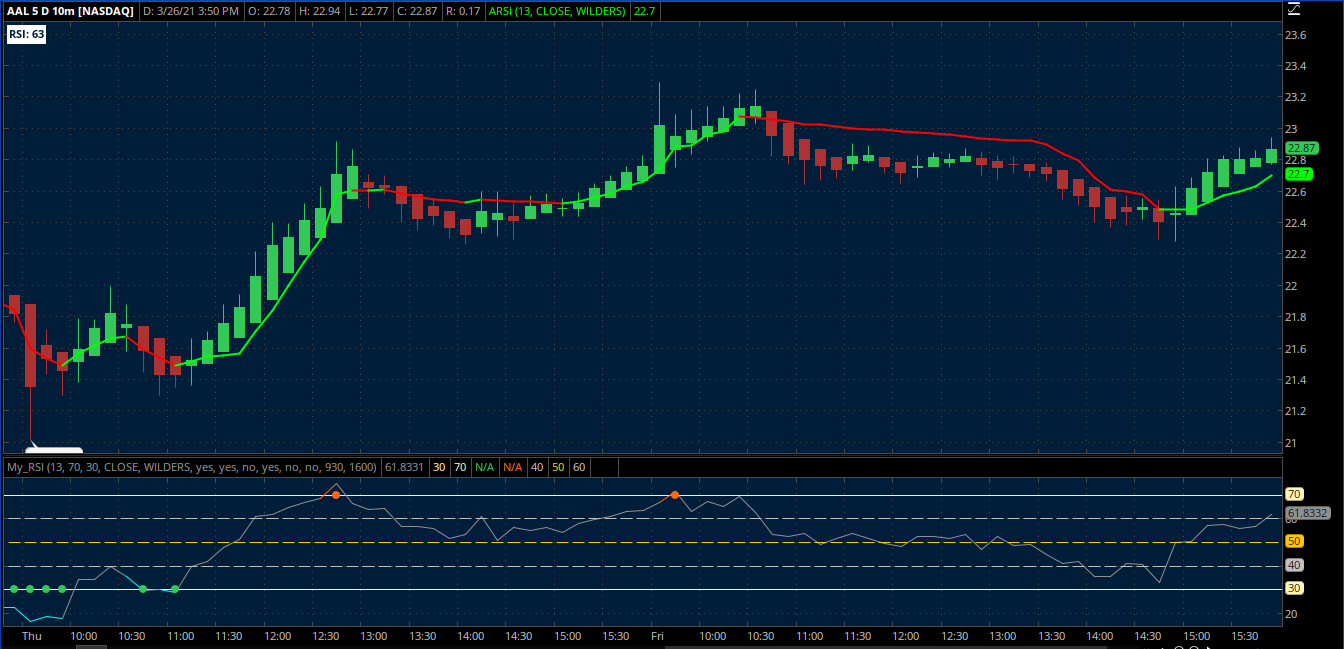

The ARSI is an upper indicator that works like a moving average but based on RSI... It works well for scalping which is what drew my original interest... While the standard RSI uses a length of 14 it is recommended to use a shorter length for this indicator and 3 is a good length for scalping on lower timeframes...

I will be adding more details as well as more images as time allows...

I will be adding more details as well as more images as time allows...

Ruby:

# ARSI

#hint: Adaptive Relative Strength Index Indicator for Thinkscript

# Created by rad14733 for usethinkscript.com

# Based on Tradingview ARSI @ https://www.tradingview.com/script/tSpy2kw2-Adaptive-RSI/

# Plots a colored line on the upper chart based on trend direction.

# v1.0 : 2021-03-28 : Initial Release

# v1.1 : 2021-05-13 : Added trend indicating ARSI value chart label

# v1.2 : 2021-07-07 : Added reversal arrows - credit to @je®emy & @SleepyZ

input length = 14;

input price = close;

input averageType = AverageType.WILDERS;

input showLabel = no;

input showReversals = no;

def rsi = 2 * AbsValue(rsi(length, price, averageType) / 100 - 0.5);

def arsiData = rsi * price + (1 - rsi) * (if isNaN(arsiData[1]) then 0 else arsiData[1]);

plot arsi = arsiData;

arsi.DefineColor("UpTrend", Color.GREEN); #GREEN

arsi.DefineColor("DownTrend", Color.RED); #RED

arsi.SetLineWeight(3);

arsi.SetPaintingStrategy(PaintingStrategy.LINE);

arsi.SetStyle(Curve.FIRM);

arsi.AssignValueColor(if arsi > arsi[1] then arsi.Color("UpTrend") else arsi.Color("DownTrend"));

AddLabel(showLabel, "ARSI: " + arsi, if arsi > arsi[1] then arsi.Color("UpTrend") else arsi.Color("DownTrend"));

plot bull = arsi[2] > arsi[1] and arsi > arsi[1];

bull.SetDefaultColor(Color.GREEN);

bull.SetlineWeight(1);

bull.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

bull.SetHiding(!showReversals);

plot bear = arsi[2] < arsi[1] and arsi < arsi[1];

bear.SetDefaultColor(Color.RED);

bear.SetLineWeight(1);

bear.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

bear.SetHiding(!showReversals);

# END - ARSI

Last edited by a moderator: