Hi. First of all, thank you for this great, helpful community. This is my first post ever, so please excuse me for any abnormalities.

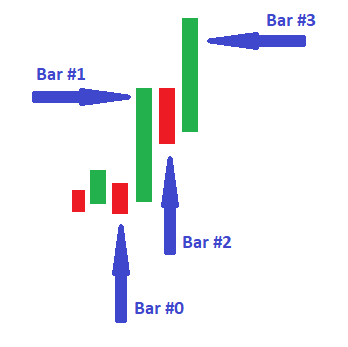

I searched our forum but have not found a script for the 3 bars play trading strategy yet (see image linked below).

I'm looking to scan any 3 bars formation and then look for entry from a small list of stock options.

The above codes are from @tradecombine (greatly appreciate this). This is the latest code/strategy for this thread (updated on 10/29/21). These codes look professionally done and seem to function much better than mine, so i will be using/testing this from now on.

Any help, suggestion, or advice is greatly appreciated! Thank you!

I searched our forum but have not found a script for the 3 bars play trading strategy yet (see image linked below).

I'm looking to scan any 3 bars formation and then look for entry from a small list of stock options.

Code:

#

#Strategy 3/4/5 Bars Breakout/down

#@tradecombine

input bodyMultiple = 2.0;

input gapMultiple = 0.0;

input volMultiple = 3.0;

input barPercent = .75; # What percentage of the bar must be body to qualify as a 3BP

input margin = 0.10; # how much to allow exceed

def VA = VolumeAvg(30).VolAvg;

#3 Bar Play:

def range3 = high[1] - low[1];

########First Bar:

#The "high" of the bar has to set a new 20 day high (or high of the previous 20 candles for intra day scans)

def bar31 = Highest(high[1], 20)

#Range of the bar has to be greater than the previous 14 bar ATR range

&& range3 > bodyMultiple * ATR(14)

# stock breaks out over range

&& open[1] > high[2] + gapMultiple * ATR(14)

# Volume is higher than average

&& volume[1] > volMultiple * VA

# breakout bar has full body or very close to it

&& (close[1] - open[1]) >= barPercent * (high[1] - low[1])

&& close[1] > open[1];

#######Second Bar:

#The "high" of the bar has to be 'less than or equal to' to high of the previous bar.

def bar32 = high <= high[1] + margin

#The "low" of the bar has to be in the upper 50% range of the first bar.

&& low >= low[1] + (0.5 * range3);

def bar3barplay = bar31 && bar32;

#--------------------------------------#

# 4 Bar Play:

def range4 = high[2] - low[2];

def bar41 = Highest(high[2], 20)

&& range4 > bodyMultiple * ATR(14)

&& open[2] > high[3] + gapMultiple*ATR(14)

&& volume[2] > volMultiple * VA

&& (close[2] - open[2]) >= barPercent * (high[2] - low[2])

&& close[2] > open[2];

def bar42 = high[1] <= high[2] + margin

&& low[1] >= low[2] + (0.5 * range4);

def bar43 = high <= high[2] + margin

&& low >= low[2] + (0.5 * range4);

def bar4barplay = bar41 && bar42 && bar43;

# 5 Bar Play:

def range5 = high[3] - low[3];

def bar51 = Highest(high[3], 20)

&& range5 > bodyMultiple * ATR(14)

&& open[3] > high[4] + gapMultiple*ATR(14)

&& volume[3] > volMultiple * VA

&& (close[3] - open[3]) >= barPercent * (high[3] - low[3])

&& close[3] > open[3];

def bar52 = high[2] <= high[3] + margin

&& low[2] >= low[3] + (0.5 * range5);

def bar53 = high[1] <= high[3] + margin

&& low[1] >= low[3] + (0.5 * range5);

def bar54 = high <= high[3] + margin

&& low >= low[3] + (0.5 * range5);

def bar5barplay = bar51 && bar52 && bar53 && bar54;

plot scan = bar3barplay OR bar4barplay OR bar5barplay;The above codes are from @tradecombine (greatly appreciate this). This is the latest code/strategy for this thread (updated on 10/29/21). These codes look professionally done and seem to function much better than mine, so i will be using/testing this from now on.

Any help, suggestion, or advice is greatly appreciated! Thank you!

Last edited: