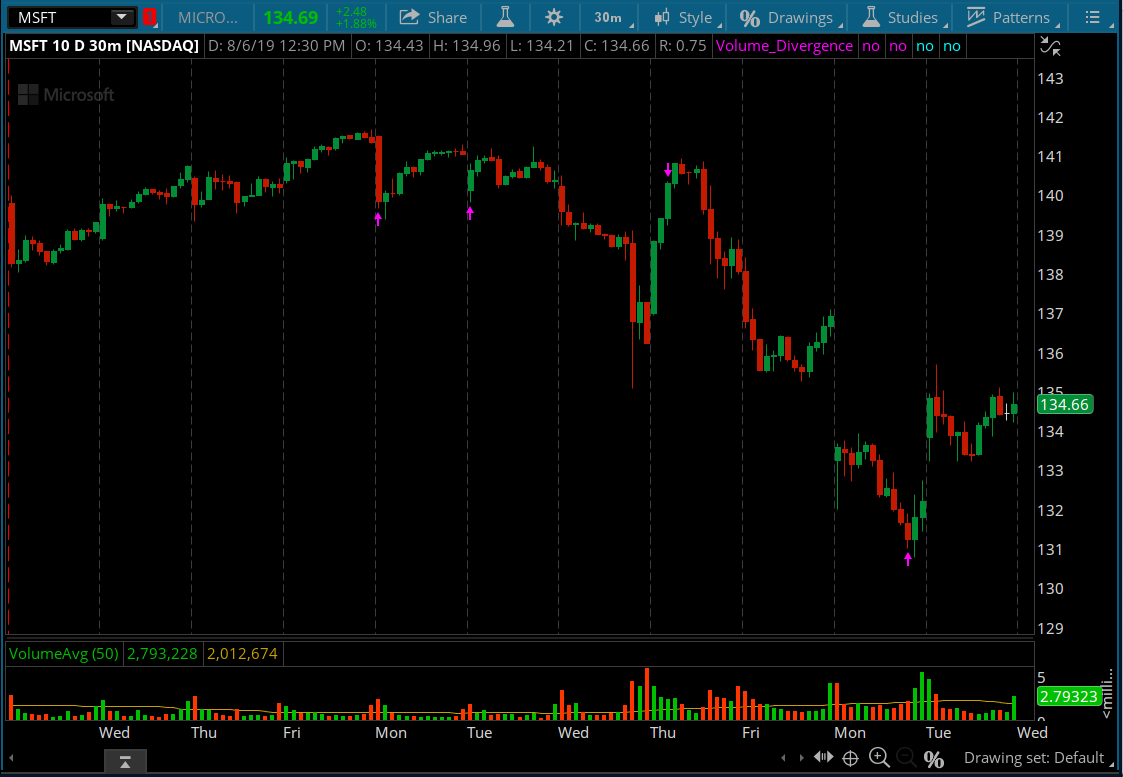

This indicator shows divergences between price and volume.

- Bullish Volume Divergence: When the price is falling while volume continues to rises.

- Bearish Volume Divergence: A bearish divergence signal occurs when the price is increasing while volume is decreasing.

- bear3 and bull3 = divergence signals within the last 3 candlesticks or bars

- bull4 and bear4 = divergences within the last 4 candlesticks or bars

thinkScript Code

Code:

# Price Volume Divergence Indicator for ThinkorSwim

# Based on the framework of Trend Exhaustion Indicator

# Assembled by BenTen at useThinkScript.com

# 3 Bars Bearish Divergence

def bearish4 = (CLOSE > CLOSE[1] AND CLOSE [1] > CLOSE [2] AND CLOSE [2] > CLOSE [3] AND VOLUMEAVG(LENGTH = 20) < VOLUMEAVG(LENGTH = 20)[1] AND VOLUMEAVG(LENGTH = 20)[1] < VOLUMEAVG(LENGTH = 20)[2] AND VOLUMEAVG(LENGTH = 20)[2] < VOLUMEAVG(LENGTH = 20)[3]);

plot bear3 = bearish4;

bear3.AssignValueColor(Color.MAGENTA);

bear3.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

# 3 Bars Bullish Divergence

def bullish4 = (CLOSE < CLOSE[1] AND CLOSE [1] < CLOSE [2] AND CLOSE [2] < CLOSE [3] AND VOLUMEAVG(LENGTH = 20) > VOLUMEAVG(LENGTH = 20)[1] AND VOLUMEAVG(LENGTH = 20)[1] > VOLUMEAVG(LENGTH = 20)[2] AND VOLUMEAVG(LENGTH = 20)[2] > VOLUMEAVG(LENGTH = 20)[3]);

plot bull3 = bullish4;

bull3.AssignValueColor(Color.MAGENTA);

bull3.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

# 4 Bars Bearish Divergence

def bearish5 = (CLOSE > CLOSE[1] AND CLOSE [1] > CLOSE [2] AND CLOSE [2] > CLOSE [3] AND CLOSE [3] > CLOSE [4] AND VOLUMEAVG(LENGTH = 20) < VOLUMEAVG(LENGTH = 20)[1] AND VOLUMEAVG(LENGTH = 20)[1] < VOLUMEAVG(LENGTH = 20)[2] AND VOLUMEAVG(LENGTH = 20)[2] < VOLUMEAVG(LENGTH = 20)[3] and VOLUMEAVG(LENGTH = 20)[3] < VOLUMEAVG(LENGTH = 20)[4]);

plot bear4 = bearish5;

bear4.AssignValueColor(Color.CYAN);

bear4.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

# 4 Bars Bullish Divergence

def bullish5 = (CLOSE < CLOSE[1] AND CLOSE [1] < CLOSE [2] AND CLOSE [2] < CLOSE [3] AND CLOSE [3] < CLOSE [4] AND VOLUMEAVG(LENGTH = 20) > VOLUMEAVG(LENGTH = 20)[1] AND VOLUMEAVG(LENGTH = 20)[1] > VOLUMEAVG(LENGTH = 20)[2] AND VOLUMEAVG(LENGTH = 20)[2] > VOLUMEAVG(LENGTH = 20)[3] and VOLUMEAVG(LENGTH = 20)[3] > VOLUMEAVG(LENGTH = 20)[4]);

plot bull4 = bullish5;

bull4.AssignValueColor(Color.CYAN);

bull4.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

# Alerts

Alert(bull3, " ", Alert.Bar, Sound.Chimes);

Alert(bear3, " ", Alert.Bar, Sound.Chimes);

Alert(bull4, " ", Alert.Bar, Sound.Bell);

Alert(bear4, " ", Alert.Bar, Sound.Bell);Shareable Link

https://tos.mx/uP5aTzAttachments

Last edited: