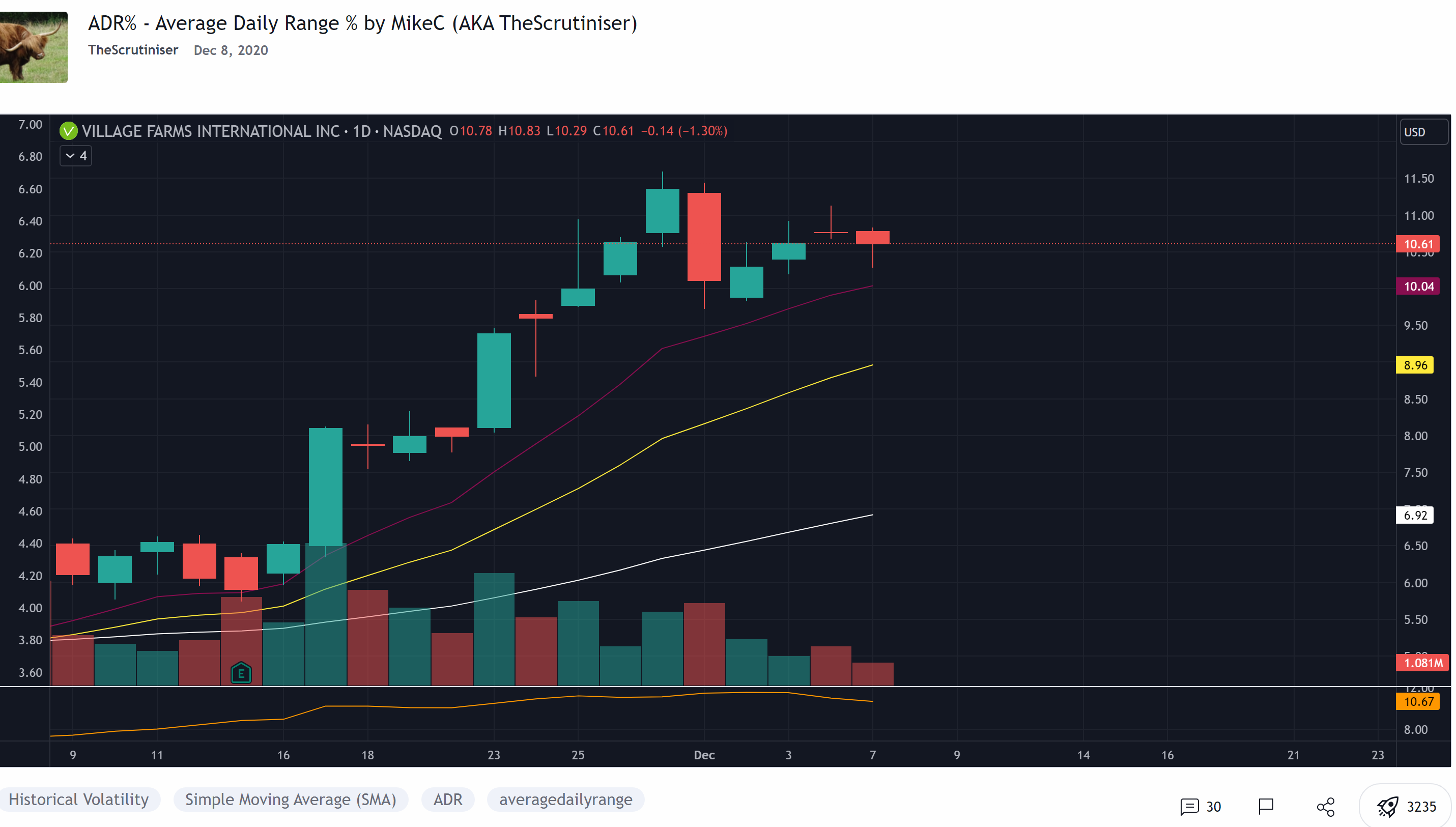

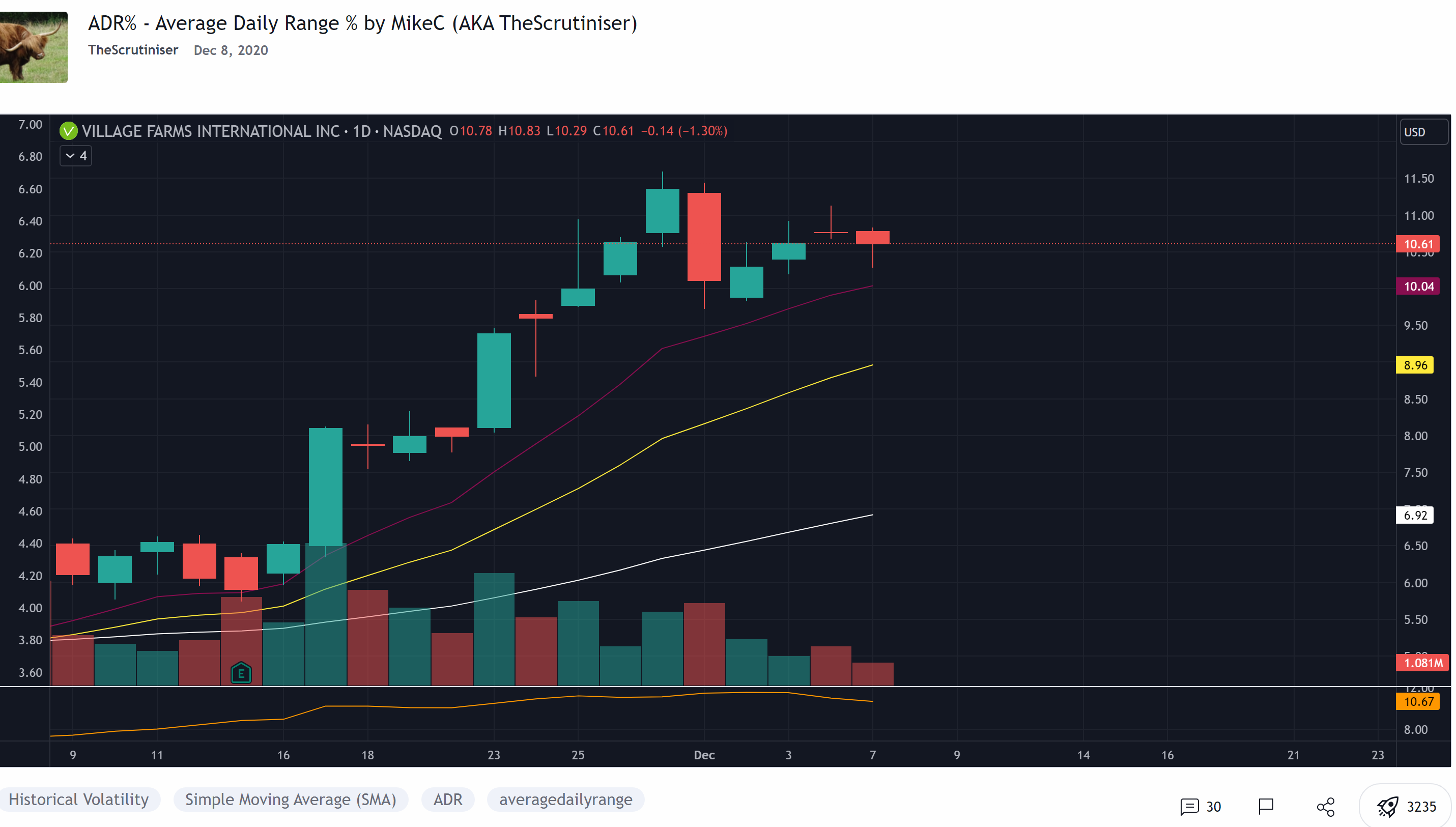

calculates the Average Daily Range (in percent) over the previous 20 periods and plots it in a chart

Hi folks,

I am looking for help coding this indicator into TOS:

GlinckEastwoot

https://in.tradingview.com/script/6KVjtmOY-ADR-Average-Daily-Range-by-MikeC-AKA-TheScrutiniser/

TIA

Hi folks,

I am looking for help coding this indicator into TOS:

GlinckEastwoot

https://in.tradingview.com/script/6KVjtmOY-ADR-Average-Daily-Range-by-MikeC-AKA-TheScrutiniser/

TIA

Last edited by a moderator: