You should upgrade or use an alternative browser.

Archived: TMO True Momentum Oscillator

- Thread starter tenacity11

- Start date

-

- Tags

- oscillator

- Status

- Not open for further replies.

My CPU is fried, I'm here for just a few minutes. ... yup, I use both even though they are similar, just for the reasons you said.Whoa @markos , I just applied the TMO to my chart with RSI Laguerre..... Sometimes the RSIL gives false signals for buys but I noticed that the TMO will keep you out of those trades!

Everyone needs their own set of "go to" tools, along with a way to use them.

Please go to Tutorials and download the grid from the RSI Laguerre file in there. When it opens > save Syle as "2 Grid RSI Laguerre".

That should also save the studies into the studies folder. If you don't use the 2 grid-timeframe, that's ok.

You need the new RSI Laguerre w Fractal Energy that is in there.

Thanks, and please continue to join the others in assisting @BenTen as you have.

@horserider thanks for posting and commenting on the study that @Chess68 posted. I appreciate that! Learning how indicators work is something that we all could brush up on to one degree or another. There are just so many.@Chess68 Just a manipulation of MACD it seems. I think ya'll would do better to learn how the indicators work and not just look for Xs and arrows. Anyway here is what I think that indicator may be doing.

<!-- TradingView Chart BEGIN -->

<script type="text/javascript" src="https://s3.tradingview.com/tv.js"></script>

<script type="text/javascript">

var tradingview_embed_options = {};

tradingview_embed_options.width = '640';

tradingview_embed_options.height = '400';

tradingview_embed_options.chart = 'ogBNlpYD';

new TradingView.chart(tradingview_embed_options);

</script>

<p><a href="https://www.tradingview.com/chart/BYND/ogBNlpYD-sell/">sell</a> by <a href="https://www.tradingview.com/u/Chess68/">Chess68</a> on <a href="https://www.tradingview.com/">TradingView.com</a></p>

<!-- TradingView Chart END -->REPAINT?!? Don't you have enough rabbit Holes to go down already ?Hmmm I wonder if those repaint. That looks very interesting. I can see it's some kind of directional indicator but I wonder what its code is like...

Could be the next reliable reversal indicator....maybe.

@horserider thanks for the answer. @Nick horserider is correct. Look at the code and chart and tell us what you think. We can steer you in the right direction if you get too far off. My pc is in repair so this is all I can do currently.@Nick Look at the chart and think. What do you believe it is telling you? Understand what each line of the indicator is actually doing and I think you can answer your questions. How about you tell us what you think the purpose is and what the setup is and then others can give their opinions. More opinions, more possibilities of finding the answers.

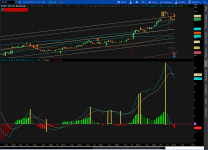

@horserider @markos Thanks guys for your encouragement. I have captured my observations in the chart attached. To be honest, i don't quite understand the codes but able to pick up some observations to my best ability.

What i would like to learn is the process how you interpret the chart

Any feedback are greatly appreciated.

@horserider @markos Thanks guys for your encouragement. I have captured my observations in the chart attached. To be honest, i don't quite understand the codes but able to pick up some observations to my best ability.

What i would like to learn is the process how you interpret the chart

Any feedback are greatly appreciated.

@markos do i need to change the period to 21, 5 3 ?

@Nick I guess you are serious about this! great.@horserider @markos Thanks guys for your encouragement. I have captured my observations in the chart attached. To be honest, i don't quite understand the codes but able to pick up some observations to my best ability.

What i would like to learn is the process how you interpret the chart

Any feedback are greatly appreciated.

It's past 10:30 pm where I am, I'll have to review the chart later.

No, for now keep The TMO D & Wk set at 14 not 21. That is how Mobius built them, he's the creator of it and has been writing scripts since ThinkorSwim opened their doors..

Also, I put a tutorial for RSI Laguerre in the Tutorial section. Please read that over. Until tomorrow, Markos

Some depends on how aggressive you want to trade. Here is how I see your chart. At observation 1 price breaks below the moving average and the week and day TMO both red so looks like good sell signal if already in a trade or a buy puts signal. Between observation 1 and 3 white dashed line just hold put position as moving average is still slightly sloped down and week TMO is red. Ignore daily TMO humps. If you want to be aggressive you could sell put or buy a call at point of while line. Price has moved away from the moving average a good amount and at the end of a somewhat long down move so a reversal is more likely. So when daily TMO turned green you could make the trade. The conservative move would be wait for price to break the moving average , moving average is sloped up and week TMO becomes green. Then just ride it up with price above MA and week TMO green.

Of course hindsignt is 20/20. Not quite as easy as it is happening.

Thank You for your feedback. I just learned to trade options with by selling spreads, eg Bull Put Spread. Thus, my trading style is to enter when price pullback to 20D or 50D Moving average. What i am looking for is a lower indicator that can help me better evaluate the momentum for the next few candles. I will explore abit more on this setup and share my observations again.@Nick Nice observations. Now do you feel you know more about the indicators? I do not use any of these so Markos may have better insight on them.

Some depends on how aggressive you want to trade. Here is how I see your chart. At observation 1 price breaks below the moving average and the week and day TMO both red so looks like good sell signal if already in a trade or a buy puts signal. Between observation 1 and 3 white dashed line just hold put position as moving average is still slightly sloped down and week TMO is red. Ignore daily TMO humps. If you want to be aggressive you could sell put or buy a call at point of while line. Price has moved away from the moving average a good amount and at the end of a somewhat long down move so a reversal is more likely. So when daily TMO turned green you could make the trade. The conservative move would be wait for price to break the moving average , moving average is sloped up and week TMO becomes green. Then just ride it up with price above MA and week TMO green.

Of course hindsignt is 20/20. Not quite as easy as it is happening.

Thanks Markos for all your sharing..I really like the community here.@Nick I guess you are serious about this! great.

It's past 10:30 pm where I am, I'll have to review the chart later.

No, for now keep The TMO D & Wk set at 14 not 21. That is how Mobius built them, he's the creator of it and has been writing scripts since ThinkorSwim opened their doors..

Also, I put a tutorial for RSI Laguerre in the Tutorial section. Please read that over. Until tomorrow, Markos

Yes..i am serious about this...Hahahha

Please watch this short video: https://askslim.com/slim-ribbon/

Because I do everything on a little android screen, (pc is broke) this may take some time.

BBL, Markos

@markos No rush markos...Yes i did review the tutorial but will watch it again.@Nick did you review my rsi_lg tutorial? There is a reason why both studies are on the chart. Your selling option spreads? I'm buying atm spreads.

Please watch this short video: https://askslim.com/slim-ribbon/

Because I do everything on a little android screen, (pc is broke) this may take some time.

BBL, Markos

Yes i am selling options, vertical spreads, mainly Bull Put Spread or Bear Call Spread with DTE about 2 wks to take advantage of the time decay. I have configured and shared the screener for pullback to moving average and it perform pretty decent on my list of uptrending stocks. So, with this TMO and RSI-Lg combo, i hope that it can help me to adjust my strikes accordingly.

@horserider you are too smart for your own good, as people my age say.@Nick Nice observations. Now do you feel you know more about the indicators? I do not use any of these so Markos may have better insight on them.

Some depends on how aggressive you want to trade. Here is how I see your chart. At observation 1 price breaks below the moving average and the week and day TMO both red so looks like good sell signal if already in a trade or a buy puts signal. Between observation 1 and 3 white dashed line just hold put position as moving average is still slightly sloped down and week TMO is red. Ignore daily TMO humps. If you want to be aggressive you could sell put or buy a call at point of while line. Price has moved away from the moving average a good amount and at the end of a somewhat long down move so a reversal is more likely. So when daily TMO turned green you could make the trade. The conservative move would be wait for price to break the moving average , moving average is sloped up and week TMO becomes green. Then just ride it up with price above MA and week TMO green.

Of course hindsignt is 20/20. Not quite as easy as it is happening.

Thanks Markos..Greatly appreciate that guidance. I also realised that we can also scan when the TMO changes from Green-Red polarity so that we can start to watch for potential direction. Will update my observations.@Nick Compare the MSFT chart to ROKU, PAYC, AAL and MMM. Don't write up an analysis, just observe the Green-Red Polarity Changes on the TMO. Remember, the yellow FE in RSILg is not a signal to trade but moreso, not to trade. Keep observing. TTL

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Archived: RSI Divergence Indicator | Indicators | 131 | |

|

|

Archived: Opening Range Breakout | Indicators | 340 | |

|

|

Archived: Supertrend Indicator by Mobius for ThinkorSwim | Indicators | 312 | |

|

|

Repaints TMO with Higher Agg_Mobius @ TSL | Indicators | 207 | |

|

|

TMO True Momentum Oscillator For ThinkOrSwim | Indicators | 143 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/