Start time is when Pre-Market starts and end time is 1minute before market starts.@METAL- would love this as well! can you explain this like we're newbies and explain each line and how you think about entering and exiting when it come to the dif color lines?? Thanks so much!!

Also @ Metal- do you need to change the times for LRC_V5 for say California time zone (PST)-- does the below look correct? Thank you!!

View attachment 23581

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trust The Levels - Trade Options In ThinkOrSwim

- Thread starter METAL

- Start date

- Status

- Not open for further replies.

pmohanty1987

New member

What are the other confirmation indicator you use along with the levels ? I am in-process of following this and looks promising. If you can share your complete workspace, will get more insight.I use several charts and confirmations with this strategy. IMO, any strategy we use should be also used with overall market confirmations. I typically do not take trades that are good setups if ES, NQ, SPY, QQQ, as well as others do not align with the trade direction.

Workspace on page 1.What are the other confirmation indicator you use along with the levels ? I am in-process of following this and looks promising. If you can share your complete workspace, will get more insight.

@METAL Expert Trader |

Big shoutout to @METAL for earning the well-deserved title of "Expert Trader"!

Your contributions go beyond simple answers—they’re like a masterclass in trading. Every post you share is packed with insight, helping the community grow, learn, and sharpen their skills.

The way you break down complex topics with patience and clarity is incredible. Your detailed trade explanations set a high bar, and your respectful approach to questions inspires collaboration.

Your presence here is truly invaluable, and the whole community is better because of it.

Thank you, @METAL, for your wisdom and dedication!

Do you have any instructions for how to get this on mobile TOS? Sorry if this is a dumb question, I'm new to both TOS and trading.

Sadly no.

https://usethinkscript.com/threads/...ions-in-thinkorswim.18367/page-16#post-146972

Metal do you think you could create a video how to draw and S/R levels manually and then use your indicator with a a few stocks or SPY please

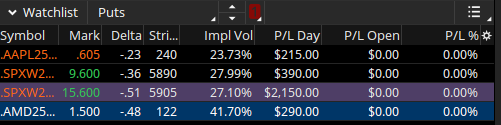

When you enter your trades, does the 2 minute candle have to close first ? or do you not wait, and enter the trade as the price goes above or below 20ema ?Todays Trades. No Losses! Great day!

View attachment 23731

AAPL:View attachment 23729

SPX:

View attachment 23732

AMD:

View attachment 23733

Todays Trades. Started off red because I did not follow my rules!  .I made back my losses and had $1,280.00 Profit

.I made back my losses and had $1,280.00 Profit

My Rules for the day is to get in calls we needed to be over 6070 ES level and 21640 NQ.

AMD (-355.00)

META: Loss ($210.00)

SPX - Loss ($190.00)

AAPL: +$305.00

IWM - Best trade of the day. $1,403.00 (TRUST THE LEVELS)

SPX Quick Scalp

My Rules for the day is to get in calls we needed to be over 6070 ES level and 21640 NQ.

AMD (-355.00)

META: Loss ($210.00)

SPX - Loss ($190.00)

AAPL: +$305.00

IWM - Best trade of the day. $1,403.00 (TRUST THE LEVELS)

SPX Quick Scalp

charlie2598

Member

this is the simple linear regression channel does it plot automatically every day.I forgot this trade today. View attachment 20989

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

745

Online

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.