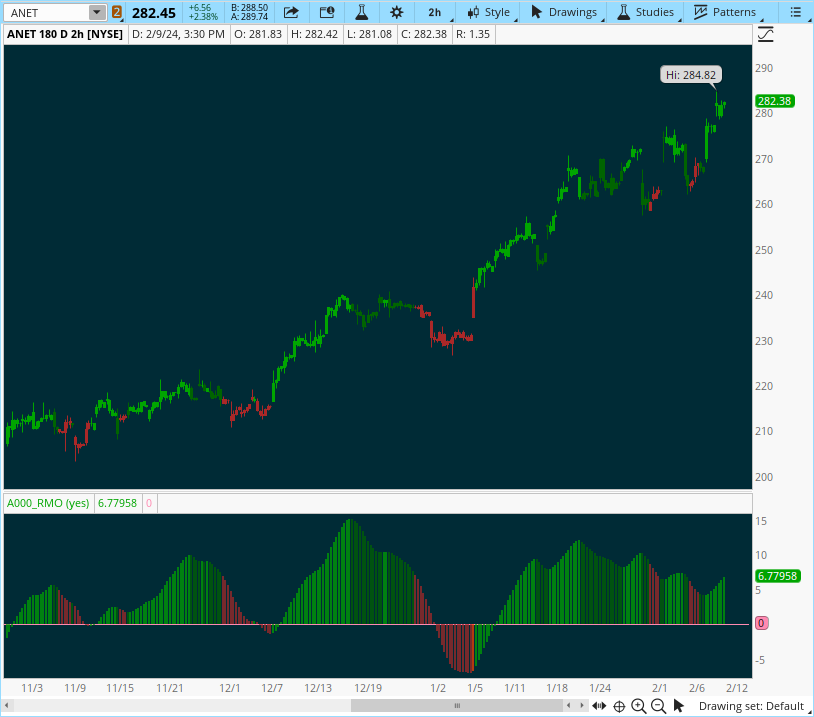

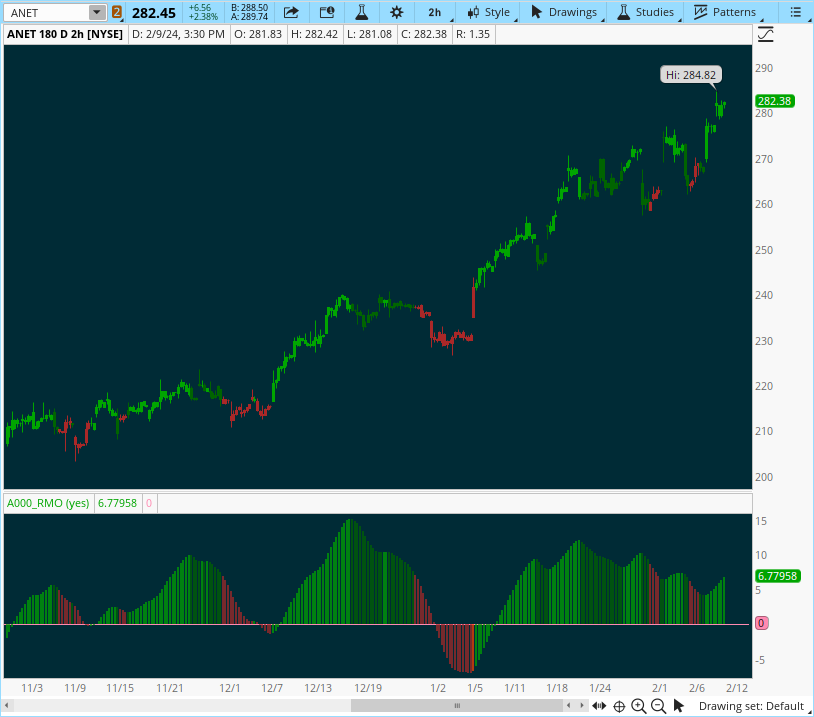

The Rahul Mohindar Oscillator spots potential reversal zones and identifies slowing of momentum.

- Red candles are the reversal zone. Look for your favorite study to trigger in this area.

- Darker Green candles are a slowing of momentum.

- Could just be a pullback before continuing its upward trajectory.

- Or could be signaling the end of the trend.

- Combine with your favorite candlestick pattern for more insight.

Rich (BB code):

# Rahul Mohindar Oscillator (RMO) Indicator for ThinkorSwim

# from TOS Yahoo Groups

declare lower;

def RMOSW2 = ExpAverage(100 *

(Close - ((SimplemovingAvg(Close, 2) +

SimplemovingAvg(SimplemovingAvg(Close, 2), 2) +

SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(Close, 2), 2), 2) +

SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(Close, 2), 2), 2), 2) +

SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(Close, 2), 2), 2), 2), 2) +

SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(Close, 2), 2), 2), 2), 2), 2) +

SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(Close, 2), 2), 2), 2), 2), 2), 2) +

SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(Close, 2), 2), 2), 2), 2), 2), 2), 2) +

SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(Close, 2), 2), 2), 2), 2), 2), 2), 2), 2) +

SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(SimplemovingAvg(Close, 2), 2), 2), 2), 2), 2), 2), 2), 2), 2)) / 10)) /

(Highest(Close, 10) - Lowest(Close, 10)), 30);

plot RMOSW3 = ExpAverage(RMOSW2, 30);

Plot Zeroline = 0;

DefineGlobalColor("bull", CreateColor(0, 165, 0)); #green

DefineGlobalColor("bear", CreateColor(170, 40, 40));#red

DefineGlobalColor("pullback", color.dark_green); #dark_green

DefineGlobalColor("zone", color.light_red); #light_red

RMOSW3.setpaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

RMOSW3.assignValueColor(

if RMOSW2<0 and RMOSW3<=RMOSW3[1] then GlobalColor("bear") else

if RMOSW2<0 and RMOSW3>RMOSW3[1] then GlobalColor("zone") else

if RMOSW3>=RMOSW3[1] then GlobalColor("bull") else GlobalColor("pullback"));

input paintCandles = yes ;

AssignPriceColor(

if !paintCandles then color.current else

if RMOSW2<0 and RMOSW3<=RMOSW3[1] then GlobalColor("bear") else

if RMOSW2<0 and RMOSW3>RMOSW3[1] then GlobalColor("zone") else

if RMOSW3>=RMOSW3[1] then GlobalColor("bull") else GlobalColor("pullback"));

Last edited by a moderator: