Author Message:

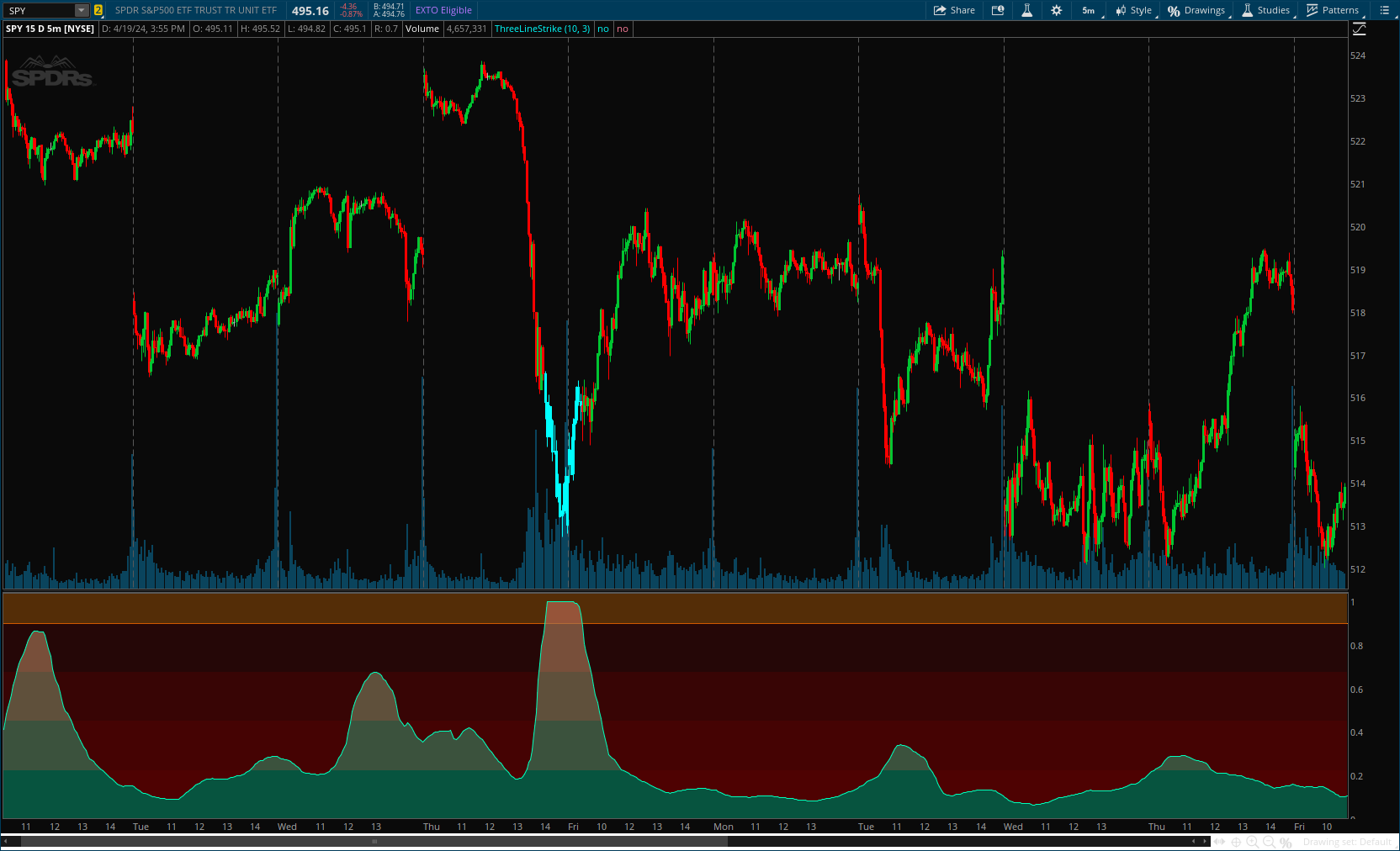

Smart Money Interest Index indicator, designed meticulously by AlgoAlpha to revolutionize the way you trade!

Read More: https://www.tradingview.com/v/oBwmJW5g/

Code:

CSS:

#// Indicator for TOS

#// © AlgoAlpha

#indicator("Smart Money Interest Index [AlgoAlpha]", "AlgoAlpha - ? Smart Money", explicit_plot_zorder = true)

# Converted by Sam4Cok@Samer800 - 04/2024

declare zerobase;

declare lower;

input colorBars = yes;

input IndexPeriod = 25; # "Index Period", minval = 1)

input VolumeFlowPeriod = 14; # "Volume Flow Period", minval = 1)

input NormalizationPeriod = 500; # "Normalization Period", minval = 1)

input HighInteresThreshold = 0.9; #, "High Interes Threshold", minval = 0.01, maxval = 0.99)

def na = Double.NaN;

def last = isNaN(close);

DefineGlobalColor("green", CreateColor(0,255,187));

DefineGlobalColor("red", CreateColor(100, 0, 0));

#// Positive Volume Index

#// the same on pine

Script f_pvi {

input src = close;

input vol = volume;

def last = isNaN(close);

def nzSrc = if(isNaN(src), 0.0, src);

def nzSrc1 = if(isNaN(src[1]), 0.0, src[1]);

def nzVol = if(isNaN(vol), 0.0, vol);

def nzVol1 = if(isNaN(vol[1]), 0.0, vol[1]);

def ta_pvi;

def prevPvi = if (if(isNaN(ta_pvi[1]), 0.0, ta_pvi[1]) == 0.0) then 1.0 else ta_pvi[1];

if nzSrc == 0.0 or nzSrc1 == 0.0 {

ta_pvi = prevPvi;

} else {

ta_pvi = if nzVol > nzVol1 then prevPvi + ((nzSrc - nzSrc1) / nzSrc1) * prevPvi else prevPvi;

}

plot f_pvi = if last then Double.NaN else if ta_pvi<=0 then 1 else ta_pvi;

}

#// Negative Volume Index

Script f_nvi {

input src = close;

input vol = volume;

def last = isNaN(close);

def nzSrc = if(isNaN(src), 0.0, src);

def nzSrc1 = if(isNaN(src[1]), 0.0, src[1]);

def nzVol = if(isNaN(vol), 0.0, vol);

def nzVol1 = if(isNaN(vol[1]), 0.0, vol[1]);

def ta_nvi;

def prevNvi = if (if(isNaN(ta_nvi[1]), 0.0, ta_nvi[1]) == 0.0) then 1.0 else ta_nvi[1];

if nzSrc == 0.0 or nzSrc1 == 0.0 {

ta_nvi = prevNvi;

} else {

ta_nvi = if nzVol < nzVol1 then prevNvi + ((nzSrc - nzSrc1) / nzSrc1) * prevNvi else prevNvi;

}

plot f_nvi = if last then Double.NaN else if ta_nvi <=0 then 1 else ta_nvi;

}

def pvi = f_pvi();

def nvi = f_nvi();

def dumb = pvi - ExpAverage(pvi, 255);

def smart = nvi - ExpAverage(nvi, 255);

def drsi = rsi(Price = dumb, Length = VolumeFlowPeriod);

def srsi = rsi(Price = smart, Length = VolumeFlowPeriod);

#//ratio shows if smart money is buying from dumb money selling and vice versa

def r = srsi / drsi;

def sums = sum(r, IndexPeriod);

def peak = highest(sums, NormalizationPeriod);

def index = sums / peak;

def bottom = if last then na else 0;

def top = if last then na else Double.POSITIVE_INFINITY;

def thresh = if last then na else HighInteresThreshold;

def SMII = index; # Smart Money Interest Index

def lvl1 = thresh * 3/4;

def lvl2 = thresh / 2;

def lvl3 = thresh / 4;

#-- Cloud and bar color

AddCloud(top, thresh, Color.DARK_ORANGE, Color.DARK_ORANGE, yes);

AddCloud(thresh, SMII, GlobalColor("red")); #, GlobalColor("red"), yes);

AddCloud(lvl1, SMII, GlobalColor("red"));#, GlobalColor("red"), yes);

AddCloud(lvl2, SMII, GlobalColor("red")); #, GlobalColor("red"), yes);

AddCloud(lvl3, SMII, GlobalColor("red")); #, GlobalColor("red"), yes);

AddCloud(SMII, bottom, GlobalColor("green"), GlobalColor("green"), yes);

AssignPriceColor(if !colorBars then Color.CURRENT else if SMII > thresh then Color.CYAN else Color.CURRENT);

#-- END of CODE

Last edited by a moderator: