ProcrastinatingPerfection

Member

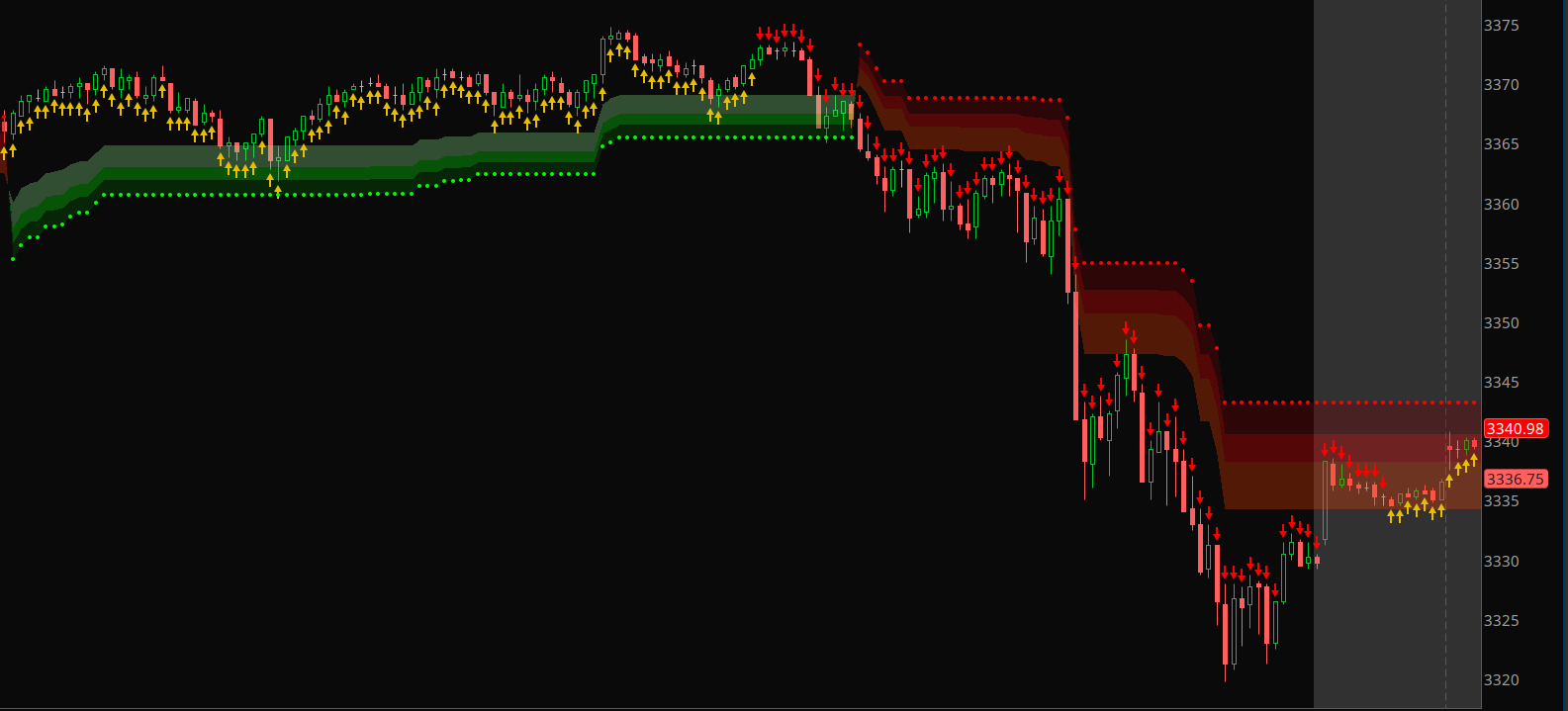

How do I set the swingarm tracker for 1 hour and entry off a 15 minute?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

I did a comparison of the july 7 swingarm version with what is posted by Jose and they are 98% identical.

yes its already on the 1st page.Didn't Jose post that July 7 version of swingarm?

yes its already on the 1st page.

quite possible or based on trend reversal or squeeze. I integrated trend reversal to it and that had some good signals. Need to play with squueze.You are comparing that one with the one he has been posting on twitter, the "Platinum 5.0" version? The main difference seems to be those "buying pressure" arrows. Are those based on volume you think?

