Is there a way to find UOA in single transactions? ie, OI =< 1000, find any transactions that => 3xOI?

We don't have the ability to query historic Time and Sales transactions, only the current Open Interest and Volume...

Is there a way to find UOA in single transactions? ie, OI =< 1000, find any transactions that => 3xOI?

Option orders worth at least $1M, Volume > Open Interest, and filled via multi-exchange.

@theelderwand @XeoNoX Golden sweeps are as defined by FlowAlgo:

condition is checked or unchecked may fix it, screenshot wouldhelp more to what you are trying to expressNot sure how to insert photos, it keeps showing for a link and i only know how to take screen shot, copy and paste. hope someone can find this info without photo. my UO Put scanner brings up two AAPL Puts Expiry March 12-2021, Strike $119 and strike $118, i go to the option chain and im able to find those two puts with over 10,000 and more than 19,000 traded but when i go to time and sales i cant find either one of them. does anyone know why that might be?

Condition not checked, nothing checkedcondition is checked or unchecked may fix it, screenshot wouldhelp more to what you are trying to express

youre going to have to post a image of what your trying to explain,Condition not checked, nothing checked

https://www.youtube.com/watch?v=O_55eg00H-whttps://usethinkscript.com/threads/how-to-insert-image-in-a-post-thread.277/The scanner is new for me, I have always just used the Time and Sales, i was hoping the scanner would returns blocks, i know sweeps will be very hard to detect in the scan. Thank youthe scanner returns total volume for the day, times and sales returns the transactions. just because there was 32,090 doesn't mean that there had to be any blocks, its possible to have blocks and its possible to not have blocks. you might see a few sweeps split up but its something you have to get used to how to look for.

(yes there are ways you can tell but it comes with experience). ....it shows you the blocks as well if you can find them, they are harder to distinguish than the sweeps, times and sales is just time and sales and it just shows you the ALL "raw transactions" including blocks, sweeps, conditional, non conditional, etc, pretty much shows you everything but T&S will not distinguish it for you, its up to you to figure it out...... what you looking for appears to be a block or sweep scanner that tell you if its a block or sweep and for that you would have to pay for a service that does that if you cant figure it out on your ownThe scanner is new for me, I have always just used the Time and Sales, i was hoping the scanner would returns blocks, i know sweeps will be very hard to detect in the scan. Thank you

@theelderwand do you still use the UOA scanner? I find scanner is confusing to me as exactly you pointed out as we don't know if it is a sell or buy call. If you do use scan, how do you implement the result without knowing if it's covered call or opening call and etc? TIA@luiscervantes30 There's almost nobody who can tell you if an UOA is a buy call or a sell call. The best indication is some services that provide if the trade got filled at ask or big which can give a clue. But that's still the best guess unfortunately.

Buying or selling you can only find out after the fact see what time order comes in and what the stock does if they bought at the bid or ask sometimes that is a tell tell to what direction.I'm just curious. Looking at this scanner, I get some call options. What I cannot find is are they buying or selling, is that possible?

Good one & add BTD in the scanner column if its below 5 & verify charts quickly to confirm the trend.Lots of buzz around Unusual Option Activity (UOA) so thought I'll share out this scanner that I fine tuned for my personal use.

The scanner looks for the following:

This is just a starter to filter through and analyze how to play the UOA. Use this as a starter to find the options and then drill down. Best used on "All stocks", the indices are too noisy with many players whose underlying intentions are usually unclear.

- Option Volume of 10k or more

- OI of 5k or less - Usually indicates fresh volume coming in or the part where Unusual comes from

- Delta 0 -> 40 - You can fine tune this as you see fit. I try to stay close to the money

- DTE 14 -> 100 - Best for getting long term ones that come here

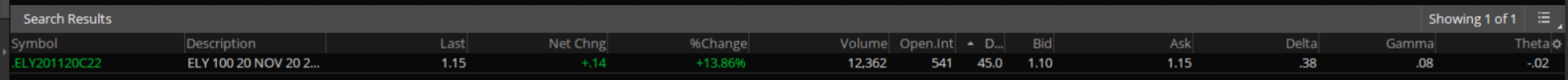

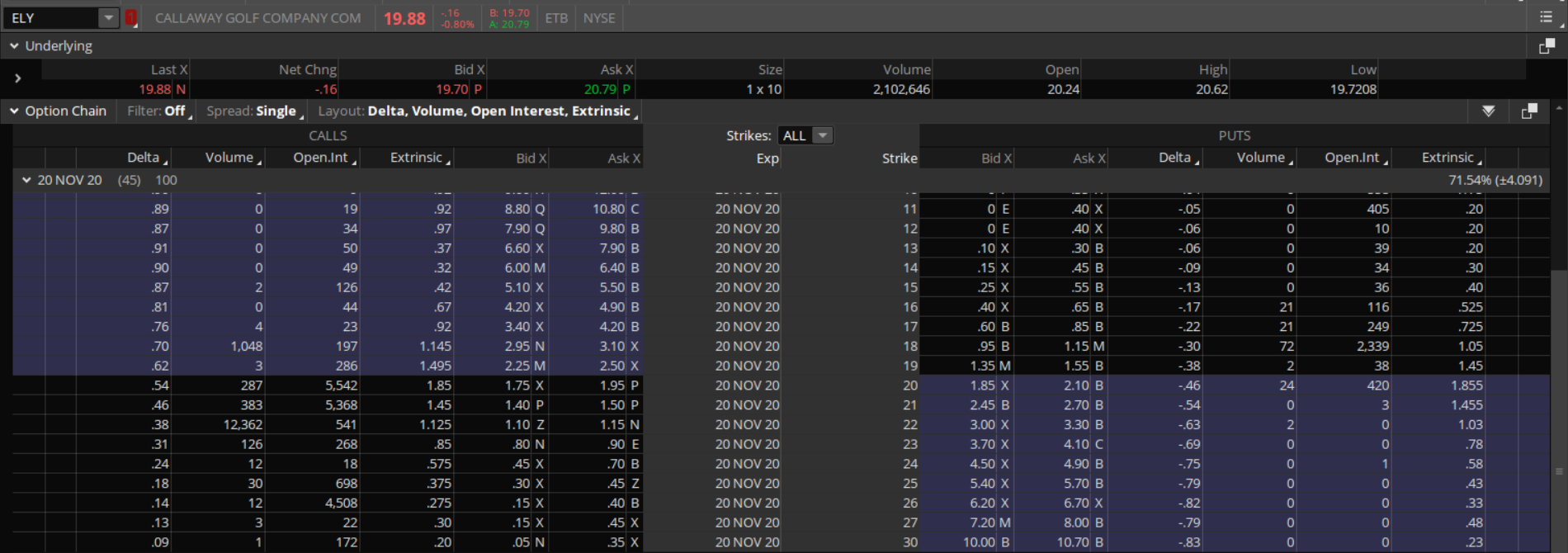

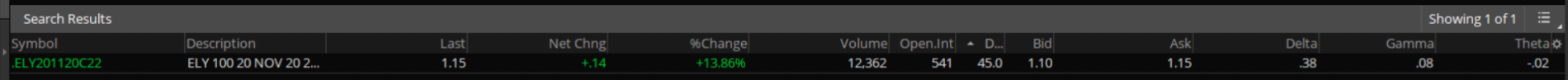

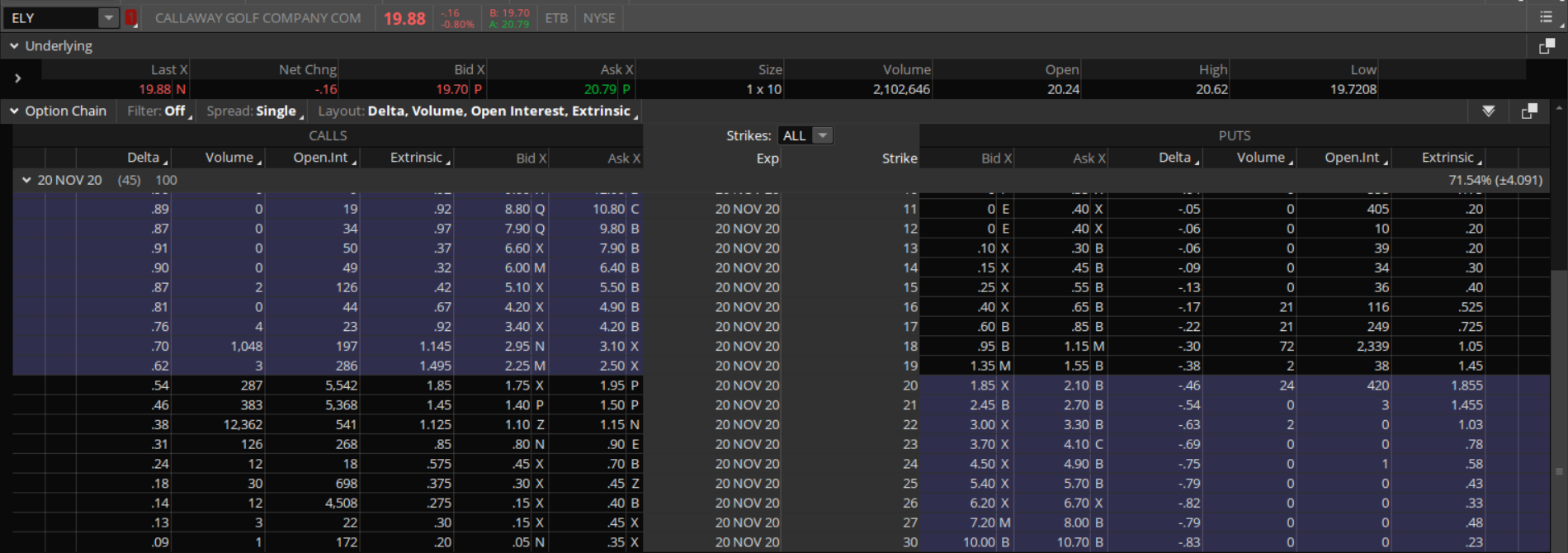

Example from today:

Option chain for ELY:

As you can see there's already good OI in 20 and 21 in the call side and 22 has 10K volume come in with 1K OI. And on the PUT side you don't see much interest. This is an entry I'll try and test it.

There could be other things that might come into play as well, but nevertheless it's a good way to track how Unusual Option Activity shows it's hands and potentially give an insight into following smart money.

Share link: http://tos.mx/REAjsH9

Why is delta only .40 and if we raise it higher what are the ramifications of that in your opinion. What do you mean "I try and stay close to the money?"Lots of buzz around Unusual Option Activity (UOA) so thought I'll share out this scanner that I fine tuned for my personal use.

The scanner looks for the following:

This is just a starter to filter through and analyze how to play the UOA. Use this as a starter to find the options and then drill down. Best used on "All stocks", the indices are too noisy with many players whose underlying intentions are usually unclear.

- Option Volume of 10k or more

- OI of 5k or less - Usually indicates fresh volume coming in or the part where Unusual comes from

- Delta 0 -> 40 - You can fine tune this as you see fit. I try to stay close to the money

- DTE 14 -> 100 - Best for getting long term ones that come here

Example from today:

Option chain for ELY:

As you can see there's already good OI in 20 and 21 in the call side and 22 has 10K volume come in with 1K OI. And on the PUT side you don't see much interest. This is an entry I'll try and test it.

There could be other things that might come into play as well, but nevertheless it's a good way to track how Unusual Option Activity shows it's hands and potentially give an insight into following smart money.

Share link: http://tos.mx/REAjsH9

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| S | Unusual Options Metric (Option Chain Column) For ThinkOrSwim | Indicators | 56 | |

|

|

Unusual Volume For ThinkOrSwim | Indicators | 45 | |

| Z | Option Heatmap and OI Strikes For ThinkOrSwim | Indicators | 206 | |

|

|

FlowAlgo Dark pool and Option Flow for ThinkorSwim | Indicators | 23 | |

|

|

Option Greeks Calculation Labels for ThinkorSwim | Indicators | 5 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.