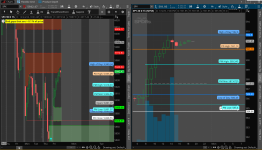

# Previous Day High/Low/Close + Premarket High/Low + High/Low/Open of Day + ATR Lines

# Created by Wiinii

# V1.6

# Some code based on code by Mobius (premarket) and TraderKevin (ATR lines

# https://usethinkscript.com/threads/previous-day-high-low-close-premarket-high-low-high-low-open-of-day-for-thinkorswim.13139/

declare hide_on_daily;

input length = 1;

input showOnlyLastPeriod = yes;

input ShowBubbles = yes;

input locate_bubbles_at = {default Expansion, Time};

input locate_bubbles_at_time = 800;

input BarsFromExpansion = 1;

input ShowPricesInBubbles = yes;

def bn = BarNumber();

def na = Double.NaN;

def h = high;

def l = low;

def o = open;

def c = close;

def v = volume;

def aggregationPeriod = AggregationPeriod.DAY;

def displace = -1;

def timeopen = SecondsFromTime(locate_bubbles_at_time) == 0;

def isExpansion = locate_bubbles_at == locate_bubbles_at.Expansion and IsNaN(close);

def firstExpansionBar = if !IsNaN(close[-1]) and isExpansion then 1 else if isExpansion then firstExpansionBar[1] + 1 else 0;

def BubbleLocation = if locate_bubbles_at == locate_bubbles_at.Time then timeopen else isExpansion and firstExpansionBar == BarsFromExpansion;

#----- Previous Day High/Low/Close -----#

plot PD_High;

plot PD_Low;

plot PD_Close;

if showOnlyLastPeriod and !IsNaN(close(period = aggregationPeriod)[-1]) {

PD_High = na;

PD_Low = na;

PD_Close = na;

} else {

PD_High = Highest(high(period = aggregationPeriod)[-displace], length);

PD_Low = Lowest(low(period = aggregationPeriod)[-displace], length);

PD_Close = close(period = aggregationPeriod)[-displace];

}

PD_High.SetDefaultColor(Color.DARK_ORANGE);

PD_High.SetStyle(Curve.LONG_DASH);

PD_High.SetLineWeight(2);

PD_High.HideTitle();

PD_Low.SetDefaultColor(Color.DARK_ORANGE);

PD_Low.SetStyle(Curve.LONG_DASH);

PD_Low.SetLineWeight(2);

PD_Low.HideTitle();

PD_Close.SetDefaultColor(Color.WHITE);

PD_Close.SetStyle(Curve.LONG_DASH);

PD_Close.SetLineWeight(2);

PD_Close.HideTitle();

DefineGlobalColor("PD_High", CreateColor(255, 204, 153));

AddChartBubble(ShowBubbles and BubbleLocation, PD_High, "PDH: " + (if ShowPricesInBubbles then AsText(PD_High) else ""), GlobalColor("PD_High"));

DefineGlobalColor("PD_Low", CreateColor(255, 204, 153));

AddChartBubble(ShowBubbles and BubbleLocation, PD_Low, "PDL: " + (if ShowPricesInBubbles then AsText(PD_Low) else ""), GlobalColor("PD_Low"), no);

DefineGlobalColor("PD_Close", Color.WHITE);

AddChartBubble(ShowBubbles and BubbleLocation, PD_Close, "PDC: " + (if ShowPricesInBubbles then AsText(PD_Close) else ""), GlobalColor("PD_Close"));

PD_High.HideBubble();

PD_Low.HideBubble();

PD_Close.HideBubble();

#----- Premarket High/Low -----# Thanks to Mobius

def GlobeX = GetTime() < RegularTradingStart(GetYYYYMMDD());

def vol = if GlobeX and !GlobeX[1]

then v

else if GlobeX

then vol[1] + v

else na;

def GlobeX_Volume = vol;

def ONhigh = if GlobeX and !GlobeX[1]

then h

else if GlobeX and

h > ONhigh[1]

then h

else ONhigh[1];

def ONhighBar = if GlobeX and h == ONhigh

then bn

else na;

def ONlow = if GlobeX and !GlobeX[1]

then l

else if GlobeX and

l < ONlow[1]

then l

else ONlow[1];

def ONlowBar = if GlobeX and l == ONlow

then bn

else na;

def OverNightHigh = if BarNumber() == HighestAll(ONhighBar)

then ONhigh

else OverNightHigh[1];

def OverNightLow = if BarNumber() == HighestAll(ONlowBar)

then ONlow

else OverNightLow[1];

plot PM_High;

plot PM_Low;

if showOnlyLastPeriod and !IsNaN(close(period = aggregationPeriod)[-1]) {

PM_High = na;

PM_Low = na;

} else {

PM_High = if OverNightHigh > 0 then OverNightHigh else na;

PM_Low = if OverNightLow > 0 then OverNightLow else na;

}

#PM_High.SetHiding(!PlotOverNightExtremes);

PM_High.SetLineWeight(2);

PM_High.SetDefaultColor(Color.CYAN);

PM_High.SetStyle(Curve.LONG_DASH);

PM_High.HideBubble();

PM_High.HideTitle();

#PM_Low.SetHiding(!PlotOverNightExtremes);

PM_Low.SetStyle(Curve.LONG_DASH);

PM_Low.SetDefaultColor(Color.CYAN);

PM_Low.HideBubble();

PM_Low.HideTitle();

DefineGlobalColor("PM_High", CreateColor(102, 255, 255));

AddChartBubble(ShowBubbles and if locate_bubbles_at == locate_bubbles_at.Time then bn == ONhighBar else isExpansion and firstExpansionBar == BarsFromExpansion, PM_High, "PMH: " + (if ShowPricesInBubbles then AsText(PM_High) else ""), GlobalColor("PM_High"));

DefineGlobalColor("PM_Low", CreateColor(102, 255, 255));

AddChartBubble(ShowBubbles and if locate_bubbles_at == locate_bubbles_at.Time then bn == ONlowBar else isExpansion and firstExpansionBar == BarsFromExpansion, PM_Low, "PML: " + (if ShowPricesInBubbles then AsText(PM_Low) else ""), GlobalColor("PM_Low"), no);

#----- Today Open/High/Low -----#

plot High_of_Day;

plot Low_of_Day;

plot DayOpen;

if showOnlyLastPeriod and !IsNaN(close(period = aggregationPeriod)[-1]) {

DayOpen = na;

High_of_Day = na;

Low_of_Day = na;

} else {

DayOpen = open(period = aggregationPeriod)[0];

High_of_Day = Highest(high(period = aggregationPeriod), length);

Low_of_Day = Lowest(low(period = aggregationPeriod), length);

}

DayOpen.SetDefaultColor (Color.GRAY);

DayOpen.SetPaintingStrategy(PaintingStrategy.DASHES);

DayOpen.SetLineWeight(2);

DayOpen.HideTitle();

High_of_Day.SetDefaultColor(CreateColor(0, 128, 255));

High_of_Day.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

High_of_Day.SetLineWeight(2);

High_of_Day.HideTitle();

Low_of_Day.SetDefaultColor(CreateColor(0, 128, 255));

Low_of_Day.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Low_of_Day.SetLineWeight(2);

Low_of_Day.HideTitle();

DefineGlobalColor("Open", Color.LIGHT_GRAY);

AddChartBubble(ShowBubbles and BubbleLocation, DayOpen, "Open: " + (if ShowPricesInBubbles then AsText(DayOpen) else ""), GlobalColor("Open"));

DefineGlobalColor("High_of_Day", CreateColor(102, 178, 255));

AddChartBubble(ShowBubbles and BubbleLocation, High_of_Day, "HOD: " + (if ShowPricesInBubbles then AsText(High_of_Day) else ""), GlobalColor("High_of_Day"));

DefineGlobalColor("Low_of_Day", CreateColor(102, 178, 255));

AddChartBubble(ShowBubbles and BubbleLocation, Low_of_Day, "LOD: " + (if ShowPricesInBubbles then AsText(Low_of_Day) else ""), GlobalColor("Low_of_Day"), no);

#----- ATR Lines -----# Thaanks to TraderKevin

input showAtrLines = Yes;

input atrLinesFrom = {default pdc, dayOpen};

input ATRlength = 14;

input averageType = AverageType.WILDERS;

def ATR = MovingAverage(averageType, TrueRange(high(period = ”DAY”)[1], close(period = ”DAY”)[1], low(period = ”DAY”)[1]), ATRlength);

plot hatr = if atrLinesFrom == atrLinesFrom .dayOpen then DayOpen + ATR else PD_Close + ATR;

plot latr = if atrLinesFrom == atrLinesFrom .dayOpen then DayOpen - ATR else PD_Close - ATR;

hatr.SetLineWeight(5);

hatr.SetDefaultColor(Color.RED);

hatr.SetStyle(Curve.LONG_DASH);

hatr.HideBubble();

hatr.HideTitle();

hatr.SetHiding(showAtrLines == no);

latr.SetLineWeight(5);

latr.SetStyle(Curve.LONG_DASH);

latr.SetDefaultColor(Color.GREEN);

latr.HideBubble();

latr.HideTitle();

latr.SetHiding(showAtrLines == no);

DefineGlobalColor("hatr", Color.PINK);

AddChartBubble(ShowBubbles and showAtrLines and BubbleLocation, hatr, "ATRH: " + (if ShowPricesInBubbles then AsText(hatr) else ""), GlobalColor("hatr"));

DefineGlobalColor("latr", Color.LIGHT_GREEN);

AddChartBubble(ShowBubbles and showAtrLines and BubbleLocation, latr, "ATRL: " + (if ShowPricesInBubbles then AsText(latr) else ""), GlobalColor("latr"), no);