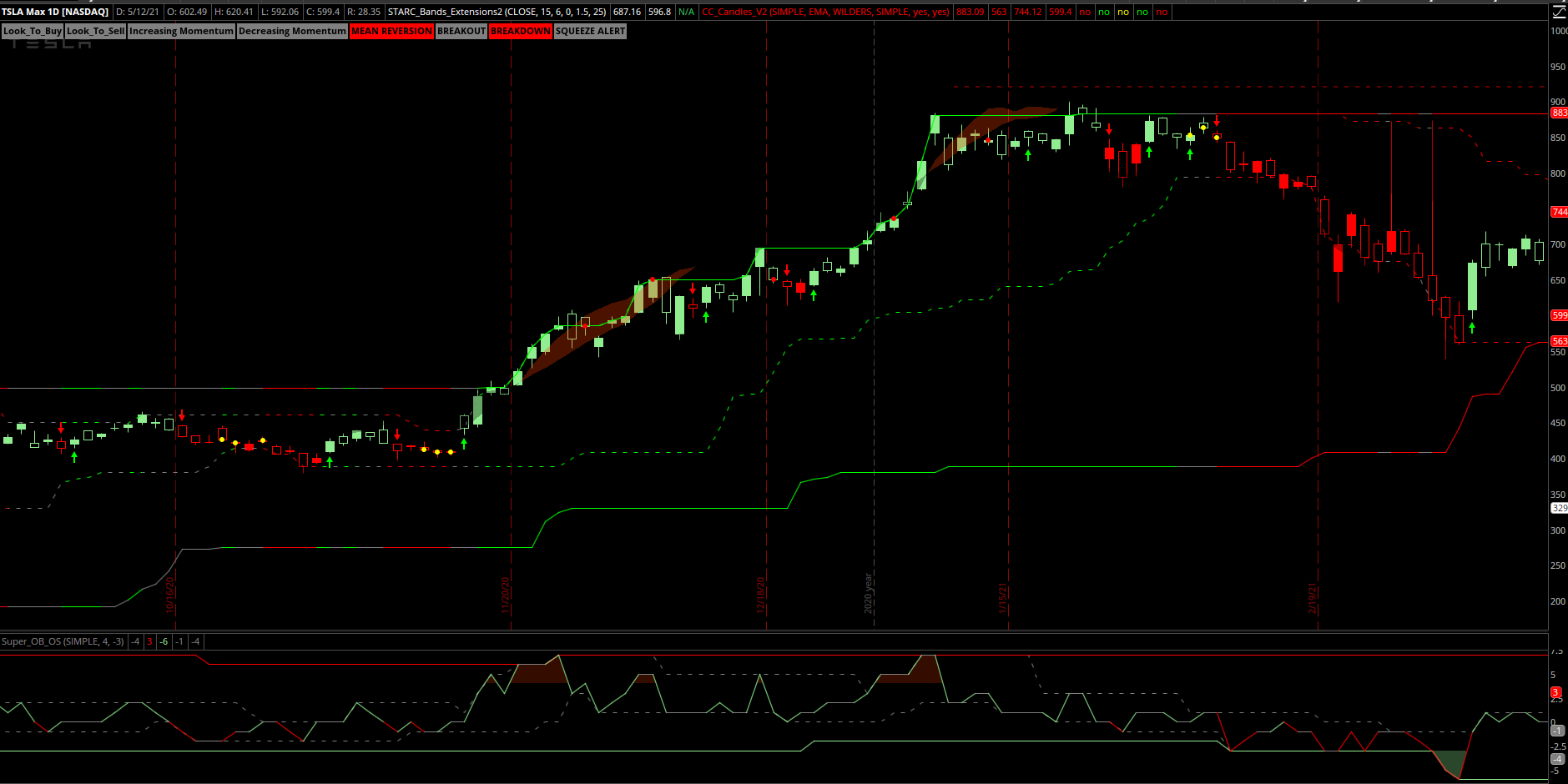

This is a lower study that I have designed to identify overbought and oversold conditions. Works very well with the Confirmation Level Lower study and Confirmation Candles. Pay close attention to when the Confirmation Level Line or the Super OB OS Line goes flat in OB or OS zones (tends to lead to reversal). See what you think.

Code:

#Super_OB_OS_Lower V.2

#Created by Christopher84 04/22/2021

#Modified 5/12/2021 Included dynamic support and resistance. Adjusted OB/OS levels.

declare lower;

def BulgeLength = 75;

def SqueezeLength = 75;

def BulgeLength2 = 8;

def SqueezeLength2 = 8;

#RSI

def price = close;

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength);

def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.Simple;

def displace = 0;

def BBPB_length = 20;

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

#Projection Oscillator

def ProjectionOsc_length = 30;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#OB/OS Calculation

def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

plot Consensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

plot Bulge = Highest(Consensus_Line, BulgeLength);

bulge.SetPaintingStrategy(PaintingStrategy.LINE);

bulge.SetLineWeight(1);

bulge.SetDefaultColor(Color.RED);

plot Squeeze = Lowest(Consensus_Line, SqueezeLength);

Squeeze.SetPaintingStrategy(PaintingStrategy.LINE);

Squeeze.SetLineWeight(1);

Squeeze.SetDefaultColor(Color.LIGHT_GREEN);

plot Bulge2 = Highest(Consensus_Line, BulgeLength2);

bulge2.SetPaintingStrategy(PaintingStrategy.LINE);

bulge2.SetStyle(Curve.SHORT_DASH);

bulge2.SetLineWeight(1);

bulge2.SetDefaultColor(Color.GRAY);

plot Squeeze2 = Lowest(Consensus_Line, SqueezeLength2);

Squeeze2.SetPaintingStrategy(PaintingStrategy.LINE);

Squeeze2.SetStyle(Curve.SHORT_DASH);

Squeeze2.SetLineWeight(1);

Squeeze2.SetDefaultColor(Color.GRAY);

input Super_OB = 4;

input Super_OS = -3;

Consensus_Line.AssignValueColor(

if Consensus_Line > Consensus_Line[1] and Consensus_Line >= Zero_Line then Color.LIGHT_GREEN

else if Consensus_Line < Consensus_Line[1] and Consensus_Line >= Zero_Line then Color.LIGHT_GREEN

else if Consensus_Line < Consensus_Line[1] and Consensus_Line < Zero_Line then Color.RED else

if Consensus_Line > Consensus_Line[1] and Consensus_Line < Zero_Line then Color.RED

else Color.GRAY);

AddCloud(Consensus_Line, Super_OB, Color.LIGHT_RED, Color.CURRENT);

AddCloud(Consensus_Line, Super_OS, Color.CURRENT, Color.LIGHT_GREEN);

Last edited: