I have zero experience with with programming based on bar count. Could somebody give this a shot for me: I want to use ATR trailing stop buy signals to plot target lines 2 ATR above the entry price as well as 1 ATR, 2 ATR, and 3 ATR above that. The key is plotting ONLY starting at the buy signal and extending right until the sell signal is hit. I've searched other threads and still can't seem to get it to work. Thanks in advance if you can help out!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Target plots after buy signals

- Thread starter wtf_dude

- Start date

What calculation and trigger are you using for the entry?I have zero experience with with programming based on bar count. Could somebody give this a shot for me: I want to use ATR trailing stop buy signals to plot target lines 2 ATR above the entry price as well as 1 ATR, 2 ATR, and 3 ATR above that. The key is plotting ONLY starting at the buy signal and extending right until the sell signal is hit. I've searched other threads and still can't seem to get it to work. Thanks in advance if you can help out!

The ATR trailing stop study that's already in TOS.

Code:

#

# TD Ameritrade IP Company, Inc. (c) 2009-2021

#

input trailType = {default modified, unmodified};

input ATRPeriod = 5;

input ATRFactor = 3.5;

input firstTrade = {default long, short};

input averageType = AverageType.WILDERS;

Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor);

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE);

def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE);

plot TrailingStop = trail;

TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS);

TrailingStop.DefineColor("Buy", GetColor(0));

TrailingStop.DefineColor("Sell", GetColor(1));

TrailingStop.AssignValueColor(if state == state.long

then TrailingStop.Color("Sell")

else TrailingStop.Color("Buy"));@wtf_dude Sounds like you only want the long plot of ATR, you can try to remove the short code. Or you can add this condition to your plot and it should do what you want as well unless I misunderstood the request.

Code:

def plotcond = if buysignal then 1 else if sellsignal then 0 else plotcond[1];no, I'm not plotting the buy signal. The default code already does that. I want to plot price targets that extend right above the price only while the buy signal is in effect.

Check out this thread's indicator to see what I'm aiming for. I just can't wrap my head around the bar coding logic atm. It's totally new to me

Check out this thread's indicator to see what I'm aiming for. I just can't wrap my head around the bar coding logic atm. It's totally new to me

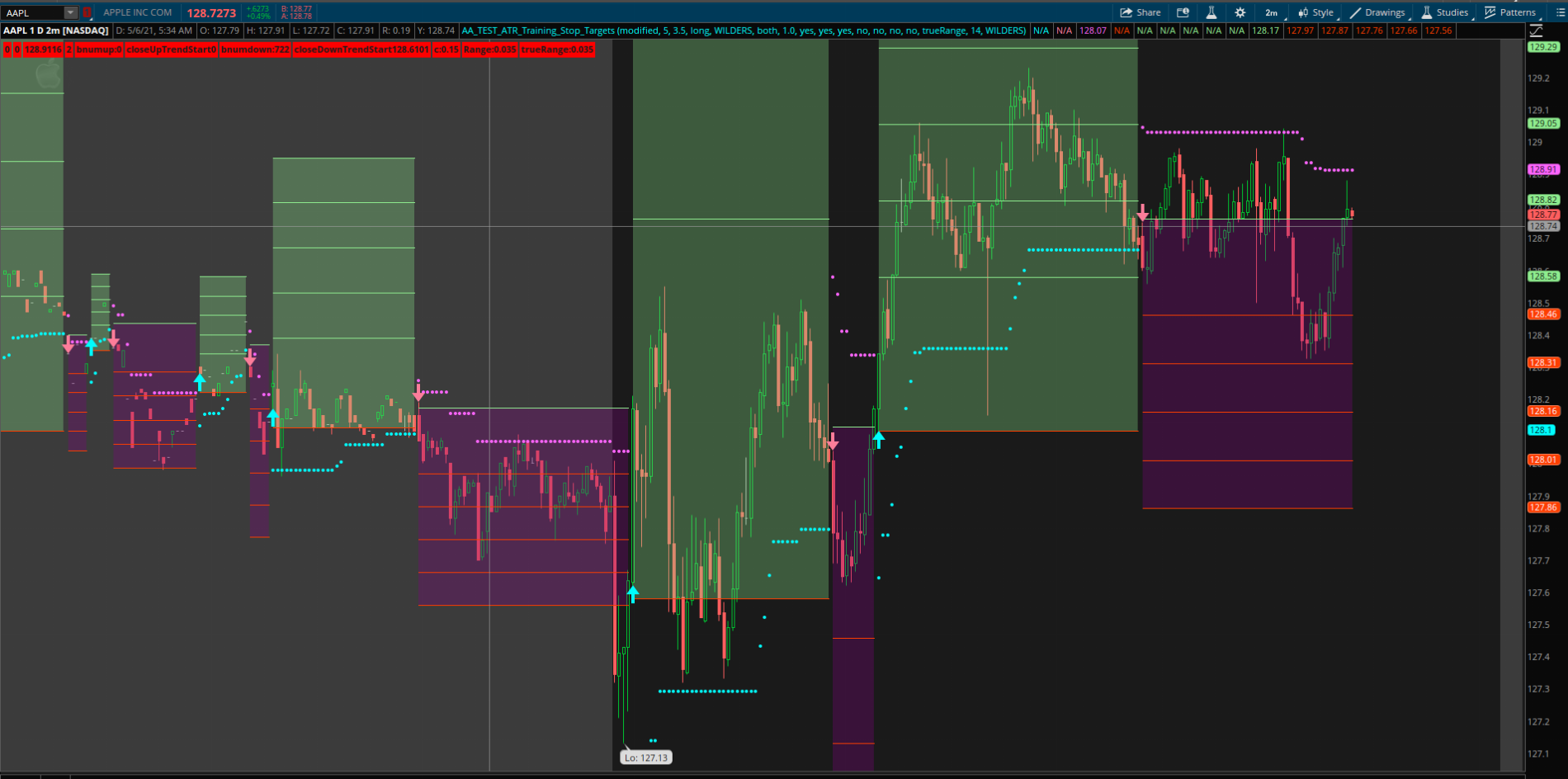

Something like this?

Please let me know if I misunderstood your request, this is just my interpretation.

You wanted to 2 ATR after the Buy or Sell Signal is triggered then also a 3rd, 4th and 5th ATR after that. The screen shot should show that. I also added the 1 ATR (for a total of 5). The original indicator trailing stop is there for the DOTS and I also included another optional stop which takes into account the close plus/minus the atr.

The Arrows indicate when the Buy and Sell signals trigger, that was just for reference, we can remove if you don't want them there since the Dots do the same thing.

Let me know if we are on the right track?

Please let me know if I misunderstood your request, this is just my interpretation.

You wanted to 2 ATR after the Buy or Sell Signal is triggered then also a 3rd, 4th and 5th ATR after that. The screen shot should show that. I also added the 1 ATR (for a total of 5). The original indicator trailing stop is there for the DOTS and I also included another optional stop which takes into account the close plus/minus the atr.

The Arrows indicate when the Buy and Sell signals trigger, that was just for reference, we can remove if you don't want them there since the Dots do the same thing.

Let me know if we are on the right track?

@SuryaKiranC and I wrote that. It is the same logic and very reusable!no, I'm not plotting the buy signal. The default code already does that. I want to plot price targets that extend right above the price only while the buy signal is in effect.

Check out this thread's indicator to see what I'm aiming for. I just can't wrap my head around the bar coding logic atm. It's totally new to me

DUDE, YES! That looks like it's exactly what I'm looking for! THANK YOU@SuryaKiranC and I wrote that. It is the same logic and very reusable!

Really appreciate it man. Would you possibly be able to include the lines of code if I differentiate and only show the current targets? HOPEFULLY, if I see how you're doing it I wont need to make newbie requests for bar code lolCool. I'll clean it up and post a version for you to use and we can tweak from there. I'll try and post it this afternoon.

As in only show the most current targets and not the previous? At the moment, I only know how to do that for the day (show previous day or not). If anyone knows how to do that for the most recent targets only, please do let me know.Really appreciate it man. Would you possibly be able to include the lines of code if I differentiate and only show the current targets? HOPEFULLY, if I see how you're doing it I wont need to make newbie requests for bar code lol

Try this for a first draft.

Updated to include current targets code from @SleepyZ and the FIB Level Multipliers.

Updated to include current targets code from @SleepyZ and the FIB Level Multipliers.

Code:

#ATR_Stoploss_Targets v1.2

#

#CHANGELOG

#

# 2021.05.12 v1.2 @cos251 - Added ADR Multipler for targets 1 through 5 based on screenshot from @wtf_dude

# - Multipliers are based on FIB leves per wtf_dude

#

# 2021.05.11 v1.1 @cos251 - Added feature to plot only current ADR Targets and Stoploss

# - Feature credit goes to @SleepyZ (thx)

# 2021.05.06 v1.0 @cos251 - Initial release - ATRStoploss Standard TOS indicator with targets after BuySignal or SellSignal trigger

#

#

#CREDITS

# requested by "@wtf_dude"

# code improvements by "@SleepyZ"

#

#LINK

# https://usethinkscript.com/threads/target-plots-after-buy-signals.6529/

#

# -- Standard ATR Stoploss Indicator TOS Version

input showlast_Targets_only = yes;

input stopLossMultiplier = 1.0;

input Target1Multiplier = .78;

input Target2Multiplier = 1.61;

input Target3Multiplier = 2.38;

input Target4Multiplier = 3.23;

input Target5Multiplier = 4.0;

input trailType = {default modified, unmodified};

input ATRPeriod = 5;

input ATRFactor = 3.5;

input firstTrade = {default long, short};

input averageType = AverageType.WILDERS;

input debug = no;

Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor);

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE);

def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE);

plot arrowup = if BuySignal then low else Double.NaN;

plot arrowdown = if SellSignal then high else Double.NaN;

arrowup.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

arrowdown.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

arrowup.SetLineWeight(5);

arrowdown.SetLineWeight(5);

arrowup.SetDefaultColor(Color.GREEN);

arrowdown.SetDefaultColor(Color.RED);

plot TrailingStop = trail;

TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS);

TrailingStop.DefineColor("Buy", GetColor(0));

TrailingStop.DefineColor("Sell", GetColor(1));

TrailingStop.AssignValueColor(if state == state.long

then TrailingStop.Color("Sell")

else TrailingStop.Color("Buy"));

AddLabel(debug, BuySignal);

AddLabel(debug, SellSignal);

AddLabel(debug, trail);

AddLabel(debug, state);

################################################################

########## ATR/ADR Calc #########

################################################################

input rangeType = { default "trueRange", "ATR", "ADR" };

input ATRlength = 14;

input ATRaverageType = AverageType.WILDERS;

def Range;

if rangeType == rangeType.ATR {

Range = MovingAverage(ATRaverageType, TrueRange(high, close, low), ATRlength);

} else if rangeType == rangeType.trueRange {

Range = trueRange;

} else {

Range = Average(high - low, 7);

}

# -- END ATR/ATR/TrueRange calc

# -- Logic for bar counter and state detector

def bnumUp;

def bnumDown;

def closeUpTrendStart;

def closeDownTrendStart;

def UpTrendBarCount;

def DownTrendBarCount;

def time;

if BuySignal {

bnumUp = BarNumber();

bnumDown = 0;

closeUpTrendStart = close;

closeDownTrendStart = 0;

UpTrendBarCount = 1;

DownTrendBarCount = 0;

time = GetTime();

} else if state == state.long {

bnumUp = bnumUp[1];

bnumDown = 0;

closeUpTrendStart = closeUpTrendStart[1];

closeDownTrendStart = 0;

UpTrendBarCount = UpTrendBarCount[1] + 1;

DownTrendBarCount = 0;

time = time[1];

} else if SellSignal {

bnumUp = 0;

bnumDown = BarNumber();

closeDownTrendStart = close;

closeUpTrendStart = 0;

UpTrendBarCount = 0;

DownTrendBarCount = 1;

time = GetTime();

} else if state == state.short {

bnumDown = bnumDown[1];

closeDownTrendStart = closeDownTrendStart[1];

DownTrendBarCount = DownTrendBarCount[1] + 1;

bnumUp = 0;

closeUpTrendStart = 0;

UpTrendBarCount = 0;

time = time[1];

} else {

bnumUp = 0;

bnumDown = 0;

closeUpTrendStart = 0;

closeDownTrendStart = 0;

UpTrendBarCount = 0;

DownTrendBarCount = 0;

time = Double.NaN;

}

def c;

if BarNumber() == bnumUp or BarNumber() == bnumDown {

c = Range;

} else if state == state.long or state == state.short {

c = c[1];

} else {

c = 0;

}

AddLabel(debug, "bnumup:" + bnumUp);

AddLabel(debug, "closeUpTrendStart" + closeUpTrendStart);

AddLabel(debug, "bnumdown:" + bnumDown);

AddLabel(debug, "closeDownTrendStart" + closeDownTrendStart);

AddLabel(debug, "c:" + c);

AddLabel(debug, "Range:" + Range);

AddLabel(debug, "trueRange:" + trueRange);

AddLabel(debug, "time:" + time);

################################################################

########## Target and Stop Loss Plots #########

################################################################

def up = if arrowup then bnumUp else Double.NaN;

def dn = if arrowdown then bnumDown else Double.NaN;

AddLabel(debug,"up:"+up);

AddLabel(debug,"dn:"+dn);

plot BuySignalStopLoss = if showlast_Targets_only == yes and (bnumUp < HighestAll(up))

then Double.NaN

else if state == state.long

then closeUpTrendStart - (c * stopLossMultiplier)

else Double.NaN ;

plot oneADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + (c * Target1Multiplier)

else Double.NaN;

plot twoADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + (c * Target2Multiplier)

else Double.NaN;

plot threeADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + (c * Target3Multiplier)

else Double.NaN;

plot fourADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + (c * Target4Multiplier)

else Double.NaN;

plot fiveADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + (c * Target5Multiplier)

else Double.NaN;

plot SellSignalStopLoss = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart + (c * stopLossMultiplier)

else Double.NaN;

plot oneADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - (c * Target1Multiplier)

else Double.NaN;

plot twoADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - (c * Target2Multiplier)

else Double.NaN;

plot threeADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - (c * Target3Multiplier)

else Double.NaN;

plot fourADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - (c * Target4Multiplier)

else Double.NaN;

plot fiveADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - (c * Target5Multiplier)

else Double.NaN;

BuySignalStopLoss.SetDefaultColor(Color.LIGHT_RED);

oneADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

twoADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

threeADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

fourADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

fiveADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

SellSignalStopLoss.SetDefaultColor(Color.LIGHT_GREEN);

oneADRMinus.SetDefaultColor(Color.LIGHT_RED);

twoADRMinus.SetDefaultColor(Color.LIGHT_RED);

threeADRMinus.SetDefaultColor(Color.LIGHT_RED);

fourADRMinus.SetDefaultColor(Color.LIGHT_RED);

fiveADRMinus.SetDefaultColor(Color.LIGHT_RED);

oneADRMinus.SetHiding(GetTime() < time);

AddCloud(fiveADRPlus, BuySignalStopLoss, Color.LIGHT_GREEN);

AddCloud(SellSignalStopLoss, fiveADRMinus, Color.PLUM);

Last edited:

Alright, good start. My thinking is on the candle where the buysignal arrow appears, the ATR is added from either the low of that candle or the ohlc4. The ATR trailing stop that's already built in is fine for the stoploss, so we won't need a second calc/multiplier. So it's Buy signal, cloud starts at low of candle, add 1 ATR to the High of the same candle, 2 ,3 4 5 etc. And vice versa. Following?Try this for a first draft.

Code:#ATR_Stoploss_Targets # #CHANGELOG # # 2021.05.06 @cos251 - Initial release - ATRStoploss Standard TOS indicator with targets after BuySignal or SellSignal trigger # # #CREDITS # requesed by "@wtf_dude" # #LINK # https://usethinkscript.com/threads/target-plots-after-buy-signals.6529/ # # -- Standard ATR Stoploss Indicator TOS Version input stopLossMultiplier = 1.0; input trailType = {default modified, unmodified}; input ATRPeriod = 5; input ATRFactor = 3.5; input firstTrade = {default long, short}; input averageType = AverageType.WILDERS; input debug = no; Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor); def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod)); def HRef = if low <= high[1] then high - close[1] else (high - close[1]) - 0.5 * (low - high[1]); def LRef = if high >= low[1] then close[1] - low else (close[1] - low) - 0.5 * (low[1] - high); def trueRange; switch (trailType) { case modified: trueRange = Max(HiLo, Max(HRef, LRef)); case unmodified: trueRange = TrueRange(high, close, low); } def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod); def state = {default init, long, short}; def trail; switch (state[1]) { case init: if (!IsNaN(loss)) { switch (firstTrade) { case long: state = state.long; trail = close - loss; case short: state = state.short; trail = close + loss; } } else { state = state.init; trail = Double.NaN; } case long: if (close > trail[1]) { state = state.long; trail = Max(trail[1], close - loss); } else { state = state.short; trail = close + loss; } case short: if (close < trail[1]) { state = state.short; trail = Min(trail[1], close + loss); } else { state = state.long; trail = close - loss; } } def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE); def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE); plot arrowup = if BuySignal then low else Double.NaN; plot arrowdown = if SellSignal then high else Double.NaN; arrowup.SetPaintingStrategy(PaintingStrategy.ARROW_UP); arrowdown.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); arrowup.SetLineWeight(5); arrowdown.SetLineweight(5); arrowup.SetDefaultColor(Color.GREEN); arrowdown.SetDefaultColor(Color.RED); plot TrailingStop = trail; TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS); TrailingStop.DefineColor("Buy", GetColor(0)); TrailingStop.DefineColor("Sell", GetColor(1)); TrailingStop.AssignValueColor(if state == state.long then TrailingStop.Color("Sell") else TrailingStop.Color("Buy")); AddLabel(debug, BuySignal); AddLabel(debug, SellSignal); AddLabel(debug, trail); AddLabel(debug, state); ################################################################ ########## ATR/ADR Calc ######### ################################################################ input rangeType = { default "trueRange", "ATR", "ADR" }; input ATRlength = 14; input ATRaverageType = AverageType.WILDERS; def Range; if rangeType == rangeType.ATR { Range = MovingAverage(ATRaverageType, TrueRange(high, close, low), ATRlength); } else if rangeType == rangeType.trueRange { Range = trueRange; } else { Range = Average(high - low, 7); } # -- END ATR/ATR/TrueRange calc # -- Logic for bar counter and state detector def bnumUp; def bnumDown; def closeUpTrendStart; def closeDownTrendStart; def UpTrendBarCount; def DownTrendBarCount; def time; if BuySignal { bnumUp = BarNumber(); bnumDown = 0; closeUpTrendStart = close; closeDownTrendStart = 0; UpTrendBarCount = 1; DownTrendBarCount = 0; time = GetTime(); } else if state == state.long { bnumUp = bnumUp[1]; bnumDown = 0; closeUpTrendStart = closeUpTrendStart[1]; closeDownTrendStart = 0; UpTrendBarCount = UpTrendBarCount[1] + 1; DownTrendBarCount = 0; time = time[1]; } else if SellSignal { bnumUp = 0; bnumDown = BarNumber(); closeDownTrendStart = close; closeUpTrendStart = 0; UpTrendBarCount = 0; DownTrendBarCount = 1; time = GetTime(); } else if state == state.short { bnumDown = bnumDown[1]; closeDownTrendStart = closeDownTrendStart[1]; DownTrendBarCount = DownTrendBarCount[1] + 1; bnumUp = 0; closeUpTrendStart = 0; UpTrendBarCount = 0; time = time[1]; } else { bnumUp = 0; bnumDown = 0; closeUpTrendStart = 0; closeDownTrendStart = 0; UpTrendBarCount = 0; DownTrendBarCount = 0; time = double.nan; } def c; if BarNumber() == bnumUp or BarNumber() == bnumDown { c = Range; } else if state == state.long or state == state.short { c = c[1]; } else { c = 0; } AddLabel(debug, "bnumup:" + bnumUp); AddLabel(debug, "closeUpTrendStart" + closeUpTrendStart); AddLabel(debug, "bnumdown:" + bnumDown); AddLabel(debug, "closeDownTrendStart" + closeDownTrendStart); AddLabel(debug, "c:" + c); AddLabel(debug, "Range:" + Range); AddLabel(debug, "trueRange:" + trueRange); AddLabel(debug, "time:"+time); ################################################################ ########## Target and Stop Loss Plots ######### ################################################################ plot BuySignalStopLoss = if state == state.long then closeUpTrendStart - (c * stopLossMultiplier) else Double.NaN; plot oneADRPlus = if state == state.long then closeUpTrendStart + c else Double.NaN; plot twoADRPlus = if state == state.long then closeUpTrendStart + c * 2 else Double.NaN; plot threeADRPlus = if state == state.long then closeUpTrendStart + c * 3 else Double.NaN; plot fourADRPlus = if state == state.long then closeUpTrendStart + c * 4 else Double.NaN; plot fiveADRPlus = if state == state.long then closeUpTrendStart + c * 5 else Double.NaN; plot SellSignalStopLoss = if state == state.short then closeDownTrendStart + (c * stopLossMultiplier) else Double.NaN; plot oneADRMinus = if state == state.short then closeDownTrendStart - c else Double.NaN; plot twoADRMinus = if state == state.short then closeDownTrendStart - c * 2 else Double.NaN; plot threeADRMinus = if state == state.short then closeDownTrendStart - c * 3 else Double.NaN; plot fourADRMinus = if state == state.short then closeDownTrendStart - c * 4 else Double.NaN; plot fiveADRMinus = if state == state.short then closeDownTrendStart - c * 5 else Double.NaN; BuySignalStopLoss.SetDefaultColor(Color.LIGHT_RED); oneADRPlus.SetDefaultColor(Color.LIGHT_GREEN); twoADRPlus.SetDefaultColor(Color.LIGHT_GREEN); threeADRPlus.SetDefaultColor(Color.LIGHT_GREEN); fourADRPlus.SetDefaultColor(Color.LIGHT_GREEN); fiveADRPlus.SetDefaultColor(Color.LIGHT_GREEN); SellSignalStopLoss.SetDefaultColor(Color.LIGHT_GREEN); oneADRMinus.SetDefaultColor(Color.LIGHT_RED); twoADRMinus.SetDefaultColor(Color.LIGHT_RED); threeADRMinus.SetDefaultColor(Color.LIGHT_RED); fourADRMinus.SetDefaultColor(Color.LIGHT_RED); fiveADRMinus.SetDefaultColor(Color.LIGHT_RED); oneADRMinus.SetHiding(GetTime() < time); AddCloud(fiveADRPlus, BuySignalStopLoss, Color.LIGHT_GREEN); AddCloud(SellSignalStopLoss, fiveADRMinus, Color.PLUM);

edit: I'm tweaking with it to see what I can come up with. Changed each ATR multiplier to an input. Also, you're a god for putting this together no way in hell I'd be able to figure that out lol

Last edited:

This should allow an option to just display only the most current set of targets

Code:

#ATR_Stoploss_Targets

#

#CHANGELOG

#

# 2021.05.06 @cos251 - Initial release - ATRStoploss Standard TOS indicator with targets after BuySignal or SellSignal trigger

#

#

#CREDITS

# requesed by "@wtf_dude"

#

#LINK

# https://usethinkscript.com/threads/target-plots-after-buy-signals.6529/

#

# -- Standard ATR Stoploss Indicator TOS Version

input showlast_Targets_only = yes;

input stopLossMultiplier = 1.0;

input trailType = {default modified, unmodified};

input ATRPeriod = 5;

input ATRFactor = 3.5;

input firstTrade = {default long, short};

input averageType = AverageType.WILDERS;

input debug = no;

Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor);

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE);

def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE);

plot arrowup = if BuySignal then low else Double.NaN;

plot arrowdown = if SellSignal then high else Double.NaN;

arrowup.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

arrowdown.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

arrowup.SetLineWeight(5);

arrowdown.SetLineWeight(5);

arrowup.SetDefaultColor(Color.GREEN);

arrowdown.SetDefaultColor(Color.RED);

plot TrailingStop = trail;

TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS);

TrailingStop.DefineColor("Buy", GetColor(0));

TrailingStop.DefineColor("Sell", GetColor(1));

TrailingStop.AssignValueColor(if state == state.long

then TrailingStop.Color("Sell")

else TrailingStop.Color("Buy"));

AddLabel(debug, BuySignal);

AddLabel(debug, SellSignal);

AddLabel(debug, trail);

AddLabel(debug, state);

################################################################

########## ATR/ADR Calc #########

################################################################

input rangeType = { default "trueRange", "ATR", "ADR" };

input ATRlength = 14;

input ATRaverageType = AverageType.WILDERS;

def Range;

if rangeType == rangeType.ATR {

Range = MovingAverage(ATRaverageType, TrueRange(high, close, low), ATRlength);

} else if rangeType == rangeType.trueRange {

Range = trueRange;

} else {

Range = Average(high - low, 7);

}

# -- END ATR/ATR/TrueRange calc

# -- Logic for bar counter and state detector

def bnumUp;

def bnumDown;

def closeUpTrendStart;

def closeDownTrendStart;

def UpTrendBarCount;

def DownTrendBarCount;

def time;

if BuySignal {

bnumUp = BarNumber();

bnumDown = 0;

closeUpTrendStart = close;

closeDownTrendStart = 0;

UpTrendBarCount = 1;

DownTrendBarCount = 0;

time = GetTime();

} else if state == state.long {

bnumUp = bnumUp[1];

bnumDown = 0;

closeUpTrendStart = closeUpTrendStart[1];

closeDownTrendStart = 0;

UpTrendBarCount = UpTrendBarCount[1] + 1;

DownTrendBarCount = 0;

time = time[1];

} else if SellSignal {

bnumUp = 0;

bnumDown = BarNumber();

closeDownTrendStart = close;

closeUpTrendStart = 0;

UpTrendBarCount = 0;

DownTrendBarCount = 1;

time = GetTime();

} else if state == state.short {

bnumDown = bnumDown[1];

closeDownTrendStart = closeDownTrendStart[1];

DownTrendBarCount = DownTrendBarCount[1] + 1;

bnumUp = 0;

closeUpTrendStart = 0;

UpTrendBarCount = 0;

time = time[1];

} else {

bnumUp = 0;

bnumDown = 0;

closeUpTrendStart = 0;

closeDownTrendStart = 0;

UpTrendBarCount = 0;

DownTrendBarCount = 0;

time = Double.NaN;

}

def c;

if BarNumber() == bnumUp or BarNumber() == bnumDown {

c = Range;

} else if state == state.long or state == state.short {

c = c[1];

} else {

c = 0;

}

AddLabel(debug, "bnumup:" + bnumUp);

AddLabel(debug, "closeUpTrendStart" + closeUpTrendStart);

AddLabel(debug, "bnumdown:" + bnumDown);

AddLabel(debug, "closeDownTrendStart" + closeDownTrendStart);

AddLabel(debug, "c:" + c);

AddLabel(debug, "Range:" + Range);

AddLabel(debug, "trueRange:" + trueRange);

AddLabel(debug, "time:" + time);

################################################################

########## Target and Stop Loss Plots #########

################################################################

def up = if arrowup then bnumUp else Double.NaN;

def dn = if arrowdown then bnumDown else Double.NaN;

plot BuySignalStopLoss = if showlast_Targets_only == yes and (bnumUp < HighestAll(up))

then Double.NaN

else if state == state.long

then closeUpTrendStart - (c * stopLossMultiplier)

else Double.NaN ;

plot oneADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + c

else Double.NaN;

plot twoADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + c * 2

else Double.NaN;

plot threeADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + c * 3

else Double.NaN;

plot fourADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + c * 4

else Double.NaN;

plot fiveADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up)))

then Double.NaN

else if state == state.long

then closeUpTrendStart + c * 5

else Double.NaN;

plot SellSignalStopLoss = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart + (c * stopLossMultiplier)

else Double.NaN;

plot oneADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - c

else Double.NaN;

plot twoADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - c * 2

else Double.NaN;

plot threeADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - c * 3

else Double.NaN;

plot fourADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - c * 4

else Double.NaN;

plot fiveADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up))

then Double.NaN

else if state == state.short

then closeDownTrendStart - c * 5

else Double.NaN;

BuySignalStopLoss.SetDefaultColor(Color.LIGHT_RED);

oneADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

twoADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

threeADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

fourADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

fiveADRPlus.SetDefaultColor(Color.LIGHT_GREEN);

SellSignalStopLoss.SetDefaultColor(Color.LIGHT_GREEN);

oneADRMinus.SetDefaultColor(Color.LIGHT_RED);

twoADRMinus.SetDefaultColor(Color.LIGHT_RED);

threeADRMinus.SetDefaultColor(Color.LIGHT_RED);

fourADRMinus.SetDefaultColor(Color.LIGHT_RED);

fiveADRMinus.SetDefaultColor(Color.LIGHT_RED);

oneADRMinus.SetHiding(GetTime() < time);

AddCloud(fiveADRPlus, BuySignalStopLoss, Color.LIGHT_GREEN);

AddCloud(SellSignalStopLoss, fiveADRMinus, Color.PLUM);Nice!! ThanksThis should allow an option to just display only the most current set of targets

Code:#ATR_Stoploss_Targets # #CHANGELOG # # 2021.05.06 @cos251 - Initial release - ATRStoploss Standard TOS indicator with targets after BuySignal or SellSignal trigger # # #CREDITS # requesed by "@wtf_dude" # #LINK # https://usethinkscript.com/threads/target-plots-after-buy-signals.6529/ # # -- Standard ATR Stoploss Indicator TOS Version input showlast_Targets_only = yes; input stopLossMultiplier = 1.0; input trailType = {default modified, unmodified}; input ATRPeriod = 5; input ATRFactor = 3.5; input firstTrade = {default long, short}; input averageType = AverageType.WILDERS; input debug = no; Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor); def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod)); def HRef = if low <= high[1] then high - close[1] else (high - close[1]) - 0.5 * (low - high[1]); def LRef = if high >= low[1] then close[1] - low else (close[1] - low) - 0.5 * (low[1] - high); def trueRange; switch (trailType) { case modified: trueRange = Max(HiLo, Max(HRef, LRef)); case unmodified: trueRange = TrueRange(high, close, low); } def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod); def state = {default init, long, short}; def trail; switch (state[1]) { case init: if (!IsNaN(loss)) { switch (firstTrade) { case long: state = state.long; trail = close - loss; case short: state = state.short; trail = close + loss; } } else { state = state.init; trail = Double.NaN; } case long: if (close > trail[1]) { state = state.long; trail = Max(trail[1], close - loss); } else { state = state.short; trail = close + loss; } case short: if (close < trail[1]) { state = state.short; trail = Min(trail[1], close + loss); } else { state = state.long; trail = close - loss; } } def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE); def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE); plot arrowup = if BuySignal then low else Double.NaN; plot arrowdown = if SellSignal then high else Double.NaN; arrowup.SetPaintingStrategy(PaintingStrategy.ARROW_UP); arrowdown.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); arrowup.SetLineWeight(5); arrowdown.SetLineWeight(5); arrowup.SetDefaultColor(Color.GREEN); arrowdown.SetDefaultColor(Color.RED); plot TrailingStop = trail; TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS); TrailingStop.DefineColor("Buy", GetColor(0)); TrailingStop.DefineColor("Sell", GetColor(1)); TrailingStop.AssignValueColor(if state == state.long then TrailingStop.Color("Sell") else TrailingStop.Color("Buy")); AddLabel(debug, BuySignal); AddLabel(debug, SellSignal); AddLabel(debug, trail); AddLabel(debug, state); ################################################################ ########## ATR/ADR Calc ######### ################################################################ input rangeType = { default "trueRange", "ATR", "ADR" }; input ATRlength = 14; input ATRaverageType = AverageType.WILDERS; def Range; if rangeType == rangeType.ATR { Range = MovingAverage(ATRaverageType, TrueRange(high, close, low), ATRlength); } else if rangeType == rangeType.trueRange { Range = trueRange; } else { Range = Average(high - low, 7); } # -- END ATR/ATR/TrueRange calc # -- Logic for bar counter and state detector def bnumUp; def bnumDown; def closeUpTrendStart; def closeDownTrendStart; def UpTrendBarCount; def DownTrendBarCount; def time; if BuySignal { bnumUp = BarNumber(); bnumDown = 0; closeUpTrendStart = close; closeDownTrendStart = 0; UpTrendBarCount = 1; DownTrendBarCount = 0; time = GetTime(); } else if state == state.long { bnumUp = bnumUp[1]; bnumDown = 0; closeUpTrendStart = closeUpTrendStart[1]; closeDownTrendStart = 0; UpTrendBarCount = UpTrendBarCount[1] + 1; DownTrendBarCount = 0; time = time[1]; } else if SellSignal { bnumUp = 0; bnumDown = BarNumber(); closeDownTrendStart = close; closeUpTrendStart = 0; UpTrendBarCount = 0; DownTrendBarCount = 1; time = GetTime(); } else if state == state.short { bnumDown = bnumDown[1]; closeDownTrendStart = closeDownTrendStart[1]; DownTrendBarCount = DownTrendBarCount[1] + 1; bnumUp = 0; closeUpTrendStart = 0; UpTrendBarCount = 0; time = time[1]; } else { bnumUp = 0; bnumDown = 0; closeUpTrendStart = 0; closeDownTrendStart = 0; UpTrendBarCount = 0; DownTrendBarCount = 0; time = Double.NaN; } def c; if BarNumber() == bnumUp or BarNumber() == bnumDown { c = Range; } else if state == state.long or state == state.short { c = c[1]; } else { c = 0; } AddLabel(debug, "bnumup:" + bnumUp); AddLabel(debug, "closeUpTrendStart" + closeUpTrendStart); AddLabel(debug, "bnumdown:" + bnumDown); AddLabel(debug, "closeDownTrendStart" + closeDownTrendStart); AddLabel(debug, "c:" + c); AddLabel(debug, "Range:" + Range); AddLabel(debug, "trueRange:" + trueRange); AddLabel(debug, "time:" + time); ################################################################ ########## Target and Stop Loss Plots ######### ################################################################ def up = if arrowup then bnumUp else Double.NaN; def dn = if arrowdown then bnumDown else Double.NaN; plot BuySignalStopLoss = if showlast_Targets_only == yes and (bnumUp < HighestAll(up)) then Double.NaN else if state == state.long then closeUpTrendStart - (c * stopLossMultiplier) else Double.NaN ; plot oneADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c else Double.NaN; plot twoADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c * 2 else Double.NaN; plot threeADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c * 3 else Double.NaN; plot fourADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c * 4 else Double.NaN; plot fiveADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c * 5 else Double.NaN; plot SellSignalStopLoss = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart + (c * stopLossMultiplier) else Double.NaN; plot oneADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c else Double.NaN; plot twoADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c * 2 else Double.NaN; plot threeADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c * 3 else Double.NaN; plot fourADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c * 4 else Double.NaN; plot fiveADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c * 5 else Double.NaN; BuySignalStopLoss.SetDefaultColor(Color.LIGHT_RED); oneADRPlus.SetDefaultColor(Color.LIGHT_GREEN); twoADRPlus.SetDefaultColor(Color.LIGHT_GREEN); threeADRPlus.SetDefaultColor(Color.LIGHT_GREEN); fourADRPlus.SetDefaultColor(Color.LIGHT_GREEN); fiveADRPlus.SetDefaultColor(Color.LIGHT_GREEN); SellSignalStopLoss.SetDefaultColor(Color.LIGHT_GREEN); oneADRMinus.SetDefaultColor(Color.LIGHT_RED); twoADRMinus.SetDefaultColor(Color.LIGHT_RED); threeADRMinus.SetDefaultColor(Color.LIGHT_RED); fourADRMinus.SetDefaultColor(Color.LIGHT_RED); fiveADRMinus.SetDefaultColor(Color.LIGHT_RED); oneADRMinus.SetHiding(GetTime() < time); AddCloud(fiveADRPlus, BuySignalStopLoss, Color.LIGHT_GREEN); AddCloud(SellSignalStopLoss, fiveADRMinus, Color.PLUM);

Beautiful, I had been trying to figure out how to do that for a while. Nice work. I will incorporate that to the RSM as a feature as well.This should allow an option to just display only the most current set of targets

Code:#ATR_Stoploss_Targets # #CHANGELOG # # 2021.05.06 @cos251 - Initial release - ATRStoploss Standard TOS indicator with targets after BuySignal or SellSignal trigger # # #CREDITS # requesed by "@wtf_dude" # #LINK # https://usethinkscript.com/threads/target-plots-after-buy-signals.6529/ # # -- Standard ATR Stoploss Indicator TOS Version input showlast_Targets_only = yes; input stopLossMultiplier = 1.0; input trailType = {default modified, unmodified}; input ATRPeriod = 5; input ATRFactor = 3.5; input firstTrade = {default long, short}; input averageType = AverageType.WILDERS; input debug = no; Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor); def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod)); def HRef = if low <= high[1] then high - close[1] else (high - close[1]) - 0.5 * (low - high[1]); def LRef = if high >= low[1] then close[1] - low else (close[1] - low) - 0.5 * (low[1] - high); def trueRange; switch (trailType) { case modified: trueRange = Max(HiLo, Max(HRef, LRef)); case unmodified: trueRange = TrueRange(high, close, low); } def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod); def state = {default init, long, short}; def trail; switch (state[1]) { case init: if (!IsNaN(loss)) { switch (firstTrade) { case long: state = state.long; trail = close - loss; case short: state = state.short; trail = close + loss; } } else { state = state.init; trail = Double.NaN; } case long: if (close > trail[1]) { state = state.long; trail = Max(trail[1], close - loss); } else { state = state.short; trail = close + loss; } case short: if (close < trail[1]) { state = state.short; trail = Min(trail[1], close + loss); } else { state = state.long; trail = close - loss; } } def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE); def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE); plot arrowup = if BuySignal then low else Double.NaN; plot arrowdown = if SellSignal then high else Double.NaN; arrowup.SetPaintingStrategy(PaintingStrategy.ARROW_UP); arrowdown.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); arrowup.SetLineWeight(5); arrowdown.SetLineWeight(5); arrowup.SetDefaultColor(Color.GREEN); arrowdown.SetDefaultColor(Color.RED); plot TrailingStop = trail; TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS); TrailingStop.DefineColor("Buy", GetColor(0)); TrailingStop.DefineColor("Sell", GetColor(1)); TrailingStop.AssignValueColor(if state == state.long then TrailingStop.Color("Sell") else TrailingStop.Color("Buy")); AddLabel(debug, BuySignal); AddLabel(debug, SellSignal); AddLabel(debug, trail); AddLabel(debug, state); ################################################################ ########## ATR/ADR Calc ######### ################################################################ input rangeType = { default "trueRange", "ATR", "ADR" }; input ATRlength = 14; input ATRaverageType = AverageType.WILDERS; def Range; if rangeType == rangeType.ATR { Range = MovingAverage(ATRaverageType, TrueRange(high, close, low), ATRlength); } else if rangeType == rangeType.trueRange { Range = trueRange; } else { Range = Average(high - low, 7); } # -- END ATR/ATR/TrueRange calc # -- Logic for bar counter and state detector def bnumUp; def bnumDown; def closeUpTrendStart; def closeDownTrendStart; def UpTrendBarCount; def DownTrendBarCount; def time; if BuySignal { bnumUp = BarNumber(); bnumDown = 0; closeUpTrendStart = close; closeDownTrendStart = 0; UpTrendBarCount = 1; DownTrendBarCount = 0; time = GetTime(); } else if state == state.long { bnumUp = bnumUp[1]; bnumDown = 0; closeUpTrendStart = closeUpTrendStart[1]; closeDownTrendStart = 0; UpTrendBarCount = UpTrendBarCount[1] + 1; DownTrendBarCount = 0; time = time[1]; } else if SellSignal { bnumUp = 0; bnumDown = BarNumber(); closeDownTrendStart = close; closeUpTrendStart = 0; UpTrendBarCount = 0; DownTrendBarCount = 1; time = GetTime(); } else if state == state.short { bnumDown = bnumDown[1]; closeDownTrendStart = closeDownTrendStart[1]; DownTrendBarCount = DownTrendBarCount[1] + 1; bnumUp = 0; closeUpTrendStart = 0; UpTrendBarCount = 0; time = time[1]; } else { bnumUp = 0; bnumDown = 0; closeUpTrendStart = 0; closeDownTrendStart = 0; UpTrendBarCount = 0; DownTrendBarCount = 0; time = Double.NaN; } def c; if BarNumber() == bnumUp or BarNumber() == bnumDown { c = Range; } else if state == state.long or state == state.short { c = c[1]; } else { c = 0; } AddLabel(debug, "bnumup:" + bnumUp); AddLabel(debug, "closeUpTrendStart" + closeUpTrendStart); AddLabel(debug, "bnumdown:" + bnumDown); AddLabel(debug, "closeDownTrendStart" + closeDownTrendStart); AddLabel(debug, "c:" + c); AddLabel(debug, "Range:" + Range); AddLabel(debug, "trueRange:" + trueRange); AddLabel(debug, "time:" + time); ################################################################ ########## Target and Stop Loss Plots ######### ################################################################ def up = if arrowup then bnumUp else Double.NaN; def dn = if arrowdown then bnumDown else Double.NaN; plot BuySignalStopLoss = if showlast_Targets_only == yes and (bnumUp < HighestAll(up)) then Double.NaN else if state == state.long then closeUpTrendStart - (c * stopLossMultiplier) else Double.NaN ; plot oneADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c else Double.NaN; plot twoADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c * 2 else Double.NaN; plot threeADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c * 3 else Double.NaN; plot fourADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c * 4 else Double.NaN; plot fiveADRPlus = if showlast_Targets_only == yes and (bnumUp < Max(HighestAll(dn), HighestAll(up))) then Double.NaN else if state == state.long then closeUpTrendStart + c * 5 else Double.NaN; plot SellSignalStopLoss = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart + (c * stopLossMultiplier) else Double.NaN; plot oneADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c else Double.NaN; plot twoADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c * 2 else Double.NaN; plot threeADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c * 3 else Double.NaN; plot fourADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c * 4 else Double.NaN; plot fiveADRMinus = if showlast_Targets_only == yes and bnumDown < Max(HighestAll(dn), HighestAll(up)) then Double.NaN else if state == state.short then closeDownTrendStart - c * 5 else Double.NaN; BuySignalStopLoss.SetDefaultColor(Color.LIGHT_RED); oneADRPlus.SetDefaultColor(Color.LIGHT_GREEN); twoADRPlus.SetDefaultColor(Color.LIGHT_GREEN); threeADRPlus.SetDefaultColor(Color.LIGHT_GREEN); fourADRPlus.SetDefaultColor(Color.LIGHT_GREEN); fiveADRPlus.SetDefaultColor(Color.LIGHT_GREEN); SellSignalStopLoss.SetDefaultColor(Color.LIGHT_GREEN); oneADRMinus.SetDefaultColor(Color.LIGHT_RED); twoADRMinus.SetDefaultColor(Color.LIGHT_RED); threeADRMinus.SetDefaultColor(Color.LIGHT_RED); fourADRMinus.SetDefaultColor(Color.LIGHT_RED); fiveADRMinus.SetDefaultColor(Color.LIGHT_RED); oneADRMinus.SetHiding(GetTime() < time); AddCloud(fiveADRPlus, BuySignalStopLoss, Color.LIGHT_GREEN); AddCloud(SellSignalStopLoss, fiveADRMinus, Color.PLUM);

In case you guys are curious, I'm experimenting with incorporating pyramiding into my strategy. ie Adding .5%, .3%. .2% risk on each subsequent ATR. If you guys have any thoughts or suggestions, throw em out here. Also curious if you go-to settings for your ATR calculation. I still haven't found one I completely love yet.

JohnnieCakes

New member

"closeUpTrendStart + c *target1mult" so it looks like the trend switches and then the atr target is multiplied by the first close after the trend switch. @cos251 may have to chime in

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

25 percent stop loss a 25% initial target and maybe a 100% 2nd target.

- Started by mrliim

- Replies: 1

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

776

Online

Similar threads

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

25 percent stop loss a 25% initial target and maybe a 100% 2nd target.

- Started by mrliim

- Replies: 1

-

-

-

Similar threads

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

25 percent stop loss a 25% initial target and maybe a 100% 2nd target.

- Started by mrliim

- Replies: 1

-

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.