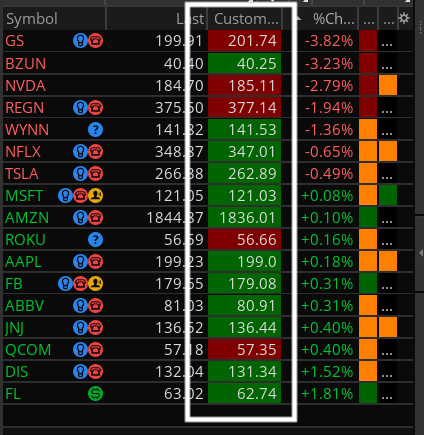

I wanted to quickly know if the stock price is currently above or below VWAP (Volume Weighted Average Price). One of our developers were able to help me put together a watchlist column that shows just that. Here is what it looks like.

Shared WatchList Link: http://tos.mx/X7jLAge Click here for --> Easiest way to load shared links

Notes:

Credit:

Shared WatchList Link: http://tos.mx/X7jLAge Click here for --> Easiest way to load shared links

Notes:

- Green means price is currently above VWAP

- Red means price is currently below VWAP

thinkScript Code

Rich (BB code):

plot vwap = vwap();

AssignBackgroundColor(if close > vwap then Color.DARK_GREEN else if close < vwap then Color.DARK_RED else Color.Dark_ORANGE);Credit:

- WalkingBallista

Attachments

Last edited by a moderator: