Hi all,

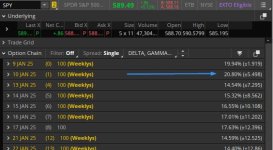

I'm trying to plot the daily expected move on my intraday chart, based yesterday's close. (What Michael Silva does at FiguringOutMoney). See the attached screenshot. For reference today is Jan 9 and the market is currently closed. It's pricing in tomorrow's IV at 20.79% or +/- 5.49pts (Jan 10). How do I get these numbers?

I tried using the imp_volatility() function and various flavors of it, but can't come up with the same numbers.

Can someone point me in the right direction?

Thanks!

I'm trying to plot the daily expected move on my intraday chart, based yesterday's close. (What Michael Silva does at FiguringOutMoney). See the attached screenshot. For reference today is Jan 9 and the market is currently closed. It's pricing in tomorrow's IV at 20.79% or +/- 5.49pts (Jan 10). How do I get these numbers?

I tried using the imp_volatility() function and various flavors of it, but can't come up with the same numbers.

Can someone point me in the right direction?

Thanks!