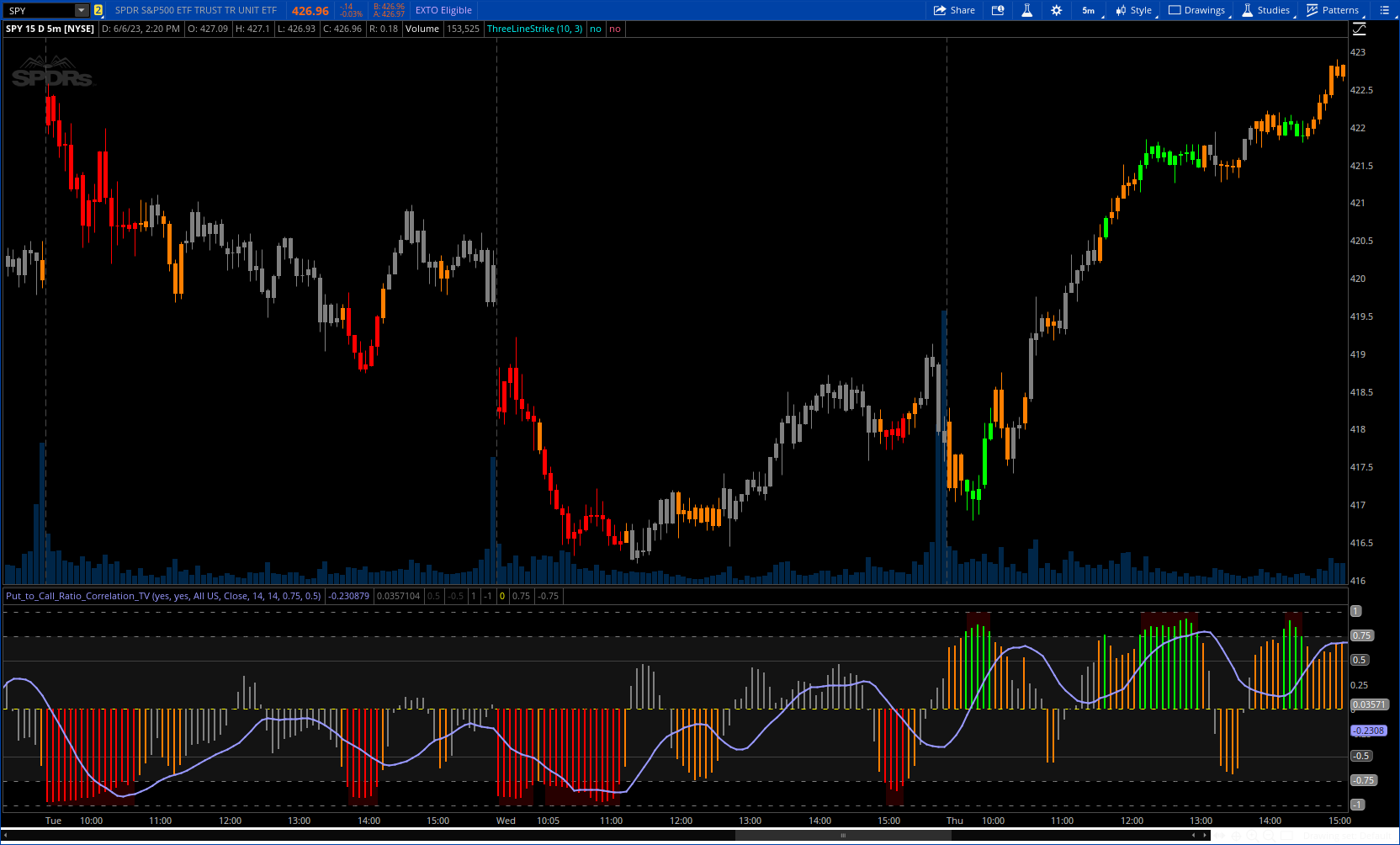

Author Message: - I added multiple symbols to select from.

check the link

https://www.tradingview.com/v/UJBQOniD/

CODE:

CSS:

# https://www.tradingview.com/v/UJBQOniD/

#// © Steversteves

#indicator("Put to Call Ratio Correlation")

# converted and mod by Sam4Cok@Samer800 - 06/2023

declare lower;

input ColorBars = yes;

input ShowSmaLine = yes;

input Market = { NYSE, NASDAQ, NASDAQ100, "S&P 500", "DOW Jones", "Russel 2000", AMEX, ARCA,default "All US"};

input source = {default "Close", "HL2", "HLC3", "OHLC4"};

input SmoothingLength = 14; # "Smoothing length", "Smoothies the SMA of the correlation."

input CorrelationLength = 14; # "Correlation Length","Reccomended to remain at 14"

input ThresholdExtreme = 0.75;

input ThresholdReversal = 0.5;

def na = Double.NaN;

def last = isNaN(close);

#-- Color

DefineGlobalColor("gray", Color.GRAY);# = color.gray

DefineGlobalColor("grayfill", Color.DARK_GRAY);

DefineGlobalColor("orange", Color.DARK_ORANGE);

DefineGlobalColor("red", Color.DARK_RED);

DefineGlobalColor("green", Color.GREEN);

#---

def tickC;

def tickHL2;

def tickOHLC4;

def tickHLC3;

switch (Market) {

case NASDAQ:

tickC = close(symbol = "$PCN/Q");

tickHL2 = hl2 (symbol = "$PCN/Q");

tickOHLC4 = ohlc4(symbol = "$PCN/Q");

tickHLC3 = hlc3 (symbol = "$PCN/Q");

case NYSE:

tickC = close(symbol = "$PCN");

tickHL2 = hl2 (symbol = "$PCN");

tickOHLC4 = ohlc4(symbol = "$PCN");

tickHLC3 = hlc3 (symbol = "$PCN");

case "Russel 2000":

tickC = close(symbol = "$PCRL");

tickHL2 = hl2 (symbol = "$PCRL");

tickOHLC4 = ohlc4(symbol = "$PCRL");

tickHLC3 = hlc3 (symbol = "$PCRL");

case "S&P 500":

tickC = close(symbol = "$PCSP");

tickHL2 = hl2 (symbol = "$PCSP");

tickOHLC4 = ohlc4(symbol = "$PCSP");

tickHLC3 = hlc3 (symbol = "$PCSP");

case "DOW Jones":

tickC = close(symbol = "$PCI");

tickHL2 = hl2 (symbol = "$PCI");

tickOHLC4 = ohlc4(symbol = "$PCI");

tickHLC3 = hlc3 (symbol = "$PCI");

case AMEX:

tickC = close(symbol = "$PCA");

tickHL2 = hl2 (symbol = "$PCA");

tickOHLC4 = ohlc4(symbol = "$PCA");

tickHLC3 = hlc3 (symbol = "$PCA");

case ARCA:

tickC = close(symbol = "$PCAR");

tickHL2 = hl2 (symbol = "$PCAR");

tickOHLC4 = ohlc4(symbol = "$PCAR");

tickHLC3 = hlc3 (symbol = "$PCAR");

case NASDAQ100:

tickC = close(symbol = "$PCND");

tickHL2 = hl2 (symbol = "$PCND");

tickOHLC4 = ohlc4(symbol = "$PCND");

tickHLC3 = hlc3 (symbol = "$PCND");

default:

tickC = close(symbol = "$PCALL");

tickHL2 = hl2 (symbol = "$PCALL");

tickOHLC4 = ohlc4(symbol = "$PCALL");

tickHLC3 = hlc3 (symbol = "$PCALL");

}

def src;

switch (source) {

case "hl2":

src = tickHL2;

case "hlc3":

src = tickHLC3;

case "ohlc4":

src = tickOHLC4;

default:

src = tickC;

}

def cor = Correlation(src, close, CorrelationLength);

def sma = Average(cor, SmoothingLength);

#/ Assessments

def neutral = cor >= 0 and cor < ThresholdReversal or cor <= 0 and cor > -ThresholdReversal;

def mid = cor >= ThresholdReversal and cor <ThresholdExtreme or cor <= -ThresholdReversal and cor >= -ThresholdExtreme;

def reversal = cor >= ThresholdExtreme;

def dnrevrsal = cor<= -ThresholdExtreme;

def negreversal = cor <= -ThresholdExtreme;

def posreversal = cor >= ThresholdExtreme;

def sentiment = if neutral then 0 else if mid then -1 else if reversal then 1 else

if negreversal then -2 else 0;

def negcolor = negreversal;

def poscolor = posreversal;

#// plots

plot smaLine = if ShowSmaLine then sma else na; # "SMA"

plot corHist = cor; # "sentiment"

smaLine.SetLineWeight(2);

smaLine.SetDefaultColor(Color.VIOLET);

corHist.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

corHist.AssignValueColor(if sentiment==1 then GlobalColor("green") else

if sentiment==-1 then GlobalColor("orange") else

if sentiment==-2 then Color.RED else GlobalColor("gray"));

#// Fills

plot upperRev = if last then na else ThresholdReversal; # "Upper Band"

plot lowerRev = if last then na else -ThresholdReversal; # "Lower Band"

plot upperband = if last then na else 1; # "Upper Band"

plot lowerband = if last then na else -1; # "Lower Band"

plot centreband = if last then na else 0; # "Centre Band"

plot lclupperband = if last then na else ThresholdExtreme; # "Threshold Band"

plot lcllowerband = if last then na else -ThresholdExtreme; # "Threshold Band"

upperRev.SetDefaultColor(Color.DARK_GRAY);

lowerRev.SetDefaultColor(Color.DARK_GRAY);

upperband.SetDefaultColor(Color.GRAY);

lowerband.SetDefaultColor(Color.GRAY);

centreband.SetDefaultColor(Color.YELLOW);

lclupperband.SetDefaultColor(Color.GRAY);

lcllowerband.SetDefaultColor(Color.GRAY);

upperband.SetStyle(Curve.SHORT_DASH);

lowerband.SetStyle(Curve.SHORT_DASH);

centreband.SetStyle(Curve.SHORT_DASH);

lclupperband.SetStyle(Curve.SHORT_DASH);

lcllowerband.SetStyle(Curve.SHORT_DASH);

AddCloud(lclupperband, lcllowerband, GlobalColor("grayfill"));

AddCloud(if negcolor then lcllowerband else na, lowerband, GlobalColor("red"));

AddCloud(if poscolor then upperband else na,lclupperband , GlobalColor("red"));

#// Bar colour for on chart notification of reversal areas

AssignPriceColor(if !ColorBars then Color.CURRENT else

if sentiment==1 then GlobalColor("green") else

if sentiment==-1 then GlobalColor("orange") else

if sentiment==-2 then Color.RED else GlobalColor("gray")); # "Bar Colour"

#--- END of CODE

Last edited: