Hi @DarthSkar , please post the complete scan code so that we are on the same page. Someone will then be able to help.

I used this Scan Code: https://tos.mx/bRLjdq it's long only scan.....I'm wondering how you can do find shorts.

Thx

Hi @DarthSkar , please post the complete scan code so that we are on the same page. Someone will then be able to help.

Wonder if anyone has tried it during market meltdown and what is the result. Also, how to combine the reading of RSI and Gamma into a strategy to test its performance?@Hotdog123 Sorry it took so long to get back. The versions used here are based on code written by Mobius. I believe that this thread is where the notes that were captured on how to use the scan and chart. If not this one, there are other threads here that may contain usage notes. Yes, please re-read post #1 & 2 as that's where the notes are.

There is no best way to set up a scan. I have 6 or 8 that I have used over time but they each had specific things that they did. They are proprietary to Theotrade, so I cannot share them. Point being that I don't use them anymore. You are best off using the stocks or Etf's that are most liquid and watch those.

Regarding Gamma: it is only a signal for when not to trade, it is not in and of itself a trading signal, though many use it that way. Gamma that is high means that the product is wound up ready to make a move, up or down. Gamma that is low has signs of an exhausted move. That is really all there is to Gamma with the RSI Laguerre. Your signal will be when the RSI line breaks above 20 with Gamma coming down to go long. Watch it and play with it. It is nuanced and takes time to pick up. It's all about probabilities. If Gamma is high in both Timing chart & signal chart, your break above 20 should be more assured on your 30 minute chart. Hope that helps.

Sorry @DarthSkar i meant the whole code from the editor, not the link. Time doesn't permit me to do anything but hit and run responses.I used this Scan Code: https://tos.mx/bRLjdq it's long only scan.....I'm wondering how you can do find shorts.

Thx

Hey @TIGER202020 please put this question in a new questions thread. It should get a response then...Wonder if anyone has tried it during market meltdown and what is the result. Also, how to combine the reading of RSI and Gamma into a strategy to test its performance?

@kinetic Mobius is never wrong. Seriously. Please point out the thread# so that I can take a look at it.@markos I'm a bit confused on something, your post and the Mobius quotes seem to contradict each other in one area. In your tutorial, you said if FE is above .6, the stock is more likely to continue trending, but Mobius said FE above .6 is more of a compression or sideways action.

Am I misinterpreting something here?

Hi @jan_angel Thomas' answer in post #49 is spot on. No matter your time frame! Put it on a chart and watch how it reacts. That is the only real way to learn how to use it. I do not backtest and never have. Learning by watching will give you the best education on this excellent indicator.@markos

thanks for posting this indicator. In the post where Mobius provides explanation, there is an example of what he looks for in a short setup. Do you have the same for long setup? Or can you provide what criteria you use for long setups?

Which indicators do you believe "hit faster"? I've read many of your posts on this forum (on different topics) and learned a lot from them.I believe there is already a scanner for it...I don't have it as I do not use this particular indicator...It just hasn't clicked with me and IMO there are better indicators out there that hit faster but others swear by it. Use the search option and type Laguerre Time RSI scan or scanner...You should find what you're looking for...Might have to do a bit of digging but I know I've seen it before on here when I was searching for various scans.

# RSI-Laguerre Self Adjusting With Fractal Energy and Gaussian Price Filter

# Mobius

# V01.12.2016

#hint: RSI-Laguerre-FE-G \n Both Fractal Energy and RSI are plotted.\n RSI in cyan and FE in yellow. Look for trend exhaustion in the FE (below .382) and a reversal of RSI or Price compression in FE (above .618)and an RSI reversal.\n Price Targets are based on the Average True Range. User Inputs determine the multiplier of the ATR for those targets.\n Labels show Target prices, percentage which is from entry value to target value and if those prices have been breached.\n Points are plotted on the RSI line if Target is breached. Green for Long Breach and Red for Short Breach

#User Inputs:

input n = 20;#hint n: length for calculation.

input AlertOn = yes;

input AtrMultUpTarget = 2;

input AtrMultDnTarget = 1.5;

input LabelOn = yes;

input PaintCandles = yes;

# Gaussian 4 Pole Filter

script G {

input data = close;

input n = 13;

def betaDev = Floor(n / 2);

def w = (2 * Double.Pi / n);

def beta = (1 - Cos(w)) / (Power(1.414, 2.0 / betaDev) - 1 );

def alpha = (-beta + Sqrt(beta * beta + 2 * beta));

def omega = Power(alpha, 4) * data +

4 * (1 – alpha) * omega[1] –

6 * Power(1 - alpha, 2) * omega[2] +

4 * Power(1 - alpha, 3) * omega[3] -

Power(1 - alpha, 4) * omega[4];

plot G = omega;

}

# Variables:

def bar;

def c;

def Go;

def Gh;

def Gl;

def Gc;

def delta;

def CU1;

def CU2;

def CU;

def CD1;

def CD2;

def CD;

def L0;

def L1;

def L2;

def L3;

def gamma;

def RSI_data;

def RSI;

def OS;

def OB;

def M;

def FEH;

def FEL;

# New Data

Go = G(data = open, n = n);

Gh = G(data = high, n = n);

Gl = G(data = low, n = n);

Gc = G(data = close, n = n);

# Calculations

c = close;

bar = barNumber();

gamma = Log(Sum((Max(Gh, Gc[1]) - Min(Gl, Gc[1])), n) /

(Highest(Gh, n) - Lowest(Gl, n)))

/ Log(n);

delta = G(data = gamma * .01, n = n);

L0 = (1 – delta) * Gc + delta * L0[1];

L1 = -delta * L0 + L0[1] + delta * L1[1];

L2 = -delta * L1 + L1[1] + delta * L2[1];

L3 = -delta * L2 + L2[1] + delta * L3[1];

if L0 >= L1

{

CU1 = L0 - L1;

CD1 = 0;

}

else

{

CD1 = L1 - L0;

CU1 = 0;

}

if L1 >= L2

{

CU2 = CU1 + L1 - L2;

CD2 = CD1;

}

else

{

CD2 = CD1 + L2 - L1;

CU2 = CU1;

}

if L2 >= L3

{

CU = CU2 + L2 - L3;

CD = CD2;

}

else

{

CU = CU2;

CD = CD2 + L3 - L2;

}

RSI_data = if CU + CD <> 0

then CU / (CU + CD)

else 0;

RSI = (Exp(4 * RSI_data) - 1) / (Exp(4 * RSI_data) + 1);

OS = if IsNaN(c) then Double.NaN else 0.2;

OB = if IsNaN(c) then Double.NaN else 0.8;

M = if IsNaN(c) then Double.NaN else 0.5;

FEH = if IsNaN(c) then Double.NaN else .618;

FEL = if IsNaN(c) then Double.NaN else .382;

Alert(AlertOn and RSI crosses below .9, "", Alert.BAR, Sound.Bell);

Alert(AlertOn and RSI crosses above .1, "", Alert.BAR, Sound.Bell);

# End Code RSI_Laguerre Self Adjusting with Fractal Energy and Gaussian Filter

# Trade Management

def ATR = Average(TrueRange(Gh, Gc, Gl), 20);

def longCond = if (RSI crosses above .2)

or

(RSI crosses above .8)

then Low

else if (RSI crosses below .2)

or

(RSI crosses below .8)

then Double.NaN

else longCond[1];

def shortCond = if (RSI crosses below .8)

or

(RSI crosses below .2)

then High

else if (RSI crosses above .2)

or

(RSI crosses above .8)

then Double.NaN

else shortCond[1];

def upperTarget = if !IsNaN(longCond)

then Round((longCond + (AtrMultUpTarget * ATR)) / TickSize(), 0) * TickSize()

else if !IsNaN(shortCond)

then Double.NaN

else upperTarget[1];

def lowerTarget = if !IsNaN(shortCond)

then Round((shortCond - (AtrMultDnTarget * ATR)) / TickSize(), 0) * TickSize()

else if !IsNaN(longCond)

then Double.NaN

else lowerTarget[1];

def TargetBreachCountUP = if RSI < .2

then 0

else if high crosses above upperTarget

then 1

else if close crosses upperTarget

then TargetBreachCountUP[1] + 1

else if close > upperTarget

then TargetBreachCountUP[1] + 1

else TargetBreachCountUP[1];

plot BreachUP = if high crosses above upperTarget

then upperTarget

else Double.NaN;

BreachUP.SetStyle(Curve.POINTS);

BreachUP.SetLineWeight(3);

BreachUP.SetDefaultColor(Color.WHITE);

plot BreachDN = if low crosses below lowerTarget

then lowerTarget

else Double.NaN;

BreachDN.SetStyle(Curve.POINTS);

BreachDN.SetLineWeight(3);

BreachDN.SetDefaultColor(Color.WHITE);

def TargetBreachCountDN = if RSI > .8

then 0

else if low crosses below lowerTarget

then 1

else if close crosses lowerTarget

then TargetBreachCountDN[1] + 1

else if close < lowerTarget

then TargetBreachCountDN[1] + 1

else TargetBreachCountDN[1];

def p = if !IsNaN(longCond)

then (upperTarget - longCond) / longCond

else if !IsNaN(shortCond)

then (shortCond - lowerTarget) / shortCond

else p[1];

AddLabel(LabelOn and upperTarget, if TargetBreachCountUP >= 1

then "Target Breached : " + AsDollars(upperTarget)

else "Target = " + AsDollars(Round(upperTarget, 2)) +

" Percent = " + AsPercent(p), Color.GREEN);

AddLabel(LabelOn and lowerTarget, if (TargetBreachCountDN >= 1)

then "Target Breached: " + AsDollars(lowerTarget)

else "Target = " + AsDollars(Round(lowerTarget, 2)) +

" Percent = " + AsPercent(p), Color.RED);

def RSIswitch;

if RSI crosses above .1

{

RSIswitch = 1;

}

else if RSI crosses above .5

{

RSIswitch = 1;

}

else if RSI crosses above .8

{

RSIswitch = 1;

}

else if RSI crosses above .955

{

RSIswitch = 1;

}

else if RSI crosses below .955

{

RSIswitch = 0;

}

else if RSI crosses below .5

{

RSIswitch = 0;

}

else if RSI crosses below .2

{

RSIswitch = 0;

}

else

{

RSIswitch = RSIswitch[1];

}

def He = if RSIswitch == 1 then BarNumber() else He[1];

def Hey = if He == BarNumber() then High else Hey[1];

def Ho = if RSIswitch == 0 then BarNumber() else Ho[1];

def Hoe = if Ho == BarNumber() then Low else Hoe[1];

def one = if RSIswitch then (Hoe) else if !RSIswitch then (Hey) else one[1];

def Conditio = if !IsNaN(one) then one else Conditio[1];

plot Condition = if conditio > 0 then conditio else Double.NaN;

Condition.AssignValueColor(if RSIswitch then Color.CYAN else if !RSIswitch then Color.MAGENTA else Color.GRAY);

AssignPriceColor(if PaintCandles and RSIswitch

then Color.GREEN

else if !PaintCandles

then Color.CURRENT

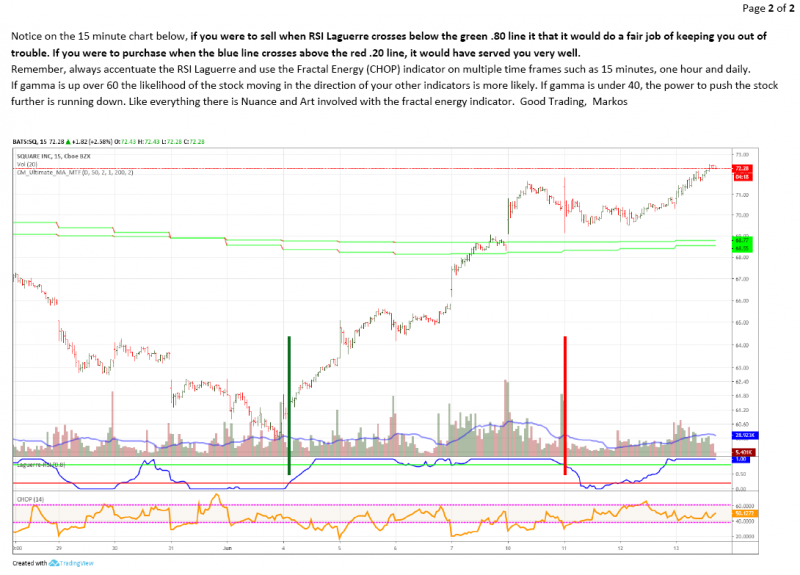

else Color.RED);Hey all. Fantastic code. Have been using for years. This is probably heresy to ask, but can anyone convert this to TradeStation, as I have had to use that platform now as well. Thanks my friends!This short tutorial is an example of how to use the indicator as shown near the bottom of the Trend Reversals Indicator with Signals Thread.

The RSI Laguerre and FE (called CHOP in the example) are separated so that their action can be seen easier.

July, 2019 Version for TOS: RSI Laguerre Auto-Adjusted with Fractal Energy algorithm https://tos.mx/LldzdS Scan Code: https://tos.mx/bRLjdq

Code and Notes in next comment below .,..

Further toward the bottom are even more usage notes.

Further toward the bottom are usage notes from "Master Yoda" himself!

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

TMO or RSI in Laguerre Time with FE - Q&A | Tutorials | 33 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.