Author Message:

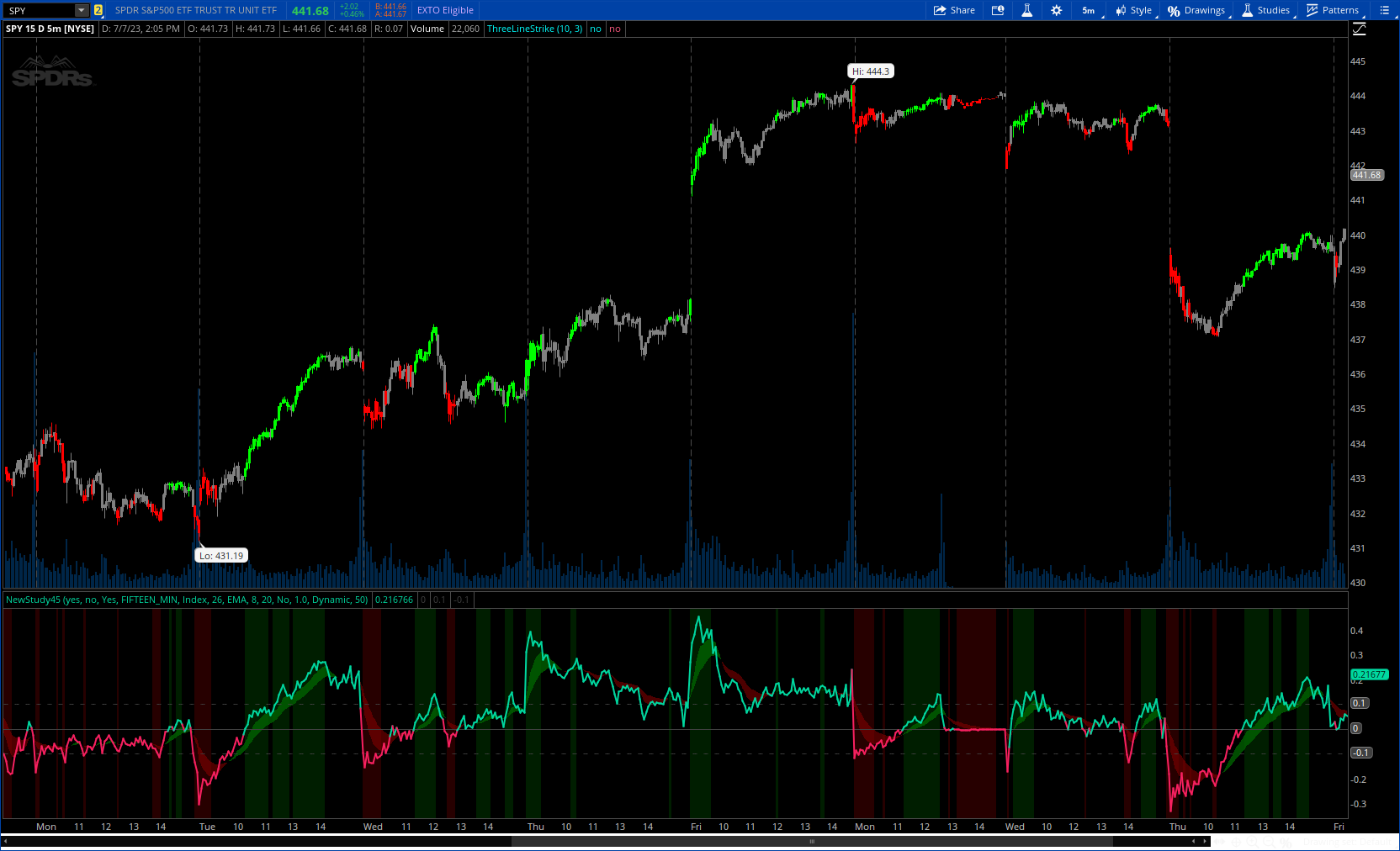

Dynamic Money Flow is a volume indicator based on Marc Chaikin's Money Flow with a few improvements.

It can be used to confirm break-outs and trends.

Zero line crosses and divergences can provide useful signals while considering chart analysis as well.

More details : https://www.tradingview.com/v/c7z3p2xh/

CODE:

CSS:

# https://www.tradingview.com/v/c7z3p2xh/

#// © RezzaHmt

#//...DMF...

#study("Dynamic Money Flow", "DMF", format=format.volume, precision=2, resolution="")

#-- Converted and mod by Sam4Cok@Samer800 - 07/07/2023

declare lower;

input colorBars = yes;

input showCloud = no;

input useChartTimeframe = {default"Yes", "No"};

input manualTimeframe = AggregationPeriod.FIFTEEN_MIN;

input mode = {default "Index", "Cumulative"};

input indexModePeriod = 26; # "Period"-"Only applies to index mode."

input ma_switch = {"OFF", default "EMA", "WMA"}; # "Moving Averages"

input fast_len = 8; # "Fast Length"

input slow_len = 20; # "Slow Length"

input simulative_vol = {"Yes", default "No"}; # "Simulative Volume"

input volumePower = 1.0; # "Power"

input weight_distribution = {default "Dynamic", "Static"};# "Weight Distribution Method"

input static_Distribution_Per = 50;# "Static Weight Distribution Bias"

def na = Double.NaN;

def last = isNaN(close);

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def index = mode == mode."Index";

def noMA = ma_switch==ma_switch."OFF";

#-- Color.

DefineGlobalColor("up", CreateColor(0,216,160));

DefineGlobalColor("dn", CreateColor(248,32,96));

#-- MTF

def c; def h; def l; def o; def v;

Switch (useChartTimeframe) {

case "Yes" :

c = close;

h = high;

l = low;

o = open;

v = volume;

case "No" :

c = close(Period=manualTimeframe);

h = high(Period=manualTimeframe);

l = low(Period=manualTimeframe);

o = open(Period=manualTimeframe);

v = volume(Period=manualTimeframe);

}

def AbsClose = AbsValue(c - c[1]);

def AbsHigh = AbsValue(h - Max(o, c));

def AbsOpen = AbsValue(Min(o, c) - l);

def vol;

switch (simulative_vol) {

case "Yes" :

vol = Power(AbsClose + AbsHigh * 2 + AbsOpen * 2, volumePower);

case "No" :

vol = Power(v, volumePower);

}

def tr = TrueRange(h, c, l);

def alpha;

switch (weight_distribution) {

case "Dynamic" :

alpha = if tr == 0 then 0 else AbsValue((c - c[1]) / tr);

case "Static" :

alpha = static_Distribution_Per / 100;

}

def trh = Max(h, c[1]);

def trl = Min(l , c[1]);

def ctr = if tr == 0 then 0 else ((c - trl) + (c - trh)) / tr * (1 - alpha) * vol;

def ctc = if c > c[1] then alpha * vol else

if c < c[1] then -alpha * vol else 0;

def ctrSum = ctrSum[1] + ctr;

def ctcSum = ctcSum[1] + ctc;

def ctSum = ctr + ctc;

def dmfCT = WildersAverage(ctSum, indexModePeriod);

def dmfVo = WildersAverage(vol, indexModePeriod);

def dmf;

switch (mode) {

case "Index" :

dmf = dmfCT / dmfVo;

case "Cumulative" :

dmf = ctrSum + ctcSum;

}

def fast_ma;

switch (ma_switch) {

case "OFF" :

fast_ma = na;

case "EMA" :

fast_ma = ExpAverage(dmf, fast_len);

case "WMA" :

fast_ma = WMA(dmf, fast_len);

}

def slow_ma;

switch (ma_switch) {

case "OFF" :

slow_ma = na;

case "EMA" :

slow_ma = ExpAverage(dmf, slow_len);

case "WMA" :

slow_ma = WMA(dmf, slow_len);

}

def main_color;

switch (mode) {

case "Index" :

main_color = if dmf > 0 then 1 else if dmf < 0 then -1 else 1;

case "Cumulative" :

main_color = if slow_ma and dmf > slow_ma then 1 else

if slow_ma and dmf < slow_ma then -1 else 1;

}

plot pMain = dmf; # "DMF"

def pZero = if Index then 0 else na;

def pFastMA = fast_ma; # "Fast MA"

def pSlowMA = slow_ma;

pMain.SetLineWeight(2);

pMain.AssignValueColor(if main_color>0 then GlobalColor("up") else

if main_color<0 then GlobalColor("dn") else GlobalColor("up"));

AddCloud(if !showCloud then na else pMain, pZero, GlobalColor("up"), GlobalColor("dn"));#"Oscillator Background"

AddCloud(pFastMA, pSlowMA, Color.GREEN, Color.RED, showCloud);# "Moving Average Fill"

plot "0" = if Index and !last then 0 else na;#, "Zero Line"

plot "1" = if Index and !last then 0.1 else na;#, "Level"

plot "-1" = if Index and !last then -0.1 else na;#, "Level"

"1".SetDefaultColor(Color.DARK_GRAY);

"0".SetDefaultColor(Color.DARK_GRAY);

"-1".SetDefaultColor(Color.DARK_GRAY);

"1".SetStyle(Curve.SHORT_DASH);

"-1".SetStyle(Curve.SHORT_DASH);

#-- Background

def upBG = if noMA then main_color > -0.1 and dmf > wma(dmf, 10) else

dmf>pFastMA and main_color>-0.1 and pFastMA>pSlowMA;

def dnBG = if noMA then main_color < 0.1 and dmf < wma(dmf, 10) else

dmf<pFastMA and main_color<0.1 and pFastMA<pSlowMA;

AddCloud(if upBG then pos else na, neg, Color.DARK_GREEN);

AddCloud(if dnBG then pos else na, neg, Color.DARK_RED);

#-- Bar Color

AssignPriceColor(if !colorBars then Color.CURRENT else

if upBG then Color.GREEN else

if dnBG then COlor.RED else Color.GRAY);

#--- END of CODE