Tried somemore today and came up with a little bit of a start... I have some more specific questions.

Here is my code thusfar:

Code:

declare lower;

input comparisonStyle = {"CANDLE", "BAR", default "LINE"};

input secondarySecurity = "SPX";

input startdate = 20210101;

def CloseonStartDate = getvalue(close, startdate);

def SecondaryCloseonStartDate = getvalue(close(symbol = secondarySecurity), startdate);

plot Bands = close(GetSymbol()) / CloseonStartDate - close(secondarySecurity) / SecondaryCloseonStartDate;

First question is, can you set up the time frame plotted using script?

Second question, why am I not seeing anything on the graph?

Third question is: is there a way to see what values are returned so I can trouble-shoot easier?

Thanks for your help in advance.

debugging

i added a bubble to your study, to display some variables.

\n , is used in a bubble, to start a new line of characters.

the \n can be within quotes of text or on its own like this , + "\n" +

all 3 variables are NA. so something in your formulas is wrong.

Code:

declare lower;

input comparisonStyle = {"CANDLE", "BAR", default "LINE"};

input secondarySecurity = "SPX";

input startdate = 20210101;

def CloseonStartDate = getvalue(close, startdate);

def SecondaryCloseonStartDate = getvalue(close(symbol = secondarySecurity), startdate);

plot Bands = close(GetSymbol()) / CloseonStartDate - close(secondarySecurity) / SecondaryCloseonStartDate;

#---------------------------

# have to have at least 1 line/shpare plotted on a chart before bubbles will appear

plot z = 0;

input test1 = yes;

addchartbubble(

test1, 0,

CloseonStartDate + " 1\n" +

SecondaryCloseonStartDate + " 2\n" +

Bands + " B"

, color.yellow, yes);

#

create bubbles to display variable values

all 3 variables are NA , so nothing is plotted

=============================================

when things don't work, copy a code line, disable it, then make it simpler.

i always copy lines, so i have the original code line to go back to if one variation doesn't work.

example,

start with this line,

copy it,

put a # in front of it to disable it.

then make it simpler, replace a variable with a constant. does it work ?

#def CloseonStartDate = getvalue(close, startdate);

def CloseonStartDate = getvalue(close, 1);

now the bubble display a number for CloseonStartDat.

so the original formula didn't work , why?

look up getvalue()

https://tlc.thinkorswim.com/center/reference/thinkScript/Functions/Others/GetValue

Returns the value of data with the specified dynamic offset.

this function expects an offset , not a date.

an offset is a number that means, to look back (or forward) x number of bars and read a variable.

by using this as a parameter in getvalue()

startdate = 20210101;

this

getvalue( close , startdate )

is trying to read a value of close, 20 million bars back in the past.

that data doesn't exist, so it is equal to NA.

===============================

use GetYYYYMMDD() to compare each bar date to the desired date.

if they match then read the close from a bar.

if the date is not a trading day, then no match and no price will be found.

20210101 is a friday, but it is a holiday, so no trading, no price data.

20210104 is a trading day.

if the date is not visible on the chart, then no match and no price will be found.

change this,

#def CloseonStartDate = getvalue(close, startdate);

to this,

def CloseonStartDate = if bn == 1 then na else if GetYYYYMMDD() == startdate then close else CloseonStartDate[1];

i use if bn == 1 then na to initialize the variable, to NA, so it won't plot.

some people use compoundvalue(), i like to do it this way.

the last part,

else CloseonStartDate[1];

will keep the previous value, so after the date, the close price will exist in the variable.

https://tlc.thinkorswim.com/center/reference/thinkScript/Functions/Date---Time/GetYYYYMMDD

set chart to day 3 year

change date to 1/4/2021 , a valid trading day.

comparing a date number to GetYYYYMMDD() has found a price

=====================

change the secondary price formula

from this,

#def SecondaryCloseonStartDate = getvalue(close(symbol = secondarySecurity), startdate);

to this,

def SecondaryCloseonStartDate = if bn == 1 then na else if GetYYYYMMDD() == startdate then close(symbol = secondarySecurity) else SecondaryCloseonStartDate[1];

now , after the desired date, we have a 3 numbers in the bubble and a line drawn on the lower chart.

change the 5th parameter for the bubble,

from ,yes) to , no),

so it will plot below the price level of 0, so it won't cover up the line.

Code:

declare lower;

def bn = barnumber();

def na = double.nan;

input comparisonStyle = {"CANDLE", "BAR", default "LINE"};

input secondarySecurity = "SPX";

#input startdate = 20210101;

input startdate = 20210104;

#def CloseonStartDate = getvalue(close, startdate);

#def CloseonStartDate = getvalue(close, 1);

def CloseonStartDate = if bn == 1 then na else if GetYYYYMMDD() == startdate then close else CloseonStartDate[1];

#def SecondaryCloseonStartDate = getvalue(close(symbol = secondarySecurity), startdate);

def SecondaryCloseonStartDate = if bn == 1 then na else if GetYYYYMMDD() == startdate then close(symbol = secondarySecurity) else SecondaryCloseonStartDate[1];

plot Bands = close(GetSymbol()) / CloseonStartDate - close(secondarySecurity) / SecondaryCloseonStartDate;

#---------------------------

# have to have at least 1 line/shpare plotted on a chart before bubbles will appear

plot z = 0;

input test1 = yes;

addchartbubble(

test1, 0,

CloseonStartDate + " 1\n" +

SecondaryCloseonStartDate + " 2\n" +

Bands + " B"

, color.yellow, no);

#

============================

turn off the bubble by changing the code, so the default for test1 is no instead of yes

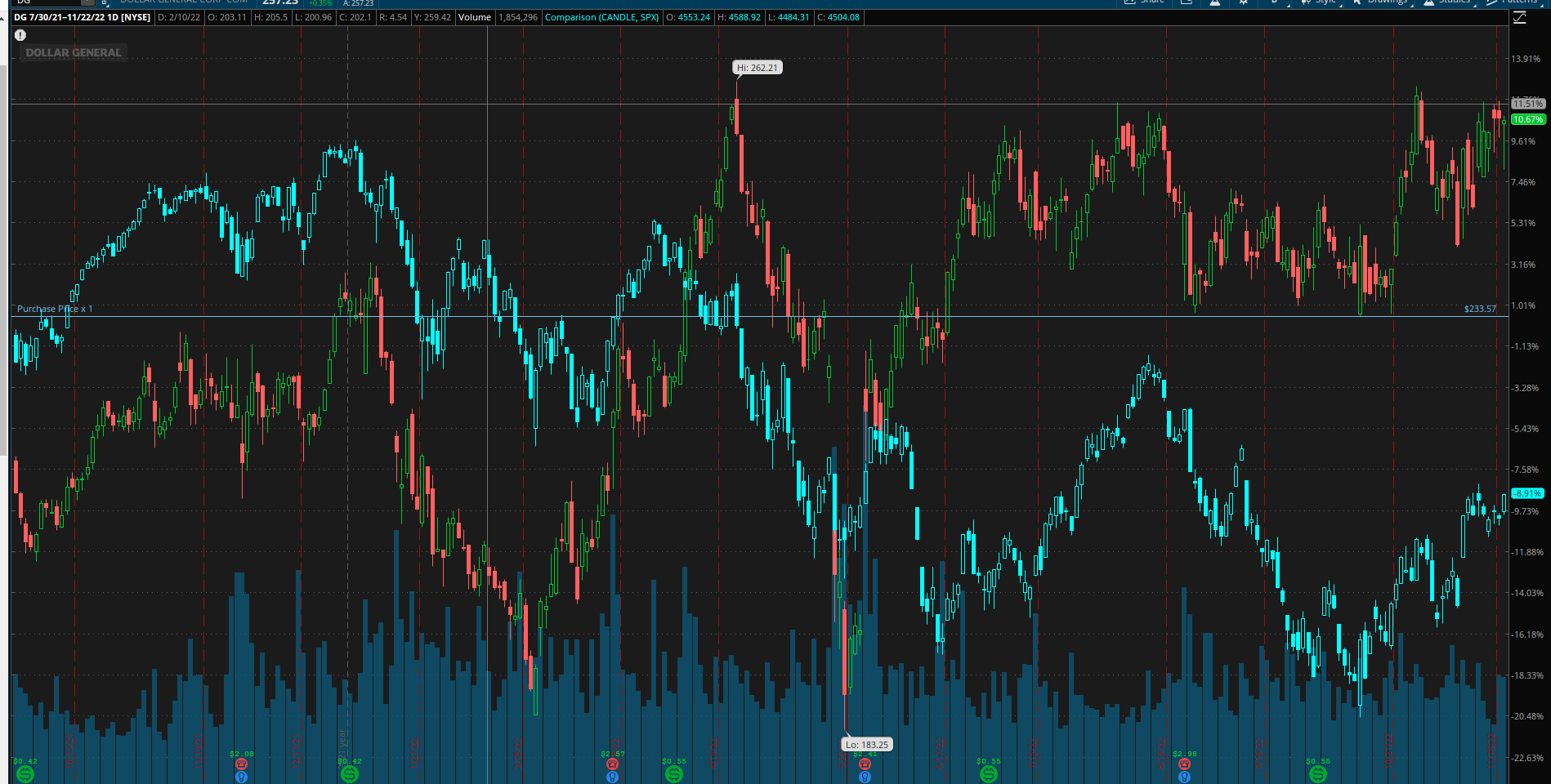

stock is EMR

chart is day 3 year

hal_debug