The first hour or two of every trading day is the BEST time for day-traders. ThinkOrSwim has MANY Public Watchlists.

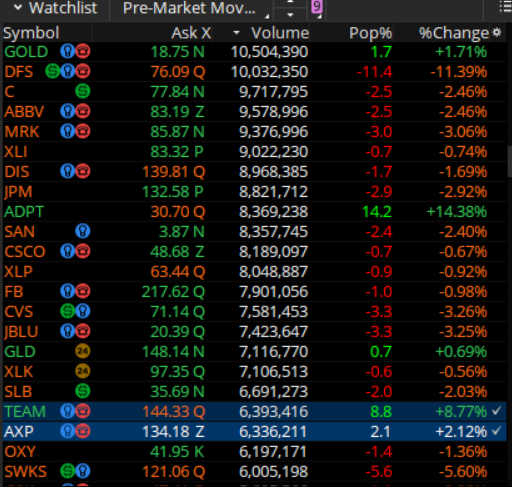

I use the one listed under Lovers and Losers, Pre-Market Movers, for all the upcoming gap Up/Down plays.

It's a big list, so it's hard to know ahead of time which ones will be best. So... I created this simple Watchlist indicator.

This little bit of code will tell you the best gaps: Long/Short plays BEFORE the market opens.

Just paste this into the thinkSscript Editor of any available Custom Quote Column.

Set the time period to D for Daily. It's based on an average of bid and asked.

So... It's never exact, but always close to the usual %Change column, as you cans see.

It works great to find the best pre-market % gaps. (But not for post-market % changes.)

Note: the %Change column listed below is for illustration purposes only.

Once you have this Pop% indicator set up correctly %Change is no longer needed.

Also, for what it's worth I usually stick to the high volume movers.

PS: The Ask X column includes a code letter, telling me which exchange the stock is traded on.

I only trade commission free US equities and ETFs. Here's the list of Exchange Codes.

I use the one listed under Lovers and Losers, Pre-Market Movers, for all the upcoming gap Up/Down plays.

It's a big list, so it's hard to know ahead of time which ones will be best. So... I created this simple Watchlist indicator.

This little bit of code will tell you the best gaps: Long/Short plays BEFORE the market opens.

Code:

plot pop = Round("number" = ((ask + bid) / 2 -close[1]) / close[1] * 100, "numberOfDigits" = 1);

pop.assignvalueColor(if pop >0 then color.green else color.red);Set the time period to D for Daily. It's based on an average of bid and asked.

So... It's never exact, but always close to the usual %Change column, as you cans see.

It works great to find the best pre-market % gaps. (But not for post-market % changes.)

Note: the %Change column listed below is for illustration purposes only.

Once you have this Pop% indicator set up correctly %Change is no longer needed.

Also, for what it's worth I usually stick to the high volume movers.

PS: The Ask X column includes a code letter, telling me which exchange the stock is traded on.

I only trade commission free US equities and ETFs. Here's the list of Exchange Codes.

Last edited by a moderator: