For those unfamiliar, I started a $1k Challenge in our Discord trading chatroom late last week (Jan. 2nd). The purpose of this challenge is to build a small account while learning about risk management, charting, and helping each other grow as a trader.

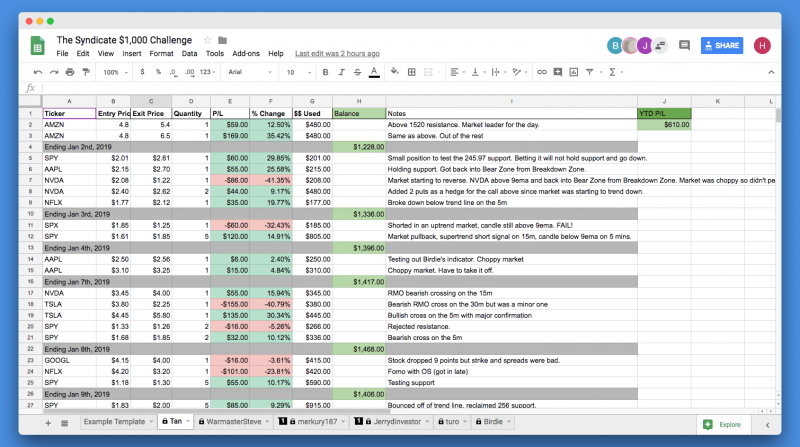

Currently, we have about 6 people competing in the challenge including myself. You can check out our spreadsheet here. Also, check out Steve's learning log as well. He has been doing a great job at logging and analyzing his trades.

This post will include some updates about what I traded since the challenge started up until today. And what I learned.

The following tickers were traded:

I have to say since the challenge started, I have invested a lot of time into learning. This includes finding new indicators that will be beneficial to my trading style, reading about different chart setup, learning about MACD divergence, and more.

All are recommended to any traders, not just people who trade options.

In a total of 8 trading days, I initiated 24 trades. All of which netted me $610. So for the first week, I'm up about $600.

I had to take a step back and evaluate my trading style and setup. I figured, let's stick to what works. And what ended up working for me was quite simple and straight to the point.

Indicators I'm using:

I'll be posting specific charts from some of the trades I took throughout the first week below. Stay tuned!

Currently, we have about 6 people competing in the challenge including myself. You can check out our spreadsheet here. Also, check out Steve's learning log as well. He has been doing a great job at logging and analyzing his trades.

This post will include some updates about what I traded since the challenge started up until today. And what I learned.

The following tickers were traded:

- AMZN

- SPY

- NFLX

- NVDA

- SPX

- AAPL

- TSLA

- GOOGL

I have to say since the challenge started, I have invested a lot of time into learning. This includes finding new indicators that will be beneficial to my trading style, reading about different chart setup, learning about MACD divergence, and more.

All are recommended to any traders, not just people who trade options.

How Much Did I Make This Week?

In a total of 8 trading days, I initiated 24 trades. All of which netted me $610. So for the first week, I'm up about $600.

Current Trading Setup

One of the biggest things I learned from doing this challenge is that less is more. Seriously! I often find myself digging through tons of websites to find indicators that will help me trade better. At one point I had about 10 indicators in one setup. This wasn't good at all.I had to take a step back and evaluate my trading style and setup. I figured, let's stick to what works. And what ended up working for me was quite simple and straight to the point.

Indicators I'm using:

- Auto Trend Lines

- Hand-drawn Support / Resistance (1h, 4h, and daily). I also use shorter timeframe and pre-market data.

- MACD Divergence

- Gap Fill (it's an indicator that shows potential gap fill)

- RSI

- DMI

- Simple Moving Average (14 and 30)

I'll be posting specific charts from some of the trades I took throughout the first week below. Stay tuned!

Last edited: