Hello, any reason why is not recognizing FullK? ThanksYou can color any plot using the AssignValueColor() function.

Ruby:FullK.AssignValueColor( if FullK > FullK[1] then Color.GREEN else if FullK < FullK[1] then Color.RED else Color.GRAY );

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stochastic Watchlist, Scan, Alert, Arrows & Other For ThinkOrSwim

- Thread starter merryDay

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Because @Slippage Provided you with a code 'snippet' You need to add the snippet to the study that you are using and you have to have FullK defined. An example would be:

Ruby:

plot FullK = reference StochasticFull().FullK ;

FullK.AssignValueColor(

if FullK > FullK[1] then Color.GREEN

else if FullK < FullK[1] then Color.RED

else Color.GRAY

);analyst2345

New member

What Im trying to do here is: Signal will occur when the fullK moving average goes overbought above 80/ overbought then the fullK moving average will come down and crossover under the fullD moving average and Signal will occur when the fullK moving average goes below 20/oversold then the fullk moving average will come up and crossover above the fullD moving average. The problem I have is that Im only getting half of the signals. Thanks.

Code:

declare lower;

# Base code by TD Ameritrade IP Company, Inc. (c) 2008-2021

input over_bought = 80;

input over_sold = 20;

input KPeriod = 10;

input DPeriod = 10;

input priceH = high;

input priceL = low;

input priceC = close;

input slowing_period = 3;

input averageType = AverageType.SIMPLE;

input showBreakoutSignals = {default "No", "On FullK", "On FullD", "On FullK & FullD"};

def lowest_k = Lowest(priceL, KPeriod);

def c1 = priceC - lowest_k;

def c2 = Highest(priceH, KPeriod) - lowest_k;

def FastK = if c2 != 0 then c1 / c2 * 100 else 0;

plot FullK = MovingAverage(averageType, FastK, slowing_period);

plot FullD = MovingAverage(averageType, FullK, DPeriod);

plot OverBought = over_bought;

plot OverSold = over_sold;

# signal

def fullKCrossesFromoverbought= FullK[1] > 80 and FullK < 80;

def fullKCrossesBelowFullD = FullK[1] > FullD[1] and FullK < FullD;

plot signaldown = fullKCrossesFromoverbought and fullKCrossesBelowFullD;

signaldown.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_down);

signaldown.SetDefaultColor(Color.magenta);

def fullKCrossesFromoversold = FullK[1] < 20 and FullK > 20;

def fullKCrossesAboveFullD = FullK[1] < FullD[1] and FullK > FullD;

plot signalup = fullKCrossesFromoversold and fullKCrossesAboveFullD;

signalup.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

signalup.SetDefaultColor(Color.cyan);@analyst2345 My understanding is that you want to

- look for a FullK that crossed oversold on some previous candle and

- is now crossing over FullD on the current candle.

Last edited:

Hello all, I'm struggling to get this to work and I'm hoping its a simple fix, tried searching for it but maybe couldn't think of the right key words. Trying to make a stochasticFull label that changes color with a few conditions. I have it turning red when over bought and green when over sold, that's pretty straightforward but trying to reference the positions of the K and D is where I am missing something. Trying to have the label yellow when above 60% but after a down cross, as well as below 40% with an upcross. The Following is as far as I got before getting stumped. Forgive my ugly coding lol. Thank you in advance.

Code:

input over_bought = 80;

input over_sold = 20;

input KPeriod = 10;

input slowing_period = 3;

input averageType = AverageType.SIMPLE;

def stoch = StochasticFull(over_bought = over_bought, over_sold = over_sold, KPeriod = KPeriod, slowing_period = slowing_period, averageType = averageType).FullK;

def StoK = reference round(StochasticFull.FullK);

def StoD = reference round(StochasticFull.FullD);

DefineGlobalColor("Neutral", Color.GRAY);

DefineGlobalColor("Overbought", Color.DARK_RED);

DefineGlobalColor("Oversold", Color.DARK_GREEN);

DefineGlobalColor("Mix", Color.YELLOW);

AddLabel(Yes, "Stoch(" +Kperiod + "):" + round(stoch, 1) if stoch > over_bought then GlobalColor("Overbought") else if stoch < over_sold then GlobalColor("Oversold") else if StoD < StoK then if stoch > 60 then GlobalColor("Mix") else GlobalColor("Neutral") else GlobalColor("Neutral"));@TTs_MikeC These Stochastic Label and WatchList scripts may have more than you asked but it has all the pieces you need to customize to your needs.

The watchlist is so you can see the various labels and modify as needed.

Shared Chart Labels: http://tos.mx/XBbftQb Click here for --> Easiest way to load shared links

Shared WatchList Labels: http://tos.mx/2wmem9E

Here is the Script for Chart Labels:

Here is the Script for WatchList Column:

The watchlist is so you can see the various labels and modify as needed.

Shared Chart Labels: http://tos.mx/XBbftQb Click here for --> Easiest way to load shared links

Shared WatchList Labels: http://tos.mx/2wmem9E

Here is the Script for Chart Labels:

Ruby:

input over_bought = 80;

input over_sold = 20;

input KPeriod = 10;

input slowing_period = 3;

input averageType = AverageType.SIMPLE;

def stoch = StochasticFull(over_bought = over_bought, over_sold = over_sold, KPeriod = KPeriod, slowing_period = slowing_period, averageType = averageType).FullK;

def StoK = reference StochasticFull.FullK;

def StoD = reference StochasticFull.FullD;

DefineGlobalColor("pretrend", CreateColor(50, 200, 255)) ;

DefineGlobalColor("TrendBEGIN", CreateColor(0, 0, 255)) ;

DefineGlobalColor("rising", CreateColor(0, 165, 0)) ;

DefineGlobalColor("TrendEnd", CreateColor(255, 204, 0)) ;

DefineGlobalColor("maxxed", CreateColor(255, 139 ,61)) ;

DefineGlobalColor("falling", CreateColor(225, 0, 0)) ;

DefineGlobalColor("neutral", CreateColor(204, 204, 204)) ;

AddLabel(yes,

if StoK < over_sold and StoK crosses above StoD then "Stoch Buy" else

if StoK > over_bought and StoK crosses below StoD then "Stoch Sell" else

if Stoch < over_sold then "Stoch pre-trend " +round(Stoch,0) else

if Stoch > over_bought then "Stoch maxxed " +round(Stoch,0) else

if Stoch crosses above over_sold then "Stoch TREND BEGIN!" else

if Stoch crosses below over_bought then "Stoch TREND END!" else

if Stoch >= Stoch[1] then "👍 " + Round(Stoch, 0) else

if Stoch < Stoch[1] then "👎 " + Round(Stoch, 0) else

"Stoch Neutral " +round(Stoch,0),

if StoK < over_sold and StoK crosses above StoD then color.cyan else

if StoK > over_bought and StoK crosses below StoD then color.magenta else

if Stoch < over_sold then GlobalColor("pretrend") else

if Stoch > over_bought then GlobalColor("maxxed") else

if Stoch crosses above over_sold then GlobalColor("TrendBEGIN") else

if Stoch crosses below over_bought then GlobalColor("TrendEND") else

if Stoch > Stoch[1] and Stoch>40 then color.Dark_green else

if Stoch < Stoch[1] and Stoch<40 then color.Dark_red else

if Stoch > Stoch[1] then GlobalColor("rising") else

if Stoch > Stoch[1] then GlobalColor("falling")

else GlobalColor("neutral")) ;

Ruby:

input over_bought = 80;

input over_sold = 20;

input KPeriod = 10;

input slowing_period = 3;

input averageType = AverageType.SIMPLE;

def stoch = StochasticFull(over_bought = over_bought, over_sold = over_sold, KPeriod = KPeriod, slowing_period = slowing_period, averageType = averageType).FullK;

def StoK = reference StochasticFull.FullK;

def StoD = reference StochasticFull.FullD;

AddLabel(yes,

if StoK < over_sold and StoK crosses above StoD then "BUY" else

if StoK > over_bought and StoK crosses below StoD then "SELL" else

if Stoch < over_sold then "pre-trend " + Round(Stoch, 0) else

if Stoch > over_bought then "maxxed " + Round(Stoch, 0) else

if Stoch crosses above over_sold then "TREND BEGIN!" else

if Stoch crosses below over_bought then "TREND END!" else

if Stoch >= Stoch[1] then "👍 " + Round(Stoch, 0) else

if Stoch < Stoch[1] then "👎 " + Round(Stoch, 0) else "Neutral " + Round(Stoch, 0),

if Stoch crosses above over_sold then color.white else

if Stoch > Stoch[1] and Stoch>40 then color.white else

if Stoch < Stoch[1] and Stoch<40 then color.white else

color.black );

AssignBackgroundColor(

if StoK < over_sold and StoK crosses above StoD then color.cyan else

if StoK > over_bought and StoK crosses below StoD then color.magenta else

if Stoch < over_sold then CreateColor(50, 200, 255) else

if Stoch > over_bought then CreateColor(255, 139 ,61) else

if Stoch crosses above over_sold then CreateColor(0, 0, 255) else

if Stoch crosses below over_bought then CreateColor(255, 204, 0) else

if Stoch > Stoch[1] and Stoch>40 then color.Dark_green else

if Stoch < Stoch[1] and Stoch<40 then color.Dark_red else

if Stoch > Stoch[1] then CreateColor(0, 165, 0) else

if Stoch < Stoch[1] then CreateColor(225, 0, 0) else

CreateColor(204, 204, 204)) ;

Last edited:

Thank you so much for the reply! I will give it a shot, I appreciate you taking the time, did you write this?@TTs_MikeC These Stochastic Label and WatchList scripts may have more than you asked but it has all the pieces you need to customize to your needs.

The watchlist is so you can see the various labels and modify as needed.

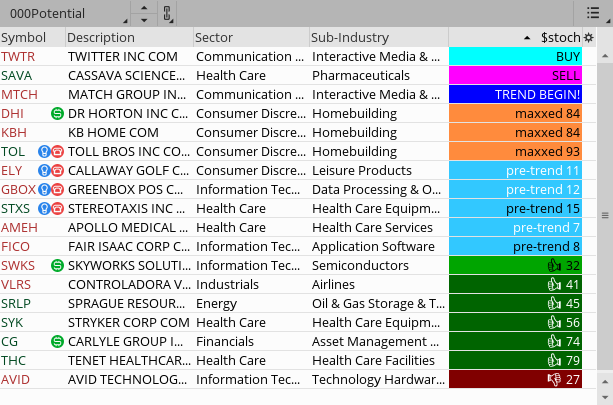

View attachment 766

Shared Chart Labels: http://tos.mx/XBbftQb Click here for --> Easiest way to load shared links

Shared WatchList Labels: http://tos.mx/2wmem9E

Here is the Script for Chart Labels:

Here is the Script for WatchList Column:Ruby:input over_bought = 80; input over_sold = 20; input KPeriod = 10; input slowing_period = 3; input averageType = AverageType.SIMPLE; def stoch = StochasticFull(over_bought = over_bought, over_sold = over_sold, KPeriod = KPeriod, slowing_period = slowing_period, averageType = averageType).FullK; def StoK = reference StochasticFull.FullK; def StoD = reference StochasticFull.FullD; DefineGlobalColor("pretrend", CreateColor(50, 200, 255)) ; DefineGlobalColor("TrendBEGIN", CreateColor(0, 0, 255)) ; DefineGlobalColor("rising", CreateColor(0, 165, 0)) ; DefineGlobalColor("TrendEnd", CreateColor(255, 204, 0)) ; DefineGlobalColor("maxxed", CreateColor(255, 139 ,61)) ; DefineGlobalColor("falling", CreateColor(225, 0, 0)) ; DefineGlobalColor("neutral", CreateColor(204, 204, 204)) ; AddLabel(yes, if StoK < over_sold and StoK crosses above StoD then "Stoch Buy" else if StoK > over_bought and StoK crosses below StoD then "Stoch Sell" else if Stoch < over_sold then "Stoch pre-trend " +round(Stoch,0) else if Stoch > over_bought then "Stoch maxxed " +round(Stoch,0) else if Stoch crosses above over_sold then "Stoch TREND BEGIN!" else if Stoch crosses below over_bought then "Stoch TREND END!" else if Stoch >= Stoch[1] then "👍 " + Round(Stoch, 0) else if Stoch < Stoch[1] then "👎 " + Round(Stoch, 0) else "Stoch Neutral " +round(Stoch,0), if StoK < over_sold and StoK crosses above StoD then color.cyan else if StoK > over_bought and StoK crosses below StoD then color.magenta else if Stoch < over_sold then GlobalColor("pretrend") else if Stoch > over_bought then GlobalColor("maxxed") else if Stoch crosses above over_sold then GlobalColor("TrendBEGIN") else if Stoch crosses below over_bought then GlobalColor("TrendEND") else if Stoch > Stoch[1] and Stoch>40 then color.Dark_green else if Stoch < Stoch[1] and Stoch<40 then color.Dark_red else if Stoch > Stoch[1] then GlobalColor("rising") else if Stoch > Stoch[1] then GlobalColor("falling") else GlobalColor("neutral")) ;

Ruby:input over_bought = 80; input over_sold = 20; input KPeriod = 10; input slowing_period = 3; input averageType = AverageType.SIMPLE; def stoch = StochasticFull(over_bought = over_bought, over_sold = over_sold, KPeriod = KPeriod, slowing_period = slowing_period, averageType = averageType).FullK; def StoK = reference StochasticFull.FullK; def StoD = reference StochasticFull.FullD; AddLabel(yes, if StoK < over_sold and StoK crosses above StoD then "BUY" else if StoK > over_bought and StoK crosses below StoD then "SELL" else if Stoch < over_sold then "pre-trend " + Round(Stoch, 0) else if Stoch > over_bought then "maxxed " + Round(Stoch, 0) else if Stoch crosses above over_sold then "TREND BEGIN!" else if Stoch crosses below over_bought then "TREND END!" else if Stoch >= Stoch[1] then "👍 " + Round(Stoch, 0) else if Stoch < Stoch[1] then "👎 " + Round(Stoch, 0) else "Neutral " + Round(Stoch, 0), if Stoch crosses above over_sold then color.white else if Stoch > Stoch[1] and Stoch>40 then color.white else if Stoch < Stoch[1] and Stoch<40 then color.white else color.black ); AssignBackgroundColor( if StoK < over_sold and StoK crosses above StoD then color.cyan else if StoK > over_bought and StoK crosses below StoD then color.magenta else if Stoch < over_sold then CreateColor(50, 200, 255) else if Stoch > over_bought then CreateColor(255, 139 ,61) else if Stoch crosses above over_sold then CreateColor(0, 0, 255) else if Stoch crosses below over_bought then CreateColor(255, 204, 0) else if Stoch > Stoch[1] and Stoch>40 then color.Dark_green else if Stoch < Stoch[1] and Stoch<40 then color.Dark_red else if Stoch > Stoch[1] then CreateColor(0, 165, 0) else if Stoch < Stoch[1] then CreateColor(225, 0, 0) else CreateColor(204, 204, 204)) ;

@TTs_MikeC I did create this label. I had the logic already created that can be applied to any oscillator.

MohamedAmarragy

New member

Would you please explain how to add the watchlist to TOS , Regards

Last edited by a moderator:

@MohamedAmarragy

Step#1 Shared WatchList Labels: http://tos.mx/2wmem9E click on instructions here ----> Easiest way to load shared links

Step#2 AFTER following the directions above, do this --> https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/#post-70999

Step#1 Shared WatchList Labels: http://tos.mx/2wmem9E click on instructions here ----> Easiest way to load shared links

Step#2 AFTER following the directions above, do this --> https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/#post-70999

I tried to create an alert with the following conditions but doesn't seem to be working. Any help is greatly appreciated. These are based of a stochastic full indicator on the 5 minute time frame using 5,3 and the %K and %D.

This one is support to alert when stock is above the 20sma on the 5minute chart, %k is over %D, and %D is under 70.

bid() is greater than SimpleMovingAvg("length" = 20)."SMA" and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD" is less than or equal to StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."OverBought" and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullK" is greater than or equal to StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD"

This one is support to alert when stock is below the 20sma on the 5minute chart, %k is under %D, and %D is above 30.

ask() is less than SimpleMovingAvg("length" = 20)."SMA" and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD" is greater than StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."OverSold" and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullK" is less than or equal to StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD" and SimpleMovingAvg()."SMA" is less than or equal to SimpleMovingAvg("length" = 20)."SMA"

This one is support to alert when stock is above the 20sma on the 5minute chart, %k is over %D, and %D is under 70.

bid() is greater than SimpleMovingAvg("length" = 20)."SMA" and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD" is less than or equal to StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."OverBought" and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullK" is greater than or equal to StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD"

This one is support to alert when stock is below the 20sma on the 5minute chart, %k is under %D, and %D is above 30.

ask() is less than SimpleMovingAvg("length" = 20)."SMA" and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD" is greater than StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."OverSold" and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullK" is less than or equal to StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD" and SimpleMovingAvg()."SMA" is less than or equal to SimpleMovingAvg("length" = 20)."SMA"

@wallie890

Here is the syntax for the requirements in your post:

stochasticFull strategy

Here is the syntax for the requirements in your post:

stochasticFull strategy

Ruby:

input OB = 70 ;

input OS = 30 ;

def StochFullD = reference StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullD" ;

def StochFullK = reference StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3)."FullK" ;

def SMA = SimpleMovingAvg()."SMA" ;

plot SMA20 = SimpleMovingAvg("length" = 20)."SMA" ;

def BidTrigger = close(priceType = PriceType.BID) is greater than SMA20 and

StochFullD is less than or equal to OB and

StochFullK is greater than or equal to StochFullD ;

def AskTrigger = close(priceType = PriceType.ASK) is less than SMA20 and

StochFullD is greater than OS and

StochFullK is less than or equal to StochFullD and

SMA is less than or equal to SMA20;

plot BidArrow = if BidTrigger then high else double.NaN ;

BidArrow.SetPaintingStrategy(paintingStrategy.ARROW_down);

plot AskArrow = if AskTrigger then low else double.NaN ;

AskArrow.SetPaintingStrategy(paintingStrategy.ARROW_UP);

AddLabel(yes, "Bid: " +close(priceType = PriceType.BID) +" | " +"Ask: " +close(priceType = PriceType.ASK), color.blue);

Alert(BidTrigger, "BidTrigger", Alert.Bar, Sound.Ding);

Alert(BidTrigger, "AskTrigger", Alert.Bar, Sound.Ring);

Last edited:

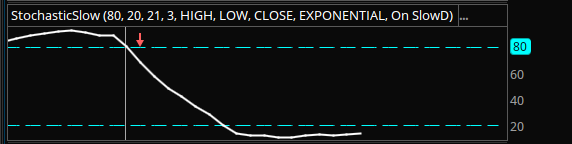

How would I change this to daily.I was looking for the exact same scan and found this great tutorial on youtube

I ended up with this - It combines stochastic slow + macd

The scan is designed for a Weekly timeframe

Enjoy

Ruby:# Courtesy of Hahn-Tech, LLC # https://www.youtube.com/watch?v=VOJwH9U0aL0 # macd scan input fastLength = 12; input slowLength = 26; input MACDLength = 9; input averageTypeMACD = AverageType.EXPONENTIAL; input showBreakoutSignals = no; def Value = MovingAverage(averageTypeMACD, close, fastLength) - MovingAverage(averageTypeMACD, close, slowLength); def Avg = MovingAverage(averageTypeMACD, Value, MACDLength); def Diff = Value - Avg; # stochastic slow scan input over_bought = 80; input over_sold = 20; input KPeriod = 14; input DPeriod = 7; input priceH = high; input priceL = low; input priceC = close; input averageTypeStoch = AverageType.SIMPLE; input showBreakoutSignalsStoch = {default "No", "On SlowK", "On SlowD", "On SlowK & SlowD"}; def SlowK = reference StochasticFull(over_bought,over_sold,KPeriod,DPeriod,priceH,priceL,priceC,3,averageTypeStoch).FullK; def SlowD = reference StochasticFull(over_bought,over_sold,KPeriod,DPeriod,priceH,priceL,priceC,3,averageTypeStoch).FullD;; # Establish crossover of slowd (SMA) above slowk (high/low prices period) plot Scan = (SlowK[1] < SlowD[1]) and (SlowK > SlowD) # Only look at slowk value under oversold value of 20 and (lowest(SlowK[1], 3) < 20) # Macd should be rising and (Diff[1] > Diff[2]);

Hello,

I was wondering if anyone could help make a stochastic scanner for the details provided below.

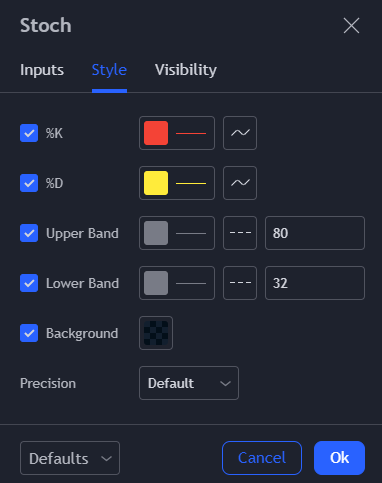

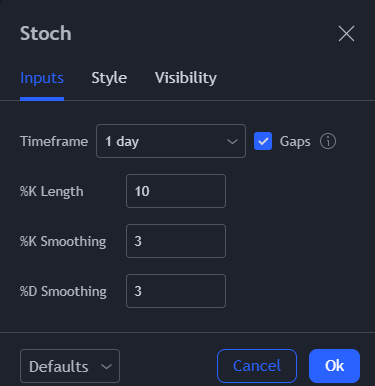

I want the %K line to be passing through the lower band length of 32 on the stochastic and preferably the %D line also passing through it. I was wondering if we could limit it to show no stocks with those lines higher than 50.

This would be on a daily time length and my settings on are all provided in the pictures above.

Thanks in advance guys!

I was wondering if anyone could help make a stochastic scanner for the details provided below.

I want the %K line to be passing through the lower band length of 32 on the stochastic and preferably the %D line also passing through it. I was wondering if we could limit it to show no stocks with those lines higher than 50.

This would be on a daily time length and my settings on are all provided in the pictures above.

Thanks in advance guys!

We don't have anything like what you describe on the forum. There is a ToS Double Smoothed Stochastic is also a smoothed Stochastic as you describe but it is calculated differently. Maybe you can make it work for you.Hello,

I was wondering if anyone could help make a stochastic scanner for the details provided below.

I want the %K line to be passing through the lower band length of 32 on the stochastic and preferably the %D line also passing through it. I was wondering if we could limit it to show no stocks with those lines higher than 50.

This would be on a daily time length and my settings on are all provided in the pictures above.

Thanks in advance guys!

Hello,

I have been following Raghee Horner from Simpler Trading and really see potential in the use of the Slow Stochastic she uses.

I am in need of some help in creating a scan that finds the green up arrow or red down arrow triggers for a specific timeframe.

The image below is a screenshot with the red down arrow on a 1 hour chart.

I did find some tutorials on creating custom scans but am not having any luck.

If anyone could offer assistance or point me in the right direction it would be much appreciated.

I have been following Raghee Horner from Simpler Trading and really see potential in the use of the Slow Stochastic she uses.

I am in need of some help in creating a scan that finds the green up arrow or red down arrow triggers for a specific timeframe.

The image below is a screenshot with the red down arrow on a 1 hour chart.

I did find some tutorials on creating custom scans but am not having any luck.

If anyone could offer assistance or point me in the right direction it would be much appreciated.

Last edited by a moderator:

I like the "StochasticWithSignals" indicator and was wanting help in deconstructing how it worked.

When it comes to the signals, I get how crossing the overbought and oversold lines generate signal arrows, but I am lost on what kind of event triggers the up and down arrows between the overbought and oversold zones.

I had assumed it was perhaps when a fast k crossed a slow d or vice versa, but comparing it to other Stoch indicators that show crossovers, none seem to match the middle zone signal events.

Any insights would be most welcome. Thank you.

When it comes to the signals, I get how crossing the overbought and oversold lines generate signal arrows, but I am lost on what kind of event triggers the up and down arrows between the overbought and oversold zones.

I had assumed it was perhaps when a fast k crossed a slow d or vice versa, but comparing it to other Stoch indicators that show crossovers, none seem to match the middle zone signal events.

Any insights would be most welcome. Thank you.

ToS does not have an indicator called "StochasticWithSignals".I like the "StochasticWithSignals" indicator and was wanting help in deconstructing how it worked.

When it comes to the signals, I get how crossing the overbought and oversold lines generate signal arrows, but I am lost on what kind of event triggers the up and down arrows between the overbought and oversold zones.

I had assumed it was perhaps when a fast k crossed a slow d or vice versa, but comparing it to other Stoch indicators that show crossovers, none seem to match the middle zone signal events.

Any insights would be most welcome. Thank you.

If referring to one of the many scripts in this thread, please provide the post# or the actual script.

Need some help.

im trying to create an alert for two conditions in the Slow Stoch.

I. when slow K is above 80, and then crosses below slow D - want a down arrow and an audible alert

II. when slow K is less than 20 and then crosses above slow D - want an up arrow and audible alert

(no alerts if there are crosses when K is between 80-20)

See my attempt below.

I've created "signal" which accomplishes "I." and "signal two" which accomplishes II. -- but i cant seem to get the arrows to work.

All of my attempts end up putting arrows corresponding with every single candle as opposed to just when the crossover occurs

can anyone help?

declare lower;

input over_bought = 80;

input over_sold = 20;

input KPeriod = 8;

input DPeriod = 3;

input priceH = high;

input priceL = low;

input priceC = close;

input averageType = AverageType.SIMPLE;

input showBreakoutSignals = {default "No", "On SlowK", "On SlowD", "On SlowK & SlowD"};

plot SlowK = reference StochasticFull(over_bought,over_sold,KPeriod,DPeriod,priceH,priceL,priceC,3,averageType).FullK;

plot SlowD = reference StochasticFull(over_bought,over_sold,KPeriod,DPeriod,priceH,priceL,priceC,3,averageType).FullD;

plot OverBought = over_bought;

plot OverSold = over_sold;

def slowKOverbought = slowK[1] > 80;

def slowKCrossesBelowSlowD = slowK[1] > slowD[1] and slowK < slowD;

def signal = slowKOverbought and slowKCrossesBelowSlowD;

Alert(signal, "SlowK and SlowD Crossing: OverBought", Alert.BAR, Sound.RING);

def slowKOverSold = slowK[1] < 20;

def slowKCrossesAboveFullD = slowK[1] < slowD[1] and slowK > slowD;

def signaltwo = slowKOverSold and slowKCrossesAboveFullD;

Alert(signaltwo, "SlowK and SlowD Crossing: OverSold", Alert.BAR, Sound.RING);

im trying to create an alert for two conditions in the Slow Stoch.

I. when slow K is above 80, and then crosses below slow D - want a down arrow and an audible alert

II. when slow K is less than 20 and then crosses above slow D - want an up arrow and audible alert

(no alerts if there are crosses when K is between 80-20)

See my attempt below.

I've created "signal" which accomplishes "I." and "signal two" which accomplishes II. -- but i cant seem to get the arrows to work.

All of my attempts end up putting arrows corresponding with every single candle as opposed to just when the crossover occurs

can anyone help?

declare lower;

input over_bought = 80;

input over_sold = 20;

input KPeriod = 8;

input DPeriod = 3;

input priceH = high;

input priceL = low;

input priceC = close;

input averageType = AverageType.SIMPLE;

input showBreakoutSignals = {default "No", "On SlowK", "On SlowD", "On SlowK & SlowD"};

plot SlowK = reference StochasticFull(over_bought,over_sold,KPeriod,DPeriod,priceH,priceL,priceC,3,averageType).FullK;

plot SlowD = reference StochasticFull(over_bought,over_sold,KPeriod,DPeriod,priceH,priceL,priceC,3,averageType).FullD;

plot OverBought = over_bought;

plot OverSold = over_sold;

def slowKOverbought = slowK[1] > 80;

def slowKCrossesBelowSlowD = slowK[1] > slowD[1] and slowK < slowD;

def signal = slowKOverbought and slowKCrossesBelowSlowD;

Alert(signal, "SlowK and SlowD Crossing: OverBought", Alert.BAR, Sound.RING);

def slowKOverSold = slowK[1] < 20;

def slowKCrossesAboveFullD = slowK[1] < slowD[1] and slowK > slowD;

def signaltwo = slowKOverSold and slowKCrossesAboveFullD;

Alert(signaltwo, "SlowK and SlowD Crossing: OverSold", Alert.BAR, Sound.RING);

Last edited by a moderator:

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Elastic Stochastic for ThinkorSwim -Upper and Lower indicator | Indicators | 8 | |

|

|

Stochastic Scalper for ThinkorSwim | Indicators | 12 | |

|

|

Repaints Mobius Full Stochastic MTF for ThinkorSwim | Indicators | 4 | |

| M | Premier Stochastic Oscillator | Indicators | 91 | |

|

|

MoneyWave Stochastic Indicator for ThinkorSwim | Indicators | 8 |

Similar threads

-

Elastic Stochastic for ThinkorSwim -Upper and Lower indicator

- Started by chewie76

- Replies: 8

-

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1705

Online

Similar threads

-

Elastic Stochastic for ThinkorSwim -Upper and Lower indicator

- Started by chewie76

- Replies: 8

-

-

-

-

Similar threads

-

Elastic Stochastic for ThinkorSwim -Upper and Lower indicator

- Started by chewie76

- Replies: 8

-

-

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.