You should upgrade or use an alternative browser.

OptionsHacker -to show Volume/OpenInterest/GammaExposure for the options chain For ThinkOrSwim

- Thread starter sudoshu

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

sudoshu

Member

Hmm not too sure, with it set to 'ContributionShares' or 'Contribution' i see the same, all positives. If you set it to 'ContributionPercent' it will show some negatives. Could be because the script doesn't get the full option chain (can try setting the strike depth higher but it times out at a certain point) or thats just how the math ends up working out for the scope we can see.great stuff here @sudoshu. question on gamma exposure... i would have expected the bars to plot in the negative here. is there a reason why they are all positive?

sudoshu

Member

There is an issue with indexes and futures on this script as the symbol is different in the options than the search bar in thinkorswim. For SPX you would normally type that into the search bar 'SPX' but the options chain looks like '.SPXW220920C1800' Notice the the 'W' is thrown in there.@sudoshu - Great work, thank you. Will this study work on SPX? I tried but the indicator doesn't show up.

I think this may be an easy fix but I'd like to try and find a way to accommodate others as well, might just need to do a giant if else statement ...

I will put this on the list of todo's

andyc

New member

great stuff here @sudoshu. question on gamma exposure... i would have expected the bars to plot in the negative here. is there a reason why they are all positive?

I found this issue as well, the script had a bug where only the last gex calculation method has put multiplied by -1, that's why you see all positive

I took the liberty to fix this and try to add a NOPE calculation, see if anyone has an extra eye to check if I done it correctly.

#hint: Options Hacker \n This study lets you scan and perform calculations on the options chain for a series and given depth. \n<b>Warning: Setting the StrikeDepth to large values requires significant processing power, and will result in slow loading times.</b>

#

# sudoshu - I would not have been able to make this work without the help, and kindness to share code from those listed below. Thank you!

#

# Credits:

# mobius

# ziongotoptions

# Angrybear

# halcyonguy

# MerryDay

# MountainKing333

# BenTen

# DeusMecanicus

# Zardoz0609

# NPTrading

#

declare once_per_bar;

declare hide_on_intraday;

declare lower;

def version = 0.5;

#-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------#

# Settings

# Colors

DefineGlobalColor("Call", Color.GREEN);

DefineGlobalColor("Put", Color.RED);

DefineGlobalColor("CallCloud",Color.DARK_GREEN);

DefineGlobalColor("PutCloud",Color.DARK_RED);

DefineGlobalColor("CallAverage",Color.LIGHT_GREEN);

DefineGlobalColor("PutAverage",Color.ORANGE);

DefineGlobalColor("GEX",Color.CYAN);

DefineGlobalColor("NOPE",Color.PINK);

#hint Series: The option expiration series to search. \n This value is used to determine the option symbol.

input Series = {

default Weekly,

Opex,

Month1,

Month2,

Month3,

Month4,

Month5,

Month6,

Month7,

Month8,

Month9

};

# Todo: Maybe can add something like this to get more than just fridays ...

#hint OpexDay:

#input OpexDay = {

# Monday,

# Tuesday,

# Wednesday,

# Thursday,

# default Friday

#};

#hint DataType: The type of option data to show.

input DataType = {default OpenInterest, Volume, GammaExposure, NetOptionPricingEffect};

#hint StrikeDepth: The level of depth to search a series. (+/- this far from ATM)

input StrikeDepth = 10;

#hint CenterStrikeOffset: The offset to use when calculating the center strike based on close price. \n Examples: \n 1 = nearest $1 interval \n 10 = nearest $10 interval.

input CenterStrikeOffset = 1.0;

#hint MaxStrikeSpacing: The maximum dollar amount between two adjacent contracts.

input MaxStrikeSpacing = 25;

#hint GEXCalculationMethod: The method to use for calculating gamma exposure. \n The total gamma exposure is then the sum of all call gex + put gex. \n <li>ContributionShares: \n gamma * OI * 100 (* -1 for puts)</li><li>Contribution: \n gamma * OI * 100 * Spot Price (* -1 for puts)</li><li>ContributionPercent: \n gamma * OI * 100 * Spot Price ^2 * 0.01 (* -1 for puts)</li>

input GEXCalculationMethod = {default ContributionShares, Contribution, ContributionPercent};

#hint ShowStrikeInfo: Show the strike info labels.

input ShowStrikeInfo = yes;

#hint ShowLabels: Show labels for the current data type.

input ShowLabels = yes;

#hint ShowClouds: Show clouds for volume and/or open interest.

input ShowClouds = yes;

#hint ShowLines: Show lines for values.

input ShowLines = yes;

#hint ShowAverages: Show the moving average lines.

input ShowAverages = yes;

#hint ShowGreeks: Show the estimated Greek calculation labels for the latest bar.

input ShowGreeks = yes;

#hint FlipPuts: Flip the puts underneath the axis

input FlipPuts = yes;

#hint StrikeMode: The mode to select an option symbol. \n AUTO will try to find the option symbol based on the Series and StrikeDepth inputs. \n MANUAL allows an override of the AUTO behavior by using the ManualCenterStrike and ManualStrikeSpacing inputs to determine the option symbol.

input StrikeMode = {default AUTO, MANUAL};

#hint ManualCenterStrike: The starting price to use when in MANUAL mode.

input ManualCenterStrike = 440;

#hint ManualStrikeSpacing: The dollar amount between two adjacent contracts to use when in MANUAL mode.

input ManualStrikeSpacing = 1.0;

#hint IVMethod: The method to use for calculating implied volatility. This is mainly used in the GEX calculations. \n ClosedFormIV uses an approximation for implied volatility based on methods from mobius. \n SeriesIV uses the built in SeriesVolatility() function.

input IVMethod = {default ClosedFormIV, SeriesIV};

#hint Debug: Shows plots and data for debugging purposes.

input Debug = no;

#-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------#

# Date, Symbol, and Strike

#

# OptionSeries is the expiry starting at 1 and raising by one for each next expiry. \n This is only used for the SeriesIV method calculation.

def OptionSeries;

switch (Series) {

case Weekly:

OptionSeries = 1;

case Opex:

OptionSeries = 2;

case Month1:

OptionSeries = 3;

case Month2:

OptionSeries = 4;

case Month3:

OptionSeries = 5;

case Month4:

OptionSeries = 6;

case Month5:

OptionSeries = 7;

case Month6:

OptionSeries = 8;

case Month7:

OptionSeries = 9;

case Month8:

OptionSeries = 10;

case Month9:

OptionSeries = 11;

};

# Open price at Regular Trading Hours

def RTHopen = open(period = AggregationPeriod.DAY);

# Current year, month, day, and date

def CurrentYear = GetYear(); # number of current bar in CST

def CurrentMonth = GetMonth(); # 1 - 12

def CurrentDay = GetDay(); # 1 - 365 (366 for leap year)

def CurrentDate = GetYYYYMMDD(); # date of the current bar in the YYYYMMDD

# Current day of this month

def CurrentDayOfMonth = GetDayOfMonth(CurrentDate);

# Get the first day of this month - 1 (Monday) to 7 (Sunday)

def FirstDayThisMonth = GetDayOfWeek((CurrentYear * 10000) + (CurrentMonth * 100) + 1);

# Get the first upcoming friday

def FirstUpcomingFriday =

if FirstDayThisMonth < 6 then 6 - FirstDayThisMonth

else if FirstDayThisMonth == 6 then 7

else 6

;

# Get the second, third, and fourth upcoming fridays

def SecondUpcomingFriday = FirstUpcomingFriday + 7;

def ThirdUpcomingFriday = FirstUpcomingFriday + 14;

def FourthUpcomingFriday = FirstUpcomingFriday + 21;

# Get the month of expiration for the option, accounting for end of month rollover

def ExpMonth1 =

if Series == Series.Opex and ThirdUpcomingFriday > CurrentDayOfMonth then CurrentMonth

else if Series == Series.Opex and ThirdUpcomingFriday < CurrentDayOfMonth then CurrentMonth + 1

else if FourthUpcomingFriday > CurrentDayOfMonth then CurrentMonth

else CurrentMonth + 1

;

# Get the month of expiration for the option, accounting for end of year rollover

def ExpMonth = if ExpMonth1 > 12 then ExpMonth1 - 12 else ExpMonth1;

# Get the year of expiration for the option

def ExpYear = if ExpMonth1 > 12 then CurrentYear + 1 else CurrentYear;

# Get the first day at the current expiration year and month

def ExpDay1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth * 100 + 1);

# Get the first friday at the current expiration year and month

def ExpFirstFridayDOM =

if ExpDay1DOW < 6 then 6 - ExpDay1DOW

else if ExpDay1DOW == 6 then 7

else 6

;

# Get the second, third, and fourth fridays at the current expiration year and month

def ExpSecondFridayDOM = ExpFirstFridayDOM + 7;

def ExpThirdFridayDOM = ExpFirstFridayDOM + 14;

def ExpFouthFridayDOM = ExpFirstFridayDOM + 21;

# Get the day of month of expiration for the option

def ExpDOM =

if Series == Series.Opex then ExpThirdFridayDOM

else if CurrentDayOfMonth < ExpFirstFridayDOM -1 then FirstUpcomingFriday

else if between(CurrentDayOfMonth, ExpFirstFridayDOM, SecondUpcomingFriday - 1) then SecondUpcomingFriday

else if between(CurrentDayOfMonth, SecondUpcomingFriday, ThirdUpcomingFriday - 1) then ThirdUpcomingFriday

else if between(CurrentDayOfMonth, ThirdUpcomingFriday, FourthUpcomingFriday - 1) then FourthUpcomingFriday

else ExpFirstFridayDOM

;

# Option Expiration Date - Depending on selected series

def OpexDate_NoHolidays = ExpYear * 10000 + ExpMonth * 100 + ExpDOM;

# Option Expiration Date - Accounting for holidays

def OpexDate =

if ExpMonth == 4 and ExpDOM == 15 then OpexDate_NoHolidays - 1 else OpexDate_NoHolidays # Exchange holiday on April 15, 2022

;

# The OpexCode is the expiry date in the format of an option symbol.

# Example:

# The date of expiry is April 15th, 2022.

# The format of this date from the code we have above, the OptionExpiryDate, would be 20,220,415

# Options symbols expect the format for this date as 220415 (we need to get rid of the leading 20)

def OpexCode = OpexDate - 20000000;

# Option Days to Expiration

#def DTE = CountTradingDays(CurrentDate, OptionExpiryDate);

def DTE = DaysTillDate(OpexDate);

# Find the center strike - the price closest to ATM option

def CenterStrike =

if (StrikeMode == StrikeMode.AUTO and !IsNaN(close)) then Round(close / CenterStrikeOffset, 0) * CenterStrikeOffset

else if (StrikeMode == StrikeMode.MANUAL and !IsNaN(close)) then ManualCenterStrike

else CenterStrike[1]

;

# Strike Spacing

def StrikeSpacingC =

fold i = 1 to MaxStrikeSpacing

with spacing = 1

do if !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + "P" + AsPrice(CenterStrike + (MaxStrikeSpacing - i)))

)

then MaxStrikeSpacing - i

else if !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + "P" + AsPrice(CenterStrike + (MaxStrikeSpacing - i)))

)

then MaxStrikeSpacing - i

else spacing

;

def StrikeSpacing =

if (StrikeMode == StrikeMode.AUTO and !IsNaN(close)) then StrikeSpacingC

else if (StrikeMode == StrikeMode.MANUAL and !IsNaN(close)) then ManualStrikeSpacing

else StrikeSpacing[1]

;

# Date and Strike Debugging

plot DebugCurrentDate = CurrentDate - 20000000;

DebugCurrentDate.SetHiding(!Debug);

plot DebugOptionExpiryDate = OpexCode;

DebugOptionExpiryDate.SetHiding(!Debug);

plot DebugDTE = DTE;

DebugDTE.SetHiding(!Debug);

plot DebugCenterStrike = CenterStrike;

DebugCenterStrike.SetHiding(!Debug);

plot DebugStrikeSpacing = StrikeSpacing;

DebugStrikeSpacing.SetHiding(!Debug);

#-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------#

# Option Chain Data Gathering

# Script to get the total open interest at a spot

script TotalSpotOI {

input StrikeDepth = 1;

input OpexCode = 1;

input CenterStrike = 1;

input StrikeSpacing = 1;

input IsCall = yes;

def total =

fold index = -(StrikeDepth) to (StrikeDepth + 1)

with value = 0

do

if !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index)))

)

then value + open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index)))

else value + 0

;

plot TotalSpotOI = total;

}

# Total Call Open Interest for selected chain depth and expiry series

def TotalCallOpenInterest = TotalSpotOI(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, yes);

# Total Put Open Interest for selected chain depth and expiry series

def TotalPutOpenInterest = TotalSpotOI(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, no);

# Script to get the total volume at a spot

script TotalSpotVolume {

input StrikeDepth = 1;

input OpexCode = 1;

input CenterStrike = 1;

input StrikeSpacing = 1;

input IsCall = yes;

def total =

fold index = -(StrikeDepth) to (StrikeDepth + 1)

with value = 0

do

if !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index)))

)

then value + volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index)))

else value + 0

;

plot TotalSpotVolume = total;

}

# Total Call Open Interest for selected chain depth and expiry series

def TotalCallVolume = TotalSpotVolume(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, yes);

# Total Put Volume for selected chain depth and expiry series

def TotalPutVolume = TotalSpotVolume(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, no);

# Abramowiz Stegun Approximation for Cumulative Normal Distribution

script CND {

input data = 1;

def a = AbsValue(data);

def b1 = .31938153;

def b2 = -.356563782;

def b3 = 1.781477937;

def b4 = -1.821255978;

def b5 = 1.330274429;

def b6 = .2316419;

def e = 1 / (1 + b6 * a);

def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) *

(b1 * e + b2 * e * e + b3 *

Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5));

plot CND = if data < 0

then 1 - i

else i;

}

# Closed form IV approximation

# IV = sqrt(2*pi / t) * (C / S)

# S = Price of the underlying

# C = Price of the option

# t = time to maturity

script ClosedFormIV {

input C = 1;

input S = 1;

input t = 1; # time to maturity

#plot IV = (C * Sqrt(2 * Double.Pi)) / (S * Sqrt(t));

plot IV = (sqrt((2 * Double.Pi)/t)) * (C / S);

}

# Greeks Calculations

#

# K - Option strike price

# N - Standard normal cumulative distribution function

# r - Risk free interest rate

# IV - Volatility of the underlying

# S - Price of the underlying

# t - Time to option's expiry

#

# d1 = (ln(S/K) + (r + (sqr(IV)/2))t) / (? (sqrt(t)))

# d2 = e -(sqr(d1) / 2) / sqrt(2*pi)

#

# Delta = N(d1)

# Gamma = (d2) / S(IV(sqrt(t)))

# Theta = ((S d2))IV) / 2 sqrt(t)) - (rK e(rt)N(d4))

# where phi(d3) = (exp(-(sqr(x)/2))) / (2 * sqrt(t))

# where d4 = d1 - IV(sqrt(t))

# Vega = S phi(d1) Sqrt(t)

def K = CenterStrike;

def S = close;

def r = GetInterestRate();

def t = (DTE / 365);

def y = GetYield();

# At the money call price used for ClosedFormIV calcuation

def ATMCallPrice = if isNaN(close(symbol = ("." + GetSymbolPart()) + AsPrice(OpexCode) + "C" + AsPrice(CenterStrike), period = aggregationPeriod.DAY))

then ATMCallPrice[1]

else close(symbol = ("." + GetSymbolPart()) + AsPrice(OpexCode) + "C" + AsPrice(CenterStrike), period = aggregationPeriod.DAY)

;

# ClosedFormIV is an approximation of implied volatility based on scripts/methods from mobius

def IV1 = ClosedFormIV(ATMCallPrice, RTHopen, t);

plot MobiusIV = if IV1 > 0 and !IsInfinite(IV1) then IV1 else IV1[1];

MobiusIV.SetHiding(!Debug);

# SeriesVolatility is the expiry starting at 1 and raising by 1 for each next expiry

def IV2 = SeriesVolatility(series = OptionSeries);

plot SeriesIV = if IV2 > 0 and !IsInfinite(IV2) then IV2 else IV2[1];

SeriesIV.SetHiding(!Debug);

# Implied Volatily method

def IV;

switch (IVMethod) {

case ClosedFormIV:

IV = IV1;

case SeriesIV:

IV = IV2;

}

# Start greek calculations

def d1 = (Log(S / K) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t));

def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi);

# Delta

def Delta = CND(d1);

# Gamma

def Gamma = d2 / (S * (IV * Sqrt(t)));

# Theta

def Theta = -(-(S*d2*IV*(.5000)/

(2*sqrt(t)))-

(r*(exp(-r*t)*K))*CND(d2)+(S*CND(d1)*(.5000)))/365;

# (.5000) variant less than .5 e(X/t)

# Vega

def Vega = (S*d2*sqrt(t))/100;

# script StrikeDelta {

# input index = 1;

# input close = 1;

# input CenterStrike = 1;

# input StrikeSpacing = 1;

# input DTE = 1;

# input IV = 1;

# input r = 1;

# input t = 1;

# input y = 1;

# def epsilon = 0.001 * close;

# plot approxDelta = (OptionPrice(CenterStrike + StrikeSpacing * index, !isCall, DTE, close + epsilon, IV, no, y, r) - OptionPrice(CenterStrike + StrikeSpacing * index, !isCall, DTE, close, IV, no, y, r)) / epsilon;

# }

# GEX Calculation Methods:

#

# ContributionShares:

# Call GEX = gamma * OI * 100

# Put GEX = gamma * OI * 100 * -1

#

# Contribution:

# Call GEX = gamma * OI * 100 * Spot Price

# Put GEX = gamma * OI * 100 * Spot Price * -1

#

# ContributionPercent:

# Call GEX = gamma * OI * 100 * Spot Price ^2 * 0.01

# Put GEX = gamma * OI * 100 * Spot Price ^2 * 0.01 * -1

#

# Script to get the total gamma exposure at a spot

script TotalSpotGEX {

input StrikeDepth = 1;

input OpexCode = 1;

input CenterStrike = 1;

input StrikeSpacing = 1;

input IsCall = yes;

input GEXCalculationMethod = {default ContributionShares, Contribution, ContributionPercent};

input DTE = 1;

input IV = 1;

input r = 1;

input t = 1;

def total =

fold index = -(StrikeDepth) to (StrikeDepth + 1)

with value = 0

do

if !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index)))

)

then value +

(Exp(-(Sqr((Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))) / 2)) / Sqrt(2 * Double.Pi) / (close * (IV * Sqrt(t)))) *

open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) *

100 *

if GEXCalculationMethod == GEXCalculationMethod.ContributionShares then

1 * if IsCall then 1 else -1

else if GEXCalculationMethod == GEXCalculationMethod.Contribution then

close * if IsCall then 1 else -1

else

Sqr(close) * 0.01 * if IsCall then 1 else -1

else value + 0

;

plot TotalSpotGEX = total;

}

# Total Call Gamma Exposure for selected chain depth and expiry series

def TotalCallGammaExposure = TotalSpotGEX(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, yes, GEXCalculationMethod, DTE, IV, r, t);

# Total Put Gamma Exposure for selected chain depth and expiry series

def TotalPutGammaExposure = TotalSpotGEX(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, no, GEXCalculationMethod, DTE, IV, r, t);

# Script to get the total volume*delta at a spot for Net Option Pricing Effect

script TotalNope {

input StrikeDepth = 1;

input OpexCode = 1;

input CenterStrike = 1;

input StrikeSpacing = 1;

input IsCall = yes;

input DTE = 1;

input IV = 1;

input r = 1;

input t = 1;

input y = 1;

def epsilon = 0.001 * close;

def total =

fold index = -(StrikeDepth) to (StrikeDepth + 1)

with value = 0

do

if !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index)))

)

then value +

volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) * 100 *

(OptionPrice(CenterStrike + StrikeSpacing * index, !isCall, DTE, close + epsilon, IV, no, y, r) - OptionPrice(CenterStrike + StrikeSpacing * index, !isCall, DTE, close, IV, no, y, r)) / epsilon * 100

# if (1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)))) < 0

# then 1 - (1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)), 2) / 2) *

# (.31938153 * 1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))) +

# -.356563782 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 2) +

# 1.781477937 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 3) +

# -1.821255978 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 4) +

# 1.330274429 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 5)))

# else (1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)), 2) / 2) *

# (.31938153 * 1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))) +

# -.356563782 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 2) +

# 1.781477937 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 3) +

# -1.821255978 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 4) +

# 1.330274429 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 5)))

else value + 0

;

plot TotalNopeValue = total;

}

def TotalCallNope = TotalNope(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, yes, DTE, IV, r, t, y);

def TotalPutNope = TotalNope(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, no, DTE, IV, r, t, y);

#-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------#

# Visuals

# Version Label

AddLabel(yes, "OptionsHacker v" + version, Color.LIGHT_GRAY);

# Selected DataType

AddLabel(yes, DataType, Color.LIGHT_GRAY);

# Selected Series

AddLabel(yes, Series, Color.LIGHT_GRAY);

# Center Strike Label

AddLabel(ShowStrikeInfo, "Center Strike: " + AsDollars(CenterStrike), if StrikeMode == StrikeMode.AUTO then Color.LIGHT_GRAY else Color.RED);

# Strike Spacing Label

AddLabel(ShowStrikeInfo, "Strike Spacing: " + AsDollars(StrikeSpacing), if StrikeMode == StrikeMode.AUTO then Color.LIGHT_GRAY else Color.RED);

# Chain Depth Label

AddLabel(ShowStrikeInfo, "Strike Depth: +/-" + StrikeDepth, Color.LIGHT_GRAY);

# Current ATM Options Labels

Addlabel(ShowStrikeInfo, "ATM Put: " + ("." + GetSymbol()) + AsPrice(OpexCode) + "P" + AsPrice(CenterStrike), GlobalColor("Call"));

Addlabel(ShowStrikeInfo, "ATM Call: " + ("." + GetSymbol()) + AsPrice(OpexCode) + "C" + AsPrice(CenterStrike), GlobalColor("Put"));

# Create a center line

plot ZeroLine = 0;

ZeroLine.SetDefaultColor(Color.WHITE);

# Call Open Interest

plot CallOpenInterest = TotalCallOpenInterest;

CallOpenInterest.SetHiding(!ShowLines or DataType != DataType.OpenInterest);

CallOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE);

CallOpenInterest.SetDefaultColor(GlobalColor("Call"));

AddLabel(ShowLabels and DataType == DataType.OpenInterest, "CallOI: " + CallOpenInterest, GlobalColor("Call"));

# Put Open Interest

plot PutOpenInterest = if FlipPuts then -(TotalPutOpenInterest) else TotalPutOpenInterest;

PutOpenInterest.SetHiding(!ShowLines or DataType != DataType.OpenInterest);

PutOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE);

PutOpenInterest.SetDefaultColor(GlobalColor("Put"));

AddLabel(ShowLabels and DataType == DataType.OpenInterest, "PutOI: " + AbsValue(PutOpenInterest), GlobalColor("Put"));

# Create Clouds for Open Interest

AddCloud(

if ShowClouds and DataType == DataType.OpenInterest then CallOpenInterest else Double.NaN,

if ShowClouds and DataType == DataType.OpenInterest then Zeroline else Double.NaN,

GlobalColor("CallCloud"), GlobalColor("PutCloud")

);

AddCloud(

if ShowClouds and DataType == DataType.OpenInterest then Zeroline else Double.NaN,

if ShowClouds and DataType == DataType.OpenInterest then PutOpenInterest else Double.NaN,

GlobalColor("PutCloud"), GlobalColor("PutCloud")

);

# Hull Moving Average of Put Open Interest

plot PutOpenInterestAverage = hullmovingavg(PutOpenInterest);

PutOpenInterestAverage.SetHiding(!ShowAverages or DataType != DataType.OpenInterest);

PutOpenInterestAverage.SetDefaultColor(GlobalColor("PutAverage"));

PutOpenInterestAverage.SetStyle(Curve.MEDIUM_DASH);

# Hull Moving Average of Call Open Interest

plot CallOpenInterestAverage = hullmovingavg(CallOpenInterest);

CallOpenInterestAverage.SetHiding(!ShowAverages or DataType != DataType.OpenInterest);

CallOpenInterestAverage.SetDefaultColor(GlobalColor("CallAverage"));

CallOpenInterestAverage.SetStyle(Curve.MEDIUM_DASH);

# Call Volume

plot CallVolume = TotalCallVolume;

CallVolume.SetHiding(!ShowLines or DataType != DataType.Volume);

CallVolume.SetPaintingStrategy(PaintingStrategy.LINE);

CallVolume.SetDefaultColor(GlobalColor("Call"));

AddLabel(ShowLabels and DataType == DataType.Volume, "CallVol: " + CallVolume, GlobalColor("Call"));

# Put Volume

plot PutVolume = if FlipPuts then -(TotalPutVolume) else TotalPutVolume;

PutVolume.SetHiding(!ShowLines or DataType != DataType.Volume);

PutVolume.SetPaintingStrategy(PaintingStrategy.LINE);

PutVolume.SetDefaultColor(GlobalColor("Put"));

AddLabel(ShowLabels and DataType == DataType.Volume, "PutVol: " + AbsValue(PutVolume), GlobalColor("Put"));

