dunpeal

New member

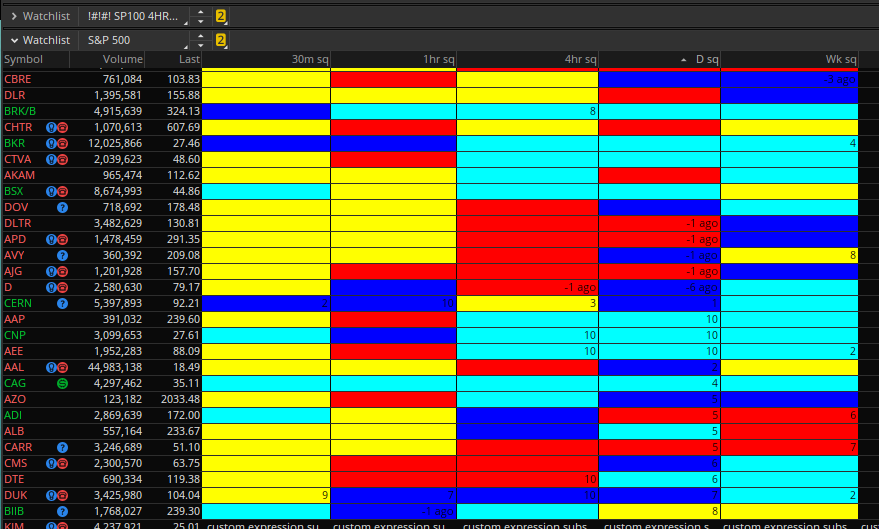

Has histo colors, squeeze count, and how long ago a squeeze fired. I like ordering the column numerically as you can see in the Daily. Now I can watch whatever time frame and see what has fired. You can look left on the small time frames and get an idea of which direction it fired. Exampled is DLTR, fired on the daily and went down on the 30m,1hr,4hr.

DUK will be an interesting one coming up with earnings.

https://tos.mx/UA6QBwB

DUK will be an interesting one coming up with earnings.

Code:

input price = CLOSE;

input length = 20;

input nK = 1.5;

input nBB = 2.0;

input alertLine = 1.0;

def keltnerChannelATRs = 1.5 ;

def bollingerBandStdDev = 2 ;

# Average True Range

def ATR = Average(TrueRange(high, close, low), 20);

# Standard Deviation

def SDev = StDev(close, 20);

# -- Calculate Bollinger Band Squeeze Indicator --

# for alert

def Denom = (keltnerChannelATRs * ATR);

def BBS_Ind = If (Denom <> 0, ((bollingerBandStdDev * SDev) / Denom), 0);#A squeeze is on if BBS_Ind < 1.0

def squeeze = if TTM_Squeeze().SqueezeAlert == 0 then 1 else 0;

def sumSqueeze = Sum(squeeze, 10);

def squeezeFired = if TTM_Squeeze().SqueezeAlert[1] == 0 and TTM_Squeeze(). SqueezeAlert == 1 then 1 else 0;

AddLabel (squeezeFired, "FIRED", color.black);

AddLabel (squeeze, +sumSqueeze, color.black);

AddLabel (!squeezeFired and !squeeze, " ", color.black);

def squeezeHistogram = TTM_Squeeze(price, length, nK, nBB, alertLine).Histogram;

plot hist = if squeezeHistogram>= 0 then

if squeezeHistogram> squeezeHistogram[1] then 2 else 1

else if squeezeHistogram < squeezeHistogram[1] then -2 else -1; assignBackgroundColor(if squeezeHistogram >= 0 then

if squeezeHistogram > squeezeHistogram[1] then color.CYAN else color.BLUE

else if squeezeHistogram < squeezeHistogram[1] then color.RED

else color.YELLOW); hist.assignvaluecolor(if squeezeHistogram >= 0 then

if squeezeHistogram > squeezeHistogram[1] then color.CYAN else color.BLUE

else if squeezeHistogram < squeezeHistogram[1] then color.RED

else color.YELLOW);

#### How long ago the squeeze fired

def Post_Count = if BBS_Ind[1] < 1.0 && BBS_Ind[0] > 1.0 then 1

else if BBS_Ind[2] < 1.0 && BBS_Ind[1] > 1.0 then 2

else if BBS_Ind[3] < 1.0 && BBS_Ind[2] > 1.0 then 3

else if BBS_Ind[4] < 1.0 && BBS_Ind[3] > 1.0 then 4

else if BBS_Ind[5] < 1.0 && BBS_Ind[4] > 1.0 then 5

else if BBS_Ind[6] < 1.0 && BBS_Ind[5] > 1.0 then 6

else Double.NaN;

AddLabel (Post_Count,Concat("-", Concat(Post_Count, " ago")), color.BLACK);

AddLabel (!squeezeFired and !squeeze, " ", color.black);