Been some time since I last took an interest, I'm more of a lurker, haha. Took me some time to investigate and get the chance to see it myself.

Re: the pressure arrows

It has NOTHING to do with volume. I suspect the platinum version or the pressure indicator as some of you called it is based on the True Momentum indicator by Mobius.

Patched something together, test it out.

This is only one method of using the TMO indicator. There are numerous different mixes.

Learn to read Level 2 + Time & Sales. That's where you find real buying / selling pressure.

Work with what you have. STOP chasing!

What time frame do you use it under for day trading? Or going long?@Pensar You have paid some of my bills Pensar. I've been looking to thank the author of that code ever since I got it. When it flashes a daily arrow, I wait for a pullback to swingarm and enter (my go to setup on the chart is a combo of your script, swingarm and the opening range break) and more often than not its a profitable play. In fact, I am saying this to everyone in all honesty, if you're stuck at trading, then add those indicators on a chart, and go find a nice big cap tech stock to trade (NVDA NFLX ETC) Super simple easy strat.

I'm glad I found you. I'm able to thank you for your tremendous work. Thank you!! May the Force be with you!

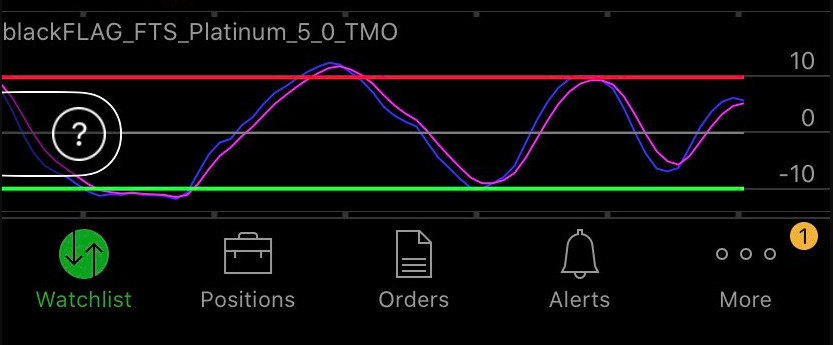

# My version of so called "blackFLAG FTS PLATINUM Ver. 5.0" @Maya

# TMO ((T)rue (M)omentum (O)scillator) With Higher Aggregation

# Mobius

# V01.05.2018

#hint: TMO calculates momentum using the DELTA of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

input length = 14;

input calcLength = 5;

input smoothLength = 3;

input agg = AggregationPeriod.HOUR;

def o = open(period = agg);

def c = close(period = agg);

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

# End Code TMO with Higher Aggregation

plot uarrow = Main > Signal;

uarrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

uarrow.SetDefaultColor(Color.CYAN);

uarrow.SetLineWeight(1);

plot darrow = Main < Signal;

darrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_Down);

darrow.SetDefaultColor(Color.red);

darrow.SetLineWeight(1);@fpapedo Nothing special, it's using TMO by Mobius with higher agg as the underlying (original thread)

Code:# My version of so called "blackFLAG FTS PLATINUM Ver. 5.0" @Maya # TMO ((T)rue (M)omentum (O)scillator) With Higher Aggregation # Mobius # V01.05.2018 #hint: TMO calculates momentum using the DELTA of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price. input length = 14; input calcLength = 5; input smoothLength = 3; input agg = AggregationPeriod.HOUR; def o = open(period = agg); def c = close(period = agg); def data = fold i = 0 to length with s do s + (if c > getValue(o, i) then 1 else if c < getValue(o, i) then - 1 else 0); def EMA5 = ExpAverage(data, calcLength); def Main = ExpAverage(EMA5, smoothLength); def Signal = ExpAverage(Main, smoothLength); # End Code TMO with Higher Aggregation plot uarrow = Main > Signal; uarrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); uarrow.SetDefaultColor(Color.CYAN); uarrow.SetLineWeight(1); plot darrow = Main < Signal; darrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_Down); darrow.SetDefaultColor(Color.red); darrow.SetLineWeight(1);

Default higher period = Hourly. Change this to anything you want. Play with it to find the best timeframe.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.