# Create Clouds for Volume

AddCloud(

if ShowClouds and DataType == DataType.Volume then CallVolume else Double.NaN,

if ShowClouds and DataType == DataType.Volume then Zeroline else Double.NaN,

GlobalColor("CallCloud"), GlobalColor("CallCloud")

);

AddCloud(

if ShowClouds and DataType == DataType.Volume then Zeroline else Double.NaN,

if ShowClouds and DataType == DataType.Volume then PutVolume else Double.NaN,

GlobalColor("PutCloud"), GlobalColor("CallCloud")

);

# Hull Moving Average of Put Volume

plot PutVolumeAverage = hullmovingavg(PutVolume);

PutVolumeAverage.SetHiding(!ShowAverages or DataType != DataType.Volume);

PutVolumeAverage.SetDefaultColor(GlobalColor("PutAverage"));

PutVolumeAverage.SetStyle(Curve.MEDIUM_DASH);

# Hull Moving Average of Call Volume

plot CallVolumeAverage = hullmovingavg(CallVolume);

CallVolumeAverage.SetHiding(!ShowAverages or DataType != DataType.Volume);

CallVolumeAverage.SetDefaultColor(GlobalColor("CallAverage"));

CallVolumeAverage.SetStyle(Curve.MEDIUM_DASH);

# Gamma Exposure

plot GammaExposure = (TotalCallGammaExposure + TotalPutGammaExposure);

GammaExposure.SetHiding(DataType != DataType.GammaExposure);

GammaExposure.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

GammaExposure.SetDefaultColor(GlobalColor("GEX"));

AddLabel(

DataType == DataType.GammaExposure,

if GEXCalculationMethod == GEXCalculationMethod.ContributionShares then

"GEX: " + GammaExposure + " Shares"

else if GEXCalculationMethod == GEXCalculationMethod.Contribution then

"GEX: " + GammaExposure + "$ Per 1$ Move"

else

"GEX: " + GammaExposure + "$ Per 1% Move"

,

GlobalColor("GEX")

);

# NOPE

plot NOPE = (TotalCallNope + TotalPutNope)/volume();

NOPE.SetHiding(DataType != DataType.NetOptionPricingEffect);

NOPE.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

NOPE.SetDefaultColor(GlobalColor("NOPE"));

AddLabel(ShowLabels and DataType == DataType.NetOptionPricingEffect, "NOPE: " + AbsValue(NOPE), GlobalColor("Nope"));

# Greeks Labels

AddLabel(ShowGreeks, "Delta: " + Delta, Color.WHITE);

AddLabel(ShowGreeks, "Gamma: " + Gamma, Color.WHITE);

AddLabel(ShowGreeks, "Theta: " + Theta, Color.WHITE);

AddLabel(ShowGreeks, "Vega: " + Vega, Color.WHITE);sudoshu

Member

Ahhhh good catch, and great work on the NOPE indicator!I found this issue as well, the script had a bug where only the last gex calculation method has put multiplied by -1, that's why you see all positive

I had tried to get delta's before but couldn't figure out how to solve CND(d1) inside the fold. Am I understanding correct that instead of doing that, the epsilon is just an estimate of the new underlying stock price? So the equation becomes:

Based on that and what @iom1 posted I think it works out well.Delta = (Of - Oi) / (Sf - Si) where

- Of: the new value of the option

- Oi: the initial value of the option

- Sf: the new value of the underlying stock

- Si: the initial value of the underlying stock

andyc

New member

you're right, I originally tried to calculate the Delta in the fold, and it was crazy I can't invoke another function call in it, hence you see the crazy expanded expression that was commented out, I tried the epsilon to approximate Delta, and it look good enough to me.Ahhhh good catch, and great work on the NOPE indicator!

I had tried to get delta's before but couldn't figure out how to solve CND(d1) inside the fold. Am I understanding correct that instead of doing that, the epsilon is just an estimate of the new underlying stock price? So the equation becomes:

Based on that and what @iom1 posted I think it works out well.

the only problem now is that this script run very slow, I really hope there's a better way to do this than thinkscript, they should update it to something modern and run faster, e.g. python.

3AMBH

Guest

Hello Sir, Has there been any break through to the scrip for SPX?There is an issue with indexes and futures on this script as the symbol is different in the options than the search bar in thinkorswim. For SPX you would normally type that into the search bar 'SPX' but the options chain looks like '.SPXW220920C1800' Notice the the 'W' is thrown in there.

I think this may be an easy fix but I'd like to try and find a way to accommodate others as well, might just need to do a giant if else statement ...

I will put this on the list of todo's

Thanks!

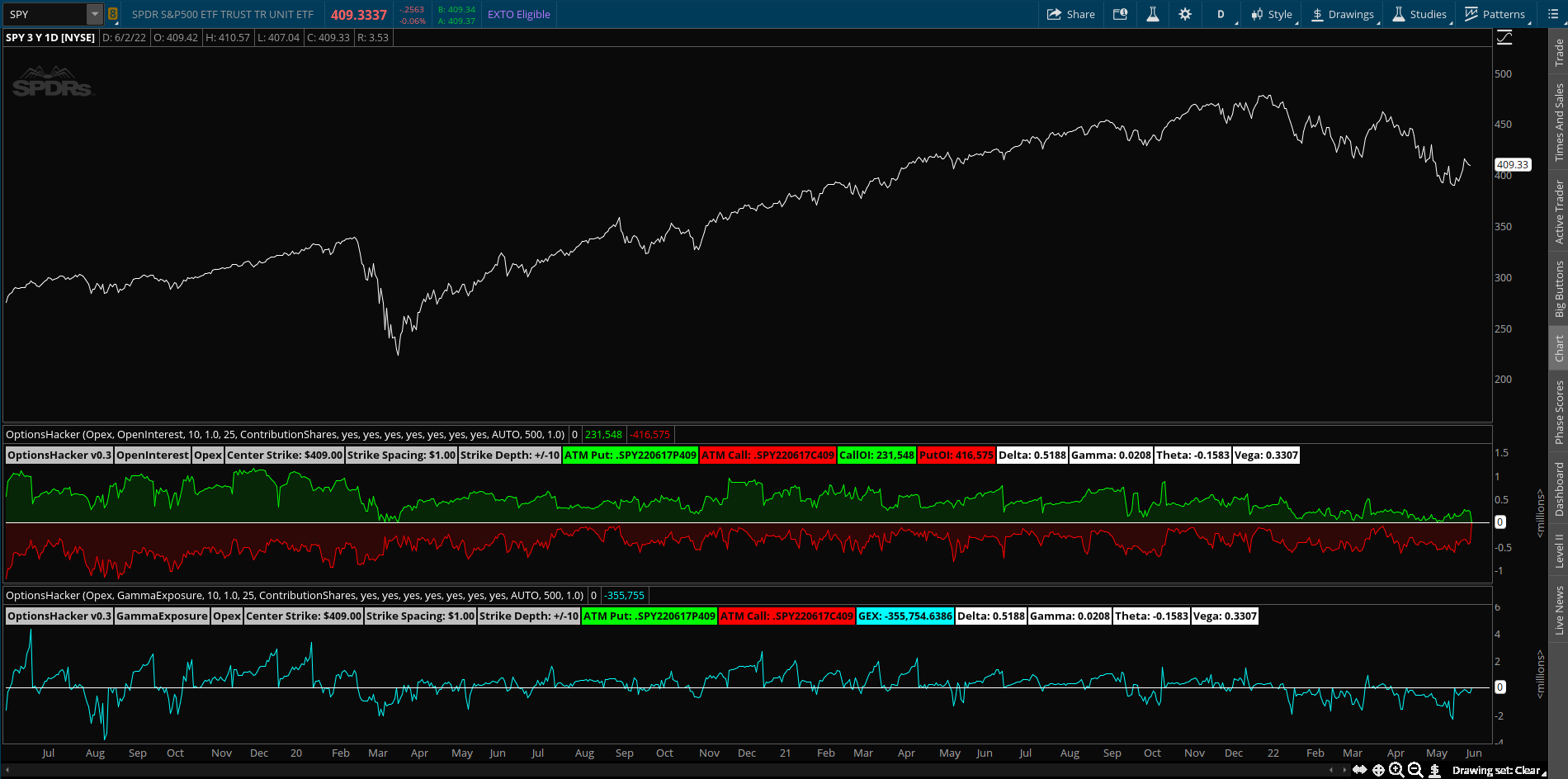

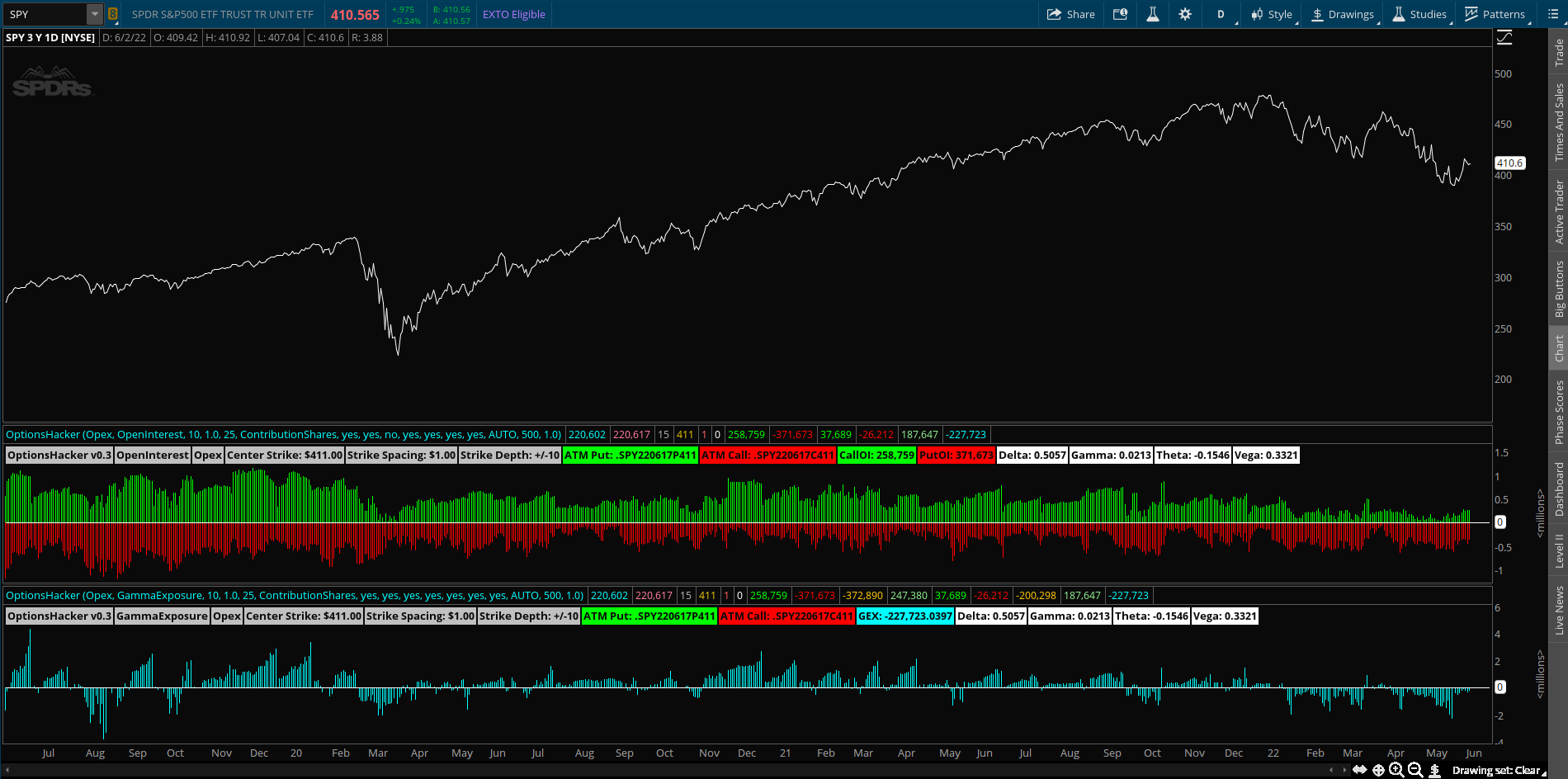

Here's my current setup, you can see how increased put buying + diminishing call buying is affecting the gamma environment.

wado729

New member

Shouldnt the GEX label beI found this issue as well, the script had a bug where only the last gex calculation method has put multiplied by -1, that's why you see all positive

I took the liberty to fix this and try to add a NOPE calculation, see if anyone has an extra eye to check if I done it correctly.

Code:#hint: Options Hacker \n This study lets you scan and perform calculations on the options chain for a series and given depth. \n<b>Warning: Setting the StrikeDepth to large values requires significant processing power, and will result in slow loading times.</b> # # sudoshu - I would not have been able to make this work without the help, and kindness to share code from those listed below. Thank you! # # Credits: # mobius # ziongotoptions # Angrybear # halcyonguy # MerryDay # MountainKing333 # BenTen # DeusMecanicus # Zardoz0609 # NPTrading # declare once_per_bar; declare hide_on_intraday; declare lower; def version = 0.5; #-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------# # Settings # Colors DefineGlobalColor("Call", Color.GREEN); DefineGlobalColor("Put", Color.RED); DefineGlobalColor("CallCloud",Color.DARK_GREEN); DefineGlobalColor("PutCloud",Color.DARK_RED); DefineGlobalColor("CallAverage",Color.LIGHT_GREEN); DefineGlobalColor("PutAverage",Color.ORANGE); DefineGlobalColor("GEX",Color.CYAN); DefineGlobalColor("NOPE",Color.PINK); #hint Series: The option expiration series to search. \n This value is used to determine the option symbol. input Series = { default Weekly, Opex, Month1, Month2, Month3, Month4, Month5, Month6, Month7, Month8, Month9 }; # Todo: Maybe can add something like this to get more than just fridays ... #hint OpexDay: #input OpexDay = { # Monday, # Tuesday, # Wednesday, # Thursday, # default Friday #}; #hint DataType: The type of option data to show. input DataType = {default OpenInterest, Volume, GammaExposure, NetOptionPricingEffect}; #hint StrikeDepth: The level of depth to search a series. (+/- this far from ATM) input StrikeDepth = 10; #hint CenterStrikeOffset: The offset to use when calculating the center strike based on close price. \n Examples: \n 1 = nearest $1 interval \n 10 = nearest $10 interval. input CenterStrikeOffset = 1.0; #hint MaxStrikeSpacing: The maximum dollar amount between two adjacent contracts. input MaxStrikeSpacing = 25; #hint GEXCalculationMethod: The method to use for calculating gamma exposure. \n The total gamma exposure is then the sum of all call gex + put gex. \n <li>ContributionShares: \n gamma * OI * 100 (* -1 for puts)</li><li>Contribution: \n gamma * OI * 100 * Spot Price (* -1 for puts)</li><li>ContributionPercent: \n gamma * OI * 100 * Spot Price ^2 * 0.01 (* -1 for puts)</li> input GEXCalculationMethod = {default ContributionShares, Contribution, ContributionPercent}; #hint ShowStrikeInfo: Show the strike info labels. input ShowStrikeInfo = yes; #hint ShowLabels: Show labels for the current data type. input ShowLabels = yes; #hint ShowClouds: Show clouds for volume and/or open interest. input ShowClouds = yes; #hint ShowLines: Show lines for values. input ShowLines = yes; #hint ShowAverages: Show the moving average lines. input ShowAverages = yes; #hint ShowGreeks: Show the estimated Greek calculation labels for the latest bar. input ShowGreeks = yes; #hint FlipPuts: Flip the puts underneath the axis input FlipPuts = yes; #hint StrikeMode: The mode to select an option symbol. \n AUTO will try to find the option symbol based on the Series and StrikeDepth inputs. \n MANUAL allows an override of the AUTO behavior by using the ManualCenterStrike and ManualStrikeSpacing inputs to determine the option symbol. input StrikeMode = {default AUTO, MANUAL}; #hint ManualCenterStrike: The starting price to use when in MANUAL mode. input ManualCenterStrike = 440; #hint ManualStrikeSpacing: The dollar amount between two adjacent contracts to use when in MANUAL mode. input ManualStrikeSpacing = 1.0; #hint IVMethod: The method to use for calculating implied volatility. This is mainly used in the GEX calculations. \n ClosedFormIV uses an approximation for implied volatility based on methods from mobius. \n SeriesIV uses the built in SeriesVolatility() function. input IVMethod = {default ClosedFormIV, SeriesIV}; #hint Debug: Shows plots and data for debugging purposes. input Debug = no; #-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------# # Date, Symbol, and Strike # # OptionSeries is the expiry starting at 1 and raising by one for each next expiry. \n This is only used for the SeriesIV method calculation. def OptionSeries; switch (Series) { case Weekly: OptionSeries = 1; case Opex: OptionSeries = 2; case Month1: OptionSeries = 3; case Month2: OptionSeries = 4; case Month3: OptionSeries = 5; case Month4: OptionSeries = 6; case Month5: OptionSeries = 7; case Month6: OptionSeries = 8; case Month7: OptionSeries = 9; case Month8: OptionSeries = 10; case Month9: OptionSeries = 11; }; # Open price at Regular Trading Hours def RTHopen = open(period = AggregationPeriod.DAY); # Current year, month, day, and date def CurrentYear = GetYear(); # number of current bar in CST def CurrentMonth = GetMonth(); # 1 - 12 def CurrentDay = GetDay(); # 1 - 365 (366 for leap year) def CurrentDate = GetYYYYMMDD(); # date of the current bar in the YYYYMMDD # Current day of this month def CurrentDayOfMonth = GetDayOfMonth(CurrentDate); # Get the first day of this month - 1 (Monday) to 7 (Sunday) def FirstDayThisMonth = GetDayOfWeek((CurrentYear * 10000) + (CurrentMonth * 100) + 1); # Get the first upcoming friday def FirstUpcomingFriday = if FirstDayThisMonth < 6 then 6 - FirstDayThisMonth else if FirstDayThisMonth == 6 then 7 else 6 ; # Get the second, third, and fourth upcoming fridays def SecondUpcomingFriday = FirstUpcomingFriday + 7; def ThirdUpcomingFriday = FirstUpcomingFriday + 14; def FourthUpcomingFriday = FirstUpcomingFriday + 21; # Get the month of expiration for the option, accounting for end of month rollover def ExpMonth1 = if Series == Series.Opex and ThirdUpcomingFriday > CurrentDayOfMonth then CurrentMonth else if Series == Series.Opex and ThirdUpcomingFriday < CurrentDayOfMonth then CurrentMonth + 1 else if FourthUpcomingFriday > CurrentDayOfMonth then CurrentMonth else CurrentMonth + 1 ; # Get the month of expiration for the option, accounting for end of year rollover def ExpMonth = if ExpMonth1 > 12 then ExpMonth1 - 12 else ExpMonth1; # Get the year of expiration for the option def ExpYear = if ExpMonth1 > 12 then CurrentYear + 1 else CurrentYear; # Get the first day at the current expiration year and month def ExpDay1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth * 100 + 1); # Get the first friday at the current expiration year and month def ExpFirstFridayDOM = if ExpDay1DOW < 6 then 6 - ExpDay1DOW else if ExpDay1DOW == 6 then 7 else 6 ; # Get the second, third, and fourth fridays at the current expiration year and month def ExpSecondFridayDOM = ExpFirstFridayDOM + 7; def ExpThirdFridayDOM = ExpFirstFridayDOM + 14; def ExpFouthFridayDOM = ExpFirstFridayDOM + 21; # Get the day of month of expiration for the option def ExpDOM = if Series == Series.Opex then ExpThirdFridayDOM else if CurrentDayOfMonth < ExpFirstFridayDOM -1 then FirstUpcomingFriday else if between(CurrentDayOfMonth, ExpFirstFridayDOM, SecondUpcomingFriday - 1) then SecondUpcomingFriday else if between(CurrentDayOfMonth, SecondUpcomingFriday, ThirdUpcomingFriday - 1) then ThirdUpcomingFriday else if between(CurrentDayOfMonth, ThirdUpcomingFriday, FourthUpcomingFriday - 1) then FourthUpcomingFriday else ExpFirstFridayDOM ; # Option Expiration Date - Depending on selected series def OpexDate_NoHolidays = ExpYear * 10000 + ExpMonth * 100 + ExpDOM; # Option Expiration Date - Accounting for holidays def OpexDate = if ExpMonth == 4 and ExpDOM == 15 then OpexDate_NoHolidays - 1 else OpexDate_NoHolidays # Exchange holiday on April 15, 2022 ; # The OpexCode is the expiry date in the format of an option symbol. # Example: # The date of expiry is April 15th, 2022. # The format of this date from the code we have above, the OptionExpiryDate, would be 20,220,415 # Options symbols expect the format for this date as 220415 (we need to get rid of the leading 20) def OpexCode = OpexDate - 20000000; # Option Days to Expiration #def DTE = CountTradingDays(CurrentDate, OptionExpiryDate); def DTE = DaysTillDate(OpexDate); # Find the center strike - the price closest to ATM option def CenterStrike = if (StrikeMode == StrikeMode.AUTO and !IsNaN(close)) then Round(close / CenterStrikeOffset, 0) * CenterStrikeOffset else if (StrikeMode == StrikeMode.MANUAL and !IsNaN(close)) then ManualCenterStrike else CenterStrike[1] ; # Strike Spacing def StrikeSpacingC = fold i = 1 to MaxStrikeSpacing with spacing = 1 do if !IsNaN( open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + "P" + AsPrice(CenterStrike + (MaxStrikeSpacing - i))) ) then MaxStrikeSpacing - i else if !IsNaN( volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + "P" + AsPrice(CenterStrike + (MaxStrikeSpacing - i))) ) then MaxStrikeSpacing - i else spacing ; def StrikeSpacing = if (StrikeMode == StrikeMode.AUTO and !IsNaN(close)) then StrikeSpacingC else if (StrikeMode == StrikeMode.MANUAL and !IsNaN(close)) then ManualStrikeSpacing else StrikeSpacing[1] ; # Date and Strike Debugging plot DebugCurrentDate = CurrentDate - 20000000; DebugCurrentDate.SetHiding(!Debug); plot DebugOptionExpiryDate = OpexCode; DebugOptionExpiryDate.SetHiding(!Debug); plot DebugDTE = DTE; DebugDTE.SetHiding(!Debug); plot DebugCenterStrike = CenterStrike; DebugCenterStrike.SetHiding(!Debug); plot DebugStrikeSpacing = StrikeSpacing; DebugStrikeSpacing.SetHiding(!Debug); #-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------# # Option Chain Data Gathering # Script to get the total open interest at a spot script TotalSpotOI { input StrikeDepth = 1; input OpexCode = 1; input CenterStrike = 1; input StrikeSpacing = 1; input IsCall = yes; def total = fold index = -(StrikeDepth) to (StrikeDepth + 1) with value = 0 do if !IsNaN( open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) ) then value + open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) else value + 0 ; plot TotalSpotOI = total; } # Total Call Open Interest for selected chain depth and expiry series def TotalCallOpenInterest = TotalSpotOI(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, yes); # Total Put Open Interest for selected chain depth and expiry series def TotalPutOpenInterest = TotalSpotOI(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, no); # Script to get the total volume at a spot script TotalSpotVolume { input StrikeDepth = 1; input OpexCode = 1; input CenterStrike = 1; input StrikeSpacing = 1; input IsCall = yes; def total = fold index = -(StrikeDepth) to (StrikeDepth + 1) with value = 0 do if !IsNaN( volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) ) then value + volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) else value + 0 ; plot TotalSpotVolume = total; } # Total Call Open Interest for selected chain depth and expiry series def TotalCallVolume = TotalSpotVolume(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, yes); # Total Put Volume for selected chain depth and expiry series def TotalPutVolume = TotalSpotVolume(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, no); # Abramowiz Stegun Approximation for Cumulative Normal Distribution script CND { input data = 1; def a = AbsValue(data); def b1 = .31938153; def b2 = -.356563782; def b3 = 1.781477937; def b4 = -1.821255978; def b5 = 1.330274429; def b6 = .2316419; def e = 1 / (1 + b6 * a); def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) * (b1 * e + b2 * e * e + b3 * Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5)); plot CND = if data < 0 then 1 - i else i; } # Closed form IV approximation # IV = sqrt(2*pi / t) * (C / S) # S = Price of the underlying # C = Price of the option # t = time to maturity script ClosedFormIV { input C = 1; input S = 1; input t = 1; # time to maturity #plot IV = (C * Sqrt(2 * Double.Pi)) / (S * Sqrt(t)); plot IV = (sqrt((2 * Double.Pi)/t)) * (C / S); } # Greeks Calculations # # K - Option strike price # N - Standard normal cumulative distribution function # r - Risk free interest rate # IV - Volatility of the underlying # S - Price of the underlying # t - Time to option's expiry # # d1 = (ln(S/K) + (r + (sqr(IV)/2))t) / (? (sqrt(t))) # d2 = e -(sqr(d1) / 2) / sqrt(2*pi) # # Delta = N(d1) # Gamma = (d2) / S(IV(sqrt(t))) # Theta = ((S d2))IV) / 2 sqrt(t)) - (rK e(rt)N(d4)) # where phi(d3) = (exp(-(sqr(x)/2))) / (2 * sqrt(t)) # where d4 = d1 - IV(sqrt(t)) # Vega = S phi(d1) Sqrt(t) def K = CenterStrike; def S = close; def r = GetInterestRate(); def t = (DTE / 365); def y = GetYield(); # At the money call price used for ClosedFormIV calcuation def ATMCallPrice = if isNaN(close(symbol = ("." + GetSymbolPart()) + AsPrice(OpexCode) + "C" + AsPrice(CenterStrike), period = aggregationPeriod.DAY)) then ATMCallPrice[1] else close(symbol = ("." + GetSymbolPart()) + AsPrice(OpexCode) + "C" + AsPrice(CenterStrike), period = aggregationPeriod.DAY) ; # ClosedFormIV is an approximation of implied volatility based on scripts/methods from mobius def IV1 = ClosedFormIV(ATMCallPrice, RTHopen, t); plot MobiusIV = if IV1 > 0 and !IsInfinite(IV1) then IV1 else IV1[1]; MobiusIV.SetHiding(!Debug); # SeriesVolatility is the expiry starting at 1 and raising by 1 for each next expiry def IV2 = SeriesVolatility(series = OptionSeries); plot SeriesIV = if IV2 > 0 and !IsInfinite(IV2) then IV2 else IV2[1]; SeriesIV.SetHiding(!Debug); # Implied Volatily method def IV; switch (IVMethod) { case ClosedFormIV: IV = IV1; case SeriesIV: IV = IV2; } # Start greek calculations def d1 = (Log(S / K) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)); def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi); # Delta def Delta = CND(d1); # Gamma def Gamma = d2 / (S * (IV * Sqrt(t))); # Theta def Theta = -(-(S*d2*IV*(.5000)/ (2*sqrt(t)))- (r*(exp(-r*t)*K))*CND(d2)+(S*CND(d1)*(.5000)))/365; # (.5000) variant less than .5 e(X/t) # Vega def Vega = (S*d2*sqrt(t))/100; # script StrikeDelta { # input index = 1; # input close = 1; # input CenterStrike = 1; # input StrikeSpacing = 1; # input DTE = 1; # input IV = 1; # input r = 1; # input t = 1; # input y = 1; # def epsilon = 0.001 * close; # plot approxDelta = (OptionPrice(CenterStrike + StrikeSpacing * index, !isCall, DTE, close + epsilon, IV, no, y, r) - OptionPrice(CenterStrike + StrikeSpacing * index, !isCall, DTE, close, IV, no, y, r)) / epsilon; # } # GEX Calculation Methods: # # ContributionShares: # Call GEX = gamma * OI * 100 # Put GEX = gamma * OI * 100 * -1 # # Contribution: # Call GEX = gamma * OI * 100 * Spot Price # Put GEX = gamma * OI * 100 * Spot Price * -1 # # ContributionPercent: # Call GEX = gamma * OI * 100 * Spot Price ^2 * 0.01 # Put GEX = gamma * OI * 100 * Spot Price ^2 * 0.01 * -1 # # Script to get the total gamma exposure at a spot script TotalSpotGEX { input StrikeDepth = 1; input OpexCode = 1; input CenterStrike = 1; input StrikeSpacing = 1; input IsCall = yes; input GEXCalculationMethod = {default ContributionShares, Contribution, ContributionPercent}; input DTE = 1; input IV = 1; input r = 1; input t = 1; def total = fold index = -(StrikeDepth) to (StrikeDepth + 1) with value = 0 do if !IsNaN( open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) ) then value + (Exp(-(Sqr((Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))) / 2)) / Sqrt(2 * Double.Pi) / (close * (IV * Sqrt(t)))) * open_interest(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) * 100 * if GEXCalculationMethod == GEXCalculationMethod.ContributionShares then 1 * if IsCall then 1 else -1 else if GEXCalculationMethod == GEXCalculationMethod.Contribution then close * if IsCall then 1 else -1 else Sqr(close) * 0.01 * if IsCall then 1 else -1 else value + 0 ; plot TotalSpotGEX = total; } # Total Call Gamma Exposure for selected chain depth and expiry series def TotalCallGammaExposure = TotalSpotGEX(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, yes, GEXCalculationMethod, DTE, IV, r, t); # Total Put Gamma Exposure for selected chain depth and expiry series def TotalPutGammaExposure = TotalSpotGEX(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, no, GEXCalculationMethod, DTE, IV, r, t); # Script to get the total volume*delta at a spot for Net Option Pricing Effect script TotalNope { input StrikeDepth = 1; input OpexCode = 1; input CenterStrike = 1; input StrikeSpacing = 1; input IsCall = yes; input DTE = 1; input IV = 1; input r = 1; input t = 1; input y = 1; def epsilon = 0.001 * close; def total = fold index = -(StrikeDepth) to (StrikeDepth + 1) with value = 0 do if !IsNaN( volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) ) then value + volume(("." + GetSymbolPart()) + AsPrice(OpexCode) + (if IsCall then "C" else "P") + AsPrice(CenterStrike + (StrikeSpacing * index))) * 100 * (OptionPrice(CenterStrike + StrikeSpacing * index, !isCall, DTE, close + epsilon, IV, no, y, r) - OptionPrice(CenterStrike + StrikeSpacing * index, !isCall, DTE, close, IV, no, y, r)) / epsilon * 100 # if (1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)))) < 0 # then 1 - (1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)), 2) / 2) * # (.31938153 * 1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))) + # -.356563782 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 2) + # 1.781477937 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 3) + # -1.821255978 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 4) + # 1.330274429 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 5))) # else (1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)), 2) / 2) * # (.31938153 * 1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))) + # -.356563782 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 2) + # 1.781477937 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 3) + # -1.821255978 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 4) + # 1.330274429 * Power(1 / (1 + .2316419 * AbsValue(Log(close / (CenterStrike + (StrikeSpacing * index))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))), 5))) else value + 0 ; plot TotalNopeValue = total; } def TotalCallNope = TotalNope(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, yes, DTE, IV, r, t, y); def TotalPutNope = TotalNope(StrikeDepth, OpexCode, CenterStrike, StrikeSpacing, no, DTE, IV, r, t, y); #-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------# # Visuals # Version Label AddLabel(yes, "OptionsHacker v" + version, Color.LIGHT_GRAY); # Selected DataType AddLabel(yes, DataType, Color.LIGHT_GRAY); # Selected Series AddLabel(yes, Series, Color.LIGHT_GRAY); # Center Strike Label AddLabel(ShowStrikeInfo, "Center Strike: " + AsDollars(CenterStrike), if StrikeMode == StrikeMode.AUTO then Color.LIGHT_GRAY else Color.RED); # Strike Spacing Label AddLabel(ShowStrikeInfo, "Strike Spacing: " + AsDollars(StrikeSpacing), if StrikeMode == StrikeMode.AUTO then Color.LIGHT_GRAY else Color.RED); # Chain Depth Label AddLabel(ShowStrikeInfo, "Strike Depth: +/-" + StrikeDepth, Color.LIGHT_GRAY); # Current ATM Options Labels Addlabel(ShowStrikeInfo, "ATM Put: " + ("." + GetSymbol()) + AsPrice(OpexCode) + "P" + AsPrice(CenterStrike), GlobalColor("Call")); Addlabel(ShowStrikeInfo, "ATM Call: " + ("." + GetSymbol()) + AsPrice(OpexCode) + "C" + AsPrice(CenterStrike), GlobalColor("Put")); # Create a center line plot ZeroLine = 0; ZeroLine.SetDefaultColor(Color.WHITE); # Call Open Interest plot CallOpenInterest = TotalCallOpenInterest; CallOpenInterest.SetHiding(!ShowLines or DataType != DataType.OpenInterest); CallOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE); CallOpenInterest.SetDefaultColor(GlobalColor("Call")); AddLabel(ShowLabels and DataType == DataType.OpenInterest, "CallOI: " + CallOpenInterest, GlobalColor("Call")); # Put Open Interest plot PutOpenInterest = if FlipPuts then -(TotalPutOpenInterest) else TotalPutOpenInterest; PutOpenInterest.SetHiding(!ShowLines or DataType != DataType.OpenInterest); PutOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE); PutOpenInterest.SetDefaultColor(GlobalColor("Put")); AddLabel(ShowLabels and DataType == DataType.OpenInterest, "PutOI: " + AbsValue(PutOpenInterest), GlobalColor("Put")); # Create Clouds for Open Interest AddCloud( if ShowClouds and DataType == DataType.OpenInterest then CallOpenInterest else Double.NaN, if ShowClouds and DataType == DataType.OpenInterest then Zeroline else Double.NaN, GlobalColor("CallCloud"), GlobalColor("PutCloud") ); AddCloud( if ShowClouds and DataType == DataType.OpenInterest then Zeroline else Double.NaN, if ShowClouds and DataType == DataType.OpenInterest then PutOpenInterest else Double.NaN, GlobalColor("PutCloud"), GlobalColor("PutCloud") ); # Hull Moving Average of Put Open Interest plot PutOpenInterestAverage = hullmovingavg(PutOpenInterest); PutOpenInterestAverage.SetHiding(!ShowAverages or DataType != DataType.OpenInterest); PutOpenInterestAverage.SetDefaultColor(GlobalColor("PutAverage")); PutOpenInterestAverage.SetStyle(Curve.MEDIUM_DASH); # Hull Moving Average of Call Open Interest plot CallOpenInterestAverage = hullmovingavg(CallOpenInterest); CallOpenInterestAverage.SetHiding(!ShowAverages or DataType != DataType.OpenInterest); CallOpenInterestAverage.SetDefaultColor(GlobalColor("CallAverage")); CallOpenInterestAverage.SetStyle(Curve.MEDIUM_DASH); # Call Volume plot CallVolume = TotalCallVolume; CallVolume.SetHiding(!ShowLines or DataType != DataType.Volume); CallVolume.SetPaintingStrategy(PaintingStrategy.LINE); CallVolume.SetDefaultColor(GlobalColor("Call")); AddLabel(ShowLabels and DataType == DataType.Volume, "CallVol: " + CallVolume, GlobalColor("Call")); # Put Volume plot PutVolume = if FlipPuts then -(TotalPutVolume) else TotalPutVolume; PutVolume.SetHiding(!ShowLines or DataType != DataType.Volume); PutVolume.SetPaintingStrategy(PaintingStrategy.LINE); PutVolume.SetDefaultColor(GlobalColor("Put")); AddLabel(ShowLabels and DataType == DataType.Volume, "PutVol: " + AbsValue(PutVolume), GlobalColor("Put")); # Create Clouds for Volume AddCloud( if ShowClouds and DataType == DataType.Volume then CallVolume else Double.NaN, if ShowClouds and DataType == DataType.Volume then Zeroline else Double.NaN, GlobalColor("CallCloud"), GlobalColor("CallCloud") ); AddCloud( if ShowClouds and DataType == DataType.Volume then Zeroline else Double.NaN, if ShowClouds and DataType == DataType.Volume then PutVolume else Double.NaN, GlobalColor("PutCloud"), GlobalColor("CallCloud") ); # Hull Moving Average of Put Volume plot PutVolumeAverage = hullmovingavg(PutVolume); PutVolumeAverage.SetHiding(!ShowAverages or DataType != DataType.Volume); PutVolumeAverage.SetDefaultColor(GlobalColor("PutAverage")); PutVolumeAverage.SetStyle(Curve.MEDIUM_DASH); # Hull Moving Average of Call Volume plot CallVolumeAverage = hullmovingavg(CallVolume); CallVolumeAverage.SetHiding(!ShowAverages or DataType != DataType.Volume); CallVolumeAverage.SetDefaultColor(GlobalColor("CallAverage")); CallVolumeAverage.SetStyle(Curve.MEDIUM_DASH); # Gamma Exposure plot GammaExposure = (TotalCallGammaExposure + TotalPutGammaExposure); GammaExposure.SetHiding(DataType != DataType.GammaExposure); GammaExposure.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); GammaExposure.SetDefaultColor(GlobalColor("GEX")); AddLabel( DataType == DataType.GammaExposure, if GEXCalculationMethod == GEXCalculationMethod.ContributionShares then "GEX: " + GammaExposure + " Shares" else if GEXCalculationMethod == GEXCalculationMethod.Contribution then "GEX: " + GammaExposure + "$ Per 1$ Move" else "GEX: " + GammaExposure + "$ Per 1% Move" , GlobalColor("GEX") ); # NOPE plot NOPE = (TotalCallNope + TotalPutNope)/volume(); NOPE.SetHiding(DataType != DataType.NetOptionPricingEffect); NOPE.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); NOPE.SetDefaultColor(GlobalColor("NOPE")); AddLabel(ShowLabels and DataType == DataType.NetOptionPricingEffect, "NOPE: " + AbsValue(NOPE), GlobalColor("Nope")); # Greeks Labels AddLabel(ShowGreeks, "Delta: " + Delta, Color.WHITE); AddLabel(ShowGreeks, "Gamma: " + Gamma, Color.WHITE); AddLabel(ShowGreeks, "Theta: " + Theta, Color.WHITE); AddLabel(ShowGreeks, "Vega: " + Vega, Color.WHITE);

