Hi

@BenTen @tomsk , or anyone else available to help, I was wondering if I could get some help to finish up this TOS code for watch-list that I was trying to complete, to show green when 9 ema crosses above vwap within last 3 bars, customizable for timeframes, and opposite as well, if 9 ema crosses below vwap within last 3 bars; Here is what I have gotten started:

Thank you

Papa

Just a follow up, as I previously did not state the issues I was having:

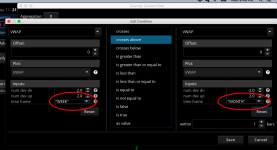

I am getting the messages invalid statements at the certain lines 2, 7 and 10.

If anyone could advise would be great, I am not a coder, but attempted to piece together what I could;

Thanks in advance @BenTen @tomsk @horserider @netarchitech or anyone else who can help me with this!

Invalid statement: input at 2:1

Invalid statement: def at 7:1

Invalid statement: AssignBackgroundC... at 10:1

@BenTen @tomsk , or anyone else available to help, I was wondering if I could get some help to finish up this TOS code for watch-list that I was trying to complete, to show green when 9 ema crosses above vwap within last 3 bars, customizable for timeframes, and opposite as well, if 9 ema crosses below vwap within last 3 bars; Here is what I have gotten started:

Code:

input maLengthOne = 9;

input maType=AverageType, EXPONENTIAL

input timeFrame = {default DAY, WEEK, MONTH};

def vwapValue = reference VWAP(-2, 2, timeFrame)."VWAP";

def ma = MovingAverage(maType, vwapValue, maLength);

inputbarsAfterCross = 3;

def crossAbove = maLengthOne > vwap

def crossBelow = maLengthOne < vwap

diff.AssignValueColor(if ma == vwap then Color.CURRENT else Color.BLACK);

AssignBackgroundColor(if diff > 0 then Color. GREEN else if diff < 0 then Color.RED else Color.CURRENT);Thank you

Papa

Just a follow up, as I previously did not state the issues I was having:

I am getting the messages invalid statements at the certain lines 2, 7 and 10.

If anyone could advise would be great, I am not a coder, but attempted to piece together what I could;

Thanks in advance @BenTen @tomsk @horserider @netarchitech or anyone else who can help me with this!

Code:

input maLengthOne = 9;

input maType=AverageType, EXPONENTIAL

input timeFrame = {default DAY, WEEK, MONTH};

def vwapValue = reference VWAP(-2, 2, timeFrame)."VWAP";

def ma = MovingAverage(maType, vwapValue, maLength);

inputbarsAfterCross = 3;

def crossAbove = maLengthOne > vwap

def crossBelow = maLengthOne < vwap

diff.AssignValueColor(if ma == vwap then Color.CURRENT else Color.BLACK);

AssignBackgroundColor(if diff > 0 then Color. GREEN else if diff < 0 then Color.RED else Color.CURRENT)Invalid statement: input at 2:1

Invalid statement: def at 7:1

Invalid statement: AssignBackgroundC... at 10:1