and vice versa. But here is the thing, it isn't that simple. The price is often in a counter-trend, either going towards the 50 channel from above it or below it. It is going to encounter resistance and reverse when it runs into the prior range, the first touch is usually a high probability trade. When 50 and 200 are near each other, we get a lot of chop.

Thanks @john3@Billions I don't use the original system. I use the VWAP, volume profile, RSI and Fibs.

Generally speaking, for intraday trading, if the price is above the 50 channel and 50 MA > 200 MA, the price is an uptrend and vice versa. But here is the thing, it isn't that simple. The price is often in a counter-trend, either going towards the 50 channel from above it or below it. It is going to encounter resistance and reverse when it runs into the prior range, the first touch is usually a high probability trade. When 50 and 200 are near each other, we get a lot of chop.

stiffdogg06

New member

I've been playing with this system for a few days. A few questions:

Should we have after-hours on or off? This changes a lot. This was originally used for Forex which I believe doesn't have "after-hours"

John3 - From the document download on a few pages back where the person is talking about setting up the system on Forex, he states using 50 EMA's. Where did you find the system using 15 EMA?

Should we have after-hours on or off? This changes a lot. This was originally used for Forex which I believe doesn't have "after-hours"

John3 - From the document download on a few pages back where the person is talking about setting up the system on Forex, he states using 50 EMA's. Where did you find the system using 15 EMA?

Last edited:

RickK

Active member

Hey Guys,

I'm finding the Blackdog strategy that @BenTen posted very intriguing and I'm trying to refine

it a bit for my screen AND incorporate that author's secondary, followup strategy

(the Blackdog MtF......"mini trend finder"), which provides for excellent

trading opportunities even when trading against the original Blackdog signals.

I don't know if this has already been posted somewhere, but is there some

code that will allow me to display the results of a MACD from a higher

time frame (let's say 15m) as a subpanel indicator on a

lower time frame (let's say 5m) chart? I know @tomsk provided

a special MACD as part of this discussion, but for this I'm certain that it has

something to do with the time aggregation needed

inside the script .... just as it was used in the original Blackdog indicator itself. I

just can't figure out how to get it to apply to MACD.

I have reviewed the author's complete 111 page PDF manual and have

made my notations (including a large correction that the author mistakingly

wrote). This 111 page PDF manual includes all of the information about

the BlackDog strategy, the followup Blackdog MtF strategy, and his final

enhancement to the Blackdog MtF strategy (which he's referring to as MtF2).

It is part of the MtF2 that requires a MACD from a higher time frame displayed

on a lower time frame chart.

Once I put this together and test it, I'll be posting my complete workspace,

which include various scripts that i've pieced together, and also my edited

version of the author's 111 page PDF manual.

Thanks!

I'm finding the Blackdog strategy that @BenTen posted very intriguing and I'm trying to refine

it a bit for my screen AND incorporate that author's secondary, followup strategy

(the Blackdog MtF......"mini trend finder"), which provides for excellent

trading opportunities even when trading against the original Blackdog signals.

I don't know if this has already been posted somewhere, but is there some

code that will allow me to display the results of a MACD from a higher

time frame (let's say 15m) as a subpanel indicator on a

lower time frame (let's say 5m) chart? I know @tomsk provided

a special MACD as part of this discussion, but for this I'm certain that it has

something to do with the time aggregation needed

inside the script .... just as it was used in the original Blackdog indicator itself. I

just can't figure out how to get it to apply to MACD.

I have reviewed the author's complete 111 page PDF manual and have

made my notations (including a large correction that the author mistakingly

wrote). This 111 page PDF manual includes all of the information about

the BlackDog strategy, the followup Blackdog MtF strategy, and his final

enhancement to the Blackdog MtF strategy (which he's referring to as MtF2).

It is part of the MtF2 that requires a MACD from a higher time frame displayed

on a lower time frame chart.

Once I put this together and test it, I'll be posting my complete workspace,

which include various scripts that i've pieced together, and also my edited

version of the author's 111 page PDF manual.

Thanks!

@RickKennedy TomSK was kind enough to make and share a script. If you can't find it let me know. It can easily be changed to make all the difference MACDs used in the bdog system. By the way, that document you reference is fairly old and there have been some changes. If you're really interested in the bdogs shoot me a message on Discord and maybe we can swap ideas about it. hash#7484

stiffdogg06

New member

I've been trying to understand this system for a few months now.

The author states to use it on 15min TF but this script is to be used on 5 min TF. Also, trying to find a way to lessen the chance of a fake out.

Lastly, say you have BDDown, SES down, MACD isn't in the red yet, how long is that signal valid until you should forget it and move on?

If you guys are able to share your workspace, that'd be greatly appreciated. @hashy The discord channel has been shut down

The author states to use it on 15min TF but this script is to be used on 5 min TF. Also, trying to find a way to lessen the chance of a fake out.

Lastly, say you have BDDown, SES down, MACD isn't in the red yet, how long is that signal valid until you should forget it and move on?

If you guys are able to share your workspace, that'd be greatly appreciated. @hashy The discord channel has been shut down

Last edited:

There's a lot more to the system than that old document. The creator was pretty sloppy about changing URLs and redirecting from his old site, but the current official site is blackdogtrader dot com. With that said, I've paid for the course and went through the whole thing, and don't really use it much. Also, you can still send me a direct message on Discord if you add me as a friend. That has nothing to do with a specific server.I've been trying to understand this system for a few months now.

The author states to use it on 15min TF but this script is to be used on 5 min TF. Also, trying to find a way to lessen the chance of a fake out.

Lastly, say you have BDDown, SES down, MACD isn't in the red yet, how long is that signal valid until you should forget it and move on?

If you guys are able to share your workspace, that'd be greatly appreciated. @hashy The discord channel has been shut down

KevinSammy

Member

Hi @RickKennedy - thank you for such a detailed post! I was wondering if you had a chance to go through the items you mentioned. Thanks and Go Green, Go White!!

hello, are you able to post the MTF2 MACD code? does anyone have it ?Hey Guys,

I'm finding the Blackdog strategy that @BenTen posted very intriguing and I'm trying to refine

it a bit for my screen AND incorporate that author's secondary, followup strategy

(the Blackdog MtF......"mini trend finder"), which provides for excellent

trading opportunities even when trading against the original Blackdog signals.

I don't know if this has already been posted somewhere, but is there some

code that will allow me to display the results of a MACD from a higher

time frame (let's say 15m) as a subpanel indicator on a

lower time frame (let's say 5m) chart? I know @tomsk provided

a special MACD as part of this discussion, but for this I'm certain that it has

something to do with the time aggregation needed

inside the script .... just as it was used in the original Blackdog indicator itself. I

just can't figure out how to get it to apply to MACD.

I have reviewed the author's complete 111 page PDF manual and have

made my notations (including a large correction that the author mistakingly

wrote). This 111 page PDF manual includes all of the information about

the BlackDog strategy, the followup Blackdog MtF strategy, and his final

enhancement to the Blackdog MtF strategy (which he's referring to as MtF2).

It is part of the MtF2 that requires a MACD from a higher time frame displayed

on a lower time frame chart.

Once I put this together and test it, I'll be posting my complete workspace,

which include various scripts that i've pieced together, and also my edited

version of the author's 111 page PDF manual.

Thanks!

Hi

I am a fairly new member. I have been trying to add the alerts noted in post #30 and # 39 to the upper chart, but have been unsuccessful. I have tried to paste them onto the original code. but get an error message after trying to copy and paste to TOS. Have tried adding it in TOS when creating , then also tried copying to a notepad, then pasting the entire sequence into TOS. Still getting an error message. Could someone please add the alerts to the original. code where I can copy and paste the entire sequence in at one time ? Only need it for the Black Dog chart, not the MACD. Thanks in advance !

I am a fairly new member. I have been trying to add the alerts noted in post #30 and # 39 to the upper chart, but have been unsuccessful. I have tried to paste them onto the original code. but get an error message after trying to copy and paste to TOS. Have tried adding it in TOS when creating , then also tried copying to a notepad, then pasting the entire sequence into TOS. Still getting an error message. Could someone please add the alerts to the original. code where I can copy and paste the entire sequence in at one time ? Only need it for the Black Dog chart, not the MACD. Thanks in advance !

@mactheknife Below is the script for post#1 with alerts added

Ruby:

# Black Dogs & SESs---For 5 minute chart ONLY

# NAMED BlackDog_SES_5min

# Here, "Black Dogs" are WHITE for use on a dark background.

input Hprice = high;

input Lprice = low;

input price = close;

input Hlength = 50;

input Llength = 50;

input Hdisplace = 0;

input Ldisplace = 0;

# High / Low Band for SES computations---------------------------

# EMA of HIGHS-----------------------------------------------------------

plot HAvg = MovAvgExponential(Hprice[-Hdisplace], Hlength);

HAvg.SetDefaultColor(Color.WHITE);

HAvg.SetLineWeight(5);

HAvg.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

HAvg.SetStyle(Curve.FIRM);

HAvg.HideBubble();

HAvg.HideTitle();

HAvg.AssignValueColor(if HAvg< HAvg[1] then Color.VIOLET else (if HAvg == HAvg[1] then Color.YELLOW else Color.YELLOW));

# EMA of LOWS------------------------------------------------------------

plot LAvg = MovAvgExponential(Lprice[-Ldisplace], LLength);

LAvg.SetDefaultColor(Color.WHITE);

LAvg.SetLineWeight(5);

LAvg.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

LAvg.SetStyle(Curve.FIRM);

LAvg.HideBubble();

LAvg.HideTitle();

LAvg.AssignValueColor(if LAvg< LAvg[1] then Color.VIOLET else (if LAvg == LAvg[1] then Color.YELLOW else Color.YELLOW));

# Crosses for SES Arrows----------------------------------------------

# SES = Standard Entry Signal

# Cross above High Average -----------------------------------------

def CrossUp = if price > HAvg AND price[1] < HAvg then 1 else 0;

Plot SESup = if CrossUp then high else double.nan;

SESup.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

SESup.SetLineWeight(3);

SESup.SetDefaultColor(color.YELLOW);

SESup.HideBubble();

SESup.HideTitle();

# Cross above Low Average --------------------------------------------

def CrossDn = if price < Lavg AND price[1] > LAvg then 1 else 0;

Plot SESdn = if CrossDn then low else double.nan;

SESdn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SESdn.SetLineWeight(3);

SESdn.SetDefaultColor(color.VIOLET);

SESdn.HideBubble();

SESdn.HideTitle();

# ================================================

#

# Black Dog Arrows------------------------------------------------------

# Change Aggregation Period to 20 minutes------------------------

def agg = AggregationPeriod.TWENTY_MIN;

def data = close(period = agg);

# 2 EMAs of Black Dogs--------------------------------------------------

def BDfastEMA=ExpAverage(DATA,20);

def BDslowEMA=ExpAverage(DATA,100);

# Black Dog UP for EMA20 crossing ABOVE EMA100-------------

def UpCross = if BDfastEMA > BDslowEma AND BDfastEMA[1] < BDslowEMA then 1 else 0;

Plot BDup = if UpCross then high else double.nan;

BDup.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

BDup.SetLineWeight(5);

BDup.SetDefaultColor(color.WHITE);

BDup.HideBubble();

BDup.HideTitle();

# Black Dog DN for EMA20 crossing BELOW EMA100-----------

def DnCross = if BDfastEMA < BDslowEma AND BDfastEMA[1] > BDslowEMA then 1 else 0;

Plot BDdn = if DnCross then low else double.nan;

BDdn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

BDdn.SetLineWeight(5);

BDdn.SetDefaultColor(color.WHITE);

BDdn.HideBubble();

BDdn.HideTitle();

Alert(BDup, "Buy Signal", Alert.BAR, Sound.Ring);

Alert(BDdn, "Sell Signal", Alert.BAR, Sound.Bell);

# END==========================================Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Repaints Black Dogs-Elliot Wave Strategy For ThinkOrSwim

- Started by rip78

- Replies: 26

-

Percent From High Dynamic Channel + Breakout System For ThinkOrSwim

- Started by uplink

- Replies: 3

-

Momentum Conviction Scoring System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 18

-

3 Trigger Pillar System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 17

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1470

Online

Similar threads

-

Repaints Black Dogs-Elliot Wave Strategy For ThinkOrSwim

- Started by rip78

- Replies: 26

-

Percent From High Dynamic Channel + Breakout System For ThinkOrSwim

- Started by uplink

- Replies: 3

-

Momentum Conviction Scoring System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 18

-

3 Trigger Pillar System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 17

-

Similar threads

-

Repaints Black Dogs-Elliot Wave Strategy For ThinkOrSwim

- Started by rip78

- Replies: 26

-

Percent From High Dynamic Channel + Breakout System For ThinkOrSwim

- Started by uplink

- Replies: 3

-

Momentum Conviction Scoring System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 18

-

3 Trigger Pillar System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 17

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.