Author Message:

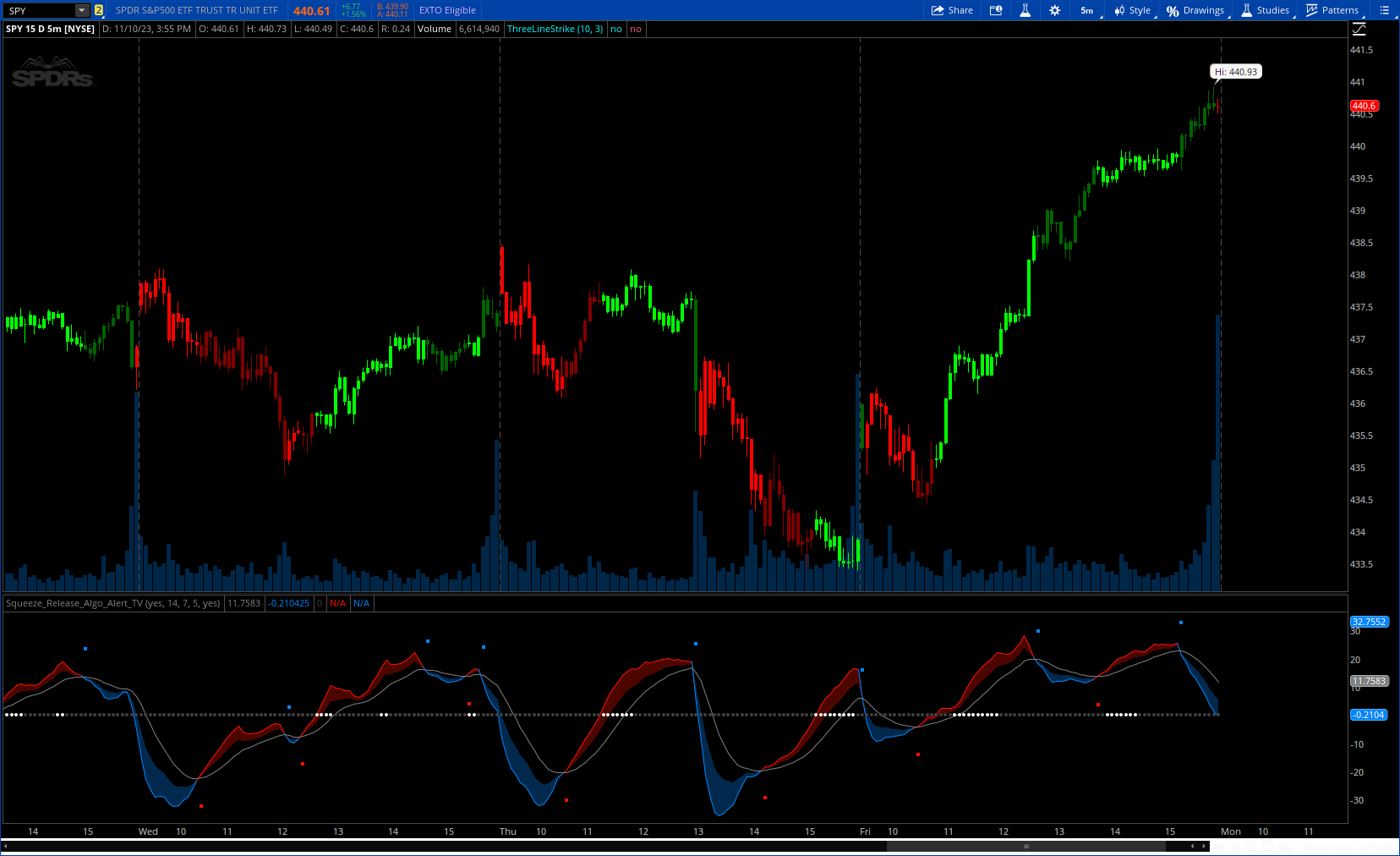

The Squeeze & Release by Algo Alert is an innovative tool designed to capture price volatility dynamics using a combination of EMA-based calculations and ATR principles. This script aims to provide traders with clear visual cues to spot potential market squeezes and release scenarios.

More details: https://www.tradingview.com/v/2GQIc9Ms/

CODE:

CSS:

#// This source code is subject to the terms of the Mozilla Public License 2.0

#// © Algo_Alert

#indicator(title="Squeeze & Release [Algo Alert]", shorttitle="?&? [Algo Alert]", overlay=false, timeframe="",

# Converted by Sam4Cok@Samer800 - 11/2023

declare lower;

input colorBars = yes;

input CalculationPeriod = 14; # "Calculation Period"

input SmoothingLength = 7; # "Smoothing Length"

input HyperSqueezeDetectionLength = 5; # "Hyper Squeeze Detection Length"

input applySmoothing = yes;

def na = Double.NaN;

def last = IsNaN(close);

DefineGlobalColor("green", CreateColor(0, 135, 255));# "Release Color"

DefineGlobalColor("red", CreateColor(255, 17, 0));# "Squeeze Color"

script rising{

input src = close;

input len = 3;

def cnt = fold i = 0 to len with p do

if src[i] > GetValue(src, i + 1) then p + 1 else p;

plot out = cnt == len;

}

def HiLo = high - low;

def tr = TrueRange(high, close, low);

def a = ExpAverage(tr, CalculationPeriod);

def ama = ExpAverage(a, CalculationPeriod * 2);

def v = ama - a;

def difEMA = ExpAverage(HiLo, CalculationPeriod * 2);

def svRegular = v / difEMA * 100;

def svSmooth = ExpAverage(svRegular, SmoothingLength);

def sv_ = if applySmoothing then svSmooth else svRegular;

def sv = sv_;

def svma = ExpAverage(sv, CalculationPeriod);

def crossUp = Crosses(sv, svma, CrossingDirection.ABOVE);

def crossDn = Crosses(sv, svma, CrossingDirection.BELOW);

def raise = sv > 0 and rising(sv, HyperSqueezeDetectionLength);

#== PLot

plot ma = svma;

ma.SetDefaultColor(Color.GRAY);

plot val = sv; # "ATR"

val.AssignValueColor(if sv > svma then GlobalColor("red") else GlobalColor("green"));

plot mid = if last then na else 0;

mid.SetPaintingStrategy(PaintingStrategy.POINTS);

mid.AssignValueColor(if raise then Color.WHITE else Color.DARK_GRAY);

plot SigUp = if crossUp then svma - 10 else na;#, "Squeeze"

plot SigDn = if crossDn then svma + 10 else na;#, "Release"

SigUp.SetPaintingStrategy(PaintingStrategy.SQUARES);

SigDn.SetPaintingStrategy(PaintingStrategy.SQUARES);

SigUp.SetDefaultColor(GlobalColor("red"));

SigDn.SetDefaultColor(GlobalColor("green"));

def fillcol = ma + (val - ma)/2;

AddCloud(val, fillcol, GlobalColor("red"), GlobalColor("green"));

#-- Bar Color

def col = if sv > 0 then

if sv > svma then 2 else 1 else

if sv < 0 then

if sv < svma then -2 else -1 else 0;

AssignPriceColor(if !colorBars then Color.CURRENT else

if col==2 then Color.GREEN else

if col==1 then Color.DARK_GREEN else

if col==-2 then Color.RED else

if col==-1 then Color.DARK_RED else Color.GRAY);

#-- END of CODE