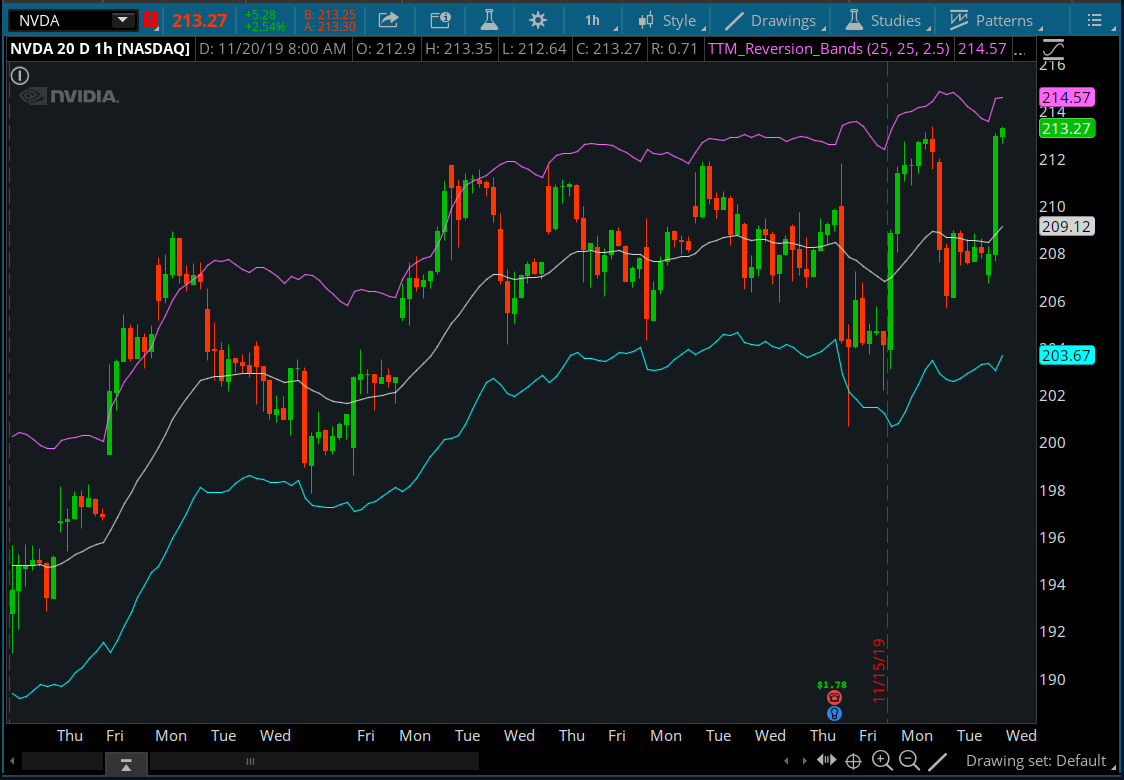

This indicator is called TTM Reversion Bands, and it's designed for mean reversion trading. When the stock's price is near the reversion bands, it's at an extreme and will generally revert to the mean over time.

In his book, John Carter shares insights on using this particular indicator for swing trading. He suggests first looking for "squeezes" and avoiding trades based on reversion-to-the-mean (RTM) during these squeezes, since they can be unpredictable.

Once a stock moves significantly above or below its average (a few ATRs), it's a good time to consider long or short options. Even better might be credit spreads, as time decay (theta) can work in your favor, even if the stock stays extended.

For settings, Carter recommends using 13, 13, 1.5 on a daily chart and 25, 25, 2.5 for intraday trading. This indicator is simple and effective for RTM strategies.

In his book, John Carter shares insights on using this particular indicator for swing trading. He suggests first looking for "squeezes" and avoiding trades based on reversion-to-the-mean (RTM) during these squeezes, since they can be unpredictable.

Once a stock moves significantly above or below its average (a few ATRs), it's a good time to consider long or short options. Even better might be credit spreads, as time decay (theta) can work in your favor, even if the stock stays extended.

For settings, Carter recommends using 13, 13, 1.5 on a daily chart and 25, 25, 2.5 for intraday trading. This indicator is simple and effective for RTM strategies.

See another version here: https://usethinkscript.com/threads/ttm-reversion-bands-for-thinkorswim.1118/#post-145270

thinkScript Code

Code:

# TTM - Reversion Bands

# Assembled by BenTen at useThinkScript.com

# Converted from https://www.tradingview.com/script/JpAQTvZH-UCS-TTM-Reversion-Bands/

input length = 25;

input atrlen = 25;

input mult = 2.5;

def tr = Max(close[1], high) - Min(close[1], low);

def range = tr;

def ma = expAverage(close, length);

def rangema = expAverage(range, atrlen);

def upper = ma + rangema * mult;

def lower = ma - rangema * mult;

plot u = upper;

plot moving = ma;

plot l = lower;

u.setDefaultColor(getColor(0));

l.setDefaultColor(getColor(1));

moving.setDefaultColor(getColor(3));Attachments

Last edited by a moderator: