Author Message:

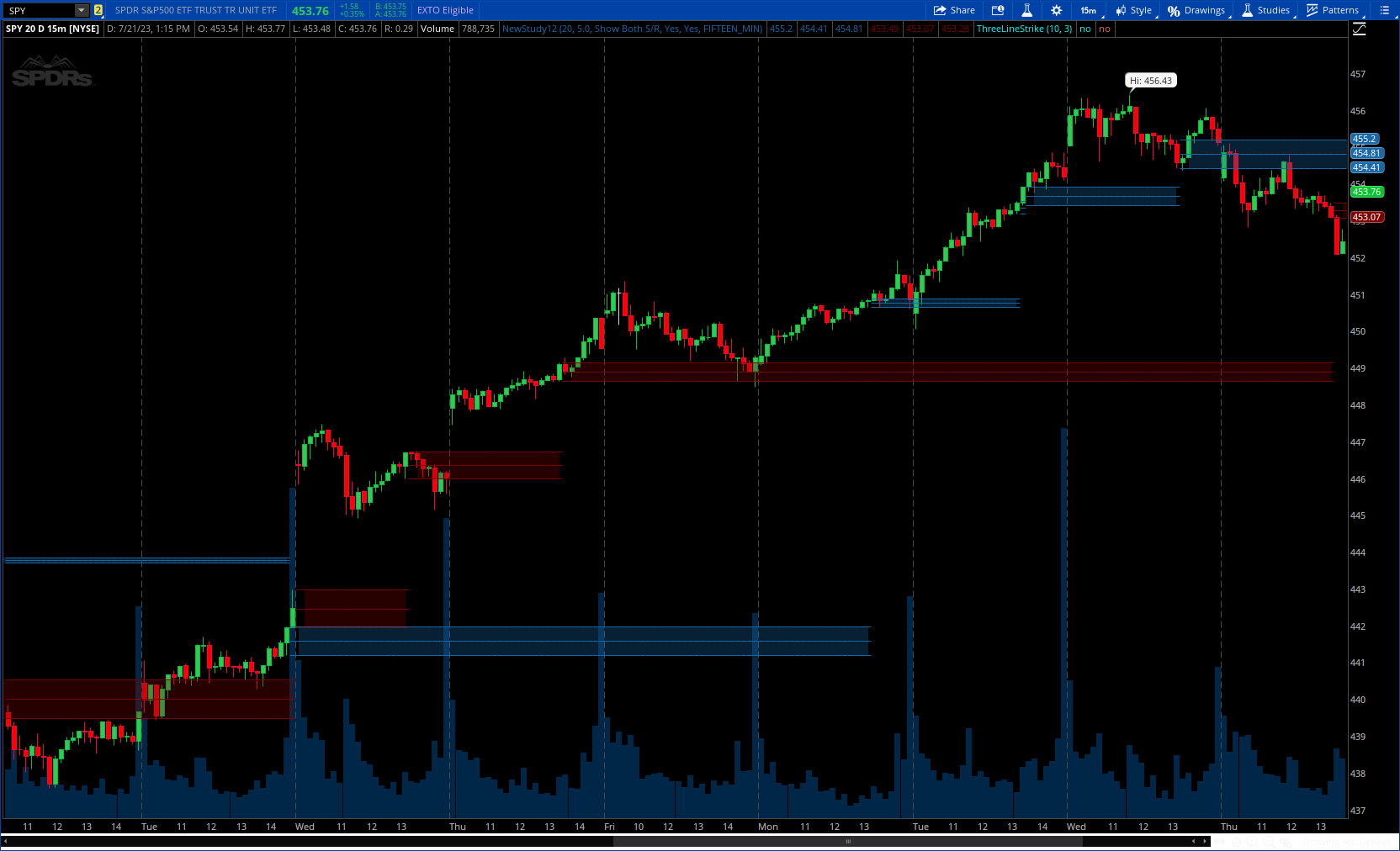

The indicator compares the size of volume bars so that if there is a noticeable increase in volume (noticeable here meaning above the indicator threshold) it marks the bar high and low prior to the bigger volume candle.

CODE:

CSS:

# https://www.tradingview.com/v/XchidFiQ/

#//@shtcoinr

#study(title="Volume Based S/R", shorttitle="VSR", precision=0, overlay=true)

# Converted and mod by Sam4Cok@Samer800 - 07/2023

input length = 20;#, minval=1)

input Threshold = 5.0;

input DisplayType = {"Support Lines Only", "Resistance Lines Only",Default "Show Both S/R", "Fair S/R"};

input useVwma = {"Yes",default "No"};

input useChartTimeframe = {default "Yes", "No"};

input ManualTimeframe = AggregationPeriod.FIFTEEN_MIN;

def na = Double.NaN;

def last = isNaN(close);

def tf = ManualTimeframe;

DefineGlobalColor("SDColor" , CreateColor(23, 105, 170));

def v; def h; def l; def c;def o;

Switch(useChartTimeframe) {

Case "Yes" :

v = volume;

h = high;

l = low;

c = close;

o = open;

Case "No" :

v = volume(Period=tf);

h = high(Period=tf);

l = low(Period=tf);

c = close(Period=tf);

o = open(Period=tf);

}

def VWMA = Average(c * v, length) / Average(v, length);

def vol;

Switch (useVwma) {

Case "Yes" :

vol = VWMA;

Case "No" :

vol = v;

}

def change = vol / vol[1] - 1;

def stdev = StDev(change, length);

def difference = change / stdev[1];

def signal = AbsValue(difference);

def cond = (signal > Threshold);

def upCandle = c > o;

def fairHi = if cond then h[1] else fairHi[1];

def fairLo = if cond then l[1] else fairLo[1];

def BullHi;

def BullLo;

def BearHi;

def BearLo;

if cond {

BullHi = if upCandle then h[1] else BullHi[1];

BullLo = if upCandle then l[1] else BullLo[1];

} else {

BullHi = BullHi[1];

BullLo = BullLo[1];

}

if cond {

BearHi = if !upCandle then h[1] else BearHi[1];

BearLo = if !upCandle then l[1] else BearLo[1];

} else {

BearHi = BearHi[1];

BearLo = BearLo[1];

}

def upHi; def upLo; def DnHi; def DnLo;

Switch (DisplayType) {

Case "Support Lines Only" :

upHi = BullHi;

upLo = BullLo;

DnHi = na;

DnLo = na;

Case "Resistance Lines Only" :

upHi = na;

upLo = na;

DnHi = BearHi;

DnLo = BearLo;

Case "Show Both S/R" :

upHi = BullHi;

upLo = BullLo;

DnHi = BearHi;

DnLo = BearLo;

Case "Fair S/R" :

upHi = fairHi;

upLo = fairLo;

DnHi = na;

DnLo = na;

}

#//plot(UpperTreshold, color=black)

plot s1 = if !upHi or last then na else upHi;

plot s2 = if !upLo or last then na else upLo;

def sMid = (s1 + s2) / 2;

plot s3 = sMid;

s1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

s2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

s3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

s3.SetStyle(Curve.SHORT_DASH);

s1.SetDefaultColor(GlobalColor("SDColor"));

s2.SetDefaultColor(GlobalColor("SDColor"));

s3.SetDefaultColor(GlobalColor("SDColor"));

plot r1 = if !DnHi or last then na else DnHi;

plot r2 = if !DnLo or last then na else DnLo;

def rMid = (r1 + r2) / 2;

plot r3 = rMid;

r1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

r2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

r3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

r3.SetStyle(Curve.SHORT_DASH);

r1.SetDefaultColor(Color.DARK_RED);

r2.SetDefaultColor(Color.DARK_RED);

r3.SetDefaultColor(Color.DARK_RED);

AddCloud(if s1!=s1[1] then na else s1, s2, GlobalColor("SDColor"));

AddCloud(if r1!=r1[1] then na else r1, r2, Color.DARK_RED);

#-- END of CODE