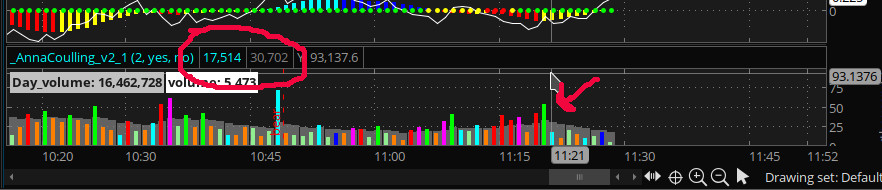

I found the source of this bug - the color assignment doesn't have a case where it handles doji candles, so it falls through to coloring them as GetColor(1). On a dark chart, GetColor(1) is COLOR.CYAN, which is the same color used for UP3.Trying to debug an anomaly in this script where a cyan bar(up3) is being printed even though its not exceeding the volAvg.

Code:def up3 = if IR_BODYG and (Vol > VolAvg) then 1 else 0;

Any ideas?

The below code colors them YELLOW instead and also has a mod to allow for user selectable average type and length to use for volume. The original indicator was using a 12 period exponential average.

Ruby:

AddLabel(yes, "Day_volume: " + volume (period = "DAY" ), Color.LIGHT_GRAY);

AddLabel(yes, "volume: " + volume, Color.white);

declare lower;

declare zerobase;

input averageType = averagetype.Exponential;

input averageLength = 12;

plot Vol = volume;

plot VolAvg = MovingAverage(averageType,volume,averageLength);

VolAvg .SetPaintingStrategy(PaintingStrategy.squared_HISTOGRAM);

VolAvg .SetDefaultColor(Color.GRAY);

def BODY_RANGE = max(oPEN,cLOSE) - min(oPEN,cLOSE);

plot IR_BODY = if BODY_RANGE < BODY_RANGE[1] and volume > volume[1] then 1 else 0 ;

def IR_BODYG = if IR_BODY and close>open then 1 else 0;

def IR_BODYR = if IR_BODY and close<open then 1 else 0;

Vol.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Vol.SetLineWeight(3);

Vol.DefineColor("Up", Color.green);

Vol.DefineColor("Down", Color.red);

Vol.DefineColor("Up2", Color.light_green);

Vol.DefineColor("Down2", Color.dark_ORANGE );

Vol.DefineColor("Up3", Color.cyan);

Vol.DefineColor("Up4", Color.blue);

Vol.DefineColor("Down3", Color.mAGENTA );

Vol.DefineColor("Down4", Color.plum );

Vol.AssignValueColor(

if close > open and IR_BODYG and Vol >VolAvg then Vol.color("Up3") else if

close > open and IR_BODYG then Vol.color("Up4")

else if close < open and IR_BODYR and Vol >VolAvg then Vol.color("Down3")

else if close < open and IR_BODYR then Vol.color("Down4")

else if close > open and Vol >VolAvg then Vol.color("Up")

else if close < open and Vol >VolAvg then Vol.color("Down")

else if close > open then Vol.color("Up2")

else if close < open then Vol.color("Down2")

else color.yellow);

input paintBars = yes;

DefineGlobalColor("CAM_UP", Color.GREEN);

DefineGlobalColor("CAM_UP2", Color.liGHT_GREEN);

DefineGlobalColor("CAM_UP3", Color.cyan);

DefineGlobalColor("CAM_UP4", Color.blue);

DefineGlobalColor("CAM_DN", Color.RED);

DefineGlobalColor("CAM_DN2", Color.darK_ORANGE );

DefineGlobalColor("CAM_DN3", Color.mAGENTA );

DefineGlobalColor("CAM_DN4", Color.plum );

AssignPriceColor(if !paintBars then Color.CURRENT

else if close > open and IR_BODYG and Vol >VolAvg then GlobalColor("CAM_UP3")

else if close < open and IR_BODYR and Vol >VolAvg then GlobalColor("CAM_DN3")

else if close > open and IR_BODYG then GlobalColor("CAM_UP4")

else if close < open and IR_BODYR then GlobalColor("CAM_DN4")

else if close > open and Vol >VolAvg then GlobalColor("CAM_UP")

else if close < open and Vol >VolAvg then GlobalColor("CAM_DN")

else if close > open then GlobalColor("CAM_UP2")

else if close < open then GlobalColor("CAM_DN2")

else Color.CURRENT);