In, @martinflds . TYVM...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Universe of ThinkScript - Your One Stop Research Shop!

- Thread starter markos

- Start date

Hi @BenTen , You may want to move that Google Drive to the Tutorials and pin it. Would that work better? Just wondering. Take care!Thank you for sharing. Please enable the share settings in Google Drive so that we don't have to request for permission to view the document.

Big duh! on my part, thanks@markos I thought it would suitable here since that Google Drive is a compilation of ToS resources similar to what we already have here. Hope you're doing well.

lukeskywalker

New member

Hi guys. A lot of useful scripts have accumulated. I want to share in this thread.

First script is HIGH, LOW, OPEN, CLOSE – SUPPORT AND RESISTANCE LINE

The indicator will draw levels Opening, Close, High, and Low of a current and previous day on the chart.

"Outside Bar" Indicator

The indicator shows us the "Outside Bar" pattern.

It will be shown on any timeframe but I recommend looking at the daytime period. You will see a certain number of signals on the chart.

The "Inside Bar" candlestick pattern is shown with arrows when the candlestick pattern is formed in the chart. An Inside Bar is formed when price trades within the high and low range of the previous day, making the candle an inside day or an inside bar. The inside bar is therefore a two candlestick price pattern. An inside bar is also similar to a bullish or a bearish harami candlestick pattern.

⚙Install the indicator in Thinkorswim. There are no special settings, but you can set the color of the arrows, size and so on.

_______________________________________

The Double Outside Bar candlestick pattern shows signals on the chart with arrows at the moment when such pattern is formed. The signal is very rare.

The Double Outside Bar candlestick pattern shows signals on the chart with arrows at the moment when such pattern is formed. The signal is very rare.

⚙ First, import indicator by using <Edit Studies> menu. It will appear on the list, but you cannot see it right away.You need to enter Studies – User Defined. Click on the necessary indicator and add - "Add Study". There are no special settings for this indicator.

_______________

First script is HIGH, LOW, OPEN, CLOSE – SUPPORT AND RESISTANCE LINE

The indicator will draw levels Opening, Close, High, and Low of a current and previous day on the chart.

Code:

#thinkscript indicator : OCHLO_levels

#It draws yesterday High, Low, Open, Close support and resistance line

#by thetrader.top

input sPeroid = {default DAY, WEEK, MONTH};

input iHigh = {default “yes”, “no”};

input iLow = {default “yes”, “no”};

input iClose = {default “yes”, “no”};

input iOpen = {default “yes”, “no”};

input iTodayOpen = {default “yes”, “no”};

plot pHigh = if !iHigh then high(period = sPeroid)[1] else Double.NaN;

plot pLow = if !iLow then low(period = sPeroid)[1] else Double.NaN;

plot pClose = if !iClose then close(period = sPeroid)[1] else Double.NaN;

plot pOpen = if !iOpen then open(period = sPeroid)[1] else Double.NaN;

plot pTodayOpen = if !iTodayOpen then open(period = sPeroid)[0] else Double.NaN;

pHigh.SetDefaultColor (Color.GREEN);

pHigh.SetPaintingStrategy(PaintingStrategy.DASHES);"Outside Bar" Indicator

The indicator shows us the "Outside Bar" pattern.

It will be shown on any timeframe but I recommend looking at the daytime period. You will see a certain number of signals on the chart.

Code:

#thinkscript indicator: Outside_Bar.

#It shows the "Outside Bar" pattern

#by thetrader.top

def bSignalDown=open[1]<close[1]and high>high[1] and close<low[1] or open[1]>close[1] and high>high[1] and close<low[1];

def bSignalUp = open[1]>close[1] and low<low[1] and close>high[1] or open[1]<close[1] and low<low[1] and close>high[1];

plot down = if bSignalDown then high else double.NaN;

plot up = if bSignalUp then high else double.NaN;

up.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_up);

down.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_down);

up.setDefaultColor(color.LIGHT_green);

down.setDefaultColor(color.LIGHT_red);The "Inside Bar" candlestick pattern is shown with arrows when the candlestick pattern is formed in the chart. An Inside Bar is formed when price trades within the high and low range of the previous day, making the candle an inside day or an inside bar. The inside bar is therefore a two candlestick price pattern. An inside bar is also similar to a bullish or a bearish harami candlestick pattern.

⚙Install the indicator in Thinkorswim. There are no special settings, but you can set the color of the arrows, size and so on.

_______________________________________

Code:

#thinkscript indicator:Inside_Bar.

#Shows the pattern “Inside Bar”

#by thetrader.top

def bSignalDown = open[1]>close[1] and open<close and high<high[1] and low>low[1];

def bSignalUp = open[1]<close[1] and open>close and high<high[1] and low>low[1];

plot down = if bSignalDown then high else double.NaN;

plot up = if bSignalUp then high else double.NaN;

up.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_up);

down.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_down);

up.setDefaultColor(color.LIGHT_green);

down.setDefaultColor(color.LIGHT_red);⚙ First, import indicator by using <Edit Studies> menu. It will appear on the list, but you cannot see it right away.You need to enter Studies – User Defined. Click on the necessary indicator and add - "Add Study". There are no special settings for this indicator.

_______________

Code:

#thinkscript indicator: Double_Outside_bar.

#Shows the pattern "Double Outside bar."

#by thetrader.top

def bSignalDown = 0;

def bSignalUp = high[2]<high[1] and high[1]<high and low[2]>low[1] and low[1]>low;

plot down = if bSignalDown then high else double.NaN;

plot up = if bSignalUp then high else double.NaN;

up.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_up);

down.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_down);

up.setDefaultColor(color.LIGHT_green);

down.setDefaultColor(color.LIGHT_red);

Last edited by a moderator:

lukeskywalker

New member

Double Inside Bar Indicator

Candlestick pattern indicator Double Inside Bar shows when the "inside bar" pattern is drawn on the chart 2 times in a row. The signal is very rare as in the "Double Outside bar" Indicator.

Candlestick pattern indicator Double Inside Bar shows when the "inside bar" pattern is drawn on the chart 2 times in a row. The signal is very rare as in the "Double Outside bar" Indicator.

⚙First, import indicator by using <Edit Studies> menu. It will appear on the list, but you cannot see it right away.

You need to enter Studies – User Defined. Click on the necessary indicator and add - "Add Study". There are no special settings for this indicator.

________________

⚙First, import indicator by using <Edit Studies> menu. It will appear on the list, but you cannot see it right away.

You need to enter Studies – User Defined. Click on the necessary indicator and add - "Add Study". There are no special settings for this indicator.

________________

Code:

#thinkscript indicator: Double_Inside_bar.

#Shows the pattern "Double Inside bar"

#by thetrader.top

def bSignalDown = high[2]>high[1] and high[1]>high and low[2]<low[1] and low[1]<low;

def bSignalUp = 0;

plot down = if bSignalDown then high else double.NaN;

plot up = if bSignalUp then high else double.NaN;

up.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_up);

down.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_down);

up.setDefaultColor(color.LIGHT_green);

down.setDefaultColor(color.LIGHT_red);@lukeskywalker thank you for your contributions to useThinkscript. It's very much appreciated!

T

Thomas

Guest

Stan_L offered a treasure trove, but were you able to make money with them?? A treasure chest....but again will it help to make money.Download this almost 200 page PDF for training and examples of thinkscript. This is StanL's original file that the TOS helpdesk often refers to.

https://onedrive.live.com/redir?res...F file|2dd9ed19-44e9-4f45-a8d7-b00efc857ea5/)

It's from JQ's OneNote. Thanks and credit go to him for making this resource available.

Last edited by a moderator:

Most of his code is for example purposes only and not necessarily designed for actual trade use, but some of the code does work well... I have used his examples as guides in writing my own custom studies...Stan_L offered a treasure trove, but were you able to make money with them?? A treasure chest....but again will it help to make money.

T

Thomas

Guest

Yes,...you are right, many experimental pieces....Most of his code is for example purposes only and not necessarily designed for actual trade use, but some of the code does work well... I have used his examples as guides in writing my own custom studies...

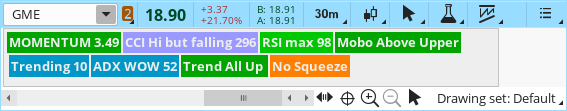

Chris Stop Light Labels

This study contains just the labels from the Chris Stop Light dashboard found in post#18

MOMENTUM Red =lower price compared to price from 5 candles ago. Green =higher price compared to price from 5 candles ago

CCI<-100 price way below historic avg and falling=DARK Red. CCI<-100 price way below historic avg and rising=Violet.

CCI<0 price slightly below avg and falling=Red. CCI<0 price slightly below avg and rising=Violet.

CCI>0 price above and rising =Green. CCI>0 price above and falling =Red

CCI> 100 price way above historic avg and rising=Cyan. CCI> 100 price way above historic avg and falling=Violet.

