@markos I like to play with shorter times. TMO is a great indicator just not working for me at this time. Probably will keep experimenting with it in the future. I have configured the stochastic and RSI to give the same phase changes but without the big oscillation. So will continue with one of those. Thanks for all your contributions here. Just was venting earlier as TMO signaled to exit a trade and then it continued higher. Oh well. Learn and move forward.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Archived: TMO True Momentum Oscillator

- Thread starter tenacity11

- Start date

-

- Tags

- oscillator

- Status

- Not open for further replies.

Yeah it was a BIG trending day today; every top was superseded, paper cut over 40 trades today, no mean reverting today. it happens. don't give up on it, things will settle down, and a combination of non trending days will mean revert the market.@diazlaz Darn TMO I am dumping it. Those oscillator swings from top to bottom are too extreme.

Working on a tweak @horserider@diazlaz Darn TMO I am dumping it. Those oscillator swings from top to bottom are too extreme.

I use the TMO also and trade 15m and 5m charts. I'd be interested in any tweaks you may be making.Working on a tweak @horserider- what type of trader are you? scalp, intraday, intermediate, position, longer term?

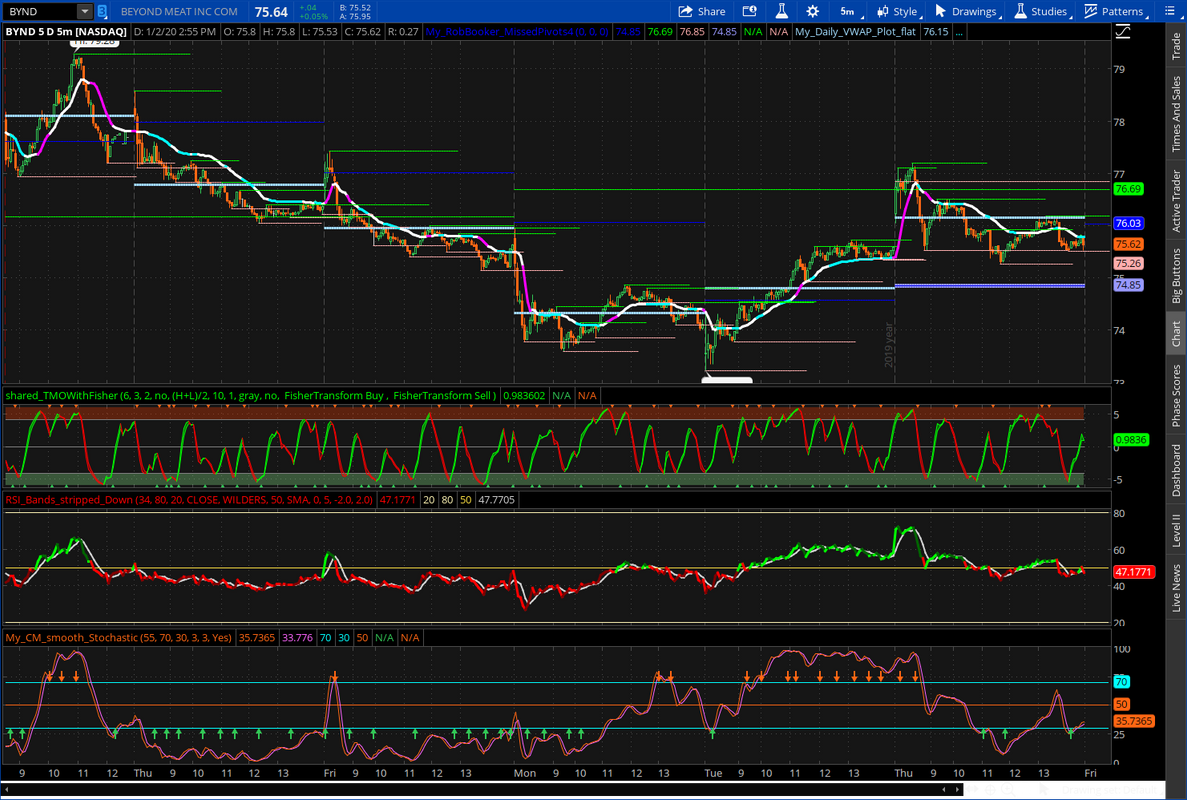

Here is why I am not going to use TMO for now anyway. Can get equivalent signals and less oscillation.

Will be happy to look at any tweaks. Always interested in varied ideas.

Will be happy to look at any tweaks. Always interested in varied ideas.

Can do the same with TMO trying to smooth the oscillation. Still prefer RSI.

I like the 3 min timeframe. I like trading futures.@chewie76 Could you let us know what time frame and type of security you trade?

I created an upper indicator that shows a dot on the candles that are over and under 5. This shows me times when I should look for a reversal. if the price doesn't reverse past that candle, then price should continue towards the trend. Below is the UPPER indicator.I like the 3 min timeframe. I like trading futures.

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

#hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

input length = 6;

input calcLength = 3;

input smoothLength = 2;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > GetValue(o, i)

then 1

else if c < GetValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

DEF Main = ExpAverage(EMA5, smoothLength);

#plot Signal = ExpAverage(Main, smoothLength);

#plot zero = if isNaN(c) then double.nan else 0;

#plot ob = if isNaN(c) then double.nan else round(length * .8);

#plot os = if isNaN(c) then double.nan else -round(length * .8);

plot sell = if main is greater than 5 then 1 else 0;

plot buy = if main is less than -5 then 1 else 0;

BUY.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

BUY.SetDefaultColor(Color.CYAN);

SELL.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

SELL.SetDefaultColor(Color.CYAN);

BUY.SetLineWeight(5);

SELL.SetLineWeight(5);

Try 6,3,2 setting.@markos I like to play with shorter times. TMO is a great indicator just not working for me at this time. Probably will keep experimenting with it in the future. I have configured the stochastic and RSI to give the same phase changes but without the big oscillation. So will continue with one of those. Thanks for all your contributions here. Just was venting earlier as TMO signaled to exit a trade and then it continued higher. Oh well. Learn and move forward.

The RSI_Rands indicator looks like it could be quite helpful.Here is why I am not going to use TMO for now anyway. Can get equivalent signals and less oscillation.

Will be happy to look at any tweaks. Always interested in varied ideas.

Is this indicator available for sharing?

@TraderBen Search for Ultimate RSI . Should find what you want there.

I created an upper indicator that shows a dot on the candles that are over and under 5. This shows me times when I should look for a reversal. if the price doesn't reverse past that candle, then price should continue towards the trend. Below is the UPPER indicator.

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

#hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

input length = 6;

input calcLength = 3;

input smoothLength = 2;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > GetValue(o, i)

then 1

else if c < GetValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

DEF Main = ExpAverage(EMA5, smoothLength);

#plot Signal = ExpAverage(Main, smoothLength);

#plot zero = if isNaN(c) then double.nan else 0;

#plot ob = if isNaN(c) then double.nan else round(length * .8);

#plot os = if isNaN(c) then double.nan else -round(length * .8);

plot sell = if main is greater than 5 then 1 else 0;

plot buy = if main is less than -5 then 1 else 0;

BUY.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

BUY.SetDefaultColor(Color.CYAN);

SELL.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

SELL.SetDefaultColor(Color.CYAN);

BUY.SetLineWeight(5);

SELL.SetLineWeight(5);

I will try this, thanks. Do I need to use your modified settings you posted for the upper indicator to work properly? I've been using the default settings.

@horserider I like the MTF TMO to avoid what you are speaking of, and I look for divergences. The second higher low or second lower high is a good entry/exit signal for me. Also, I of course use it with other indicators. Around 11:30 on the chart you posted (most recent day) where there is a lower high would be my entry on the short. It is a lower high.

Ok good plan. I would rather just have the smoother plots. Can do it on TMO also, check post #108. All momentum studies so choose what works best. I just prefer RSI then Stochastic or MACD over TMO. There is a MTF RSI on here somewhere, think I added it.

I actually really like how you slowed down the TMO, it gave a very clear sell signal on the third day from the left, about halfway through the day and a bit later when the green turned to red. Clearer to me than the other two indicators. I may try that setting. Thanks!Ok good plan. I would rather just have the smoother plots. Can do it on TMO also, check post #108. All momentum studies so choose what works best. I just prefer RSI then Stochastic or MACD over TMO. There is a MTF RSI on here somewhere, think I added it.

HighBredCloud

Well-known member

@tomsk I trust vacation was good. Thank you for helping with @tenacity11 's question.

I have one for you. How do I set the scan up for polarity change within last three days as well as within the last 3 periods with all 3 periods past the crossing? Use another input? Thanks Markos

@markos What is the reason behind your question? Is it that you want to display the last 3 days on the daily chart when TMO changed polarity? I am not sure how this particular scan works...but does it ONLY show the first day of the polarity change on the daily chart and no longer pulls up stocks that had polarity change more than a day ago...? Because if that is the case where the scanner would pull up the last 3 days of the polarity change on the daily chart that would be great...

I still don't understand about the 3 periods past crossing part...I am trying to find a good way to scan via TMO...

switchfire

Member

Hello,

Hopefully I didn't miss this somewhere on one of the pages, but I'm trying to figure out how to set up a scan for a specific time frame for when the momentum changes. It doesn't need to be in the +10/-10 areas, just any time it switches. I'm going to set an alert with the scan.

Thanks for any insight!

@tomsk @BenTen

Hopefully I didn't miss this somewhere on one of the pages, but I'm trying to figure out how to set up a scan for a specific time frame for when the momentum changes. It doesn't need to be in the +10/-10 areas, just any time it switches. I'm going to set an alert with the scan.

Thanks for any insight!

@tomsk @BenTen

@switchfire I did some work with the TMO Scan a while ago - Have a read through post #93 and #96 It might get you closer to what you seek. If not adjustments can be made

switchfire

Member

Yes, i did see your post and have actually been using it@switchfire I did some work with the TMO Scan a while ago - Have a read through post #93 and #96 It might get you closer to what you seek. If not adjustments can be made

Thanks for your contributions!!

Try something like the following. All it does is to make sure that both the main and signal plots have indeed pulled back from the previous bar. However do test it thoroughly and see if this is something you really desire. Note that this does not have the requirement for any specific level

I just ran that scan on the S&P 500 (Daily aggregation) and obtained 310 results, so looks like the tide has changed

Code:

plot scan = main < main[1] and signal < signal[1];I just ran that scan on the S&P 500 (Daily aggregation) and obtained 310 results, so looks like the tide has changed

Last edited:

HighBredCloud

Well-known member

@tomsk The scan that you mentioned in post #93 and #96 with the -10 instance...does that indicate the polarity change or simply crossing from oversold? Also if you change the instance to 10 from -10 will that scan for a bearish instance from over bought? Where exactly would you put the code from post #123? at the top or bottom of the code? Thanks...

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Archived: RSI Divergence Indicator | Indicators | 131 | |

|

|

Archived: Opening Range Breakout | Indicators | 340 | |

|

|

Archived: Supertrend Indicator by Mobius for ThinkorSwim | Indicators | 312 | |

|

|

Repaints TMO with Higher Agg_Mobius @ TSL | Indicators | 207 | |

|

|

TMO True Momentum Oscillator For ThinkOrSwim | Indicators | 143 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

667

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.