else if GEXCalculationMethod == GEXCalculationMethod.Contribution then

"GEX: $" + GammaExposure + " Per $1 Move"

else

"GEX: $" + GammaExposure + " Per 1% Move"

That way the dollar sign comes before the Gamma Exposure number i.e. GEX: $110,972,448.1813 per $1 move

quantumomegallc

Member

You're better off doing it for /ES as that mirrors the SPX exactly whereas SPY has a little hedging lag in price vs. SPX.Hello Sir, Has there been any break through to the scrip for SPX?

Is there a way to code the OptionsHacker so you can look just at 0DTE each day for SPY? One thing I have noticed is when a strike has a large negative gamma it seems to be the strike that gets hit. Example was 410 puts on Friday 5-12. Large OI but based on Tradytics data it was negative gamma or short puts. So if negative gamma is short calls and puts and positive gamma is long puts and calls its most important to know when that strike has a change in gamma. Tradytics data is good but sometimes there just to much delay in seeing the gamma change. So if I could have a study and say only want to see + or - 5 strikes of ATM on just one strike then maybe I could know when to take the trade. When we hit right at 409 Friday the gamma flipped and the futures went back up. They got squeeze out. I knew premarket that the short puts were there but short calls at 416 too. And the 416 calls was a little larger amount so I figured they would push it up but I was wrong. The market only cares about the 0DTE. So having a way to view changes in specific strikes is key to knowing when the direction is going to change. SPX gamma plays a big role to but just having SPY is enough but having it for SPX would be great if possible. And view it on a lower time chart 1 min, 5 min or tick?

Here's my current setup, you can see how increased put buying + diminishing call buying is affecting the gamma environment.

The ToS Options Hacker Module doesn't allow the using of custom studies to scan against options related data.

https://usethinkscript.com/threads/options-scan-hacker-in-thinkorswim.5114/page-3#post-82892

https://usethinkscript.com/threads/options-scan-hacker-in-thinkorswim.5114/page-2#post-81329

Let me rephrase what I'm asking. The code on page 1 of this thread has lower code for options. I want to know is there a code for watching just one strike on 0DTE? A lower study as a visualization to see the change in gamma of that strike?@FuturesTrader2022

The ToS Options Hacker Module doesn't allow the using of custom studies to scan against options related data.

https://usethinkscript.com/threads/options-scan-hacker-in-thinkorswim.5114/page-3#post-82892

https://usethinkscript.com/threads/options-scan-hacker-in-thinkorswim.5114/page-2#post-81329

quantumomegallc

Member

None commercially available that I know of. Dr Harlin might have something, he's around on Twitter.Let me rephrase what I'm asking. The code on page 1 of this thread has lower code for options. I want to know is there a code for watching just one strike on 0DTE? A lower study as a visualization to see the change in gamma of that strike?

quantumomegallc

Member

Two things that come to mind - Gex is real, and Option Volume flow matters.new to options trading, can some give a high level overview of how to interpret this signal..thank you so much

Static Open Interest Gex may or may not act as gravity towards the strikes that are heaviest.

MM's (market makers) tend to use options to structure the daily market with 0DTE calls/puts sold throughout the day.

Map the highest volume and you will know the pivots of the SPX movement.

Hint: Use volume on SPY, price action on SPX.

Track gamma(volume) and gex(OI) throught the day.

Puts fuel rallies and Calls pull price upwards (in positive Gex) and the oppositie occurs (in negative Gex).

Similar threads

-

-

Trade Ideas Intraday , single bar , Relative Volume RVOL For ThinkOrSwim

- Started by Svanoy

- Replies: 15

-

-

Cumulative Delta Volume Pressure - Mod by Sam4Cok for ThinkOrSwim

- Started by merryDay

- Replies: 34

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

Trade Ideas Intraday , single bar , Relative Volume RVOL For ThinkOrSwim

- Started by Svanoy

- Replies: 15

-

-

Cumulative Delta Volume Pressure - Mod by Sam4Cok for ThinkOrSwim

- Started by merryDay

- Replies: 34

-

Similar threads

-

-

Trade Ideas Intraday , single bar , Relative Volume RVOL For ThinkOrSwim

- Started by Svanoy

- Replies: 15

-

-

Cumulative Delta Volume Pressure - Mod by Sam4Cok for ThinkOrSwim

- Started by merryDay

- Replies: 34

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/