I took this indicator from Robert and tweaked it a little to my need. Originally it plots the 5 min opening range breakout. However, I took that out and only keep the previous day high and low. Then I add some customizations to it to make the breakout or breakdown more noticeable.

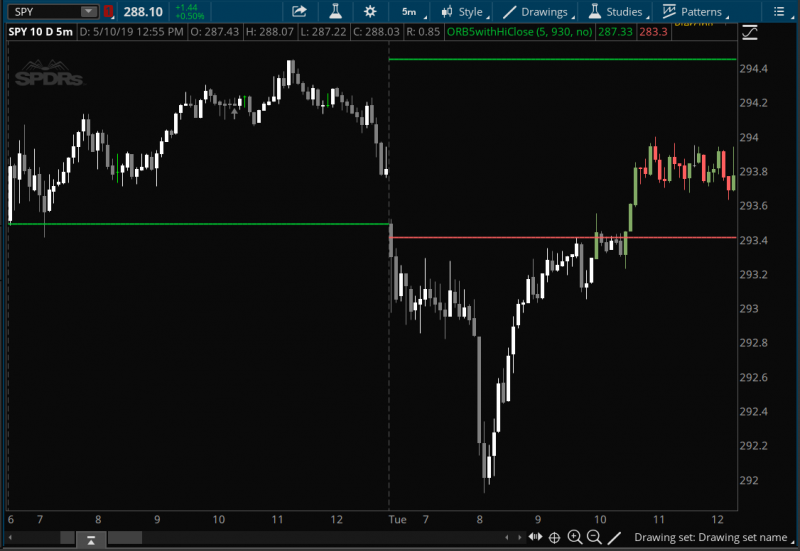

Here is what it looks like:

When the price is within the previous day high and low range then you would see the color of the regular candle. When it's outside of the range then red candles become gray and green candles become white.

Here is what it looks like:

When the price is within the previous day high and low range then you would see the color of the regular candle. When it's outside of the range then red candles become gray and green candles become white.

thinkScript Code

Rich (BB code):

# 5 min opening range

# Robert Payne

#Plot opening range high / low

input OpenRangeMinutes = 5;

input MarketOpenTime = 0930;

input ShowTodayOnly = yes;

def Today = if GetDay() == GetLastDay() then 1 else 0;

def FirstMinute = if SecondsFromTime(MarketOpenTime) < 60 then 1 else 0;

def OpenRangeTime = if SecondsFromTime(MarketOpenTime) < 60 * OpenRangeMinutes then 1 else 0;

#Plot yesterday's high / low

plot Yhigh = if ShowTodayOnly and !Today then Double.NaN else high(period = "day" )[1];

plot Ylow = if ShowTodayOnly and !Today then Double.NaN else low(period = "day" )[1];

Yhigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Yhigh.SetDefaultColor(Color.UPTICK);

Yhigh.SetLineWeight(2);

Ylow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Ylow.SetDefaultColor(Color.DOWNTICK);

Ylow.SetLineWeight(2);

#Plot pivot

plot Pivot = if ShowTodayOnly and !Today then Double.NaN else (high(period = "day" )[1] + low(period = "day" )[1] + close(period = "day" )[1]) / 3;

Pivot.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Pivot.SetDefaultColor(Color.YELLOW);

Pivot.SetLineWeight(2);

#Plot 10 day high / low

plot TenHigh = if ShowTodayOnly and !Today then Double.NaN else Highest(high(period = "day" )[1], 10);

plot TenLow = if ShowTodayOnly and !Today then Double.NaN else Lowest(low(period = "day" )[1], 10);

TenHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

TenHigh.SetDefaultColor(Color.UPTICK);

TenHigh.SetLineWeight(3);

TenLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

TenLow.SetDefaultColor(Color.DOWNTICK);

TenLow.SetLineWeight(3);

AssignPriceColor(if close >= Yhigh then Color.GREEN

else if close <= Ylow then Color.RED

else Color.CURRENT);

AssignPriceColor(if close > Yhigh and open < close then Color.White

else if close > YHIGH and open > close then Color.Gray

else if close < Ylow and open < close then Color.White

else if close < Ylow and open > close then Color.Gray

else Color.CURRENT);Shareable Link

https://tos.mx/tbjMgbPrevious Intradays High, Low, Mean

Code:

# Previous Intradays High, Low, Mean

# Mobius

# V01.12.2017 Desktop and Mobile

# Revised original code that uses SecondsFromTime() and SecondsTillTime(). Code now uses RegularTradingStart() and RegularTradingEnd() to bracket RTH. Works in Mobile Apps

def bar = barNumber();

def h = high;

def l = low;

def c = close;

def firstBar = if getTime() crosses above RegularTradingStart(GetYYYYMMDD()) and

!isNaN(close)

then bar

else double.nan;

def lastBar = if getTime() crosses above RegularTradingEnd(GetYYYYMMDD()) and

!isNaN(close)

then bar

else double.nan;

addVerticalLine(bar == HighestAll(firstBar), "first bar", color.cyan, curve.short_dash);

addVerticalLine(bar == HighestAll(lastBar), "last bar", color.cyan, curve.short_dash);

def bar_t1 = if !isNaN(firstBar)

then bar

else bar_t1[1];

def bar_t2 = if !isNaN(lastBar)

then bar

else bar_t2[1];

def prevFirstBar = if bar_t1 != bar_t1[1]

then bar_t1[1]

else prevFirstBar[1];

def prevLastBar = if bar_t2 != bar_t2[1]

then bar_t2[1]

else prevLastBar[1];

addVerticalLine(bar == HighestAll(prevFirstBar), "prev first bar", color.red, curve.short_dash);

addVerticalLine(bar == HighestAll(prevLastBar), "prev Last bar", color.red, curve.short_dash);

def hh = if bar == HighestAll(prevFirstBar)

then h

else if between(bar, highestAll(prevFirstBar), highestAll(LastBar)) and

h > hh[1]

then h

else hh[1];

def hhBar = if h == hh and between(bar, highestAll(prevFirstBar), highestAll(LastBar))

then barNumber()

else double.nan;

def ll = if bar == HighestAll(prevFirstBar)

then l

else if between(bar, highestAll(prevFirstBar), highestAll(LastBar)) and

l < ll[1]

then l

else ll[1];

def llBar = if l == ll and between(bar, highestAll(prevFirstBar), highestAll(LastBar))

then bar

else double.nan;

plot PrevDayHigh = if bar >= highestAll(hhBar)

then highestAll(if isNaN(c[-1])

then hh

else double.nan)

else double.nan;

PrevDayHigh.SetStyle(Curve.Long_Dash);

PrevDayHigh.SetLineWeight(3);

PrevDayHigh.SetDefaultColor(Color.Green);

PrevDayHigh.HideTitle();

plot PrevDayLow = if bar >= HighestAll(llBar)

then highestAll(if isNaN(c[-1])

then ll

else double.nan)

else double.nan;

PrevDayLow.SetStyle(Curve.Long_Dash);

PrevDayLow.SetLineWeight(3);

PrevDayLow.SetDefaultColor(Color.Red);

PrevDayLow.HideTitle();

def hl2bar = Floor((highestAll(hhbar) + highestAll(llBar)) / 2);

def hl2price = Round(((PrevDayHigh + PrevDayLow) / 2) / TickSize(), 0) * TickSize();

plot PrevDayHL2 = if bar >= highestAll(HL2bar)

then highestAll(if !isNaN(c[-1])

then HL2price

else double.nan)

else double.nan;

PrevDayHL2.SetStyle(Curve.Long_Dash);

PrevDayHL2.SetLineWeight(3);

PrevDayHL2.SetDefaultColor(Color.Yellow);

PrevDayHL2.HideTitle();

# End Code Previous Days High, Low, MeanAttachments

Last edited: