mod note:

Hello All -

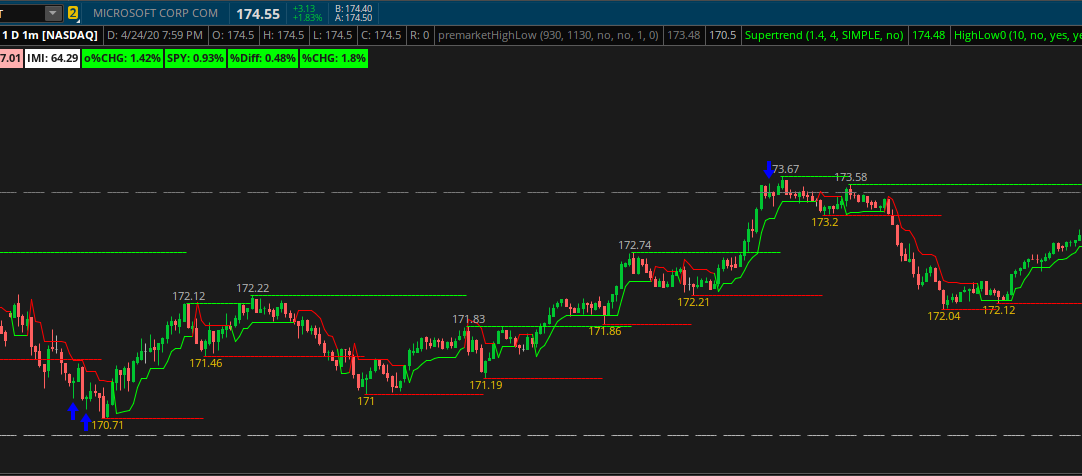

The below TOS indicator attempts to determine likelihood of an upcoming reversal, pullback, or scalp opportunity from a 1 min chart. Could be used for .20 cent moves or potential full reversal points for a hold and run.

The indicator finds opportunities by candle formation, VWAP, and Intraday Momentum.

Yellow arrows = bounce in a up/down trend towards the current trend. If above VWAP and sharp pull back towards VWAP, it will look to find a location where it might bounce and continue higher/lower. These usually happen closer to VWAP.

Blue arrows = bounce from a low or high point in a up/downtrend back towards VWAP.

These point can also be used as points of trade failure to change from long to short or vise-versa.

This main has shown promise on the 1min charts.

Includes alerts as well.

aggregate min alerts on a lower min chart:

It should be noted, that members on this thread have commented that the indicator is "broken" because they don't get signals. It is not broken. However, the candle pattern / vwap confluence is not common.

While signals from this indicator are infrequent; when triggers do occur they are worth reviewing.

As they mean:

Something Interesting This Way Comes!

Hello All -

The below TOS indicator attempts to determine likelihood of an upcoming reversal, pullback, or scalp opportunity from a 1 min chart. Could be used for .20 cent moves or potential full reversal points for a hold and run.

The indicator finds opportunities by candle formation, VWAP, and Intraday Momentum.

Yellow arrows = bounce in a up/down trend towards the current trend. If above VWAP and sharp pull back towards VWAP, it will look to find a location where it might bounce and continue higher/lower. These usually happen closer to VWAP.

Blue arrows = bounce from a low or high point in a up/downtrend back towards VWAP.

These point can also be used as points of trade failure to change from long to short or vise-versa.

This main has shown promise on the 1min charts.

Includes alerts as well.

Code:

#RCONNER7 - 4/2020

#VWAP REVERSAL/BOUNCE - CANDLE FORMATION

#v1

# Length of the candle's wick

def UpperWick = high - Max(open, close);

def LowerWick = Min(open, close) - low;

def FullLength = AbsValue(high - low);

# Length of the candle's body

def CandleBody = AbsValue(open - close);

def AvgBodyFull = Round((CandleBody / FullLength) * 100, 1);

def smallbody = if AvgBodyFull < 10 then 1 else 0;

#VWAP

input numDevDn = -2.0;

input numDevUp = 2.0;

input timeFrame = {default DAY, WEEK, MONTH};

def cap = getAggregationPeriod();

def errorInAggregation =

timeFrame == timeFrame.DAY and cap >= AggregationPeriod.WEEK or

timeFrame == timeFrame.WEEK and cap >= AggregationPeriod.MONTH;

assert(!errorInAggregation, "timeFrame should be not less than current chart aggregation period");

def yyyyMmDd = getYyyyMmDd();

def periodIndx;

switch (timeFrame) {

case DAY:

periodIndx = yyyyMmDd;

case WEEK:

periodIndx = Floor((daysFromDate(first(yyyyMmDd)) + getDayOfWeek(first(yyyyMmDd))) / 7);

case MONTH:

periodIndx = roundDown(yyyyMmDd / 100, 0);

}

def isPeriodRolled = compoundValue(1, periodIndx != periodIndx[1], yes);

def volumeSum;

def volumeVwapSum;

def volumeVwap2Sum;

if (isPeriodRolled) {

volumeSum = volume;

volumeVwapSum = volume * vwap;

volumeVwap2Sum = volume * Sqr(vwap);

} else {

volumeSum = compoundValue(1, volumeSum[1] + volume, volume);

volumeVwapSum = compoundValue(1, volumeVwapSum[1] + volume * vwap, volume * vwap);

volumeVwap2Sum = compoundValue(1, volumeVwap2Sum[1] + volume * Sqr(vwap), volume * Sqr(vwap));

}

def price = volumeVwapSum / volumeSum;

def deviation = Sqrt(Max(volumeVwap2Sum / volumeSum - Sqr(price), 0));

def VWAP = price;

def UpperBand = price + numDevUp * deviation;

def LowerBand = price + numDevDn * deviation;

##True Range

input RangeGreater = .01;

def Range = TrueRangeindicator();

def OK_Range = if Range > RangeGreater then 1 else 0;

#IMI

input length = 21;

input smooth_length = 1;

def CloseOpenDiff = if close > open then close - open else 0;

def OpenCloseDiff = if close < open then open - close else 0;

def avgCloseOpen = Average(CloseOpenDiff, length);

def avgOpenClose = Average(OpenCloseDiff, length);

def IMI = avgCloseOpen / (avgCloseOpen + avgOpenClose) * 100;

#IMI.SetDefaultColor(GetColor(8));

def avgIMI = Average(IMI, smooth_length);

def IMI_VWAPLower = if low < LowerBand and avgIMI < 30 then 1 else 0;

def IMI_VWAPHigher = if high > UpperBand and avgIMI > 70 then 1 else 0;

def IMI_Low = if avgIMI < 30 then 1 else 0;

def IMI_High = if avgIMI > 70 then 1 else 0;

# Compare body to wicks

input CandleWickVar = 1.75;

def Hammer = (lowerWick / CandleBody >= CandleWickVar) and if smallbody then lowerwick > upperWick * candleWickVar else upperWick / CandleBody <= 1.33;

def STAR = (UpperWick / CandleBody >= CandleWickVar) and if smallbody then LowerWick * candleWickVar < UpperWick else (LowerWick / CandleBody <= 1.33);

#trend

input trendlookback = 10;

def uptrend = isAscending(open, trendlookback)[1];

def downtrend = isdescending(open, trendlookback)[1];

#lowest/Highest within

input HiLowLookback = 10;

def hh = high == Highest(high, HiLowLookback);

def ll = low == Lowest(low, HiLowLookback);

def bullVWAP = if open >= reference VWAP()."VWAP" and close >= reference VWAP()."VWAP" then 1 else 0;

def bearVWAP = if open <= reference VWAP()."VWAP" and close <= reference VWAP()."VWAP" then 1 else 0;

plot Hammer_Signal_IMI = Hammer and ll and bullVWAP and IMI_Low and OK_Range;

plot STAR_Signal_IMI = STAR and hh and bearVWAP and IMI_High and OK_Range;

#plot Hammer_Signal = Hammer and ll and bullVWAP and OK_Range and !Hammer_Signal_IMI and downtrend;

#plot STAR_Signal = STAR and hh and bearVWAP and OK_Range and !STAR_Signal_IMI and uptrend;

plot BullRev = Hammer and ll and IMI_VWAPLower and OK_Range;

plot BearRev = STAR and hh and IMI_VWAPHigher and OK_Range;

#Hammer_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#Hammer_Signal.AssignValueColor(Color.GREEN );

Hammer_Signal_IMI.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Hammer_Signal_IMI.AssignValueColor(Color.YELLOW);

BullRev.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

BullRev.AssignValueColor(Color.BLUE );

#STAR_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#STAR_Signal.AssignValueColor(Color.GREEN );

STAR_Signal_IMI.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

STAR_Signal_IMI.AssignValueColor(Color.YELLOW);

BearRev.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

BearRev.AssignValueColor(Color.BLUE );

alert(Hammer_Signal_IMI or BullRev, "BUY BUY BUY", Alert.Bar, Sound.Bell);

alert(STAR_Signal_IMI or BearRev, "SELL SELL SELL", Alert.Bar, Sound.Ring);aggregate min alerts on a lower min chart:

Code:

#RCONNER7 - 5/2020

#VWAP REVERSAL/BOUNCE - Priace Action Candles

#v2 - input forced aggregation - example -- set to 3min for alerts when viewing 1min chart

# agg total arrows should show. Proper entry to should done after low or high of those agg candles.

# Length of the candle's wick

input agg = aggregationPeriod.THREE_MIN;

def UpperWick = high(period = agg) - Max(open(period = agg), close(period = agg));

def LowerWick = Min(open(period = agg), close(period = agg)) - low(period = agg);

def FullLength = AbsValue(high(period = agg) - low(period = agg));

# Length of the candle's body

def CandleBody = AbsValue(open(period = agg) - close(period = agg));

def AvgBodyFull = Round((CandleBody / FullLength) * 100, 1);

def smallbody = if AvgBodyFull < 10 then 1 else 0;

#VWAP

def VWAP = reference VWAP()."VWAP";

def UpperBand = reference VWAP()."UpperBand";

def LowerBand = reference VWAP()."LowerBand";

##True Range

input RangeGreater = .02;

def Range = TrueRangeindicator();

def OK_Range = if Range > RangeGreater then 1 else 0;

#IMI

input length = 21;

#input smooth_length = 1;

def CloseOpenDiff = if close(period = agg) > open(period = agg) then close(period = agg) - open(period = agg) else 0;

def OpenCloseDiff = if close(period = agg) < open(period = agg) then open(period = agg) - close(period = agg) else 0;

def avgCloseOpen = Average(CloseOpenDiff, length);

def avgOpenClose = Average(OpenCloseDiff, length);

def IMI = avgCloseOpen / (avgCloseOpen + avgOpenClose) * 100;

#IMI.SetDefaultColor(GetColor(8));

#def avgIMI = Average(IMI, smooth_length);

def IMI_VWAPLower = if low(period = agg) < LowerBand and IMI < 30 then 1 else 0;

def IMI_VWAPHigher = if high(period = agg) > UpperBand and IMI > 70 then 1 else 0;

def IMI_Low = if IMI < 30 then 1 else 0;

def IMI_High = if IMI > 70 then 1 else 0;

# Compare body to wicks

input CandleWickVar = 1.76;

def Hammer = (lowerWick / CandleBody >= CandleWickVar) and if smallbody then lowerwick > upperWick * candleWickVar else upperWick / CandleBody <= 1.33;

def STAR = (UpperWick / CandleBody >= CandleWickVar) and if smallbody then LowerWick * candleWickVar < UpperWick else (LowerWick / CandleBody <= 1.33);

#trend

#input trendlookback = 10;

#def uptrend = isAscending(open, trendlookback)[1];

#def downtrend = isdescending(open, trendlookback)[1];

#lowest/Highest within

input HiLowLookback = 10;

def hh = high(period = agg) == Highest(high(period = agg), HiLowLookback);

def ll = low(period = agg) == Lowest(low(period = agg), HiLowLookback);

def bullVWAP = if open(period = agg) >= VWAP and close(period = agg) >= VWAP then 1 else 0;

def bearVWAP = if open(period = agg) <= VWAP and close(period = agg) <= VWAP then 1 else 0;

plot Hammer_Signal_IMI = Hammer and ll and bullVWAP and IMI_Low and OK_Range;

plot STAR_Signal_IMI = STAR and hh and bearVWAP and IMI_High and OK_Range;

#plot Hammer_Signal = Hammer and ll and bullVWAP and OK_Range and !Hammer_Signal_IMI and downtrend;

#plot STAR_Signal = STAR and hh and bearVWAP and OK_Range and !STAR_Signal_IMI and uptrend;

plot BullRev = Hammer and ll and IMI_VWAPLower and OK_Range;

plot BearRev = STAR and hh and IMI_VWAPHigher and OK_Range;

#Hammer_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#Hammer_Signal.AssignValueColor(Color.GREEN );

Hammer_Signal_IMI.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#Hammer_Signal_IMI.AssignValueColor(Color.YELLOW);

BullRev.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#BullRev.AssignValueColor(Color.BLUE );

#STAR_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#STAR_Signal.AssignValueColor(Color.GREEN );

STAR_Signal_IMI.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#STAR_Signal_IMI.AssignValueColor(Color.YELLOW);

BearRev.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#BearRev.AssignValueColor(Color.BLUE );

alert(Hammer_Signal_IMI or BullRev, "3MIN BUY BUY BUY", Alert.Bar, Sound.Bell);

alert(STAR_Signal_IMI or BearRev, "3MIN SELL SELL SELL", Alert.Bar, Sound.Ring);

Last edited by a moderator: