In order to keep the post clean, updates are now found at the very bottom of the thread

NEWEST: 07/25/23

But before we get to all of that, here is a link to a really great video that Rob just recorded for Benzinga where he gives a GREAT introduction to The STRAT. It is NOT recommended that you use any of my indicators for trading with live money until you've had the chance to gain a real understanding of how The STRAT works and given yourself ample opportunity to practice on paper.

Here's the video: https://benzinga.wistia.com/medias/zoi6e794v3?fbclid=IwAR06RBtG0bimZcgyDuryjd12K7BdbDPCdkrE-O0k3hcT7JvMsk889v8qv3c

Keep in mind that I am not the creator of The STRAT. I am a disciple who has been creating these TOS studies along the way in my journey to learn this system and be able to visualize how it works. For more information on the STRAT, and to really learn how to use it to trade effectively with or without any of my studies, please visit Rob on Sepia!!

!!!VERY IMPORTANT!!!! THERE ARE NO BUY AND SELL SIGNALS.!!!

The decision to buy or sell MUST BE predicated upon a deeper understanding of this system and any other tools at your disposal.

Lastly, I would like to point out that this is an active thread that is constantly evolving as I continue to improve and add to these studies. If you have questions or comments about them I just ask, as I noted above, that you first make sure you are referring to the most recent version of a particular study and that you be very specific using screenshots in any such comments.

For those of you from Twitter who are just here for the bare essentials, here are two very basic studies:

Add the following line to the code above, down at the very bottom:

assignPriceColor(if insidebar then color.yellow else if outsidebar then color.magenta else color.current);

Please watch this 10 minute tutorial for how to configure and use this study:

https://youtu.be/wYB-OVTDy6U

Same as the REMIX but with candle paint only on Inside Bars, Outside Bars, and Reversals. Allows user to turn toggle each.

Same as the REMIX but completely stripped down to the bare essentials for machines with performance issues. This is the study I use.

By popular request! A version of REMIX that only looks for 2-2 reversals. BUT!! You can select a secondary (higher) time frame in the settings. So you could have your chart on the 15ers, for example, and still get alerted to the 2-2 reversals on the 60m. Coming soon: REMIX with Secondary TF.

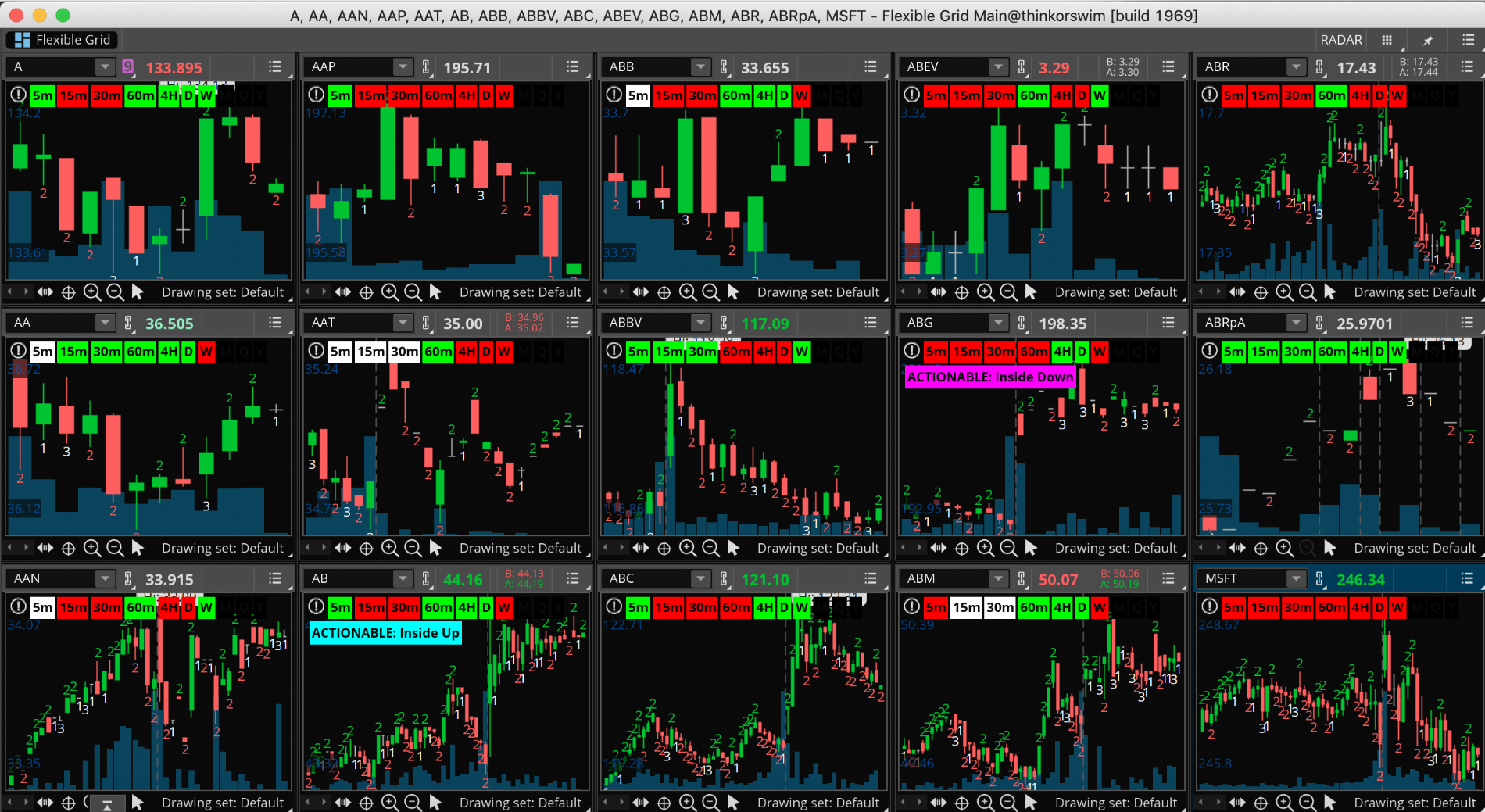

Custom Flex Grid I made for a friend. Here's a video for how to load the symbols on it:

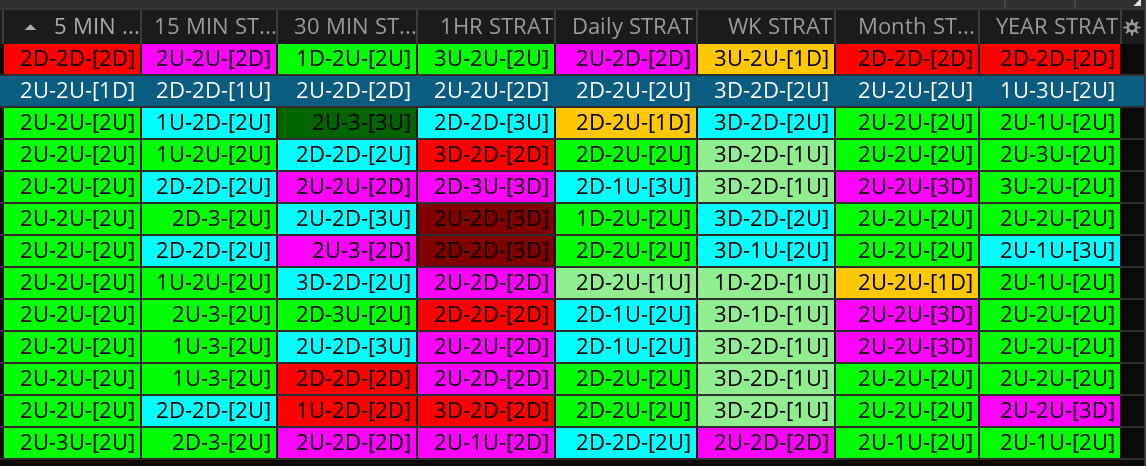

Here's what it looks like:

Custom Flex Grid that was Alex Option's idea. Here's a video for it:

Here's what it looks like:

Hammers_N_Shooters

https://tos.mx/zGPo4F4

Darkest shade of green/red Version 1: https://tos.mx/tjloQ7e (the lowest time frame)

Medium shade of green/red Version 2:https://tos.mx/TCdGJMZ

Medium shade of green/red Version 3: https://tos.mx/tRTlDa1

Lightest shade of green/red Version 4: https://tos.mx/ZRF4K8Z(the highest time frame)

Pre-Loaded intraday chart: https://tos.mx/q7Bfm3J (Now complete with TFC study!)

Pre-Loaded full chart: https://tos.mx/jSJp52F (Now complete with TFC study!)

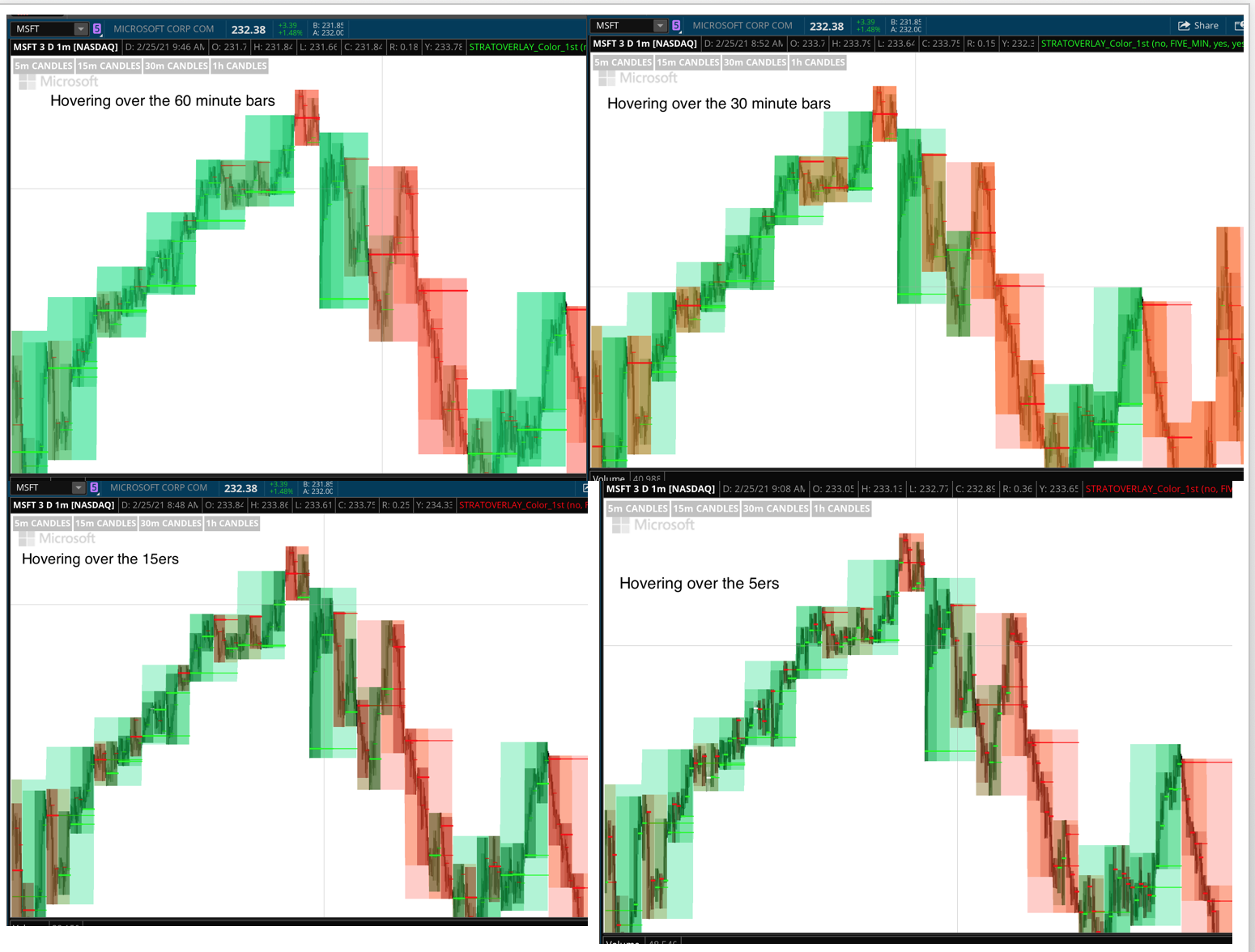

New addition to the overlays.: This one is a script I found in a different thread that is much better than the ones I posted because it shows wicks. It was provided by BPerrot but it appears to be based on the original Paul Townsend framework with elements of logic from Robert Payne as well as Halcyon Guy (I recognized his handiwork in the code). I find this to be particularly useful if all you want is to overlay one or two higher time frames.

https://tos.mx/VX0M8C3

https://imgur.com/R2RTGY3

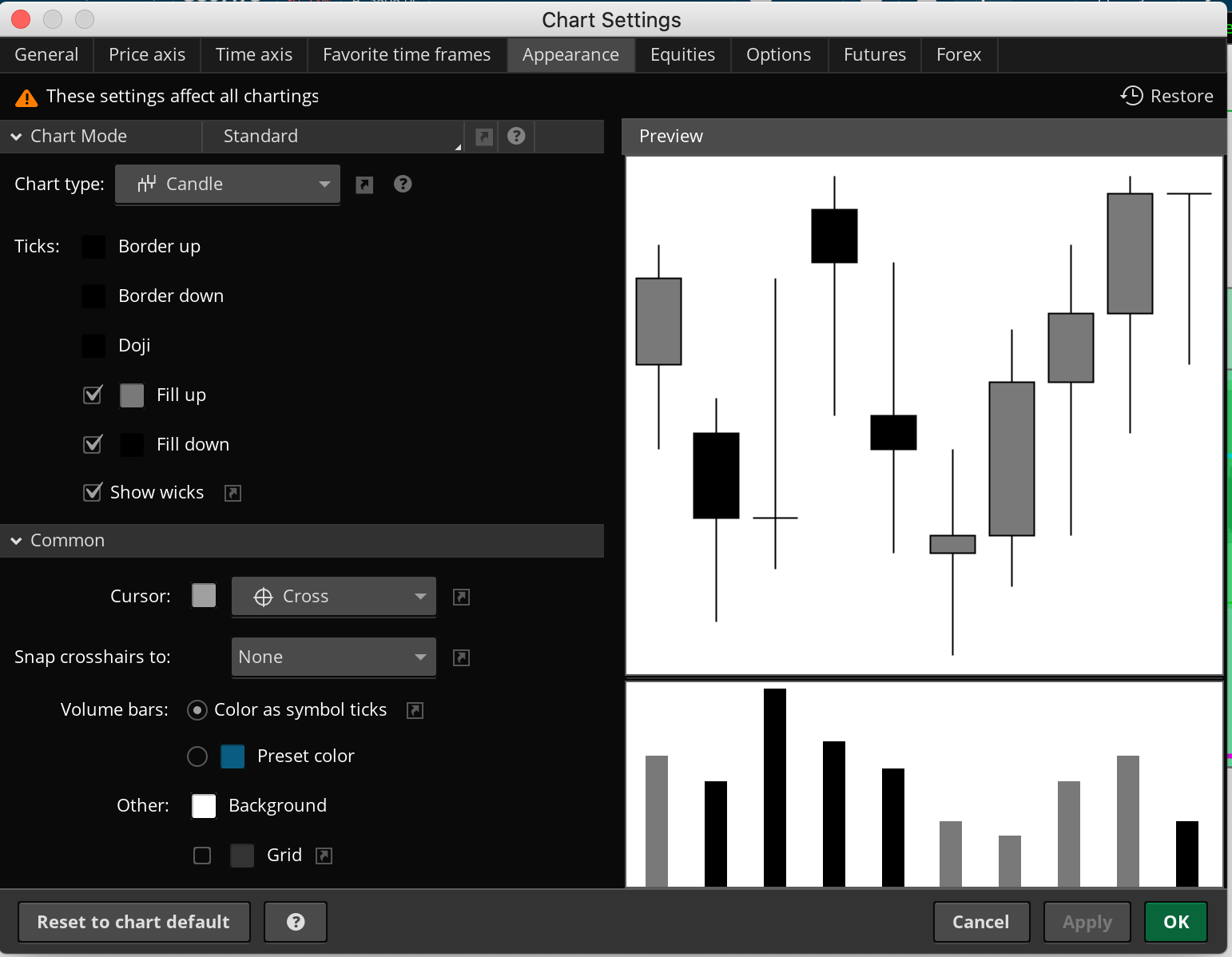

I find these are the best settings to the overall appearance the chart if you're using the green/red overlays:

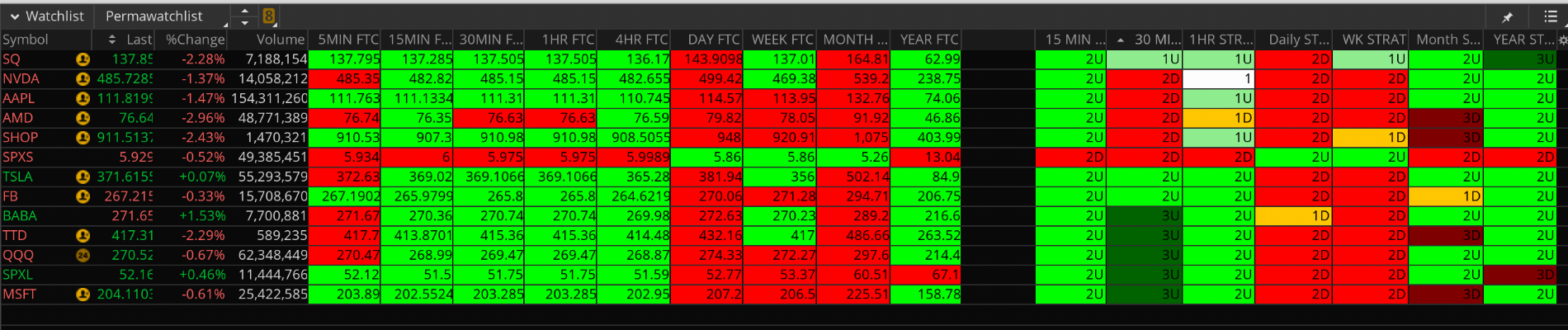

Here is a code for STRAT Candle watchlist column:

Here is a code for FTC Watchlist columns:

·

https://youtu.be/UM9v9yYs4qc

Here's what how they appear:

The colors indicate the following:

Green = Full Time Frame Continuity Up

Red = Full Time Frame Continuity Down

Gray = Conflict

This is what it should look like:

I really enjoy using this version because it allows you to sort of backtest in the sense that you can visually see TFC as it was in the past (which is something that was not possible with previous versions).

When using these studies, be sure and look at the code so that you know which time frames are being considered by them to calculate continuity. Here are the studies:

5 Minute

15 Minute

30 Minute

60 Minute

4 Hour

Day

Week

Month

Quarter

Here is a sample of the code from the 5 minute study:

3_1_Broadening_Formation

https://tos.mx/U6xvWgx

1 Bar Rev Strat Daily

https://tos.mx/sml8vKo

2 Bar Rev Strat Daily

https://tos.mx/fUIotqN

Hammer Rev

https://tos.mx/A2w2Jkt

Inside Break Bull

https://tos.mx/JKIrGGZ

Kicking Bull

https://tos.mx/JLI4AXC

https://tos.mx/LFDcKrZ

FAILED 2 UP

https://tos.mx/i9q0UgE

Link to James Fox’s STRAT Scan video:

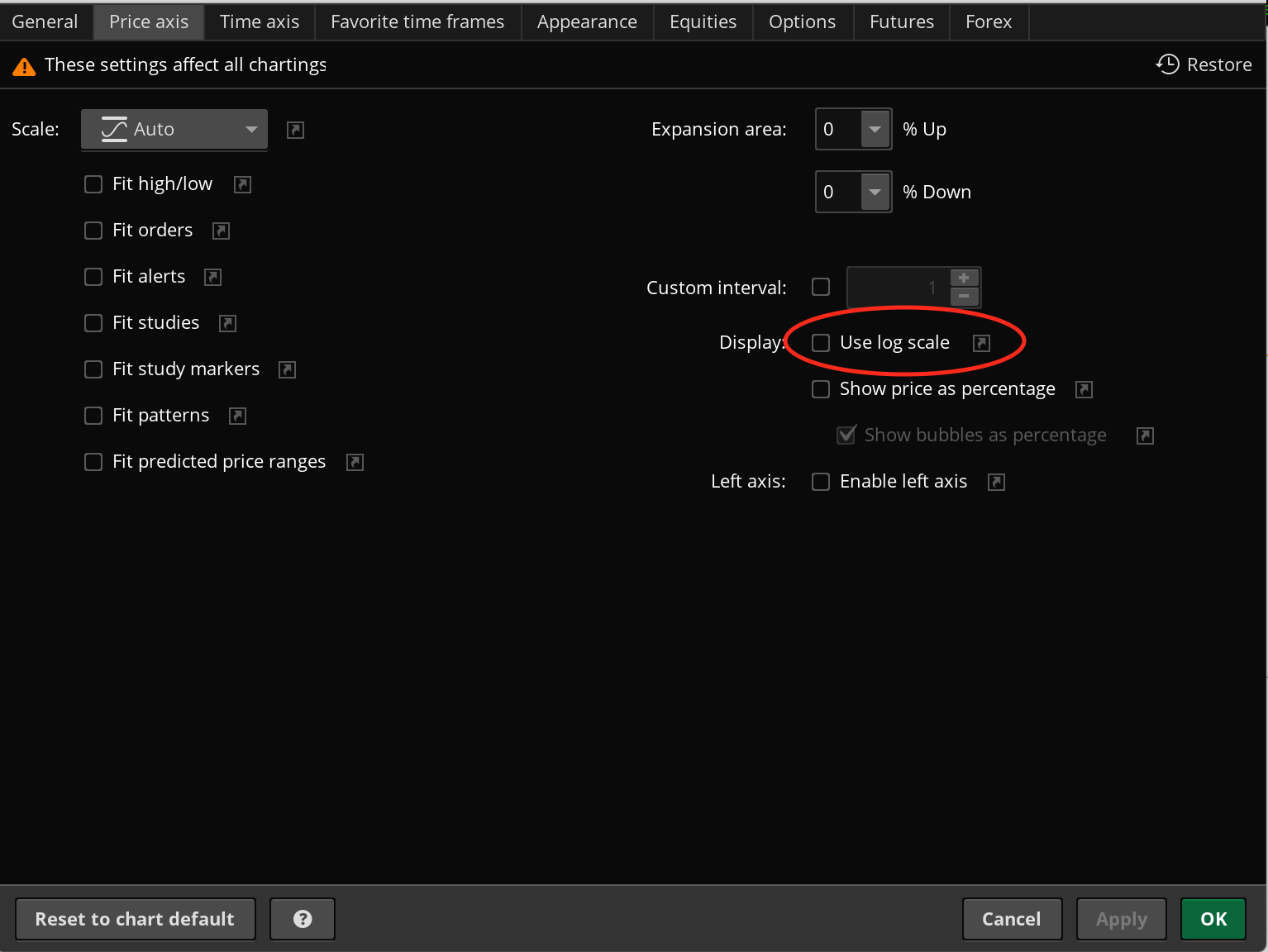

UPDATE: 03/23/21 Tried to re-upload complete overlay charts with a new link because I noticed that they were set to use log scale. I noticed it messes with my drawings so I turn it off on all my charts. I think it's the best setting. Ill try to give y'all fresh links later (probably just a problem with TOS right now), but for now, to change it manually, it looks like this:

UPDATE: 07/25/23 Removed all-in-one TFC study and replaced it with new candle paint study which is superior for many reasons as stated in the description

UPDATE: 01/23/23 Added a version of the overlay that I found which appears to be the work of Paul Townsend, Robert Payne and Don Larson (Halcyon Guy). I find it to be superior to mine especially if all you want is to overlay one or two higher time frames.

UPDATE: 04/25/22 Added user contribution by Jason Getgen. Look for his "Failed 2" scan in the scan section.

UPDATE: 08/25/21 By popular request! A version of REMIX that only looks for 2-2 reversals. BUT!! You can select a secondary (higher) time frame in the settings. Coming soon: REMIX with Secondary TF.

UPDATE: 05/21/21 Updated strat numbers so that the 1's and 3's appear as white numbers below, the 2U is a green number above and the 2D is a red number below. Added that component to all REMIX studies. Added REMIX SUPER LITE for machines with performance issues. And lastly, I have added two flex grids, one that is only continuity labels, and another that is a full radar screen based on Alex Option's idea. There are video tutorials for each. I also removed the studies that have been incorporated into the REMIX or TFC master studies as well as older studies that were glitchy and I don't have time or desire to support.

UPDATE: 04/01/21 Updated Kicker Actionable signal to include opposite continuity for kick age and fixed bug with measured move. Streamlined thread removing studies that are now obsolete.

UPDATE: 02/28/21 Added TFC study to Pre-Loaded Color Overlay Charts. This is because the Complete TFC study at the top changes the color of the background which defeats the purpose of the color overlay chart on a white background. This is simply a condensed, simplified version of the TFC study. It will only work if the intraday chart is set to 1 minute and the full chart is set to 1 hour.

UPDATE: 02/28/21 Added additional new version of color script. Re-worked the colors to let each TF stand out.

UPDATE: 02/26/21 Added new color version of the overlay study. There are three separate versions, each a different shade.

UPDATE: 01/02/21 Corrected bug in watchlist columns. Then you very much for catching that @fishstick1229 !!!!!!

UPDATE: 10/19/20 Placed link for the two main studies at the top. Added set up tutorial video for two main (most recent studies). Removed older studies (Basic Four). Added Hammers_and_Shooters study. Added Actionable Signal Scans and video

UPDATE: 10/15/20 Made Background Color script all inclusive and MTF capable. Added specific type of actionable signal onto the alerts written into the Remix version

UPDATE: 10/14/20 Per request, added alerts for reversals to the Reversal Remix and Actionable Signal study. Added alert to Background Color FTC Study. Added 1st draft Broadening Formation study.

NEWEST: 07/25/23

A SUITE OF PRODUCTS BY PELONSAX AKA RAMON DV FOR USE WITH: ROB SMITH’S THE STRAT

I am writing these to help myself learn The STRAT because I am a visual learner. And I am sharing them because many generous people have shared their time and expertise with me along my journey and we can do more when we work together.But before we get to all of that, here is a link to a really great video that Rob just recorded for Benzinga where he gives a GREAT introduction to The STRAT. It is NOT recommended that you use any of my indicators for trading with live money until you've had the chance to gain a real understanding of how The STRAT works and given yourself ample opportunity to practice on paper.

Here's the video: https://benzinga.wistia.com/medias/zoi6e794v3?fbclid=IwAR06RBtG0bimZcgyDuryjd12K7BdbDPCdkrE-O0k3hcT7JvMsk889v8qv3c

Keep in mind that I am not the creator of The STRAT. I am a disciple who has been creating these TOS studies along the way in my journey to learn this system and be able to visualize how it works. For more information on the STRAT, and to really learn how to use it to trade effectively with or without any of my studies, please visit Rob on Sepia!!

!!!VERY IMPORTANT!!!! THERE ARE NO BUY AND SELL SIGNALS.!!!

The decision to buy or sell MUST BE predicated upon a deeper understanding of this system and any other tools at your disposal.

Lastly, I would like to point out that this is an active thread that is constantly evolving as I continue to improve and add to these studies. If you have questions or comments about them I just ask, as I noted above, that you first make sure you are referring to the most recent version of a particular study and that you be very specific using screenshots in any such comments.

For those of you from Twitter who are just here for the bare essentials, here are two very basic studies:

STRAT BAR NUMBERS 2.0

https://tos.mx/Kac4tLf

Code:

#------------------------------------

# S T R A T N U M B E R S

#

# A study by Ramon DV. aka Pelonsax

#

# Version 1.0 8/01/20

#

# Version 2.0 8/4/20 Corrected errors in logic for scenarios

#

#------------------------------------

#------------------------------------

# DEFINE SCENARIOS

#------------------------------------

def H = high;

def L = low;

def C = close;

def O = open;

def insidebar = (H < H[1] and L > L[1]) or (H == H[1] and L > L[1]) or (H < H[1] and L == L[1]) or (H == H[1] and L == L[1]);

def outsidebar = H > H[1] and L < L[1];

def twoup = H > H[1] and L >= L[1];

def twodown = H <= H[1] and L < L[1];

#------------------------------------

# STRAT NUMBERS

#------------------------------------

input Show_Strat_Numbers = yes;

input Show_Twos = yes;

plot barType = if Show_Strat_Numbers and insidebar then 1 else if Show_Strat_Numbers and outsidebar then 3 else Double.NaN;

barType.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

barType.AssignValueColor(color.WHITE);

plot barTypeDN = if Show_Strat_Numbers and !insidebar and !outsidebar and Show_Twos and twodown then 2 else Double.NaN;

barTypeDN.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

barTypeDN.AssignValueColor(color.DOWNTICK);

plot barTypeUP = if Show_Strat_Numbers and !insidebar and !outsidebar and Show_Twos and twoup then 2 else Double.NaN;

barTypeUP.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

barTypeUP.AssignValueColor(color.UPTICK);STRAT BAR CANDLES PAINT ON ONES AND THREES WITH NUMBERS BELOW

https://tos.mx/jdHvqj4Add the following line to the code above, down at the very bottom:

assignPriceColor(if insidebar then color.yellow else if outsidebar then color.magenta else color.current);

MAIN STUDIES:

TIME_FRAME_CONTINUITY

https://tos.mx/JZROQzWPlease watch this 10 minute tutorial for how to configure and use this study:

https://youtu.be/wYB-OVTDy6U

STRAT_REMIX_2.0

https://tos.mx/dpLsYg3STRAT_REMIX_LITE_2.0

https://tos.mx/4osFry3Same as the REMIX but with candle paint only on Inside Bars, Outside Bars, and Reversals. Allows user to turn toggle each.

STRAT_REMIX_SUPER_LITE

https://tos.mx/l7NLHn2Same as the REMIX but completely stripped down to the bare essentials for machines with performance issues. This is the study I use.

