I am inputing the time frames in the input section of the code. I use a 7min chart above but regardless of whether DAY, TWO_DAYS, THREE_DAYS, FOUR_DAYS, or use MINs, I get NA, NAIs your aggregation period changed on the indicator when you switch time frames? They have to match or it wont show up

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints TMO with Higher Agg_Mobius @ TSL

- Thread starter markos

- Start date

-

- Tags

- oscillator

Repaints

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Gotcha, well what I'm saying is that if you were using 7 min for the chart. You would have to select 7min for the drop down menu option when you set up the indicator. BUT it looks like it only gives you the options of the TOS default time frames, no customs. So I dunno man, maybe somebody who is more advanced here can figure out a way to add custom time frames to the drop down menu.I am inputing the time frames in the input section of the code. I use a 7min chart above but regardless of whether DAY, TWO_DAYS, THREE_DAYS, FOUR_DAYS, or use MINs, I get NA, NA

I tried 5,10,20,30 MINS on a 5 min chart ==> NA

Hmmmm maybe the code you copied got glitched up. Copy this one, I know for a fact that it works.I tried 5,10,20,30 MINS on a 5 min chart ==> NA

Code:

# TMO ((T)rue (M)omentum (O)scillator) With Higher Aggregation

# Mobius

# V01.05.2018

#hint: TMO calculates momentum using the DELTA of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

declare Lower;

input length = 14;

input calcLength = 5;

input smoothLength = 3;

input agg = AggregationPeriod.Fifteen_min;

def o = open(period = agg);

def c = close(period = agg);

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

plot Main = ExpAverage(EMA5, smoothLength);

plot Signal = ExpAverage(Main, smoothLength);

Main.AssignValueColor(if Main > Signal

then color.green

else color.red);

Signal.AssignValueColor(if Main > Signal

then color.green

else color.red);

Signal.HideBubble();

Signal.HideTitle();

addCloud(Main, Signal, color.green, color.red);

plot zero = if isNaN(c) then double.nan else 0;

zero.SetDefaultColor(Color.gray);

zero.hideBubble();

zero.hideTitle();

plot ob = if isNaN(c) then double.nan else round(length * .7);

ob.SetDefaultColor(Color.gray);

ob.HideBubble();

ob.HideTitle();

plot os = if isNaN(c) then double.nan else -round(length * .7);

os.SetDefaultColor(Color.gray);

os.HideBubble();

os.HideTitle();

addCloud(ob, length, color.light_red, color.light_red, no);

addCloud(-length, os, color.light_green, color.light_green);

# End Code TMO with Higher AggregationTurned this into an upper indicator with breakout arrows and it's amazing for reversals. You'll get alot of fakeouts in choppy markets, so look for confirmations elsewhere. Quickest reversal alert I've found.

Code:

# TMO ((T)rue (M)omentum (O)scillator) With Higher Aggregation breakouts only

# Mobius

# custom by WTF_Dude based off V01.05.2018

#hint: TMO calculates momentum using the DELTA of price. Giving a much better picture of trend, trend reversals and divergence than momentum oscillators using price.

declare upper;

input length = 21;

input calcLength = 5;

input smoothLength = 3;

input agg = AggregationPeriod.DAY;

def o = open(period = agg);

def c = close(period = agg);

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

#Main.AssignValueColor(if Main > Signal

# then color.green

# else color.red);

# Signal.AssignValueColor(if Main > Signal

# then color.green

# else color.red);

# Signal.HideBubble();

#Signal.HideTitle();

#addCloud(Main, Signal, color.green, color.red);

plot Bull = Crosses(main, signal, CrossingDirection.ABOVE);

plot Bear = Crosses(main, signal, CrossingDirection.BELOW);

Bull.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Bull.SetDefaultColor(Color.CYAN);

Bull.SetLineWeight(2);

Bear.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Bear.SetDefaultColor(Color.MAGENTA);

Bear.SetLineWeight(2);o0oboneheado0o

New member

@wtf_dude This is Amazing! thank you! i ran a scan off it and was able to pull a couple that matched my criteria and placed the orders... this is awesome. By the way, $WATT came up on the scanner I out together last week so I took a position at .90 and it was steadily climbing through the week so yesterday I sold 60% of my position for a 10% profit... and then today it runs 380% - I got out with about 128% of the rest of my position. This TMO is for real.

@o0oboneheado0o would you mind posting the scan code? I haven't really messed with scans as of yet. Appreciate it

o0oboneheado0o

New member

I'm at work and don't have the actual thinkscript for the scan but I did post the scan in post #56 (i believe) of this thread... It's still a work in progress and I'll probably just re-tool the scan based off of what you did here since it seems a little easier.

o0oboneheado0o

New member

Just a quick update on the system I'm using incorporating the TMO... I've found that scanning for stocks that have #1 have an avg volume above 500,000 alogn with the weekly timeframe TMO main crossing the TMO signal and both are below -12, leads me to my prospects. Then I look for strong looking short term uptrends and place buy orders above the most recent peak in price action (on the daily chart). When I set the buy orders, i set them as OCO brackets with a 10% limit sell and a 3% stop order. I've found that by proper position sizing and only using 10% per position i'm risking .30% of my bankroll for a 1% overall profit. As new flags or peaks form above my entry I then place another duplicate buy order at the new level and wash rinse repeat. Basically once it breaks the previous peak level, it'll run 5-10% pretty quick and just move my stops up to my ATR trailing stop level as long as the price action is above it. It probably sounds a little busy but its really not and its very manageable for me.

In the last 3 weeks, I have gained over 50% of my total bankroll using this and man I feel like I may have a future in this. ALL this is thanks to you guys and this information you guys posted here... thank you!

In the last 3 weeks, I have gained over 50% of my total bankroll using this and man I feel like I may have a future in this. ALL this is thanks to you guys and this information you guys posted here... thank you!

Can you share your scan query? Think I got it, but not sure I'm matching you. You just doing those TMO settings on the weekly and no other time frame? Going to see if I can add some tweaksJust a quick update on the system I'm using incorporating the TMO...

Last edited:

o0oboneheado0o

New member

When I can get to my computer after work I'll get it to yaCan you share your scan query? Think I got it, but not sure I'm matching you. You just doing those TMO settings on the weekly and no other time frame? Going to see if I can add some tweaks

o0oboneheado0o

New member

Sorry for the delay brutha... heres the most recent version of the scan i'm using (link below as well as the actual criteria) and i'm finding that it gets a lot more results and with some really nice ABCD patterns to play... Also it appears to give me at least a day on most of the results to process them and evaluate before the occurrence of an optimal entry for my strategy (which is nice so I don't have to rush). I'm also looking into incorporating your TMO Upper into the scan to see if that'll help widdle it down a little better as well.Can you share your scan query? Think I got it, but not sure I'm matching you. You just doing those TMO settings on the weekly and no other time frame? Going to see if I can add some tweaks

https://tos.mx/uPfzY2r

heres the settings:

Stock: min $1 to max $100

Stock: Shares min 1000 max blank

Study: Average volume 15 period SMA of volume is greater than 500,000

Study: (Custom) TMO week "main" crosses above TMO week "signal"

Study: (Custom) Stochastic Slow "Slow K" crosses above "Slow D" [WEEK]

Study: (Custom) Stochastic Slow "Slow K" crosses above "Slow D" [DAY]

Thanks man. No problem. You leaving the TMO length at 14,5,3 or did you move it up to 21,5,3? Stochastics at 10,10?Sorry for the delay brutha... heres the most recent version of the scan i'm using (link below as well as the actual criteria) and i'm finding that it gets a lot more results and with some really nice ABCD patterns to play... Also it appears to give me at least a day on most of the results to process them and evaluate before the occurrence of an optimal entry for my strategy (which is nice so I don't have to rush). I'm also looking into incorporating your TMO Upper into the scan to see if that'll help widdle it down a little better as well.

https://tos.mx/uPfzY2r

heres the settings:

Stock: min $1 to max $100

Stock: Shares min 1000 max blank

Study: Average volume 15 period SMA of volume is greater than 500,000

Study: (Custom) TMO week "main" crosses above TMO week "signal"

Study: (Custom) Stochastic Slow "Slow K" crosses above "Slow D" [WEEK]

Study: (Custom) Stochastic Slow "Slow K" crosses above "Slow D" [DAY]

Last edited:

o0oboneheado0o

New member

yes just the 14,5,3.... is the length of 21 better? should I change it? and yes the Stochastics are both 10-10Thanks man. No problem. You leaving the TMO length at 14,5,3 or did you move it up to 21,5,3? Stochastics at 10,10?

Well, really I just ended up combining the 2 settings lists (doesnt seem to be much difference) and looked over all the charts. 2 things: this kicks out alot of garbage stocks that have tanked with earnings going up in flames, so I'd at least take a glance at fundamentals. Second, the badass thinga bout this scan is the chart patterns that are spat out are verrrry predictable Nearly everything that shows in the results is either a cup (may or may not have handle), ascending channel after massive drop, or a multiple bottoms. I'm going to keep playing with this scan definitely. Nice find man! ThanksI'll let ya know in a little bit. The 21 changes up just part of the results. The other common slow stoch setting of 14,3 spat out no results, so definitely sticking with the 10,10 there

o0oboneheado0o

New member

Yeah all i've been doing is looking left for the most recent higher high and placing a buy order like 5 cents or so above that level. If i get filled, it runs pretty nicely (for the most part) and then trail the ATR trailing stop with my stop order... it's been amazing for me.... but as you know mother market will do and change everything up on you at a moments notice so I am working on placing GTC orders on the stronger charts and trying to fine tune this strategy to allow for after/pre market pops where i won't get filled at open at a much higher price and then it tanks form the pre market profit takers... I'm thinking I just may need to stick to day orders or jump to weekly charts or something. I don't know I like being able to buy one day and then have the pop pretty quickly and then get out the next. This damn PDT rule ****s, I could do this so much easier on smaller timeframes.Well, really I just ended up combining the 2 settings lists (doesnt seem to be much difference) and looked over all the charts. 2 things: this kicks out alot of garbage stocks that have tanked with earnings going up in flames, so I'd at least take a glance at fundamentals. Second, the badass thinga bout this scan is the chart patterns that are spat out are verrrry predictable Nearly everything that shows in the results is either a cup (may or may not have handle), ascending channel after massive drop, or a multiple bottoms. I'm going to keep playing with this scan definitely. Nice find man! Thanks

o0oboneheado0o

New member

I just love this system though... it's like with $AMC yesterday, saw the first hour candle top out just under like 4 bucks so I watched it for the day and then put in an order at like 4.03 as volume started kickin up... got filled at 4.04 and then rode it on into today and then luckily nearly top ticked it as volume started to fade for a quick 40%... It's just after and pre market that is screwing with my psychology and making me over think.

o0oboneheado0o

New member

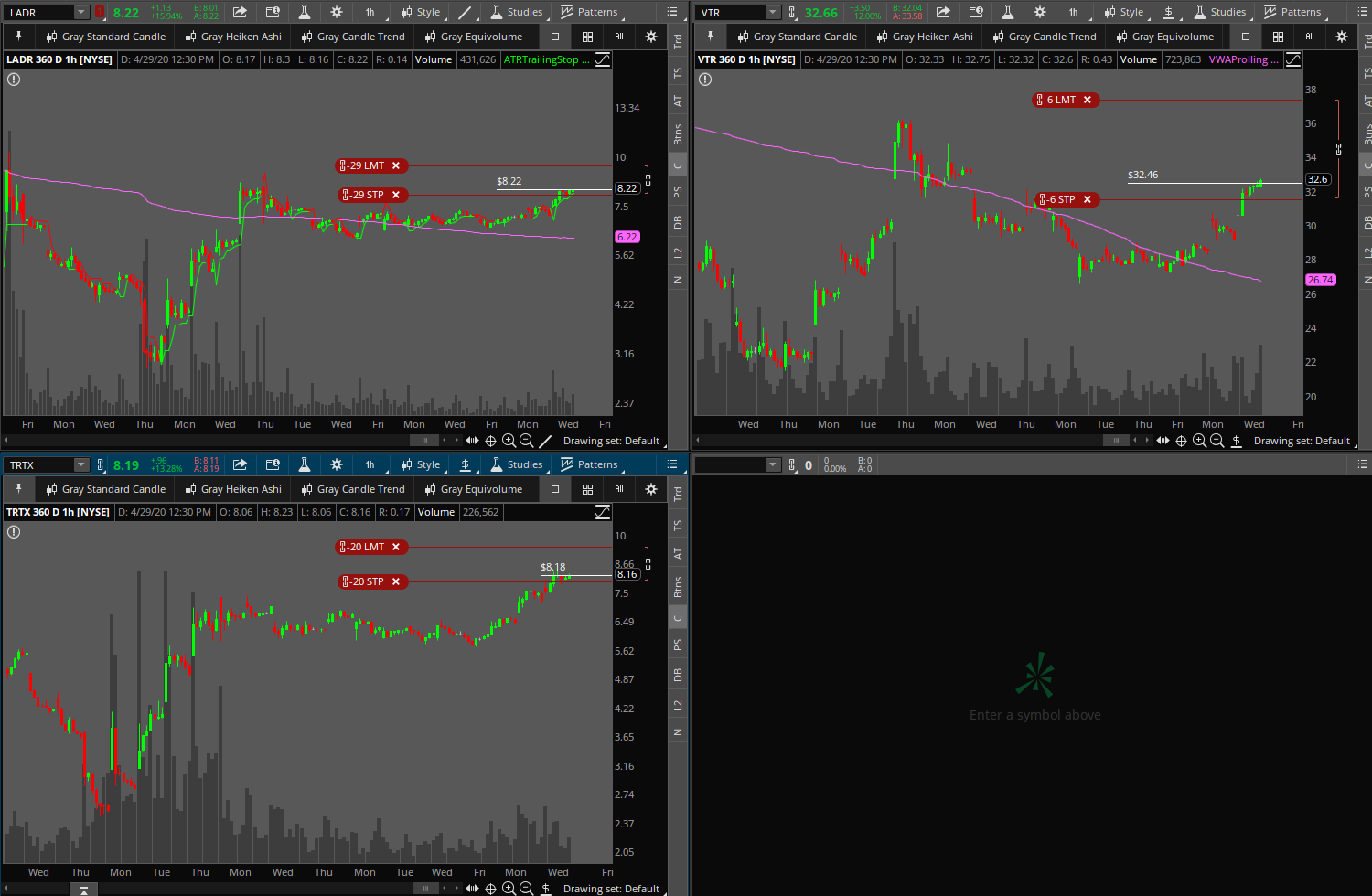

I guess we'll how these do overnight...(LADR, VTR, &TRTX)

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Archived: TMO True Momentum Oscillator | Indicators | 346 | |

|

|

TMO True Momentum Oscillator For ThinkOrSwim | Indicators | 143 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

853

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.