Hey guys. I've been scouring the internet for an RVOL (Relative Volume) indicator for Thinkorswim but can't find a free one. Really need RVOL to be able to execute my trading plan.

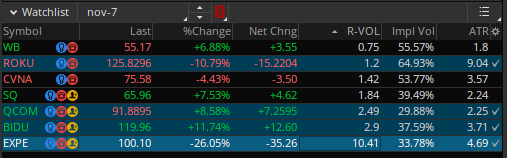

I need something like what's posted in the attached image. If you do find one, I would need assistance installing it/setting it up as a watchlist as well.

Thanks a lot!

Edit: Thank you to everyone for helping me. Below is a few different RVOL indicators for ThinkorSwim.

Version 1: https://usethinkscript.com/threads/...ator-watchlist-for-thinkorswim.1014/post-8511

Version 2: I believe shared by @Sonny

Version 3: https://usethinkscript.com/threads/...gy-and-momentum-scanner-for-thinkorswim.3002/

Continue to read throughout this post and you'll find more variations of relative volume indicators. Good luck!

I need something like what's posted in the attached image. If you do find one, I would need assistance installing it/setting it up as a watchlist as well.

Thanks a lot!

Edit: Thank you to everyone for helping me. Below is a few different RVOL indicators for ThinkorSwim.

Version 1: https://usethinkscript.com/threads/...ator-watchlist-for-thinkorswim.1014/post-8511

Version 2: I believe shared by @Sonny

Code:

def isRollover = GetYYYYMMDD() != GetYYYYMMDD()[1];

def beforeStart = GetTime() < RegularTradingStart(GetYYYYMMDD());

def vol = if isRollover and beforeStart then volume else if beforeStart then vol[1] + volume else Double.NaN;

def PMV = if IsNaN(vol) then PMV[1] else vol;

def AV = AggregationPeriod.DAY;

def x = Average(Volume(period=AV)[1],60);

def y1 = Round((PMV/x),2);

def L = Lg(y1);

def p = if L>=1 then 0 else if L>=0 then 1 else 2;

def y2 = Round(y1,p);

plot z = y2;

z.assignValueColor(if z>=10 then color.CYAN else if z>=1 then createcolor(255,153,153) else createcolor(0,215,0));Version 3: https://usethinkscript.com/threads/...gy-and-momentum-scanner-for-thinkorswim.3002/

Continue to read throughout this post and you'll find more variations of relative volume indicators. Good luck!