JUST THE 2-2's PLEASE!!

https://tos.mx/oHUheTIBy popular request! A version of REMIX that only looks for 2-2 reversals. BUT!! You can select a secondary (higher) time frame in the settings. So you could have your chart on the 15ers, for example, and still get alerted to the 2-2 reversals on the 60m. Coming soon: REMIX with Secondary TF.

CONTINUITY FLEX GRID

https://tos.mx/bWIOYRvCustom Flex Grid I made for a friend. Here's a video for how to load the symbols on it:

Here's what it looks like:

RADAR FLEX GRID

https://tos.mx/ekXrkrBCustom Flex Grid that was Alex Option's idea. Here's a video for it:

Here's what it looks like:

VIDEO TUTORIAL FOR MAIN STUDIES:

HAMMERS AND SHOOTERS

This study is ONLY meant to allow the user to find the best settings for the hammer and shooting star component of the Remix study and Actionable Signals studies. All it does is find Hammers and Shooters using the same code in those other studies and paints them green or red while all other candles are painted gray. With this study you can tweak the settings in a way that best serves your purposes and then transfer those settings to the Strat studies.Hammers_N_Shooters

https://tos.mx/zGPo4F4

NEW FULL COLOR VERSION OF OVERLAYS

These work great on a white chartDarkest shade of green/red Version 1: https://tos.mx/tjloQ7e (the lowest time frame)

Medium shade of green/red Version 2:https://tos.mx/TCdGJMZ

Medium shade of green/red Version 3: https://tos.mx/tRTlDa1

Lightest shade of green/red Version 4: https://tos.mx/ZRF4K8Z(the highest time frame)

Pre-Loaded intraday chart: https://tos.mx/q7Bfm3J (Now complete with TFC study!)

Pre-Loaded full chart: https://tos.mx/jSJp52F (Now complete with TFC study!)

New addition to the overlays.: This one is a script I found in a different thread that is much better than the ones I posted because it shows wicks. It was provided by BPerrot but it appears to be based on the original Paul Townsend framework with elements of logic from Robert Payne as well as Halcyon Guy (I recognized his handiwork in the code). I find this to be particularly useful if all you want is to overlay one or two higher time frames.

https://tos.mx/VX0M8C3

https://imgur.com/R2RTGY3

I find these are the best settings to the overall appearance the chart if you're using the green/red overlays:

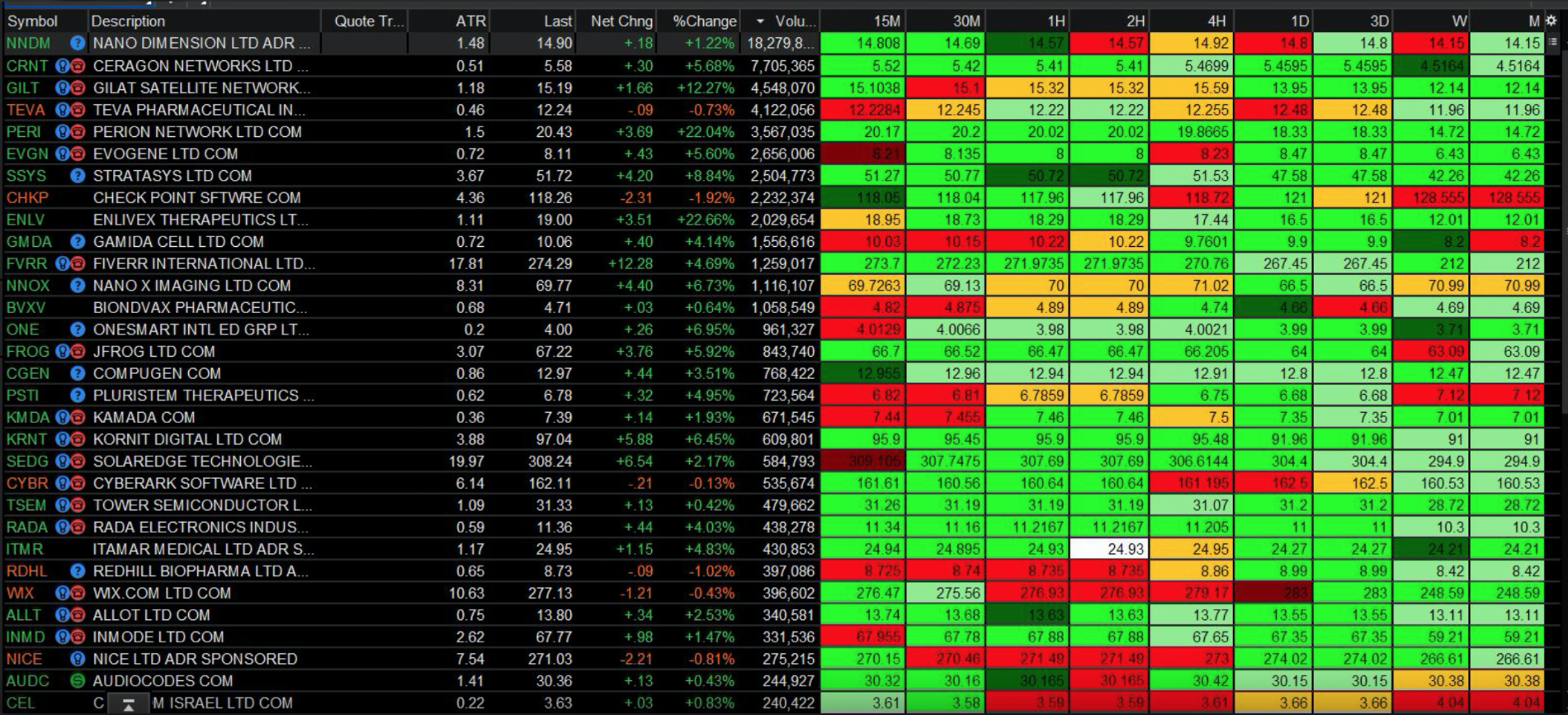

SIMPLE WATCHLIST COLUMNS

Here's what they look like:Here is a code for STRAT Candle watchlist column:

Code:

#------------------------------------

#

# M T F S T R A T

# W A T C H L I S T

# a Study by Ramon DV. aka Pelonsax

#

#------------------------------------

#------------------------------------

# S T R A T R E V E R S A L S

#

# A study by Ramon DV. aka Pelonsax

#

# Version 1.0 8/01/20

#

# Version 2.0 8/4/20 Corrected errors in logic for scenarios

# Version 2.1 8/15/20 Added Reversals

#

#------------------------------------

def H = high;

def L = low;

def O = open;

def C = close;

#------------------------------------

# DEFINE SCENARIOS

#------------------------------------

def insidebar = (H < H[1] and L > L[1]) or (H == H[1] and L > L[1]) or (H < H[1] and L == L[1]) or (H == H[1] and L == L[1]);

def outsidebar = H > H[1] and L < L[1];

def insidebarup = insidebar and O < C;

def twoup = H > H[1] and L >= L[1];

def outsidebarup = outsidebar and O < C;

def insidebardown = insidebar and O > C;

def twodown = H <= H[1] and L < L[1];

def outsidebardown = outsidebar and O > C;

#------------------------------------

# LABEL SECTION

#------------------------------------

AddLabel(yes,

if twoup then “2U” else if twodown then “2D” else if insidebarup then “1U" else if insidebardown then “1D” else if outsidebarup then “3U” else if outsidebardown then “3D” else if insidebar and !insidebarup and !insidebardown then "1" else if outsidebar and !outsidebarup and !outsidebardown then "3" else "", color.black);

assignbackgroundColor(

if

twoup then color.green else if

twodown then color.red else if

outsidebarup then color.dark_green else if

insidebarup then color.light_green else if

outsidebardown then color.dark_red else if

insidebardown then color.orange else if

!insidebarup and

!insidebardown and

insidebar then color.white else if

!outsidebardown and

!outsidebarup and

outsidebar then color.white else color.current);Here is a code for FTC Watchlist columns:

Code:

#S T R A T F T C

#WATCHLIST

#Ramon DV aka Pelonsax

plot O = open;

def C = close;

assignBackgroundColor(if C > O then color.GREEN else if O > C then color.RED else if O == C then color.white else color.current);

addlabel(yes, O, color.black);

# ENDNEW WATCHLIST COLUMN.

Here's a video tutorial for how to set it up:https://youtu.be/UM9v9yYs4qc

Code:

#------------------------------------

#

# M T F S T R A T

# W A T C H L I S T

# a Study by Ramon DV. aka Pelonsax

#

#------------------------------------

#------------------------------------

# S T R A T R E V E R S A L S

#

# A study by Ramon DV. aka Pelonsax

#

# Version 1.0 8/01/20

#

# Version 2.0 8/4/20 Corrected errors in logic for scenarios

# Version 2.1 8/15/20 Added Reversals

# 9/15/20 added two previous bars and reversals for WL columns

#

#------------------------------------

def H = high;

def L = low;

def O = open;

def C = close;

#------------------------------------

# DEFINE SCENARIOS

#------------------------------------

def insidebar = (H < H[1] and L > L[1]) or (H == H[1] and L > L[1]) or (H < H[1] and L == L[1]) or (H == H[1] and L == L[1]);

def outsidebar = H > H[1] and L < L[1];

def insidebarup = insidebar and O < C;

def twoup = H > H[1] and L >= L[1];

def outsidebarup = outsidebar and O < C;

def insidebardown = insidebar and O > C;

def twodown = H <= H[1] and L < L[1];

def outsidebardown = outsidebar and O > C;

def insidebar1 = (H[1] < H[2] and L[1] > L[2]) or (H[1] == H[2] and L[1] > L[2]) or (H[1] < H[2] and L[1] == L[2]) or (H[1] == H[2] and L[1] == L[2]);

def outsidebar1 = H[1] > H[2] and L[1] < L[2];

def insidebarup1 = insidebar1 and O[1] < C[1];

def twoup1 = H[1] > H[2] and L[1] >= L[2];

def outsidebarup1 = outsidebar1 and O[1] < C[1];

def insidebardown1 = insidebar1 and O[1] > C[1];

def twodown1 = H[1] <= H[2] and L[1] < L[2];

def outsidebardown1 = outsidebar1 and O[1] > C[1];

def insidebar2 = (H[2] < H[3] and L[2] > L[3]) or (H[2] == H[3] and L[2] > L[3]) or (H[2] < H[3] and L[2] == L[3]) or (H[2] == H[3] and L[2] == L[3]);

def outsidebar2 = H[2] > H[3] and L[2] < L[3];

def insidebarup2 = insidebar2 and O[2] < C[2];

def twoup2 = H[2] > H[3] and L[2] >= L[3];

def outsidebarup2 = outsidebar2 and O[2] < C[2];

def insidebardown2 = insidebar2 and O[2] > C[2];

def twodown2 = H[2] <= H[3] and L[2] < L[3];

def outsidebardown2 = outsidebar2 and O[2] > C[2];

#------------------------------------

# DEFINE REVERSALS (Basic four)

#------------------------------------

# Bullish

def TwoOneTwoBull = twoup and insidebar1 and twodown2;

def TwoTwoBull = twoup and twodown1;

def ThreeBull = outsidebarup and (twodown1 or insidebar1 or outsidebardown1);

def ThreeOneTwoBull = twoup and insidebar1 and outsidebardown2;

# Bearish

def TwoOneTwoBear = twodown and insidebar1 and twoup2;

def TwoTwoBear = twodown and twoup2;

def ThreeBear = outsidebardown and (twoup1 or insidebar1 or outsidebarup1);

def ThreeOneTwoBear = twodown and insidebar1 and outsidebarup2;

#------------------------------------

# LABEL SECTION

#------------------------------------

AddLabel(yes,

(if twoup2 then “2U” else if twodown2 then “2D” else if insidebarup2 then “1U" else if insidebardown2 then “1D” else if outsidebarup2 then “3U” else if outsidebardown2 then “3D” else if insidebar2 and !insidebarup2 and !insidebardown2 then "1" else if outsidebar2 and !outsidebarup2 and !outsidebardown2 then "3" else “”) + “-“ +

(if twoup1 then “2U” else if twodown1 then “2D” else if insidebarup1 then “1U" else if insidebardown1 then “1D” else if outsidebarup1 then “3U” else if outsidebardown1 then “3D” else if insidebar1 and !insidebarup1 and !insidebardown1 then "1" else if outsidebar1 and !outsidebarup1 and !outsidebardown1 then "3" else “”)+ ”-“ +

(if twoup then “[2U]” else if twodown then “[2D]” else if insidebarup then “[1U]” else if insidebardown then “[1D]” else if outsidebarup then “[3U]” else if outsidebardown then “[3D]” else if insidebar and !insidebarup and !insidebardown then “[1]” else if outsidebar and !outsidebarup and !outsidebardown then “[3]” else “”), color.black);

assignbackgroundColor(if TwoOneTwoBull or TwoTwoBull or ThreeBull or ThreeOneTwoBull then color.cyan else if TwoOneTwoBear or TwoTwoBear or ThreeBear or ThreeOneTwoBear then color.magenta else if

!TwoTwoBull and

!ThreeBull and

!ThreeOneTwoBull and

!TwoOneTwoBear and

!TwoTwoBear and

!ThreeBear and

!ThreeOneTwoBear and

twoup then color.green else if

!TwoOneTwoBull and

!TwoTwoBull and

!ThreeBull and

!ThreeOneTwoBull and

!TwoOneTwoBear and

!TwoTwoBear and

!ThreeBear and

!ThreeOneTwoBear and

twodown then color.red else if

!TwoOneTwoBull and

!TwoTwoBull and

!ThreeBull and

!ThreeOneTwoBull and

!TwoOneTwoBear and

!TwoTwoBear and

!ThreeBear and

!ThreeOneTwoBear and

outsidebarup then color.dark_green else if

!TwoOneTwoBull and

!TwoTwoBull and

!ThreeBull and

!ThreeOneTwoBull and

!TwoOneTwoBear and

!TwoTwoBear and

!ThreeBear and

!ThreeOneTwoBear and

insidebarup then color.light_green else if

!TwoOneTwoBull and

!TwoTwoBull and

!ThreeBull and

!ThreeOneTwoBull and

!TwoOneTwoBear and

!TwoTwoBear and

!ThreeBear and

!ThreeOneTwoBear and

outsidebardown then color.dark_red else if

!TwoOneTwoBull and

!TwoTwoBull and

!ThreeBull and

!ThreeOneTwoBull and

!TwoOneTwoBear and

!TwoTwoBear and

!ThreeBear and

!ThreeOneTwoBear and

insidebardown then color.orange else if

!TwoOneTwoBull and

!TwoTwoBull and

!ThreeBull and

!ThreeOneTwoBull and

!TwoOneTwoBear and

!TwoTwoBear and

!ThreeBear and

!ThreeOneTwoBear and

!insidebarup and

!insidebardown and

insidebar then color.white else if

!TwoOneTwoBull and

!TwoTwoBull and

!ThreeBull and

!ThreeOneTwoBull and

!TwoOneTwoBear and

!TwoTwoBear and

!ThreeBear and

!ThreeOneTwoBear and

!outsidebardown and

!outsidebarup and

outsidebar then color.white

else color.current);Here's what how they appear:

USER MOD REQUEST: SAME Watchlist as above but the colors are controlled by TFC

Code:

#------------------------------------

#

# M T F S T R A T

# W A T C H L I S T

# a Study by Ramon DV. aka Pelonsax

#

#------------------------------------

#------------------------------------

# SCENARIOS PLUS TFC

#

# A study by Ramon DV. aka Pelonsax

#

# Version 1.0 8/01/20

#

# Version 2.0 8/4/20 Corrected errors in logic for scenarios

# Version 2.1 8/15/20 Added Reversals

# 9/15/20 added two previous bars and reversals to the watchlist

#

#------------------------------------

def H = high;

def L = low;

def O = open;

def C = close;

#------------------------------------

# DEFINE SCENARIOS

#------------------------------------

def insidebar = (H < H[1] and L > L[1]) or (H == H[1] and L > L[1]) or (H < H[1] and L == L[1]) or (H == H[1] and L == L[1]);

def outsidebar = H > H[1] and L < L[1];

def insidebarup = insidebar and O < C;

def twoup = H > H[1] and L >= L[1];

def outsidebarup = outsidebar and O < C;

def insidebardown = insidebar and O > C;

def twodown = H <= H[1] and L < L[1];

def outsidebardown = outsidebar and O > C;

def insidebar1 = (H[1] < H[2] and L[1] > L[2]) or (H[1] == H[2] and L[1] > L[2]) or (H[1] < H[2] and L[1] == L[2]) or (H[1] == H[2] and L[1] == L[2]);

def outsidebar1 = H[1] > H[2] and L[1] < L[2];

def insidebarup1 = insidebar1 and O[1] < C[1];

def twoup1 = H[1] > H[2] and L[1] >= L[2];

def outsidebarup1 = outsidebar1 and O[1] < C[1];

def insidebardown1 = insidebar1 and O[1] > C[1];

def twodown1 = H[1] <= H[2] and L[1] < L[2];

def outsidebardown1 = outsidebar1 and O[1] > C[1];

def insidebar2 = (H[2] < H[3] and L[2] > L[3]) or (H[2] == H[3] and L[2] > L[3]) or (H[2] < H[3] and L[2] == L[3]) or (H[2] == H[3] and L[2] == L[3]);

def outsidebar2 = H[2] > H[3] and L[2] < L[3];

def insidebarup2 = insidebar2 and O[2] < C[2];

def twoup2 = H[2] > H[3] and L[2] >= L[3];

def outsidebarup2 = outsidebar2 and O[2] < C[2];

def insidebardown2 = insidebar2 and O[2] > C[2];

def twodown2 = H[2] <= H[3] and L[2] < L[3];

def outsidebardown2 = outsidebar2 and O[2] > C[2];

#------------------------------------

# LABEL SECTION

#------------------------------------

AddLabel(yes,

(if twoup2 then “2U” else if twodown2 then “2D” else if insidebarup2 then “1U" else if insidebardown2 then “1D” else if outsidebarup2 then “3U” else if outsidebardown2 then “3D” else if insidebar2 and !insidebarup2 and !insidebardown2 then "1" else if outsidebar2 and !outsidebarup2 and !outsidebardown2 then "3" else “”) + “-“ +

(if twoup1 then “2U” else if twodown1 then “2D” else if insidebarup1 then “1U" else if insidebardown1 then “1D” else if outsidebarup1 then “3U” else if outsidebardown1 then “3D” else if insidebar1 and !insidebarup1 and !insidebardown1 then "1" else if outsidebar1 and !outsidebarup1 and !outsidebardown1 then "3" else “”)+ ”-“ +

(if twoup then “[2U]” else if twodown then “[2D]” else if insidebarup then “[1U]” else if insidebardown then “[1D]” else if outsidebarup then “[3U]” else if outsidebardown then “[3D]” else if insidebar and !insidebarup and !insidebardown then “[1]” else if outsidebar and !outsidebarup and !outsidebardown then “[3]” else “”), color.black);

assignBackgroundColor(if C > O then color.GREEN else if O > C then color.RED else if O == C then color.white else color.current);USER MOD BY BOB'S A STRATTER (THANK'S BOB!)

Code:

#------------------------------------

#

# M T F S T R A T

# W A T C H L I S T

# a Study by Ramon DV. aka Pelonsax

# Modified by Bob's a Stratter

#

#------------------------------------

#------------------------------------

# S T R A T R E V E R S A L S

#

# A study by Ramon DV. aka Pelonsax

#

# Version 1.0 8/01/20

#

# Version 2.0 8/4/20 Corrected errors in logic for scenarios

# Version 2.1 8/15/20 Added Reversals

#

#------------------------------------

plot O = open;

def H = high;

def L = low;

def C = close;

#------------------------------------

# DEFINE SCENARIOS

#------------------------------------

def insidebar = (H < H[1] and L > L[1]) or (H == H[1] and L > L[1]) or (H < H[1] and L == L[1]) or (H == H[1] and L == L[1]);

def outsidebar = H > H[1] and L < L[1];

def insidebarup = insidebar and O < C;

def twoup = H > H[1] and L >= L[1];

def outsidebarup = outsidebar and O < C;

def insidebardown = insidebar and O > C;

def twodown = H <= H[1] and L < L[1];

def outsidebardown = outsidebar and O > C;

#------------------------------------

# LABEL SECTION

#------------------------------------

AssignBackgroundColor(

if

twoup then Color.GREEN else if

twodown then Color.RED else if

outsidebarup then Color.DARK_GREEN else if

insidebarup then Color.LIGHT_GREEN else if

outsidebardown then Color.DARK_RED else if

insidebardown then Color.ORANGE else if

!insidebarup and

!insidebardown and

insidebar then Color.WHITE else if

!outsidebardown and

!outsidebarup and

outsidebar then Color.YELLOW else Color.CURRENT);

addlabel(yes, O, color.black);TIME FRAME CONTINUITY STUDY THAT PAINTS CANDLES

I've gotten rid of the other compete TFC study because it interferes with some of the other studies in this suite (like the overlay charts) and is not the easiest thing in the world to load or understand. In it's place, I am sharing this new version of my TFC studies that paints the candles. It uses exactly the same logic as before, so please go to my YouTube channel and watch Beginner Tutorial Part 2 starting at the 25 minute mark in order to understand the theory and logic behind this study. The Part 3 video and Part 4 video further explain and illustrate the power of TFC. There is a version of the study for each of the major time frames titled: Continuity_X, where X is the TF you'll want to load it on. As with any study in TOS, these will only work on time frames that are the same or lower than the time frame used by the study. So for example, Continuity_5 will not work on a 15 minute chart, but it will work on a 1 minute chart, etc.The colors indicate the following:

Green = Full Time Frame Continuity Up

Red = Full Time Frame Continuity Down

Gray = Conflict

This is what it should look like:

I really enjoy using this version because it allows you to sort of backtest in the sense that you can visually see TFC as it was in the past (which is something that was not possible with previous versions).

When using these studies, be sure and look at the code so that you know which time frames are being considered by them to calculate continuity. Here are the studies:

5 Minute

15 Minute

30 Minute

60 Minute

4 Hour

Day

Week

Month

Quarter

Here is a sample of the code from the 5 minute study:

Code:

#-------------------------------

#

# C O N T I N U I T Y 5

#

# a study that indicates the highest

# and lowest open on mutliple time frames

# for full time frame continuity INTRADAY

#

# Author: Ramon DV aka Pelonsax

#

#--------------------------------

declare upper;

def "5mAGG" = AggregationPeriod.FIVE_MIN;

def "15mAGG" = AggregationPeriod.FIFTEEN_MIN;

def "30mAGG" = AggregationPeriod.THIRTY_MIN;

def "1hAGG" = AggregationPeriod.HOUR;

def five = open(period = "5mAGG");

def fifteen = open(period = "15mAGG");

def thirty = open(period = "30mAGG");

def hour = open(period = "1hAGG");

def top = if five >=

fifteen and five >=

thirty and five >=

hour

then five else

if fifteen >=

five and fifteen >=

thirty and fifteen >=

hour

then fifteen else

if thirty >=

five and thirty >=

fifteen and thirty >=

hour

then thirty else

if hour >=

five and hour >=

fifteen and hour >=

thirty

then hour else Double.NaN;

def bottom = if five <=

fifteen and five <=

thirty and five <=

hour

then five else

if fifteen <=

five and fifteen <=

thirty and fifteen <=

hour

then fifteen else

if thirty <=

five and thirty <=

fifteen and thirty <=

hour

then thirty else

if hour <=

five and hour <=

fifteen and hour <=

thirty

then hour else Double.NaN;

def Fullup = close >= top;

def Fulldown = close <= bottom;

AssignPriceColor( if Fullup then Color.GREEN else if Fulldown then Color.RED else Color.GRAY);BROADENING FORMATIONS (1ST DRAFT)

This study will only find 1-3 combos and extend diagonal lines outward. I wasn't going to release it yet because I'm waiting to really make it work with multi bar pivots, but someone asked for exactly this in the comments and since this one is ready now, here you go. Keep in mind that this is not exactly the same as a broadening formation as Rob describes it. (It is and it isn't. This is only one example of a broadening formation). It could come in handy if you want to run it on a higher time frame like the daily or weekly and then draw over the lines so that it shows up on the lower time frames. I have to credit Halcyon Guy (Don L.) who wrote the backbone and has given me permission to publish. I moded his version of a similar study that looks for wedges. This is basically the 2 bar inverse of his study.3_1_Broadening_Formation

https://tos.mx/U6xvWgx

Code:

## ----------------------------------------

# BROADENING FORMATION

# A STRAT STUDY BY PELONSAX AKA RAMON DV

#

# ADAPTED FROM

# quadinsidebar_01

# 2020-06-27

# halcyonguy

# ----------------------------------------

input extend_lines = 100;

def na = double.nan;

def hi = high;

def lo = low;

def bn = barnumber();

# ----- 2 bar outside pattern ---------------------------------

def insidebar0 = hi < hi[-1] and lo > lo[-1];

def insidebar = insidebar0 or insidebar0[1];

def next = insidebar0[-1];

def pattern = fold i = 0 to extend_lines

with p

do if i > bn then p + 0 else p + GetValue(insidebar,i);

def extend = if (!next and pattern > 0) then 1 else 0;

def en_slopelines = extend;

# ===================================================================

def bargaps = 1;

def slopehi2 = (hi[-bargaps] - hi[0])/bargaps;

def slopelo2 = (lo[-bargaps] - lo[0])/bargaps;

def slopehi = if insidebar0 then slopehi2 else if en_slopelines then slopehi[1] else na;

def slopelo = if insidebar0 then slopelo2 else if en_slopelines then slopelo[1] else na;

def bar0number = if insidebar0 then barnumber() else if en_slopelines then bar0number[1] else na;

def bar0high = if insidebar0 then hi else if en_slopelines then bar0high[1] else na;

def bar0low = if insidebar0 then lo else if en_slopelines then bar0low[1] else na;

plot diaghi = if en_slopelines then ( bar0high + (slopehi * (barnumber() - bar0number))) else na;

diaghi.AssignValueColor(Color.dark_Green);

diaghi.SetStyle(Curve.MEDIUM_DASH);

plot diaglo = if en_slopelines then ( bar0low + (slopelo * (barnumber() - bar0number))) else na;

diaglo.AssignValueColor(Color.dark_green);

diaglo.SetStyle(Curve.MEDIUM_DASH);

#

# ------------------------------------------------------------------

#!!ACTIONABLE SIGNAL SCANS!!

Rather than go into another lengthy description, I just decided to make a video and post the links.1 Bar Rev Strat Daily

https://tos.mx/sml8vKo

2 Bar Rev Strat Daily

https://tos.mx/fUIotqN

Hammer Rev

https://tos.mx/A2w2Jkt

Inside Break Bull

https://tos.mx/JKIrGGZ

Kicking Bull

https://tos.mx/JLI4AXC

FAILED 2 SCAN BY JASON GETGEN:

FAILED 2 DOWN:https://tos.mx/LFDcKrZ

FAILED 2 UP

https://tos.mx/i9q0UgE

Link to James Fox’s STRAT Scan video:

Check out this really great bottom of the hour scan and video for how to set it up by Tim Greco who has been doing amazing work!

https://twitter.com/tgreco2626/status/1406394354344902657?s=20UPDATE: 03/23/21 Tried to re-upload complete overlay charts with a new link because I noticed that they were set to use log scale. I noticed it messes with my drawings so I turn it off on all my charts. I think it's the best setting. Ill try to give y'all fresh links later (probably just a problem with TOS right now), but for now, to change it manually, it looks like this:

UPDATE: 07/25/23 Removed all-in-one TFC study and replaced it with new candle paint study which is superior for many reasons as stated in the description

UPDATE: 01/23/23 Added a version of the overlay that I found which appears to be the work of Paul Townsend, Robert Payne and Don Larson (Halcyon Guy). I find it to be superior to mine especially if all you want is to overlay one or two higher time frames.

UPDATE: 04/25/22 Added user contribution by Jason Getgen. Look for his "Failed 2" scan in the scan section.

UPDATE: 08/25/21 By popular request! A version of REMIX that only looks for 2-2 reversals. BUT!! You can select a secondary (higher) time frame in the settings. Coming soon: REMIX with Secondary TF.

UPDATE: 05/21/21 Updated strat numbers so that the 1's and 3's appear as white numbers below, the 2U is a green number above and the 2D is a red number below. Added that component to all REMIX studies. Added REMIX SUPER LITE for machines with performance issues. And lastly, I have added two flex grids, one that is only continuity labels, and another that is a full radar screen based on Alex Option's idea. There are video tutorials for each. I also removed the studies that have been incorporated into the REMIX or TFC master studies as well as older studies that were glitchy and I don't have time or desire to support.

UPDATE: 04/01/21 Updated Kicker Actionable signal to include opposite continuity for kick age and fixed bug with measured move. Streamlined thread removing studies that are now obsolete.

UPDATE: 02/28/21 Added TFC study to Pre-Loaded Color Overlay Charts. This is because the Complete TFC study at the top changes the color of the background which defeats the purpose of the color overlay chart on a white background. This is simply a condensed, simplified version of the TFC study. It will only work if the intraday chart is set to 1 minute and the full chart is set to 1 hour.

UPDATE: 02/28/21 Added additional new version of color script. Re-worked the colors to let each TF stand out.

UPDATE: 02/26/21 Added new color version of the overlay study. There are three separate versions, each a different shade.

UPDATE: 01/02/21 Corrected bug in watchlist columns. Then you very much for catching that @fishstick1229 !!!!!!

UPDATE: 10/19/20 Placed link for the two main studies at the top. Added set up tutorial video for two main (most recent studies). Removed older studies (Basic Four). Added Hammers_and_Shooters study. Added Actionable Signal Scans and video

UPDATE: 10/15/20 Made Background Color script all inclusive and MTF capable. Added specific type of actionable signal onto the alerts written into the Remix version

UPDATE: 10/14/20 Per request, added alerts for reversals to the Reversal Remix and Actionable Signal study. Added alert to Background Color FTC Study. Added 1st draft Broadening Formation study.

Attachments

Last edited: