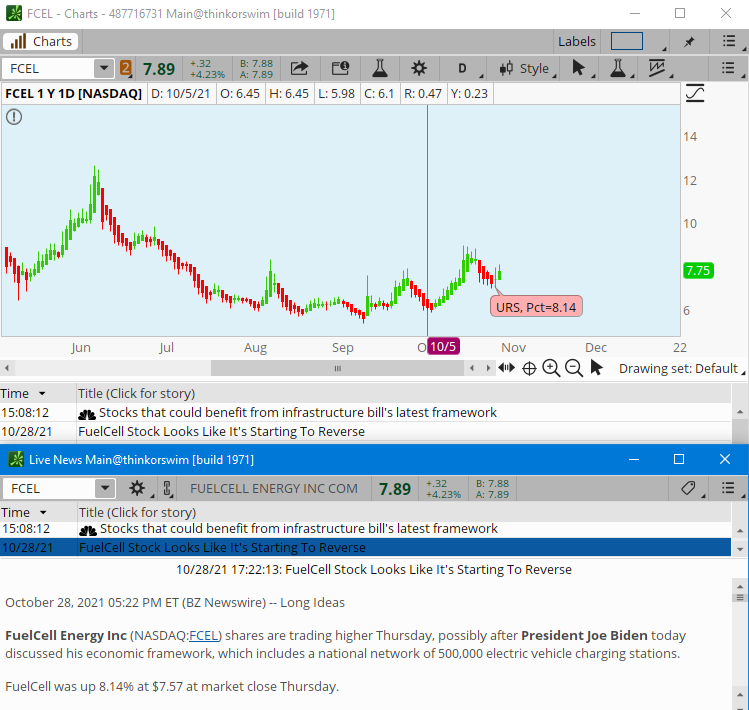

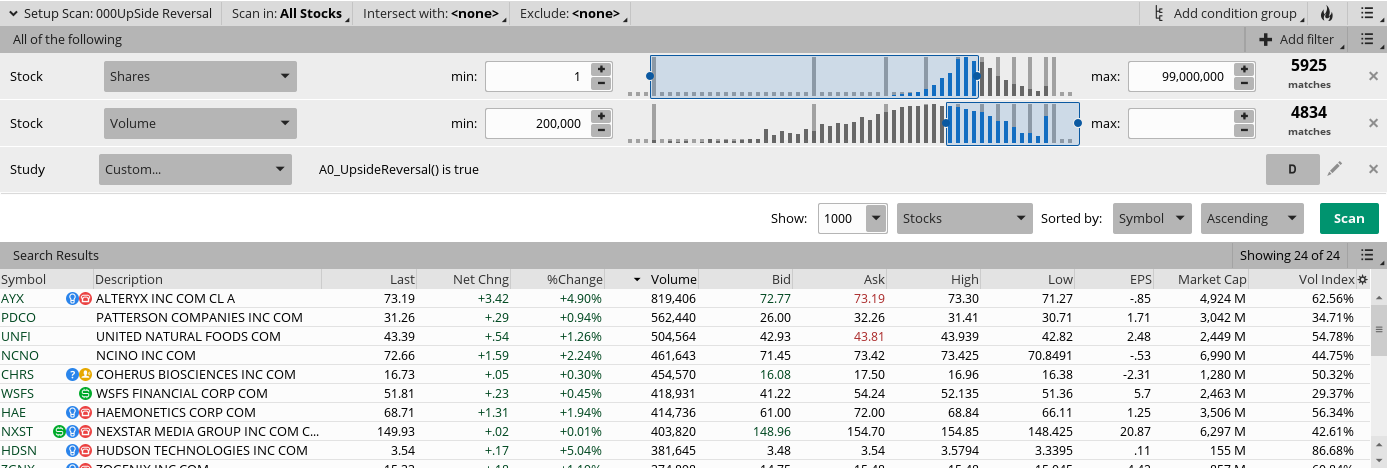

Upside Reversal Chart & Scan For ThinkOrSwim

Scan filter UpsideReversal is true

Ruby:

declare upper;

input range1 = 10;

input range2 = 30;

def SMA50 = SimpleMovingAvg(close, 50);

def EMA10 = MovAvgExponential(close, 10);

def EMA20 = MovAvgExponential(close, 20);

def Vol10 = SimpleMovingAvg(volume,10);

def pct = round((close - close[1]) / close[1] * 100, 2);

def lo = lowest(low,range1);

def hi = highest(high,range2);

def URS_calc = close >= hi * 0.75

and lo <= hi * 0.95

and high < hi * 0.98

and close > close[1]

and close > open

#and volume > Vol10[1]

and ((volume > Vol10[1] and volume > volume[1] * 0.8) or (volume > volume[1] * 1.5))

and (EMA20 > SMA50 or EMA10 > SMA50)

and close > SMA50

and SMA50 > SMA50[1]

#and (low == lo or low[1] == lo)

and (low == lo or low[1] == lo or low[2] ==lo)

and (close[2] > close [1] or close[3] > close[2])

#and URS[1] is false

;

def URS = URS_calc >0;

plot UpsideReversal = URS and !URS[1];

#UpsideReversal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_down);

#UpsideReversal.SetDefaultColor(GetColor(3));

#UpsideReversal.SetLineWeight(1);

UpsideReversal.hide();

AddChartBubble(UpsideReversal, low, “URS, Pct=" + pct, Color.PINK, no);

Last edited by a moderator: