Here is a pre-market gap scanner for ThinkorSwim that looks for stocks with a 1% gap up or down from the previous close. Mobius shared this in the thinkScript lounge.

Here is another one:

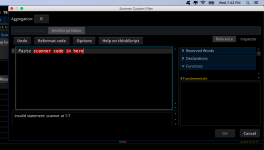

Code:

Code:

# Scan PreMarket: Scan for 1 Percent gap from Previous Close

# Scan at 5 min aggregation or less

# Mobius

# Chat Room Request

def PrevClose = if SecondsTillTime(1555) == 0 and

SecondsFromTime(1555) == 0

then close

else PrevClose[1];

def ScanActive = if SecondsTillTime(0930) >= 0 and

SecondsFromTime(0730) > 0

then 1

else 0;

def ll = if ScanActive and !ScanActive[1]

then low

else if !ScanActive

then double.nan

else if ScanActive and low < ll[1]

then low

else ll[1];

def hh = if ScanActive and !ScanActive[1]

then high

else if !ScanActive

then double.nan

else if ScanActive and high > hh[1]

then high

else hh[1];

# Comment out (#) Plot NOT wanted

plot gapUP = if ScanActive and ll > PrevClose * 1.01

then 1

else 0;

#plot gapDN = if ScanActive and hh < PrevClose * .99

# then 1

# else 0;Here is another one:

14:34 davidanderson: Hello guys, wondering if anyone here has the code for column that would show %gap pre market (like total, since yesterday's close at 4pm). it's (the number that corresponds to After_Hours_Percent_change. but I can't express it in a column. thank you

14:35 Mobius: sectors that are stable.. not out of favor with the general trading world.

14:35 bigworm: so not a sector that is really volatilie

14:42 AlphaInvestor: Column must be set to 1 minute, with Extended Hours Session turned on

14:42 AlphaInvestor: This isn't really a "gap" just a change after-hours or pre-market

Code:

Code:

# PM_AH_Chg

#09:26 GapnGo: This worked as a watchlist column until we had the last big TOS update.

#09:27 GapnGo: anyone know what the problem is with the script

#09:37 Mobius: Gap.. Since the introduction of GetTime(), watchlists and mobile applications seem to work more reliably using it rather than SecondsTillTime() or SecondsFromTime()

#09:52 Mobius: Gap.. I think this will get it going

def Post = getTime() > RegularTradingEnd(getYYYYMMDD());

def Pre = getTime() < RegularTradingStart(getYYYYMMDD());

def Closed = Post or Pre;

def DayClose1 = if getTime() crosses RegularTradingEnd(getYYYYMMDD())

then close

else DayClose1[1];

#09:39 Mobius: Alpha.. I don't know why there'd be a difference but using cross vs crosses above does make a difference with some equities.

def DayClose2 = if getTime() crosses above RegularTradingEnd(getYYYYMMDD())

then close

else DayClose2[1];

#addLabel(1, "Prev Close = " + DayClose2);

def Change = Round((close - DayClose2), 2);

def Percent = Round(((close - DayClose2) / DayClose2) * 100, 2);

plot Xtended = If(Closed, Percent, 0);

AssignBackgroundColor(Color.BLACK);

Xtended.AssignValueColor(if !Closed then Color.YELLOW else if Percent > 0 then Color.GREEN else if Percent < 0 then Color.RED else color.gray);