kartik2272

New member

Question: Heard in the video "70 Delta Option". Correct? Just wanted to know what is your choice for DTE? 0DTE, 1DTE or longer Dated Option? A newbee question (please).

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

If you are brand new to trading, you should never touch 0 dte's and only play 70 deltas. The market is already working against you and you don't want your emotions to do the same, although if you are new, chances are you will be emotional even with 70 deltas.Question: Heard in the video "70 Delta Option". Correct? Just wanted to know what is your choice for DTE? 0DTE, 1DTE or longer Dated Option? A newbee question (please).

Thank you for taking time to reply. Much appreciated. Feel very confident that I am on the right path. Glad I came across this "PAM" at the right moment. Look forward to updates and lots more.If you are brand new to trading, you should never touch 0 dte's and only play 70 deltas. The market is already working against you and you don't want your emotions to do the same, although if you are new, chances are you will be emotional even with 70 deltas.

I recommend taking a standard option that expires a week out with a 70 delta if you are a new trader so you give the trade time to breathe.

The reasoning is that you probably won't get in at the right time, you will definitely mismanage the trade as you are learning, and you want to lose as little as possible while you learn.

I will also say that the very best option contract traders I know of only trade 70 deltas and they've been doing it for a very long time. If you trade anything less, you are paying entirely too much for premium and there is not enough intrinsic value in the contract so your positions will be subjected to time melting your premium off the contract instead of price action.

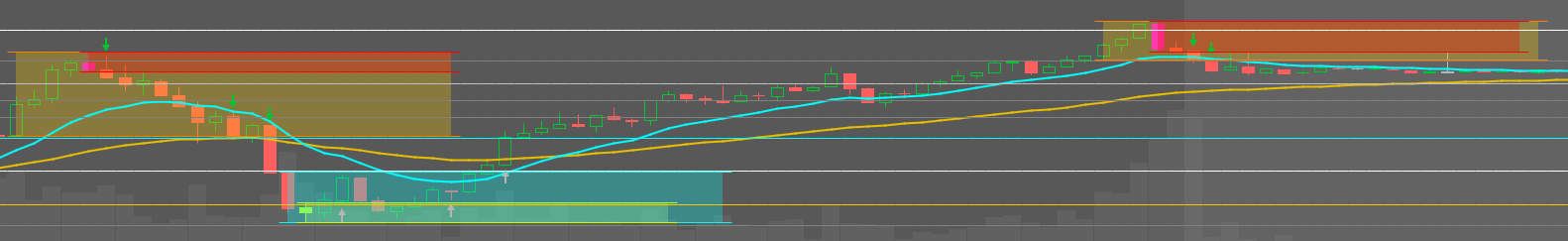

You mean basically overlaying the time frames? Yes, that shouldn't be too hard to do -- happy to add that in, or to just have the option to choose any higher time frame to overlay. Sorry, I likely won't be around much this week due to family matters though. I may be able to get back with the next batch of updates sometime next week.@Chemmy We have a group member in the discord that as we are putting PAM into practice, we have found tremendous value of being able to have two timeframes for buy call and buy put signals. So the picture will probably explain it better but essentially having a 3m timeframe in a 15m timeframe and having them different colors is amazing and really allows you to fully kill it with PAM. Take a look and is it something we can do on the next iteration?

No worries. Thanks for everything you do. PAM has really caught fire.You mean basically overlaying the time frames? Yes, that shouldn't be too hard to do -- happy to add that in, or to just have the option to choose any higher time frame to overlay. Sorry, I likely won't be around much this week due to family matters though. I may be able to get back with the next batch of updates sometime next week.

I use daily and weekly along with the 3 and 15mAnybody using this in the daily timeframe?

How do you decide on your swing entries with daily? Same rules as intraday? Any additional confirmation?I use daily and weekly along with the 3 and 15m

How do you decide on your swing entries with daily? Same rules as intraday? Any additional confirmation?

Honestly, I have moved to the 3m with 3m PAM and 15m PAM overlayed. It's beautiful. I caught 32% move on 416p's today.Anybody using this in the daily timeframe?

I also work with ICT concepts namely Order Blocks but I keep things very simple. No other indicators or oscillators.

The only thing I use differently than you is the 10m instead of the 15m. Given the accuracy of PAM long term, I feel this is a safe transition. I moved from 15m to 10m.I use daily and weekly along with the 3 and 15m

So basically you're saying 3m and 10m as opposed to 3 and 15? I will say it is really nice to see how PAM intersects with order blocks.The only thing I use differently than you is the 10m instead of the 15m. Given the accuracy of PAM long term, I feel this is a safe transition. I moved from 15m to 10m.

I tested it on the 5m with the 15m overlay. i think I used it correctly and it is impressive. I actually used the HAM strat I am working on to take trade on a 2m and this for confirmation. Great work!The only thing I use differently than you is the 10m instead of the 15m. Given the accuracy of PAM long term, I feel this is a safe transition. I moved from 15m to 10m.

How do you identify order blocks while using PAM? What do you use to identify the order blocks?So basically you're saying 3m and 10m as opposed to 3 and 15? I will say it is really nice to see how PAM intersects with order blocks.

are you using TOS? I can post my study if you are.How do you identify order blocks while using PAM? What do you use to identify the order blocks?

Yes, I use TOS.are you using TOS? I can post my study if you are.

This shows both bullish and bearish order blocks.Yes, I use TOS.

I'm still trying to wrap my head around the order blocks concept the way he teaches it. I would like to add FVG's to PAM as FVG's tend to be filled and then price moves away from it. I think it's another good area of confluence for PAM to have built inside of it.So basically you're saying 3m and 10m as opposed to 3 and 15? I will say it is really nice to see how PAM intersects with order blocks.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.