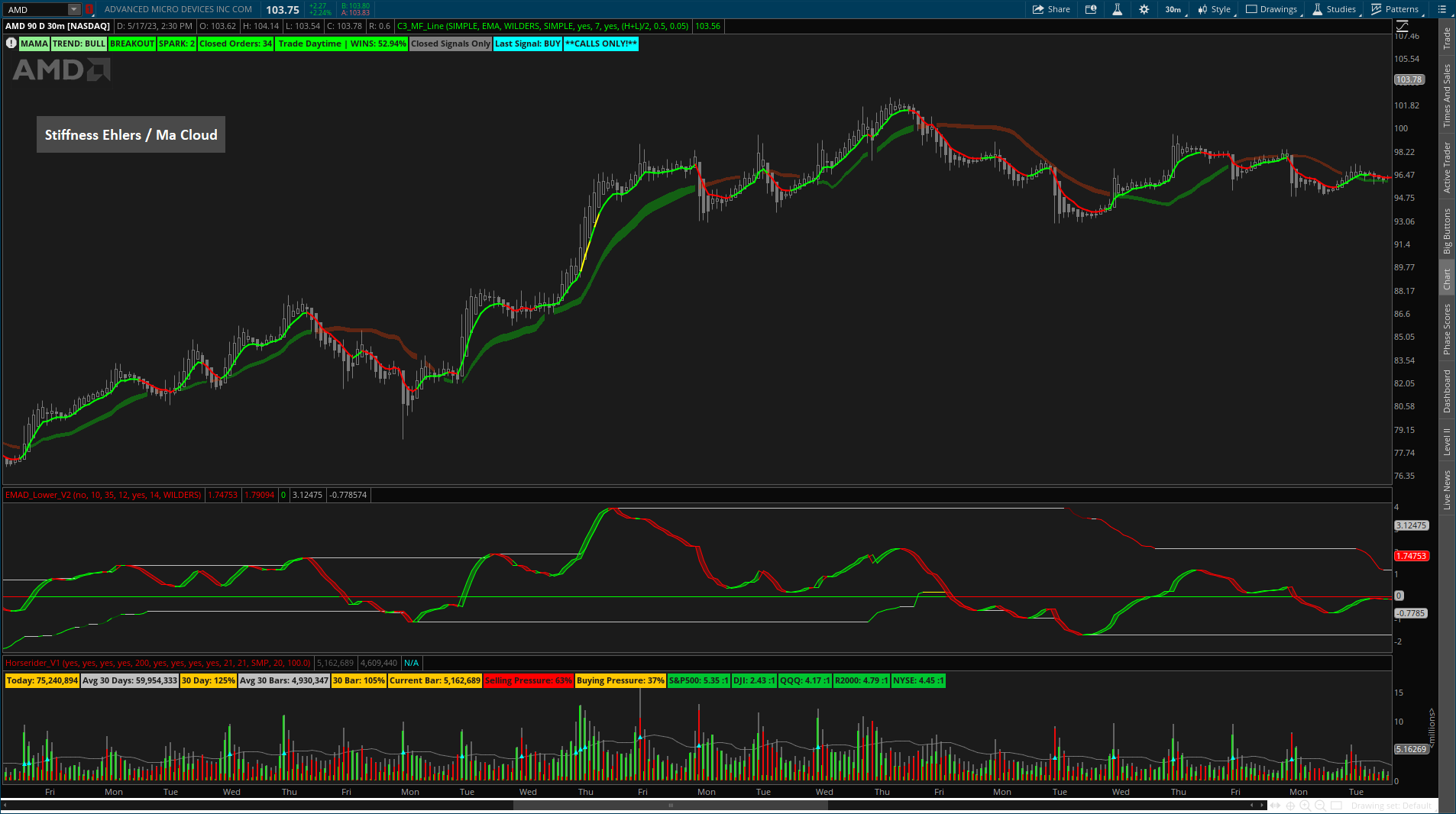

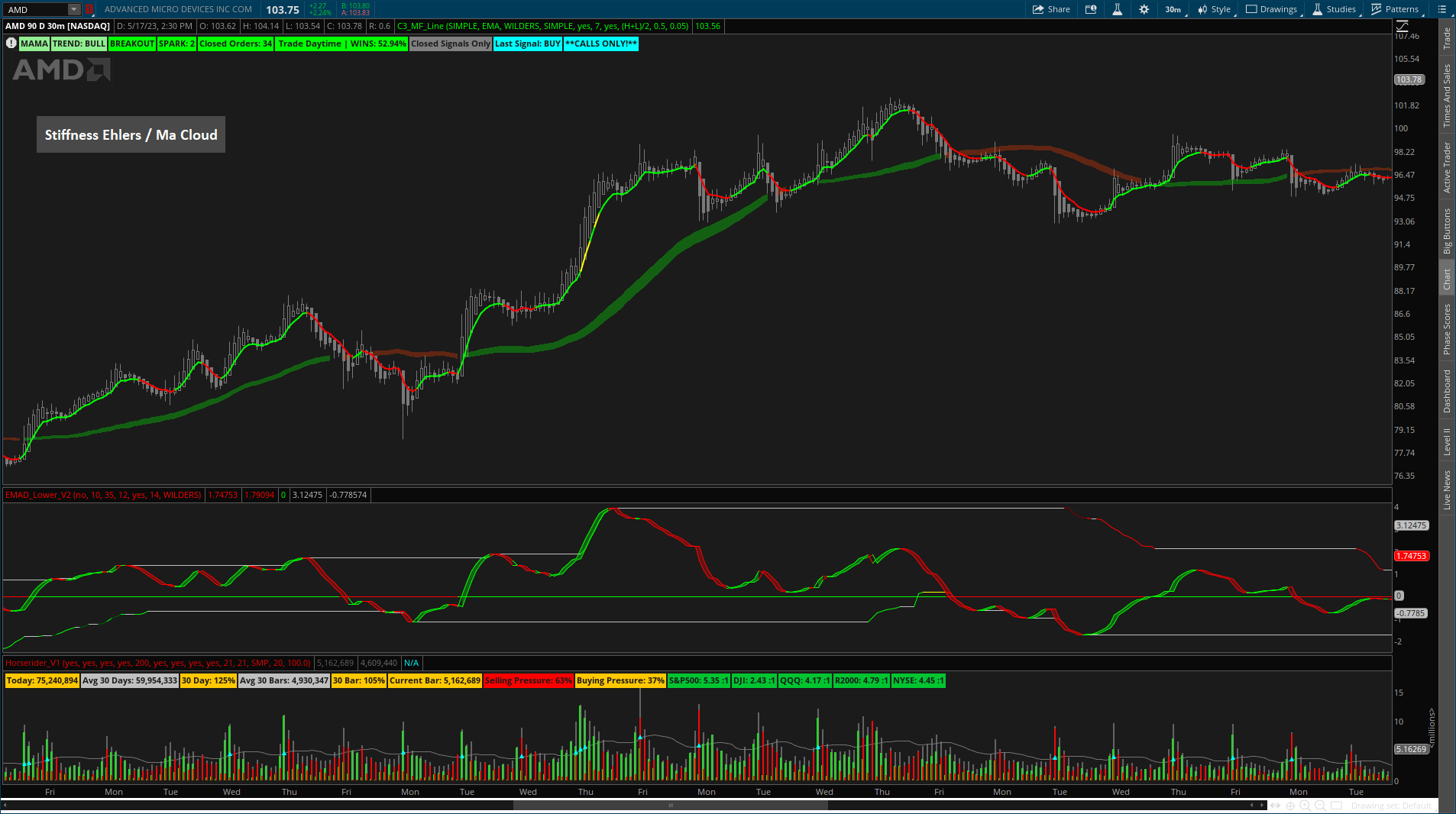

#Stiffness MA/Ehlers Clouds

input MALength = 100;

input StiffnessLength = 60;

input Threshold = 90;

input ELlength = 23;

input coloredCandlesOn = no;

input show_ema_cloud_Ehlers = yes;

input show_ema_cloud_MA = no;

input show_Ehlers_arrows = yes;

input show_MA_arrows = no;

def price = (high + low) / 2;

def coeff = ELlength * price * price - 2 * price * sum(price, ELlength)[1] + sum(price * price, ELlength)[1];

plot Ehlers = sum(coeff * price, ELlength) / sum(coeff, ELlength);

Ehlers.SetDefaultColor(Color.light_gray);

def c = close;

def o = open;

def MAValue = MovingAverage(AverageType.SIMPLE, close, MALength);

def MACorValue = MAValue - 0.2 * StDev(close, MALength);

def NumAboveMA = if close > MAValue then NumAboveMA[1] + 1 else 0;

def MAValue2 = sum(coeff * price, ELlength) / sum(coeff, ELlength);

def MACorValue2 = MAValue2 - 0.2 * StDev(close, ELLength);

def NumAboveMA2 = if close > MAValue2 then NumAboveMA2[1] + 1 else 0;

def Stiffness_Ehlers = 100 * (NumAboveMA2 / StiffnessLength);

def Stiffness_Ehlers_2 = ExpAverage(Stiffness_Ehlers, StiffnessLength);

plot MA_COR = MACorValue;

plot MA = MAValue;

plot MA_COR2 = MACorValue2;

plot MA2 = MAValue2;

#def compressed = MAValue2 - MACorValue2;

#def compression = if (compressed <= 1) then 1 else 0;

#plot Squeeze_Alert = if compression then 1 else 0;

#Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS);

#Squeeze_Alert.SetLineWeight(5);

#Squeeze_Alert.SetDefaultColor(Color.white);

def MA_Cor2_UP = if ((MA_cor2 > MA_cor2[1])) then 1 else 0;

def MA_Cor2_dn = if ((MA_cor2 < MA_cor2[1])) then 1 else 0;

def MA_Cor_UP = if ((MA_cor > MA_cor[1])) then 1 else 0;

def MA_Cor_dn = if ((MA_cor < MA_cor[1])) then 1 else 0;

plot MA_Cor2_UP_1 = if show_MA_arrows and MA_Cor2_UP and !MA_Cor2_UP[1] then low else Double.NaN;

MA_Cor2_UP_1.SetPaintingStrategy(PaintingSTrategy.ARROW_up);

MA_Cor2_UP_1.SetDefaultColor(Color.white);

plot MA_Cor2_DN_1 = if show_MA_arrows and MA_Cor2_DN and !MA_Cor2_DN[1] then high else Double.NaN;

MA_Cor2_DN_1.SetPaintingSTrategy(paintingSTrategy.Arrow_DOWN);

MA_Cor2_DN_1.SetDefaultColor(Color.white);

plot MA_Cor_UP_2 = if show_Ehlers_arrows and MA_Cor2_UP and !MA_Cor2_UP[1] then low else Double.NaN;

MA_Cor_UP_2.SetPaintingStrategy(PaintingSTrategy.ARROW_up);

MA_Cor_UP_2.SetDefaultColor(Color.white);

plot MA_Cor_DN_2 = if show_Ehlers_arrows and MA_Cor2_DN and !MA_Cor2_DN[1] then high else Double.NaN;

MA_Cor_DN_2.SetPaintingSTrategy(paintingSTrategy.Arrow_DOWN);

MA_Cor_DN_2.SetDefaultColor(Color.white);

AddCloud(if show_ema_cloud_Ehlers and MA_Cor2 < close then MA_cor2 else MA2, MA_cor2, Color.LIGHT_red, Color.green);

AddCloud(if show_ema_cloud_Ehlers and MA_Cor2 > close then MA2 else MA_COR2, MA2, Color.LIGHT_red, Color.green);

AddCloud(if show_ema_cloud_MA and ((MA_cor > MA_cor[1])and(MA > MA[1])) then MA_cor else MA, MA, Color.LIGHT_red, Color.green);

AddCloud(if show_ema_cloud_MA and ((MA_cor < MA_cor[1])and(MA < MA[1])) then MA else MA_COR, MA_COR, Color.LIGHT_red, Color.green);

#plot Crossup3 = Crossup2;

#Crossup3.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_Up);

#Crossup3.SetDefaultColor(Color.Orange);

#Crossup3.SetLineWeight(arrow_size2);

#plot Crossdown3 = Crossdown2;

#Crossdown3.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_Down);

#Crossdown3.SetDefaultColor(Color.orange);

#Crossdown3.SetLineWeight(arrow_size2);

#plot Stiffness = Stiffness_1;

#plot StiffnessEMA = StiffnessEMA_1;

#Stiffness.SetDefaultColor(GetColor(3));

#StiffnessEMA.SetDefaultColor(GetColor(4));