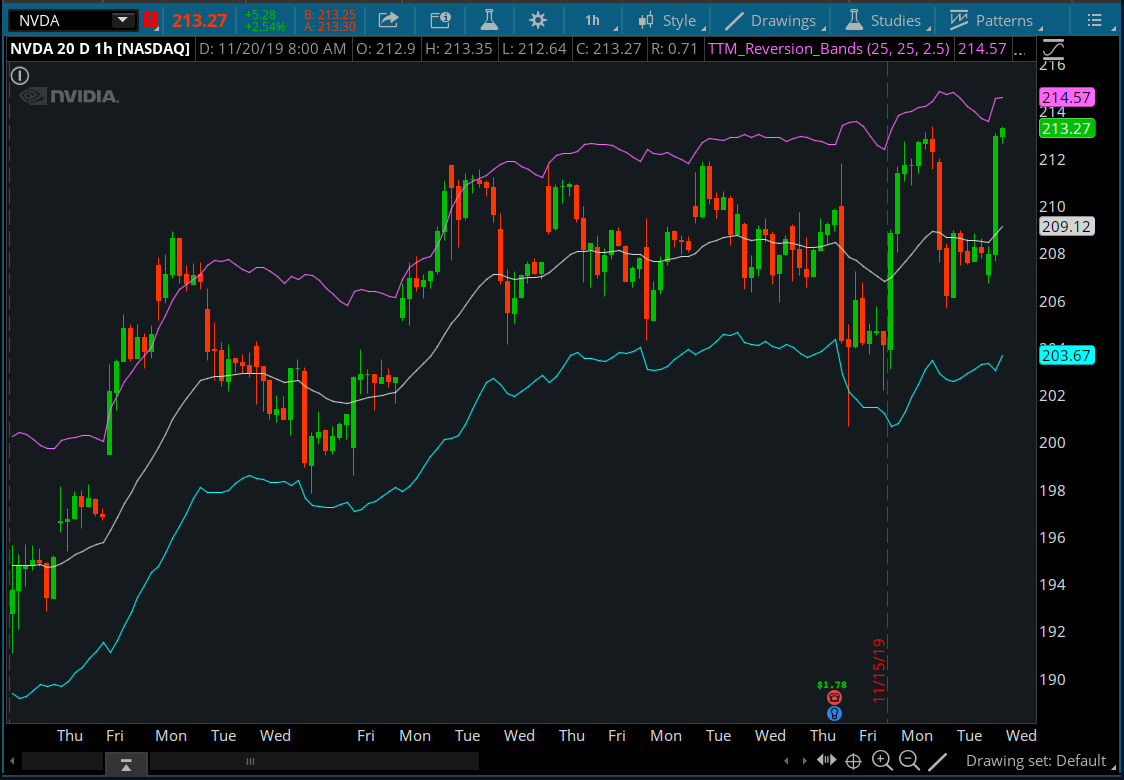

This indicator is called TTM Reversion Bands, and it's designed for mean reversion trading. When the stock's price is near the reversion bands, it's at an extreme and will generally revert to the mean over time.

thinkScript Code

Code:

# TTM - Reversion Bands

# Assembled by BenTen at useThinkScript.com

# Converted from https://www.tradingview.com/script/JpAQTvZH-UCS-TTM-Reversion-Bands/

input length = 25;

input atrlen = 25;

input mult = 2.5;

def tr = Max(close[1], high) - Min(close[1], low);

def range = tr;

def ma = expAverage(close, length);

def rangema = expAverage(range, atrlen);

def upper = ma + rangema * mult;

def lower = ma - rangema * mult;

plot u = upper;

plot moving = ma;

plot l = lower;

u.setDefaultColor(getColor(0));

l.setDefaultColor(getColor(1));

moving.setDefaultColor(getColor(3));