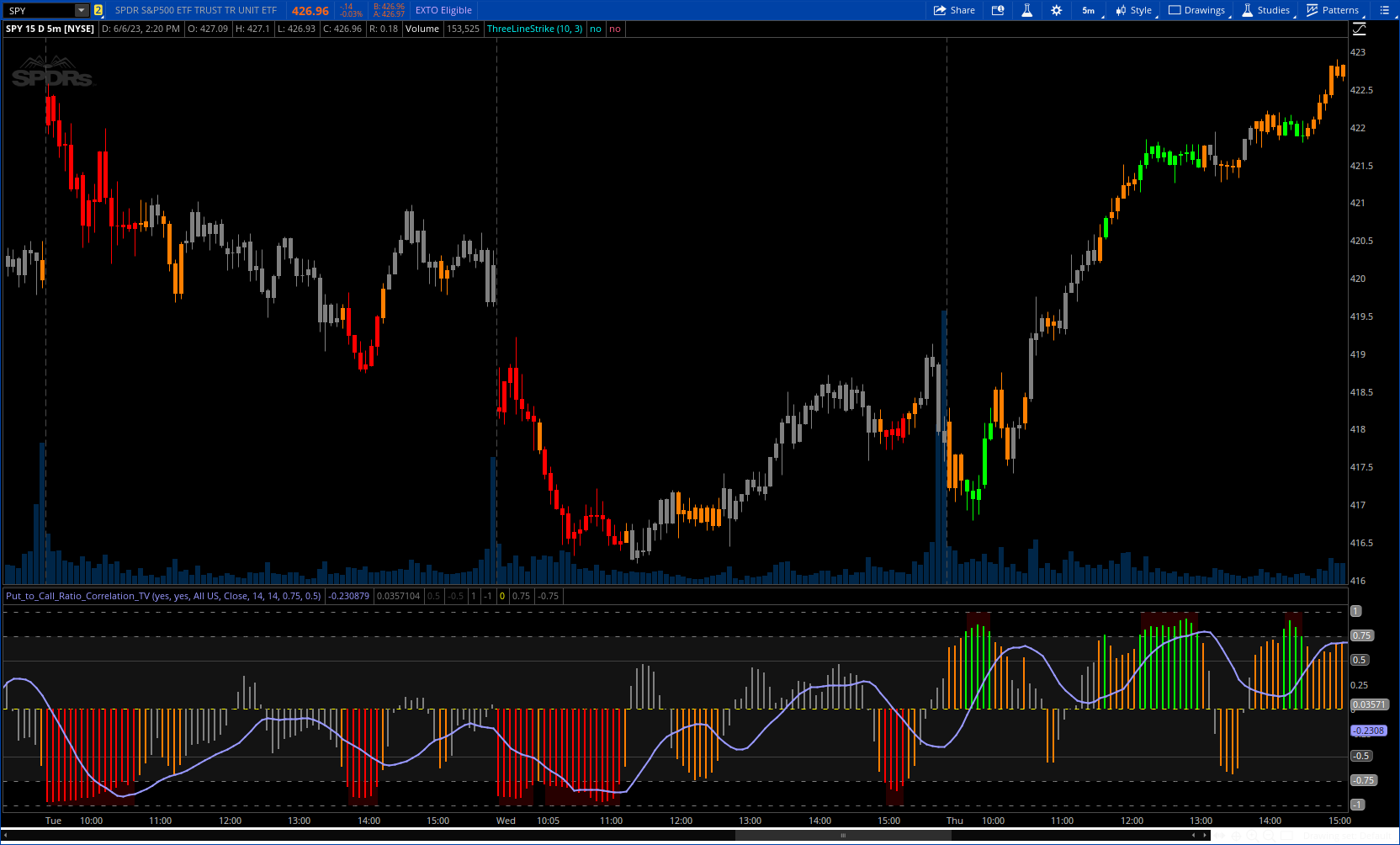

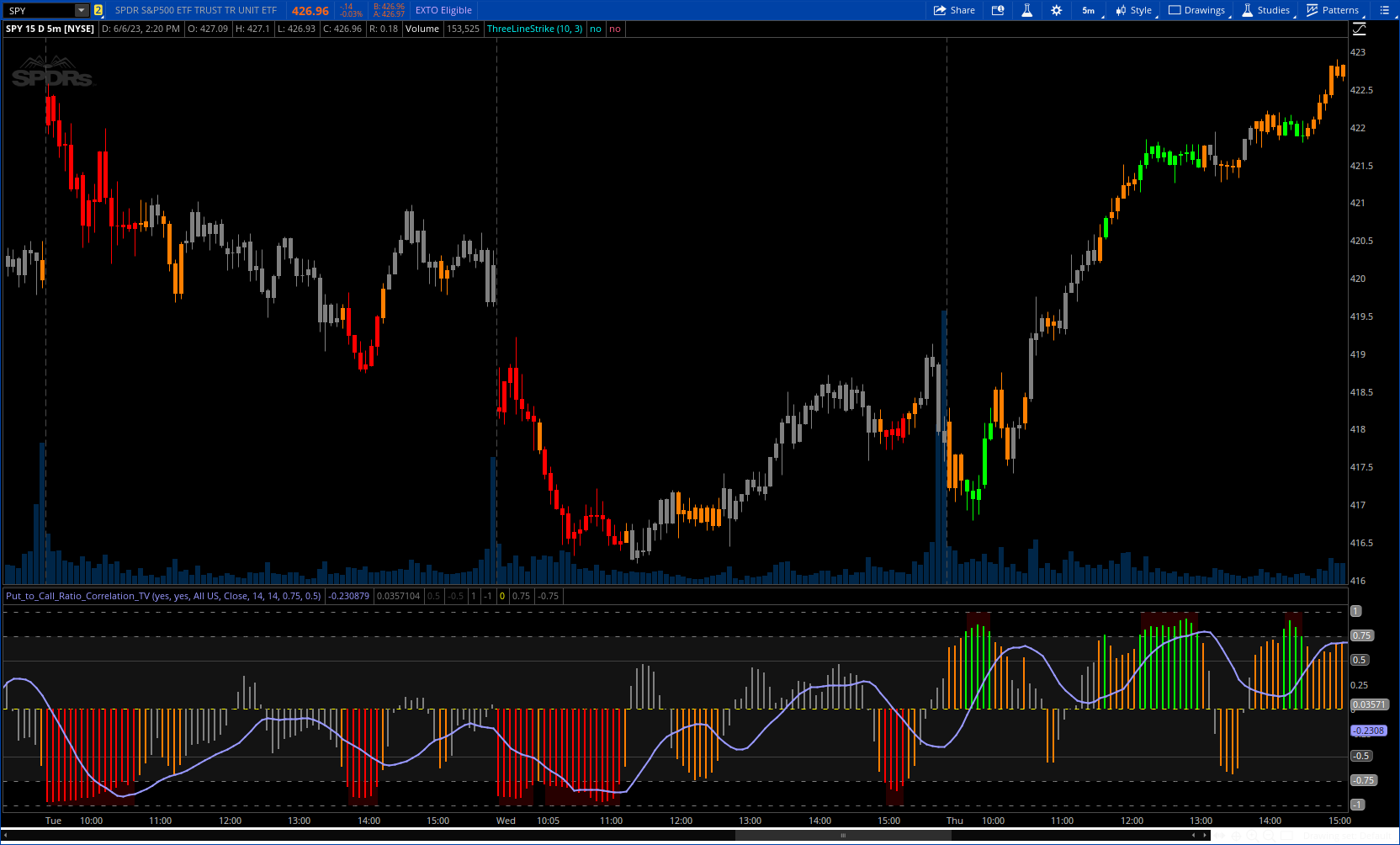

Author states: This indicator is very simple. It pulls the data from the index and runs a correlation assessment against whichever ticker you are on.

Its helpful to correlate with indices such as SPY, IWM and QQQ, but I have had success correlating with individual tickers such as NVDA and AMD.

The correlation length is defaulted to 14. You can modify it if you wish, but I do recommend leaving it at this as the default, and the testing I have done with this have all been on the 14 correlation length.

You can chose to smooth the SMA over whichever length of period you wish as well.

When the indicator is approaching a significant negative or positive relationship, you will see the indicator flash red in the upper or lower band

I added multiple symbols to select from.

check the link

https://www.tradingview.com/v/UJBQOniD/

CODE:

Its helpful to correlate with indices such as SPY, IWM and QQQ, but I have had success correlating with individual tickers such as NVDA and AMD.

The correlation length is defaulted to 14. You can modify it if you wish, but I do recommend leaving it at this as the default, and the testing I have done with this have all been on the 14 correlation length.

You can chose to smooth the SMA over whichever length of period you wish as well.

When the indicator is approaching a significant negative or positive relationship, you will see the indicator flash red in the upper or lower band

I added multiple symbols to select from.

check the link

https://www.tradingview.com/v/UJBQOniD/

CODE:

CSS:

# https://www.tradingview.com/v/UJBQOniD/

#// © Steversteves

#indicator("Put to Call Ratio Correlation")

# converted and mod by Sam4Cok@Samer800 - 06/2023

declare lower;

input ColorBars = yes;

input ShowSmaLine = yes;

input Market = { NYSE, NASDAQ, NASDAQ100, "S&P 500", "DOW Jones", "Russel 2000", AMEX, ARCA,default "All US"};

input source = {default "Close", "HL2", "HLC3", "OHLC4"};

input SmoothingLength = 14; # "Smoothing length", "Smoothies the SMA of the correlation."

input CorrelationLength = 14; # "Correlation Length","Reccomended to remain at 14"

input ThresholdExtreme = 0.75;

input ThresholdReversal = 0.5;

def na = Double.NaN;

def last = isNaN(close);

#-- Color

DefineGlobalColor("gray", Color.GRAY);# = color.gray

DefineGlobalColor("grayfill", Color.DARK_GRAY);

DefineGlobalColor("orange", Color.DARK_ORANGE);

DefineGlobalColor("red", Color.DARK_RED);

DefineGlobalColor("green", Color.GREEN);

#---

def tickC;

def tickHL2;

def tickOHLC4;

def tickHLC3;

switch (Market) {

case NASDAQ:

tickC = close(symbol = "$PCN/Q");

tickHL2 = hl2 (symbol = "$PCN/Q");

tickOHLC4 = ohlc4(symbol = "$PCN/Q");

tickHLC3 = hlc3 (symbol = "$PCN/Q");

case NYSE:

tickC = close(symbol = "$PCN");

tickHL2 = hl2 (symbol = "$PCN");

tickOHLC4 = ohlc4(symbol = "$PCN");

tickHLC3 = hlc3 (symbol = "$PCN");

case "Russel 2000":

tickC = close(symbol = "$PCRL");

tickHL2 = hl2 (symbol = "$PCRL");

tickOHLC4 = ohlc4(symbol = "$PCRL");

tickHLC3 = hlc3 (symbol = "$PCRL");

case "S&P 500":

tickC = close(symbol = "$PCSP");

tickHL2 = hl2 (symbol = "$PCSP");

tickOHLC4 = ohlc4(symbol = "$PCSP");

tickHLC3 = hlc3 (symbol = "$PCSP");

case "DOW Jones":

tickC = close(symbol = "$PCI");

tickHL2 = hl2 (symbol = "$PCI");

tickOHLC4 = ohlc4(symbol = "$PCI");

tickHLC3 = hlc3 (symbol = "$PCI");

case AMEX:

tickC = close(symbol = "$PCA");

tickHL2 = hl2 (symbol = "$PCA");

tickOHLC4 = ohlc4(symbol = "$PCA");

tickHLC3 = hlc3 (symbol = "$PCA");

case ARCA:

tickC = close(symbol = "$PCAR");

tickHL2 = hl2 (symbol = "$PCAR");

tickOHLC4 = ohlc4(symbol = "$PCAR");

tickHLC3 = hlc3 (symbol = "$PCAR");

case NASDAQ100:

tickC = close(symbol = "$PCND");

tickHL2 = hl2 (symbol = "$PCND");

tickOHLC4 = ohlc4(symbol = "$PCND");

tickHLC3 = hlc3 (symbol = "$PCND");

default:

tickC = close(symbol = "$PCALL");

tickHL2 = hl2 (symbol = "$PCALL");

tickOHLC4 = ohlc4(symbol = "$PCALL");

tickHLC3 = hlc3 (symbol = "$PCALL");

}

def src;

switch (source) {

case "hl2":

src = tickHL2;

case "hlc3":

src = tickHLC3;

case "ohlc4":

src = tickOHLC4;

default:

src = tickC;

}

def cor = Correlation(src, close, CorrelationLength);

def sma = Average(cor, SmoothingLength);

#/ Assessments

def neutral = cor >= 0 and cor < ThresholdReversal or cor <= 0 and cor > -ThresholdReversal;

def mid = cor >= ThresholdReversal and cor <ThresholdExtreme or cor <= -ThresholdReversal and cor >= -ThresholdExtreme;

def reversal = cor >= ThresholdExtreme;

def dnrevrsal = cor<= -ThresholdExtreme;

def negreversal = cor <= -ThresholdExtreme;

def posreversal = cor >= ThresholdExtreme;

def sentiment = if neutral then 0 else if mid then -1 else if reversal then 1 else

if negreversal then -2 else 0;

def negcolor = negreversal;

def poscolor = posreversal;

#// plots

plot smaLine = if ShowSmaLine then sma else na; # "SMA"

plot corHist = cor; # "sentiment"

smaLine.SetLineWeight(2);

smaLine.SetDefaultColor(Color.VIOLET);

corHist.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

corHist.AssignValueColor(if sentiment==1 then GlobalColor("green") else

if sentiment==-1 then GlobalColor("orange") else

if sentiment==-2 then Color.RED else GlobalColor("gray"));

#// Fills

plot upperRev = if last then na else ThresholdReversal; # "Upper Band"

plot lowerRev = if last then na else -ThresholdReversal; # "Lower Band"

plot upperband = if last then na else 1; # "Upper Band"

plot lowerband = if last then na else -1; # "Lower Band"

plot centreband = if last then na else 0; # "Centre Band"

plot lclupperband = if last then na else ThresholdExtreme; # "Threshold Band"

plot lcllowerband = if last then na else -ThresholdExtreme; # "Threshold Band"

upperRev.SetDefaultColor(Color.DARK_GRAY);

lowerRev.SetDefaultColor(Color.DARK_GRAY);

upperband.SetDefaultColor(Color.GRAY);

lowerband.SetDefaultColor(Color.GRAY);

centreband.SetDefaultColor(Color.YELLOW);

lclupperband.SetDefaultColor(Color.GRAY);

lcllowerband.SetDefaultColor(Color.GRAY);

upperband.SetStyle(Curve.SHORT_DASH);

lowerband.SetStyle(Curve.SHORT_DASH);

centreband.SetStyle(Curve.SHORT_DASH);

lclupperband.SetStyle(Curve.SHORT_DASH);

lcllowerband.SetStyle(Curve.SHORT_DASH);

AddCloud(lclupperband, lcllowerband, GlobalColor("grayfill"));

AddCloud(if negcolor then lcllowerband else na, lowerband, GlobalColor("red"));

AddCloud(if poscolor then upperband else na,lclupperband , GlobalColor("red"));

#// Bar colour for on chart notification of reversal areas

AssignPriceColor(if !ColorBars then Color.CURRENT else

if sentiment==1 then GlobalColor("green") else

if sentiment==-1 then GlobalColor("orange") else

if sentiment==-2 then Color.RED else GlobalColor("gray")); # "Bar Colour"

#--- END of CODE

Last edited by a moderator: