A few years back I taught AP Physics.Ya I got Physics, US History, and Micro Ec. I probably won't trade at all tomorrow or Friday either because I have tests on both days.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

YungTrader's Ultimate Indicator

- Thread starter YungTraderFromMontana

- Start date

- Status

- Not open for further replies.

t I'd be able to tell you the general fe move

hi television.. how do you play shorts. Do you actually short the stock or buy puts. If buying puts do you do otm puts expiring in a week or longer timeframe.

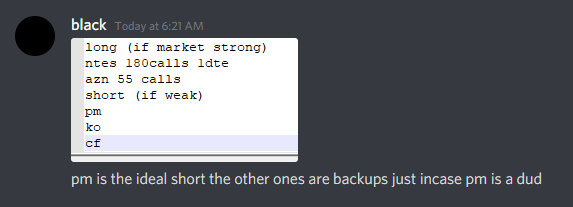

woke up late and forgot to post my list here but these were my picks before market open for options

up 90% on pm rn

down a bit on cf and 10% on KO

didnt play any of my longs cuz market strong and vix (plus ntes and azn had gap downs and showed 0 strength)

television

Member

i use yungtrader's scanner to pick out stocks that look good for longs AND shorts (hedge out beta[market risk])hi television.. how do you play shorts. Do you actually short the stock or buy puts. If buying puts do you do otm puts expiring in a week or longer timeframe.

^i play shares on these and i put little money into each of them (set up oco brackets and forget ab em)

the beauty of this is it takes very little time on the screen aside from the 1 hour or so at night for building ur stock picks

this generates nice returns over a month (according to yung ~30% [im still gathering data myself ])

since school is out rn, i have a lot of time so i figured i would flip these options throughout the day since i know there will be a large move to the upside or down. these returns are often 100%+ so its a good skill to have if ur tryna build a small acc like i will be doing

i play these on large caps with weeklies

today i played pm the the shortside (90%)

i look for high open interest and volume

i dont have a set formula. i just eyeball it using the stonks atr and days till expiry. like if its a monday ill usually go the full atr of the stock out of the money. (i still make sure oi and volume is there) be sure to pay attention to psychological levels for the strikes. ex. tesla 700 750 800 tend to be more liquid and have tighter spreads then other strikes so ill play them

just make sure u dont pay a lot for the spreads (be extremely careful of payin more then 30% of the contract price on the spread)

YungTraderFromMontana

Well-known member

I'm not surprised you seem smartA few years back I taught AP Physics.

@camitos - I only go long as well. Here is a snapshot of my grid. I use an anchor chart to signal a potential stock and the hourly for entry. Here is a long that I took today. Stock trading a $2.58 - based on L2 I tookThanks for your reply but my chart does indeed show SR, I didn't remove those plots from the study.

1.40 target price with a stop loss of 1.60? Are you shorting? I'm confused. what price would be the entry

I'm only interested in long trades too btw.

@television - Yea, Northern Africa. Changed to a sub-Saharan role model: Shaka Zululmao do u realize hannibal was carthaginian? nice cope

Hm okay, I still haven't learned the significance of L2 yet so I'm way behind. Thanks for explaining@camitos - I only go long as well. Here is a snapshot of my grid. I use an anchor chart to signal a potential stock and the hourly for entry. Here is a long that I took today. Stock trading a $2.58 - based on L2 I tooka position at 2.28 with an OCO order - purchase 2.28 SL 1.58 with a target of 2.60 next resistance level.

Hi @camitos Can you please share TOS link for your charts. Thank you.Hm okay, I still haven't learned the significance of L2 yet so I'm way behind. Thanks for explaining

Prison Mike

Member

Hey,

Looked at this thread many times. Wasn't till looking over @YungTraderFromMontana code that I realized that have been using something similar. Although Yung's study is way cooler and sophisticated scanning using my study has shown a lot of the same results. Maybe these will help someone out.

What this indicator does is lookback X number of bars to find X high.

This one aggs the time so you can see daily line on intraday charts

This one the lines move with the chart

Been using these in two ways. First is I scan for the "close" between "level" and "lowlevel" (think that’s what I called them)then trading between the range. The second way is much like Yung's scan in were I scan for a high/low that breaks through a level.

Still trying to figure out how to catch them before the break. Maybe thats were KE and FE come in?

Edit: when I first posted I had some errors that drew the lower levels on each other. Should be fixed.

Edit: I have edited this so many times

Looked at this thread many times. Wasn't till looking over @YungTraderFromMontana code that I realized that have been using something similar. Although Yung's study is way cooler and sophisticated scanning using my study has shown a lot of the same results. Maybe these will help someone out.

What this indicator does is lookback X number of bars to find X high.

This one aggs the time so you can see daily line on intraday charts

Code:

input agg = AggregationPeriod.DAY;

def price = close(period = agg);

def hi = high(period = agg);

def lo = low(period = agg);

input highestInXBars = 10;

input lookBackBars = 10;

def highestInBarsBack = Highest(hi, highestInXBars);

def lastBar = !IsNaN(price) and IsNaN(price[-1]);

def targetHigh = if lastBar then highestInBarsBack[lookBackBars] else 0;

plot higherlevel = HighestAll(targetHigh);

input highestInXBars2 = 20;

input lookBackBars2 = 20;

def highestInBarsBack2 = Highest(hi, highestInXBars2);

def lastBar2 = !IsNaN(price) and IsNaN(price[-1]);

def targetHigh2 = if lastBar2 then highestInBarsBack[lookBackBars2] else 0;

plot highestlevel = HighestAll(targetHigh2);

input lowestInXBars = 10;

input lowlookBackBars = 10;

def lowestInBarsBack = Lowest(lo, lowestInXBars);

def lowlastBar = !IsNaN(price) and IsNaN(price[-1]);

def targetLow = if lowlastBar then lowestInBarsBack[lowlookBackBars] else Double.POSITIVE_INFINITY;

plot lowerlevel = LowestAll(targetLow);

input lowestInXBars1 = 20;

input lowlookBackBars1 = 20;

def lowestInBarsBack1 = Lowest(lo, lowestInXBars1);

def lowlastBar1 = !IsNaN(price) and IsNaN(price[-1]);

def targetLow1 = if lowlastBar1 then lowestInBarsBack1[lowlookBackBars1] else Double.POSITIVE_INFINITY;

plot lowestlevel = LowestAll(targetLow1);This one the lines move with the chart

Code:

input price = close;

input highestInXBars = 10;

input lookBackBars = 10;

def highestInBarsBack = Highest(high, highestInXBars);

def lastBar = !IsNaN(close) and IsNaN(close[-1]);

def targetHigh = if lastBar then highestInBarsBack[lookBackBars] else 0;

plot higherlevel = HighestAll(targetHigh);

input highestInXBars2 = 20;

input lookBackBars2 = 20;

def highestInBarsBack2 = Highest(high, highestInXBars2);

def lastBar2 = !IsNaN(close) and IsNaN(close[-1]);

def targetHigh2 = if lastBar2 then highestInBarsBack[lookBackBars2] else 0;

plot highestlevel = HighestAll(targetHigh2);

input lowestInXBars = 10;

input lowlookBackBars = 10;

def lowestInBarsBack = Lowest(low, lowestInXBars);

def lowlastBar = !IsNaN(close) and IsNaN(close[-1]);

def targetLow = if lowlastBar then lowestInBarsBack[lowlookBackBars] else Double.POSITIVE_INFINITY;

plot lowerlevel = LowestAll(targetLow);

input lowestInXBars1 = 20;

input lowlookBackBars1 = 20;

def lowestInBarsBack1 = Lowest(low, lowestInXBars1);

def lowlastBar1 = !IsNaN(close) and IsNaN(close[-1]);

def targetLow1 = if lowlastBar1 then lowestInBarsBack1[lowlookBackBars1] else Double.POSITIVE_INFINITY;

plot lowestlevel = LowestAll(targetLow1);

def risk = higherlevel - price;

def reward = price - lowerlevel;

def RR = reward / risk;

def rr1 = RR;

AddLabel(yes, "Risk/reward" + Round(RR), if RR >= 2 / 1 then Color.GREEN else Color.RED);Been using these in two ways. First is I scan for the "close" between "level" and "lowlevel" (think that’s what I called them)then trading between the range. The second way is much like Yung's scan in were I scan for a high/low that breaks through a level.

Still trying to figure out how to catch them before the break. Maybe thats were KE and FE come in?

Edit: when I first posted I had some errors that drew the lower levels on each other. Should be fixed.

Edit: I have edited this so many times

Last edited:

television

Member

today i will not be playing options as i dont see any nice setups BESIDES NOC to the downside(even NOC does not look promising so will probs sit out on option plays)

long

brfs

nem

gcap

short

*noc (really has to have a good intraday set up for me to consider taking)

post

kindi

rmti

sens (risky, 100 mil market cap)

long

brfs

nem

gcap

short

*noc (really has to have a good intraday set up for me to consider taking)

post

kindi

rmti

sens (risky, 100 mil market cap)

Hi @camitos Can you please share TOS link for your charts. Thank you.

Hey I'm using paper TOS and don't believe I can share my workspace/charts.Hi @camitos Can you please share TOS link for your charts. Thank you.

Here are some screenshots.

So far I'm just using the trend reversal arrows, 10ema, and swinglowshighs (coloured candles from tenacity). I added the RSI w/ FE but don't understand it completely as yet.

television

Member

whyd you get in MU?I had some swings from yesterday(I jumped in right before market close)

KLAC calls - up %25

MU puts - up %218

NEM calls - up %172

XOM puts - down %40

also take not of the daily 50 sma on exxon

market condition wasnt good (not enough strength) and also RSI FE pointing down, Ichi clouds and I took a risk. Friday FUNDAY (0.11 per contracts and market opened red) I was up %700 at once during premarketwhyd you get in MU?

also take not of the daily 50 sma on exxon

What delta puts/call do you buy and whats the EXP date?I had some swings from yesterday(I jumped in right before market close)

KLAC calls - up %25

MU puts - up %218

NEM calls - up %172

XOM puts - down %40

What do you guys think of TOPS  it looks grim but it shows a low bubble, trend reversal signal, and a decent amount of consolidation. It's spiked before

it looks grim but it shows a low bubble, trend reversal signal, and a decent amount of consolidation. It's spiked before

to be honest I buy weekly puts/calls and otm which it moves quick and it doesnt cost muchWhat delta puts/call do you buy and whats the EXP date?

@YungTraderFromMontana This grad was amazing superb, thanks for sharing!!!!. Thanks for scanner as well found in one of the pagehttps://tos.mx/RcCE0GV

current chart set-up. I remember someone asking.

Last edited:

What do you guys think of TOPSit looks grim but it shows a low bubble, trend reversal signal, and a decent amount of consolidation. It's spiked before

tbh I would not trade TOPS if you don't have experience with it. There are better setups elsewhere. just my 2cents

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

YungTrader's Relative Volume | Indicators | 17 | |

|

|

The Ultimate Buy and Sell Indicator for ThinkOrSwim | Indicators | 6 | |

| P | Ultimate MACD For ThinkOrSwim | Indicators | 16 | |

|

|

Ultimate RSI [LuxAlgo] for ThinkOrSwim | Indicators | 20 | |

|

|

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading | Indicators | 26 |

Similar threads

-

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

784

Online

Similar threads

-

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

Similar threads

-

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.