RSI <20 =DARK Red. RSI>20 and rising =Green. RSI>80 =light Green. RSI<80 and falling =Red

MOBO price inside BOLLINGER BANDS=Red. Price above BB=Green. Price below BB=Violet

CHOP considered CHOPPY when the index is above 61.8=Red. Price is considered TRENDING when the index is below 38.2=Cyan. As the index rises above 50 and approaches CHOP=light Green. Otherwise, Green. Read more

ADX<20 =Red. ADX>20 =Green. ADX>40 =Cyan.

The Trend ALL creates an average for these indicators to determine if the trend is overall Bull/Bear

Squeeze Orange Labels are Squeezed or Not Squeezed +# of bars squeezed. Read more

Here is the share link: http://tos.mx/7nbKjCu

This study contains just the labels from the Chris Stop Light dashboard found in post#18

MOMENTUM Red =lower price compared to price from 5 candles ago. Green =higher price compared to price from 5 candles ago

CCI<-100 price way below historic avg and falling=DARK Red. CCI<-100 price way below historic avg and rising=Violet.

CCI<0 price slightly below avg and falling=Red. CCI<0 price slightly below avg and rising=Violet.

CCI>0 price above and rising =Green. CCI>0 price above and falling =Red

CCI> 100 price way above historic avg and rising=Cyan. CCI> 100 price way above historic avg and falling=Violet.

RSI <20 =DARK Red. RSI>20 and rising =Green. RSI>80 =light Green. RSI<80 and falling =Red

MOBO price inside BOLLINGER BANDS=Red. Price above BB=Green. Price below BB=Violet

CHOP considered CHOPPY when the index is above 61.8=Red. Price is considered TRENDING when the index is below 38.2=Cyan. As the index rises above 50 and approaches CHOP=light Green. Otherwise, Green. Read more

ADX<20 =Red. ADX>20 =Green. ADX>40 =Cyan.

The Trend ALL creates an average for these indicators to determine if the trend is overall Bull/Bear

Squeeze Orange Labels are Squeezed or Not Squeezed +# of bars squeezed. Read more

Here is the share link: http://tos.mx/7nbKjCu

Code:

#Name: ChrisStoplight LABELS ONLY

#Programmed By: Chris Ball (xxx) on #1/31/09

#Added Choppiness and Squeeze Indicator by Mobius@Thinkscript Lounge

#Added FW_Mobo_Basic

#Modified to add/change indicators

#Modified to show labels only @MerryDay 12/2020

input rsilength = 5;

def c = close;

def h = high;

def l = low;

def o = open;

#MOMENTUM

input lengthmo = 5;

def Momentum = c - c[lengthmo];

def mopos = if Momentum >= 0 then 3 else 2;

def moneg = if Momentum < 0 then 3 else 2;

#CCI

input lengthcci = 13;

def pricecci = c + l + h;

def linDev = LinDev(pricecci, lengthcci);

def CCI = if linDev == 0 then 0 else (pricecci - Average(pricecci, lengthcci)) / linDev / 0.015;

def cci1 = if CCI >= 0 then 4 else 3;

def cci2 = if CCI < 0 then 4 else 3;

#RSI

def rsi = reference RSI(length = rsilength)."RSI";

def rsi1 = if rsi >= 50 then 5 else 4;

def rsi2 = if rsi < 50 then 5 else 4;

#Bollinger Bands MOBO

input lengthmobo = 10;

input Num_Dev_Dn = -0.8;

input Num_Dev_up = 0.8;

def sDev = StDev(data = c, length = lengthmobo);

def Midmobo = Average(c, length = lengthmobo);

def Lowermobo = Midmobo + Num_Dev_Dn * sDev;

def Uppermobo = Midmobo + Num_Dev_up * sDev;

def upmobo = if upmobo[1] == 0 and c >= Uppermobo then 1 else if upmobo[1] == 1 and c > Lowermobo then 1 else 0;

def upmo = if upmobo and c > Uppermobo then 1 else 0;

def dnmo = if !upmobo and c > Lowermobo then 1 else 0;

def mobo1 = if upmobo == 1 then 6 else 5;

def mobo2 = if upmobo == 0 then 6 else 5;

#Trend

#Choppiness Indicator from Mobius @My Trade with color changes by Lar

#Set ADX & SMA to how you trade

#Indicates Trending or Chop along with current ADX level

def ADXLength = 5; #TOS default 10

input AverageType = AverageType.HULL;

def AvgLength = 5; #TOS default 8

def Lengthchop = 8;

def Signal = 3;

def Choppy = 61.8;

def MidLine = 50;

def Trending = 38.2;

def ADX = Round(reference ADX(length = ADXLength), 0);

def AVG = MovingAverage(AverageType = AverageType, c, AvgLength);

def CIB = ((Log(Sum(TrueRange(h, c, l), Lengthchop) /

(Highest(if h >= c[1] then h else

c[1], Lengthchop) -

Lowest( if l <= c[1] then l else c[1], Lengthchop)))

/ Log(10)) / (Log(Lengthchop) / Log(10))) * 100;

def CI = CIB;

#Choppiness/Trend Indicator

def chop = if CI > MidLine then 7 else 6;

def trend1 = if CI < MidLine and c > AVG then 7 else 6;

def trend2 = if CI < MidLine and c < AVG then 7 else 6;

#Overall

def uptrend = if mopos == 3 and cci1 == 4 and rsi1 == 5 and mobo1 == 6 then 8 else 7;

def dntrend = if moneg == 3 and cci2 == 4 and rsi2 == 5 and mobo2 == 6 then 8 else 7;

#Squeeze by Mobius @ My Trade with color mod by Lar

#Look at Cloud Color as a possible indication of direction once squeeze ends

def nK = 1.5;

def nBB = 2.0;

def lengthsqueeze = 20;

def BBHalfWidth = StDev(c, lengthsqueeze);

def KCHalfWidth = nK * Average(TrueRange(h, c, l), lengthsqueeze);

def isSqueezed = nBB * BBHalfWidth / KCHalfWidth < 1;

#Squeeze for Longer Term Trend Indicator

def BBS_Ind = if isSqueezed then 8.2 else Double.NaN;

DefineGlobalColor("Pre_Cyan", CreateColor(0, 150, 200)) ;

DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ;

DefineGlobalColor("Label2Green", CreateColor(0, 200, 0)) ;

DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ;

AddLabel(yes, "MOMENTUM " + Round(Momentum, 2), if Momentum >= 0 then GlobalColor("LabelGreen") else GlobalColor("LabelRed"));

AddLabel(yes,

if CCI < -100 and CCI > CCI[1] then "CCI down but rising " +round(CCI,0) else

if CCI < -100 then "CCI down & falling " +round(CCI,0) else

if CCI > 100 and CCI > CCI[1] then "CCI TRENDING " +round(CCI,0) else

if CCI > 100 then "CCI Hi but falling " +round(CCI,0) else

if CCI < 0 and CCI > CCI[1] then "CCI low but rising " +round(CCI,0) else

if CCI < 0 then "CCI low & falling " +round(CCI,0) else

if CCI > CCI[1] then "CCI Rising " +round(CCI,0) else "CCI Falling " +round(CCI,0),

if CCI < -100 and CCI > CCI[1] then color.violet else

if CCI < -100 then color.dark_red else

if CCI > 100 and CCI > CCI[1] then GlobalColor("Pre_Cyan") else

if CCI > 100 then color.violet else

if CCI < 0 and CCI > CCI[1] then color.violet else

if CCI < 0 then GlobalColor("LabelRed") else

if CCI > CCI[1] then GlobalColor("LabelGreen") else GlobalColor("LabelRed"));

AddLabel(yes,

if rsi < 20 then "RSI bottom " +round(rsi,0) else

if rsi > 80 then "RSI max " +round(rsi,0) else

if rsi > rsi[1] then "RSI Rising " +round(rsi,0) else "RSI Falling " +round(rsi,0),

if rsi < 20 then Color.Dark_red else

if rsi > 80 then GlobalColor("Label2Green") else

if rsi > rsi[1] then GlobalColor("LabelGreen") else GlobalColor("LabelRed"));

AddLabel(yes, if upmobo and upmo then "Mobo Above Upper" else

if !upmo and dnmo then "Mobo Below Lower" else "Mobo Inside",

if upmobo and upmo then GlobalColor("LabelGreen") else

if !upmo and dnmo then color.violet else GlobalColor("LabelRed"));

AddLabel(yes, if CI < 38.2 then "Trending " +round(CI,0) else

if CI > 61.8 then "CHOPPY " +round(CI,0) else "No Chop " +round(CI,0),

if CI < 38.2 then GlobalColor("Pre_Cyan") else

if CI > 61.8 then GlobalColor("LabelRed") else

if CI > midLine then GlobalColor("Label2Green") else GlobalColor("LabelGreen"));

AddLabel(yes,

if ADX <= 20 then "ADX No Trend " +round(ADX,0) else

if ADX > 40 then "ADX WOW " +round(ADX,0) else "ADX Trending " +round(ADX,0),

if ADX < 20 then GlobalColor("LabelRed") else

if ADX > 40 then GlobalColor("Pre_Cyan") else GlobalColor("LabelGreen"));

AddLabel(yes, if uptrend == 8 then "Trend All Up " else if dntrend == 8 then "Trend All Down " else "Trend Mixed ", if uptrend == 8 then GlobalColor("LabelGreen") else if dntrend == 8 then GlobalColor("LabelRed") else Color.GRAY);

#Count of Periods in consecutive squeeze

rec count = if isSqueezed then count[1] + 1 else 0;

AddLabel(yes, if isSqueezed then Concat("Squeeze ", count) else "No Squeeze", Color.DARK_ORANGE);

Last edited:

mourningwood4521

Member

@MerryDay What I'm not understanding is for ADX, its showing right now on CHWY at 69 but when I scroll my mouse along the chart, the values in the title and on the graph change, But the values in the SHOW LABELS section are only showing today. Is there a way to make the labels sync with my mouse?

Edit:

So the one you posted doesn't show anything and the key with the title is disappearing. Like, when I hold my mouse over the one you linked, it shows Y: N/A and then that entire line disappears when my mouse goes back up to the chart. I will try to tweak some things as yours shows more info on the Labels, but I like the mass of info on post#18 of this thread.

Edit:

So the one you posted doesn't show anything and the key with the title is disappearing. Like, when I hold my mouse over the one you linked, it shows Y: N/A and then that entire line disappears when my mouse goes back up to the chart. I will try to tweak some things as yours shows more info on the Labels, but I like the mass of info on post#18 of this thread.

Last edited:

@mourningwood4521 I didn't write the definitions; just took them as Chris Ball wrote them and made them into labels.

Go look at Stanl's more comprehensive dashboard that @markos put together. Be sure to read his notes. Try posting both of the studies on a chart and comparing the effect of different indicator settings.

Come back here and let us know what you learn. I will modify the labeling scheme with anything you find interesting.

Go look at Stanl's more comprehensive dashboard that @markos put together. Be sure to read his notes. Try posting both of the studies on a chart and comparing the effect of different indicator settings.

Come back here and let us know what you learn. I will modify the labeling scheme with anything you find interesting.

Hey Everyone. When I would search thinkscript in Google, this would never come up and I only see one indicator ever mentioned from this person on this site. Perhaps this is new to many people and I wanted to share.

Thinkscript Resources

Another OneNote

Looks like there's tons of stuff.

Thinkscript Resources

Another OneNote

Looks like there's tons of stuff.

nothingness99

New member

Wow..I found a treasury in the New Year. Thank you for sharing

Trader Sam

New member

Seems like the Thinkscript community OneNote notebook is no longer accessible. Does anyone have a copy of it that you can share?

The link to the thinkScript Community OneNote is: http://b.link/tSCommunity or https://1drv.ms/u/s!AnkeHrrRM_cvgxQTl1xckINYlKhZ

The link to the thinkScript Community OneNote is: http://b.link/tSCommunity or https://1drv.ms/u/s!AnkeHrrRM_cvgxQTl1xckINYlKhZ

Seems like the Thinkscript community OneNote notebook is no longer accessible. Does anyone have a copy of it that you can share?

The link to the thinkScript Community OneNote is: http://b.link/tSCommunity or https://1drv.ms/u/s!AnkeHrrRM_cvgxQTl1xckINYlKhZ

A copy of that huge database is not currently available.

The JP OneNote Archive Is Currently Being Moved To A New App.

The new link to this amazing resource will be updated when available.

Last edited:

These are new working links to the OneNote archive -

https://tinyurl.com/thinkScriptLoungeChatArchive

https://tinyurl.com/thinkScriptLoungeScriptArchive

https://tinyurl.com/thinkScriptLoungeChatArchive

https://tinyurl.com/thinkScriptLoungeScriptArchive

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

thinkScript IDE For ThinkOrSwim | Tutorials | 8 | |

|

|

Thinkorswim Chart Study and Thinkscript Plot Hierarchy | Tutorials | 5 | |

|

|

How to debug ThinkScript | Tutorials | 6 | |

|

|

thinkScript BarNumber() Function Usage and Examples | Tutorials | 7 | |

| D | AddOrder thinkScript - Backtest Buy & Sell in ThinkorSwim | Tutorials | 184 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1219

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.