Author Message:

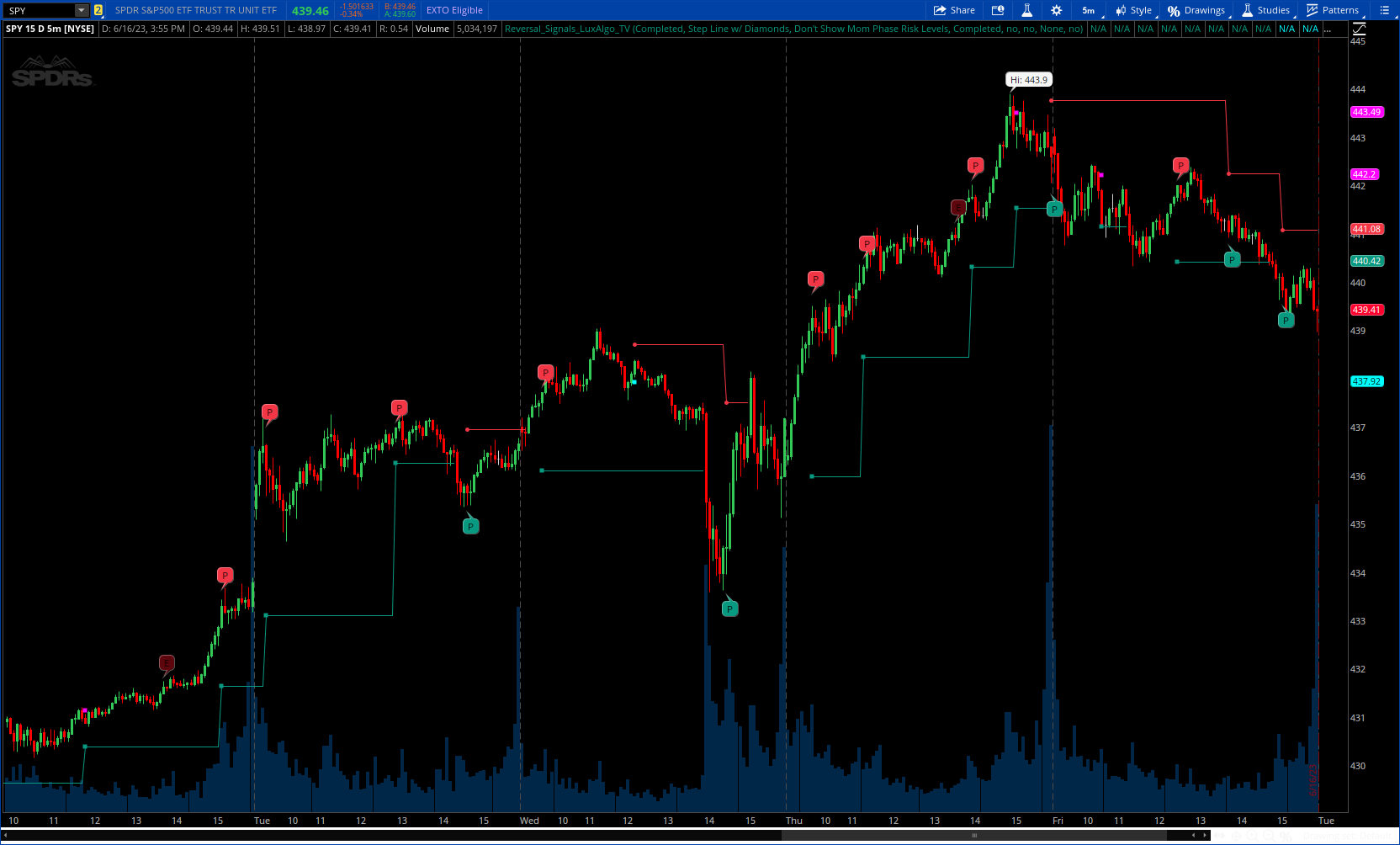

he Reversal Signals indicator is a technical analysis tool that aims to identify when a trend is fading and potentially starting to reverse.

As a counter-trend tool, the Reversal Signals indicator aims to solve the problem of several technical analysis indicators that perform well during trending markets but struggle in ranging markets. By understanding the key concepts and applications of the tool, traders can enhance their market timing and improve their trading strategies.

Note: It's important to explore the settings of the indicator to customize to your own usage & display as there are various options available as covered below.

More Details : https://www.tradingview.com/v/qTWl7ZOy/

CODE:

CSS:

#// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0)

#https://www.tradingview.com/v/qTWl7ZOy/

#// © LuxAlgo

#indicator("Reversal Signals [LuxAlgo]", "LuxAlgo - Reversal Signals"

# Converted by Sam4Cok@Samer800 - 06/2023

input MomentumPhase = {default Completed, Detailed, None};#, 'Display Phases'

input SupportAndResistanceLevels = {Circles, "Step Line", default "Step Line w/ Diamonds", "Don't Show Sup/Res Levels"};

input MomentumPhaseRiskLevels = {Circles, "Step Line",default "Don't Show Mom Phase Risk Levels"};

input TrendExhaustionPhase = {default Completed, Detailed, None}; #"Display Phases'

input DisplayTrendExhaustionPhaseRiskLevels = no; # 'Trend Exhaustion Phase Risk Levels'

input DisplayTrendExhaustionPhaseTargetLevels = no; # 'Trend Exhaustion Phase Target Levels'

input PhaseSpecificTradeSetupOptions = {Momentum, Exhaustion, Qualified, default None};

input PriceFlipsAgainstThePhaseSpecificTradeSetups = no; # 'Price Flips against the Phase Specific Trade Setups'

def na = Double.NaN;

def natr = ATR(Length = 1) / 3;

def Diamonds = SupportAndResistanceLevels == SupportAndResistanceLevels."Step Line w/ Diamonds";

def srL = SupportAndResistanceLevels!=SupportAndResistanceLevels."Don't Show Sup/Res Levels";

def rsB = MomentumPhaseRiskLevels!=MomentumPhaseRiskLevels."Don't Show Mom Phase Risk Levels";

def rsE = DisplayTrendExhaustionPhaseRiskLevels;

def ttE = DisplayTrendExhaustionPhaseTargetLevels;

def war = PriceFlipsAgainstThePhaseSpecificTradeSetups;

#--- Colors

DefineGlobalColor("noC", Color.BLACK);

DefineGlobalColor("rdC", CreateColor(242, 54, 69));

DefineGlobalColor("DrdC", CreateColor(94, 6, 13));

DefineGlobalColor("gnC", CreateColor(8, 153, 129));

DefineGlobalColor("DgnC", CreateColor(4, 78, 66));

DefineGlobalColor("whC", Color.WHITE);

DefineGlobalColor("blC", CreateColor(41, 98, 255));

DefineGlobalColor("grC", CreateColor(120, 123, 134));

DefineGlobalColor("bgC", CreateColor(0, 188, 212));

#// General Calculations

#def BnoShw = false

def Bcmpltd = MomentumPhase == MomentumPhase.Completed;

def BnoShw = if MomentumPhase == MomentumPhase.None then no else yes;

#var noShw = false

def cmpltd = TrendExhaustionPhase == TrendExhaustionPhase.Completed;

def noShw = if TrendExhaustionPhase == TrendExhaustionPhase.None then no else yes;

#// User Defined Types

#type bar

def o = open;

def h = high;

def l = low;

def c = close;

def i = AbsValue(CompoundValue(1, BarNumber(), 0));

#// Functions / Methods

#f_xLX(_p, _l) =>

script f_xLX {

input _p = close;

input _l = low;

def f_xLX = (_l > _p and _l < _p[1]) or (_l < _p and _l > _p[1]);

plot out = f_xLX;

}

#// Calculations

def ptLB = SupportAndResistanceLevels == SupportAndResistanceLevels.Circles;

def ptRS = MomentumPhaseRiskLevels == MomentumPhaseRiskLevels.Circles;

#/ Momentum Phase

def con = c < c[4];

def SbSC;

def SsSC;

if con {

SbSC = if SbSC[1] == 9 then 1 else SbSC[1] + 1;

SsSC = 0;

} else {

SsSC = if SsSC[1] == 9 then 1 else SsSC[1] + 1;

SbSC = 0;

}

def pbS = (l <= l[3] and l <= l[2]) or (l[1] <= l[3] and l[1] <= l[2]);

plot "1" = if BnoShw and !Bcmpltd and SbSC == 1 then SbSC else na;

plot "2" = if BnoShw and !Bcmpltd and SbSC == 2 then SbSC else na;

plot "3" = if BnoShw and !Bcmpltd and SbSC == 3 then SbSC else na;

plot "4" = if BnoShw and !Bcmpltd and SbSC == 4 then SbSC else na;

plot "5" = if BnoShw and !Bcmpltd and SbSC == 5 then SbSC else na;

plot "6" = if BnoShw and !Bcmpltd and SbSC == 6 then SbSC else na;

plot "7" = if BnoShw and !Bcmpltd and SbSC == 7 then SbSC else na;

plot "8" = if BnoShw and !Bcmpltd and SbSC == 8 and !pbS then SbSC else na;

plot "9" = if BnoShw and SbSC == 9 and !pbS then l - natr else na;#, 'Bullish Momentum Phases'

plot "9_" = if BnoShw and SbSC[1] == 8 and SsSC == 1 then l - natr else na;#, 'Bullish Momentum Phases'

AddChartBubble(BnoShw and !Bcmpltd and SbSC == 8 and pbS, h + natr, "P\n8", GlobalColor("DgnC"), yes);

AddChartBubble(BnoShw and SbSC == 9 and pbS, l - natr, "P", GlobalColor("gnC"), no);# Perfect Bullish Momentum Phases'

"9".SetLineWeight(2);

"9_".SetLineWeight(2);

"1".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"2".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"3".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"4".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"5".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"6".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"7".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"8".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"9".SetPaintingStrategy(PaintingStrategy.SQUARES);

"9_".SetPaintingStrategy(PaintingStrategy.SQUARES);

"1".SetDefaultColor(GlobalColor("gnC"));

"2".SetDefaultColor(GlobalColor("gnC"));

"3".SetDefaultColor(GlobalColor("gnC"));

"4".SetDefaultColor(GlobalColor("gnC"));

"5".SetDefaultColor(GlobalColor("gnC"));

"6".SetDefaultColor(GlobalColor("gnC"));

"7".SetDefaultColor(GlobalColor("gnC"));

"8".SetDefaultColor(GlobalColor("gnC"));

"9".SetDefaultColor(Color.CYAN);

"9_".SetDefaultColor(Color.CYAN);

def bC8 = SbSC[1] == 8 and SsSC == 1;

def sR = Highest(h, 9);

#bSR = 0.0

def bSR = CompoundValue(1, if SbSC == 9 or bC8 then sR else if c > bSR[1] then 0 else bSR[1], 0);

plot ResLevels = if (srL and bSR) > 0 then bSR else na;#, "Resistance Levels", color.new(rdC, 50), 2, ptLB)

plot diamond = if srL and bSR > 0 and bSR != bSR[1] and Diamonds then bSR else na;

diamond.SetLineWeight(2);

diamond.SetDefaultColor(GlobalColor("rdC"));

diamond.SetPaintingStrategy(PaintingStrategy.POINTS);

ResLevels.SetDefaultColor(GlobalColor("rdC"));

ResLevels.SetPaintingStrategy(if ptLB then PaintingStrategy.POINTS else PaintingStrategy.LINE);

def SbSL;

def SbSH;

if SbSC == 1 {

SbSL = l;

SbSH = SbSH[1];

} else

if SbSC > 0 {

SbSL = if !Min(l, SbSL[1]) then l else Min(l, SbSL[1]);

SbSH = if l == SbSL then h else SbSH[1];

} else {

SbSL = SbSL[1];

SbSH = SbSH[1];

}

def bSD_ = 2 * SbSL - SbSH;

def bSD = CompoundValue(1, if SbSC == 9 then bSD_ else if c < bSD[1] or SsSC == 9 then 0 else bSD[1], 0);

plot BullMom = if (rsB and bSD) > 0 then bSD else na;#, "Bullish Momentum Risk Levels"

BullMom.SetPaintingStrategy(if ptRS then PaintingStrategy.POINTS else PaintingStrategy.LINE);

BullMom.SetDefaultColor(GlobalColor("blC"));

def psS = (h >= h[3] and h >= h[2]) or (h[1] >= h[3] and h[1] >= h[2]);

plot "n1" = if BnoShw and !Bcmpltd and SsSC == 1 then SsSC else na;

plot "n2" = if BnoShw and !Bcmpltd and SsSC == 2 then SsSC else na;

plot "n3" = if BnoShw and !Bcmpltd and SsSC == 3 then SsSC else na;

plot "n4" = if BnoShw and !Bcmpltd and SsSC == 4 then SsSC else na;

plot "n5" = if BnoShw and !Bcmpltd and SsSC == 5 then SsSC else na;

plot "n6" = if BnoShw and !Bcmpltd and SsSC == 6 then SsSC else na;

plot "n7" = if BnoShw and !Bcmpltd and SsSC == 7 then SsSC else na;

plot "n8" = if BnoShw and !Bcmpltd and SsSC == 8 and !psS then SsSC else na;

plot "n9" = if BnoShw and SsSC == 9 and !psS then h + natr else na; #'Completed Bearish Momentum Phases'

plot "n9_" = if BnoShw and SsSC[1] == 8 and SbSC == 1 then h + natr else na; #'Early Bearish Momentum Phases'

AddChartBubble(BnoShw and !Bcmpltd and SsSC == 8 and psS, h + natr, "P\n8", GlobalColor("DrdC"), yes);

AddChartBubble(BnoShw and SsSC == 9 and psS, h + natr, "P", GlobalColor("rdC"), yes);#'Perfect Bearish Momentum Phases'

"n9".SetLineWeight(2);

"n9_".SetLineWeight(2);

"n1".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"n2".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"n3".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"n4".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"n5".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"n6".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"n7".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"n8".SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

"n9".SetPaintingStrategy(PaintingStrategy.SQUARES);

"n9_".SetPaintingStrategy(PaintingStrategy.SQUARES);

"n1".SetDefaultColor(GlobalColor("rdC"));

"n2".SetDefaultColor(GlobalColor("rdC"));

"n3".SetDefaultColor(GlobalColor("rdC"));

"n4".SetDefaultColor(GlobalColor("rdC"));

"n5".SetDefaultColor(GlobalColor("rdC"));

"n6".SetDefaultColor(GlobalColor("rdC"));

"n7".SetDefaultColor(GlobalColor("rdC"));

"n8".SetDefaultColor(GlobalColor("rdC"));

"n9".SetDefaultColor(Color.MAGENTA);

"n9_".SetDefaultColor(Color.MAGENTA);

def sC8 = SsSC[1] == 8 and SbSC == 1;

def sS = Lowest(low, 9);

def sSS = CompoundValue(1, if SsSC == 9 or sC8 then sS else if c < sSS[1] then 0 else sSS[1], 0);

plot SupLevels = if (srL and sSS) > 0 then sSS else na;# "Support Levels"

plot SupDiamonds = if (srL and sSS) > 0 and sSS != sSS[1] and Diamonds then sSS else na;

#SupLevels.SetLineWeight(2);

SupLevels.SetDefaultColor(GlobalColor("gnC"));

SupLevels.SetPaintingStrategy(if ptLB then PaintingStrategy.POINTS else PaintingStrategy.LINE);

SupDiamonds.SetLineWeight(2);

SupDiamonds.SetDefaultColor(GlobalColor("gnC"));

SupDiamonds.SetPaintingStrategy(PaintingStrategy.SQUARES);

def SsSH;

def SsSL;

if SsSC == 1 {

SsSH = h;

SsSL = SsSL[1];

} else

if SsSC > 0 {

SsSH = Max(h, SsSH[1]);

SsSL = if h == SsSH then l else SsSL[1];

} else {

SsSH = SsSH[1];

SsSL = SsSL[1];

}

def sSD = CompoundValue(1, if SsSC == 9 then 2 * SsSH - SsSL else if c > sSD[1] or SbSC == 9 then 0 else sSD[1], 0);

plot BearMom = if (rsB and sSD) > 0 then sSD else na; # "Bearish Momentum Risk Levels"

BearMom.SetPaintingStrategy(if ptRS then PaintingStrategy.POINTS else PaintingStrategy.LINE);

BearMom.SetDefaultColor(GlobalColor("blC"));

#// Trend Exhaustion Phase

def CbC8;

def CbCC;

def C_bCC;

def bCC = c <= l[2];

def b13 = c <= l[2] and l >= CbC8[1];

#def sbC;# = false

def sbC = if SbSC == 9 and CbCC[1] == 0 and (pbS or pbS[1]) then yes else

if SsSC == 9 or CbCC[1] == 13 or c > bSR then no else sbC[1];

C_bCC = if sbC then

if SbSC == 9 then

if bCC then 1 else 0 else

if bCC then CbCC[1] + 1 else CbCC[1] else 0;

CbCC = if C_bCC == 13 and b13 then C_bCC - 1 else C_bCC;

CbC8 = if CbCC == 8 and CbCC != CbCC[1] then c else CbC8[1];

def shwBC = noShw and !cmpltd and sbC and CbCC != CbCC[1];

plot "01" = if shwBC and CbCC == 1 then CbCC else na;

plot "02" = if shwBC and CbCC == 2 then CbCC else na;

plot "03" = if shwBC and CbCC == 3 then CbCC else na;

plot "04" = if shwBC and CbCC == 4 then CbCC else na;

plot "05" = if shwBC and CbCC == 5 then CbCC else na;

plot "06" = if shwBC and CbCC == 6 then CbCC else na;

plot "07" = if shwBC and CbCC == 7 then CbCC else na;

plot "08" = if shwBC and CbCC == 8 then CbCC else na;

plot "09" = if shwBC and CbCC == 9 then CbCC else na;

plot "10" = if shwBC and CbCC == 10 then CbCC else na;

plot "11" = if shwBC and CbCC == 11 then CbCC else na;

plot "12" = if shwBC and CbCC == 12 then CbCC else na;

plot "+" = if noShw and !cmpltd and sbC and CbCC == CbCC[1] and CbCC == 12 and b13 then l - natr else na;

AddChartBubble(noShw and sbC and CbCC != CbCC[1] and CbCC == 13, l - natr, "E", GlobalColor("DgnC"), no);# 'Completed Bullish Exhaustions'

"+".SetLineWeight(2);

"01".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"02".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"03".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"04".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"05".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"06".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"07".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"08".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"09".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"10".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"11".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"12".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"+".SetPaintingStrategy(PaintingStrategy.TRIANGLES);

"01".SetDefaultColor(GlobalColor("gnC"));

"02".SetDefaultColor(GlobalColor("gnC"));

"03".SetDefaultColor(GlobalColor("gnC"));

"04".SetDefaultColor(GlobalColor("gnC"));

"05".SetDefaultColor(GlobalColor("gnC"));

"06".SetDefaultColor(GlobalColor("gnC"));

"07".SetDefaultColor(GlobalColor("gnC"));

"08".SetDefaultColor(GlobalColor("gnC"));

"09".SetDefaultColor(GlobalColor("gnC"));

"10".SetDefaultColor(GlobalColor("gnC"));

"11".SetDefaultColor(GlobalColor("gnC"));

"12".SetDefaultColor(GlobalColor("gnC"));

"+".SetDefaultColor(GlobalColor("gnC"));

def CbCLt;

def CbCHt;

def CbCL;

def CbCH;

if CbCC == 1 {

CbCLt = l;

CbCHt = h;

CbCL = CbCL[1];

CbCH = CbCH[1];

} else

if sbC {

CbCHt = Max(h, CbCHt[1]);

CbCLt = if !Min(l, CbCLt[1]) then l else Min(l, CbCLt[1]);

CbCL = if h == CbCHt then l else CbCL[1];

CbCH = if l == CbCLt then h else CbCH[1];

} else {

CbCLt = CbCLt[1];

CbCHt = CbCHt[1];

CbCL = CbCL[1];

CbCH = CbCH[1];

}

def CbCD;

def CsCC;

def CsC8;

def bCT_ = 2 * CbCHt - CbCL;

def bCT = CompoundValue(1, if CbCC == 13 then bCT_ else

if c > bCT[1] or (CbCD[1] == 0 and CsCC == 13) then 0 else bCT[1], 0);

plot BullExhTarget = if (ttE and bCT) > 0 then bCT else na;#, "Bullish Exhaustion Target Levels"

BullExhTarget.SetPaintingStrategy(PaintingStrategy.POINTS);

BullExhTarget.SetDefaultColor(GlobalColor("grC"));

def bCD_ = 2 * CbCLt - CbCH;

def bCD = CompoundValue(1, if CbCC == 13 then bCD_ else

if c < bCD[1] or (bCT == 0 and CsCC == 13) then 0 else bCD[1], 0);

CbCD = bCD;

plot BullExhRisk = if (rsE and bCD) > 0 then bCD else na;#, "Bullish Exhaustion Risk Levels"

BullExhRisk.SetPaintingStrategy(PaintingStrategy.POINTS);

BullExhRisk.SetDefaultColor(GlobalColor("bgC"));

def sCC = c >= h[2];

def s13 = c >= h[2] and h <= CsC8[1];

#var ssC = false

def ssC = if SsSC == 9 and CsCC[1] == 0 and (psS or psS[1]) then yes else

if SbSC == 9 or CsCC[1] == 13 or c < sSS then no else ssC[1];

def C_sCC = if ssC then if SsSC == 9 then if sCC then 1 else 0 else

if sCC then CsCC[1] + 1 else CsCC[1] else 0;

CsCC = if C_sCC == 13 and s13 then C_sCC - 1 else C_sCC;

CsC8 = if CsCC == 8 and CsCC != CsCC[1] then c else CsC8[1];

def shwSC = noShw and !cmpltd and ssC and CsCC != CsCC[1];

plot "n01" = if shwSC and CsCC == 1 then CsCC else na;# , '', shpD, locB, noC, 0, '?' , rdC, dspN)

plot "n02" = if shwSC and CsCC == 2 then CsCC else na;

plot "n03" = if shwSC and CsCC == 3 then CsCC else na;

plot "n04" = if shwSC and CsCC == 4 then CsCC else na;

plot "n05" = if shwSC and CsCC == 5 then CsCC else na;

plot "n06" = if shwSC and CsCC == 6 then CsCC else na;

plot "n07" = if shwSC and CsCC == 7 then CsCC else na;

plot "n08" = if shwSC and CsCC == 8 then CsCC else na;

plot "n09" = if shwSC and CsCC == 9 then CsCC else na;

plot "n10" = if shwSC and CsCC == 10 then CsCC else na;

plot "n11" = if shwSC and CsCC == 11 then CsCC else na;

plot "n12" = if shwSC and CsCC == 12 then CsCC else na;

plot "n+" = if noShw and !cmpltd and ssC and CsCC == CsCC[1] and CsCC == 12 and s13 then l - natr else na;

AddChartBubble(noShw and ssC and CsCC != CsCC[1] and CsCC == 13, h + natr, "E", GlobalColor("DrdC"), yes);

"n+".SetLineWeight(2);

"n01".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n02".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n03".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n04".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n05".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n06".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n07".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n08".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n09".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n10".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n11".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n12".SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

"n+".SetPaintingStrategy(PaintingStrategy.TRIANGLES);

"n01".SetDefaultColor(GlobalColor("rdC"));

"n02".SetDefaultColor(GlobalColor("rdC"));

"n03".SetDefaultColor(GlobalColor("rdC"));

"n04".SetDefaultColor(GlobalColor("rdC"));

"n05".SetDefaultColor(GlobalColor("rdC"));

"n06".SetDefaultColor(GlobalColor("rdC"));

"n07".SetDefaultColor(GlobalColor("rdC"));

"n08".SetDefaultColor(GlobalColor("rdC"));

"n09".SetDefaultColor(GlobalColor("rdC"));

"n10".SetDefaultColor(GlobalColor("rdC"));

"n11".SetDefaultColor(GlobalColor("rdC"));

"n12".SetDefaultColor(GlobalColor("rdC"));

"n+".SetDefaultColor(GlobalColor("rdC"));

def CsCLt;

def CsCHt;

def CsCL;

def CsCH;

def CsCT;

if CsCC == 1 {

CsCLt = l;

CsCHt = h;

CsCL = CsCL[1];

CsCH = CsCH[1];

} else

if ssC {

CsCHt = Max(h, CsCHt[1]);

CsCLt = if ! Min(l, CsCLt[1]) then l else Min(l, CsCLt[1]);

CsCL = if h == CsCHt then l else CsCL[1];

CsCH = if l == CsCLt then h else CsCH[1];

} else {

CsCLt = CsCLt[1];

CsCHt = CsCHt[1];

CsCL = CsCL[1];

CsCH = CsCH[1];

}

def sCD_ = 2 * CsCHt - CsCL;

def sCD = CompoundValue(1, if CsCC == 13 then sCD_ else

if c > sCD[1] or (CsCT[1] == 0 and CbCC == 13) then 0 else sCD[1], 0);

plot BearExhRisk = if (rsE and sCD) > 0 then sCD else na; # "Bearish Exhaustion Risk Levels"

BearExhRisk.SetPaintingStrategy(PaintingStrategy.POINTS);

BearExhRisk.SetDefaultColor(GlobalColor("bgC"));

def sCT_ = 2 * CsCLt - CsCH;

def sCT = CompoundValue(1, if CsCC == 13 then sCT_ else

if c < sCT[1] or (sCD == 0 and CbCC == 13) then 0 else sCT[1], 0);

CsCT = sCT;

plot BearExhTarget = if (ttE and sCT) > 0 then sCT else na; # "Bearish Exhaustion Target Levels"

BearExhTarget.SetPaintingStrategy(PaintingStrategy.POINTS);

BearExhTarget.SetDefaultColor(GlobalColor("grC"));

#// Trade Setups

def bPFc;

def sPFc;

def lTrd;

def sTrd;

def bubS;

def lblS;

def bubL;

def lblL;

def lTrd1;

def sTrd1;

def bBl9 = if SbSC == 9 then i else bBl9[1];

def bBp9 = if bBl9 != bBl9[1] then bBl9[1] else bBp9[1];

def bB13 = if CbCC == 13 then i else bB13[1];

def sBl9 = if SsSC == 9 then i else sBl9[1];

def sBp9 = if sBl9 != sBl9[1] then sBl9[1] else sBp9[1];

def sB13 = if CsCC == 13 then i else sB13[1];

def trdS = PhaseSpecificTradeSetupOptions != PhaseSpecificTradeSetupOptions.None;

def trdMom = PhaseSpecificTradeSetupOptions == PhaseSpecificTradeSetupOptions.Momentum;

def trdExh = PhaseSpecificTradeSetupOptions == PhaseSpecificTradeSetupOptions.Exhaustion;

def sQC = (sBl9 > sB13) and (sB13 > sBp9) and (sBp9 > bBl9);

def sPFO = if trdMom then (SsSC == 9 or sC8) else

if trdExh then CsCC[5] == 13 else (SsSC == 9 and sQC);

def ssPF = if sPFO then yes else if sPFc[1] then no else ssPF[1];

sPFc = ssPF and c < c[4] and c[1] > c[5];

def bQC = (bBl9 > bB13) and (bB13 > bBp9) and (bBp9 > sBl9);

def bPFO = if trdMom then (SbSC == 9 or bC8) else

if trdExh then CbCC[5] == 13 else SbSC == 9 and bQC;

def sbPF = if bPFO then yes else if bPFc[1] then no else sbPF[1];

bPFc = sbPF and c > c[4] and c[1] < c[5];

if sPFc and trdS {

bubS = 1;

lblS = 1;

sTrd = yes;

lTrd = no;

} else

if war and sTrd1[1] and o < c and SsSC == 2 and !lTrd1[1] {

bubS = 2;

lblS = no;

sTrd = no;

lTrd = lTrd[1];

} else

if war and sTrd1[1] and o < c and ((sSD[1] != 0 and c > sSD[1]) or (sCD[1] != 0 and c > sCD[1])) {

bubS = 3;

lblS = no;

sTrd = no;

lTrd = lTrd[1];

} else {

bubS = no;

lblS = no;

sTrd = sTrd1[1];

lTrd = lTrd1[1];

}

if bPFc and trdS {

bubL = 1;

lblL = 1;

sTrd1 = no;

lTrd1 = yes;

} else

if war and lTrd and o > c and SbSC == 2 and !sTrd {

bubL = 2;

lblL = no;

sTrd1 = sTrd1[1];

lTrd1 = no;

} else

if war and lTrd and o > c and (c < bSD[1] or c < bCD[1]) {

bubL = 3;

lblL = no;

sTrd1 = sTrd1[1];

lTrd1 = no;

} else {

bubL = 0;

lblL = 0;

sTrd1 = sTrd;

lTrd1 = lTrd;

}

AddChartBubble(bubS==1, h, "S", Color.YELLOW, yes);

AddChartBubble(bubS==2, l, "!!", Color.YELLOW, no);

AddChartBubble(bubS==3, l, "!!", Color.YELLOW, no);

AddChartBubble(bubL==1, l, "L", Color.CYAN, no);

AddChartBubble(bubL==2, h, "!!", Color.CYAN, yes);

AddChartBubble(bubL==3, h, "!!", Color.CYAN, yes);

#-- END