@Steakeater

Here is what I have learned about day trading for best results: (for myself, you will have to develop your own style)

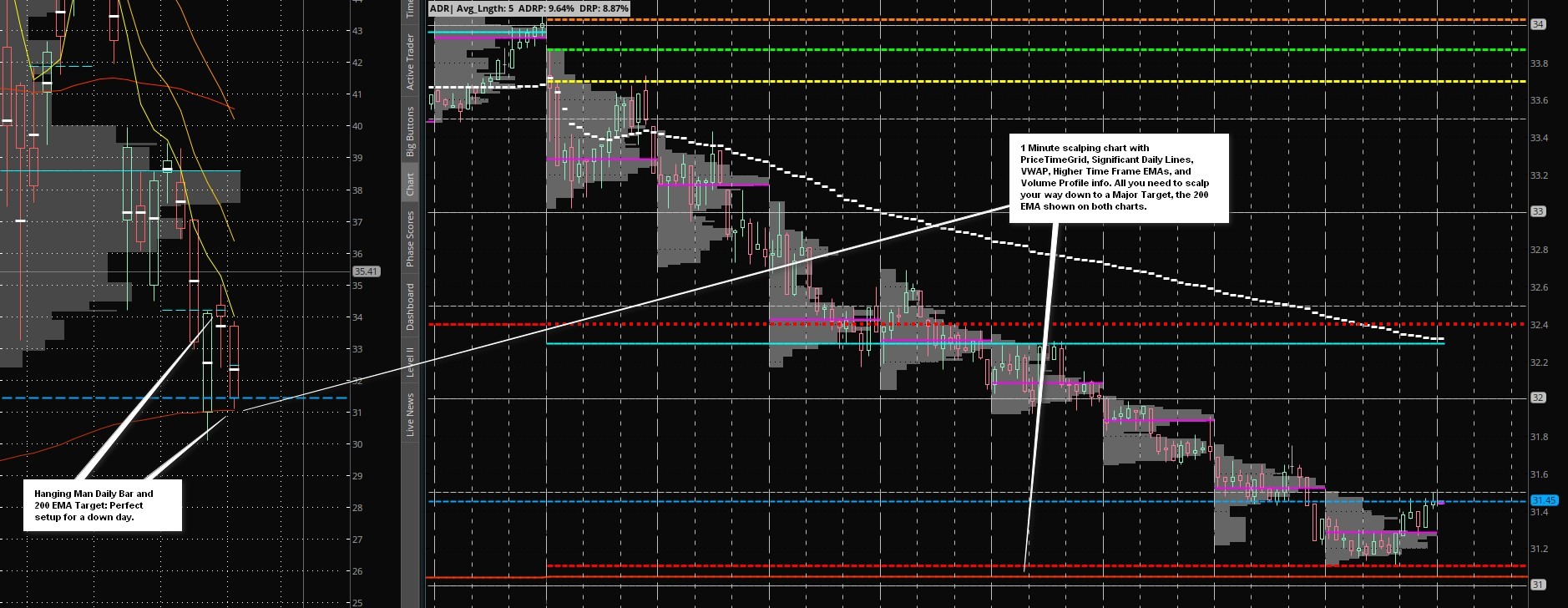

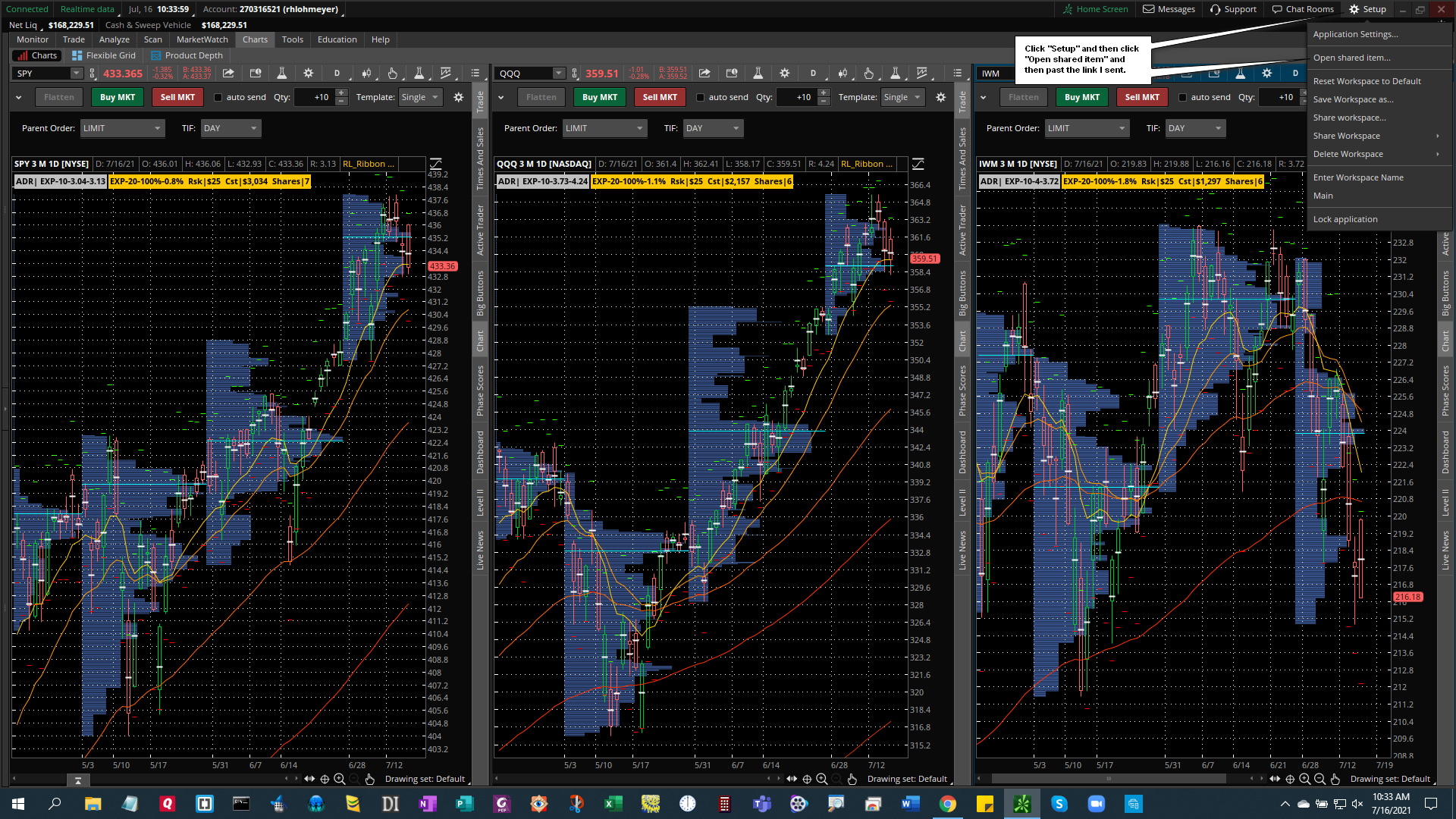

1. Trading just certain levels, like significant price levels or the edges of volume profile, will get you killed. You must watch price action as it is forming and creating its own levels. Specifically 5 minute bars. I found trading lower time frames than 5 minutes creates overtrading. The tops and bottoms of 5 minute bars form their own patterns, and if you watch these forming, you will notice that price will often reject the tops and bottoms of 5 minute bars, especially as they group near a significant level. Big traders and their algorithm's are sensitive to the 5 minute time frame. Price action must confirm the sensitivity of a specific level, rather than expect a significant level, such as a price level, to be sensitive on its own.

2. Understand how certain times tend to be better for trading. I tend to trade after the 1st half hour, and leave after about 2 hours. The first half hour can be seen as the initial range setting. It can be straight up or down, but this is never guaranteed. After 2.5 hours in the morning can be seen as the mid-day period when the big trading houses are lunching, etc, and price action can be less volatile and get choppy. Afternoon about 1.5 to 1 hours prior to close, you can start get more volatile price action, though I tend to not trade that period. AM is it for me. Also understand that the start of each new 15 minute period you can get increased volatility, as there are many 15 minute and 30 minute traders.

3. You need to plan each trade, even if you only trade twice during a 2 hour period. Watch price action near certain levels to determine the sensitivity of the level to rejection. Then set a trade near one of these levels as price action nears it. This will allow you to set a very specific stop level that gives you a very precise risk. You must control your risk precisely, rather than worrying about your potential reward. And the potential REASONABLE reward based on your risk should be 2 times your risk. AND NEVER CHASE A TRADE. IF YOU MISSED IT, JUST WAIT FOR THE NEXT OPPORTUNITY.

4. If you are learning day trading, you must put in the screen time to understand price action. And this means not "needing" to earn money from it. The more psychological pressure you have with "needing" to win, sets the psyche up for failure. This means never risking more than you can "happily" lose and stay in the game.

Day trading is more of a game for me. Others on this forum are professional at some level, and you will notice they end up setting specific, simple rules based systems that they follow. I swing trade the day time frame over weeks or even months for bread and butter trades.

Hope this helps.

Bob